Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 16 Feb, 2023

By Heike Doerr

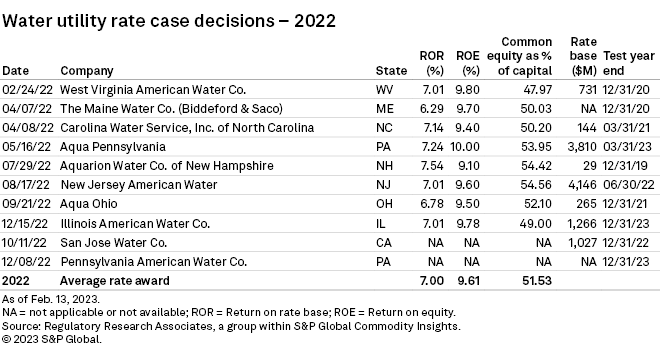

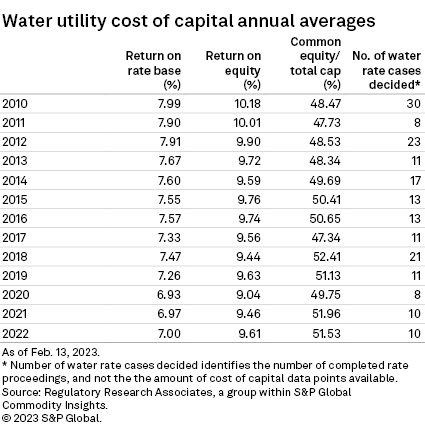

The 10 water utility rate cases completed nationwide in 2022 had an average return on equity of 9.61%. Regulatory Research Associates evaluates water utility regulation in 22 state jurisdictions and monitors rate proceedings involving rate change requests of at least $1.0 million for the 12 largest investor-owned and privately held water utilities. This report examines trends from the 185 rate case proceedings in our records, spanning a time period between January 2010 and December 2022.

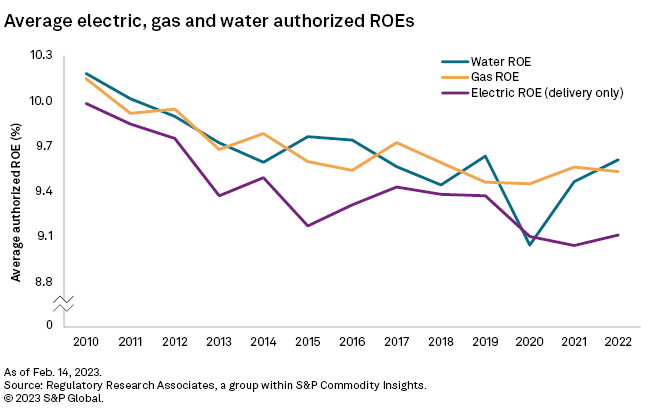

* While the average electric and gas authorized ROEs remained near all-time lows in 2022, the average for water utilities trended upward to a greater degree, albeit based on a small sample set. In base rate proceedings for RRA-tracked water utilities across nine states, ROEs ranged from 9.1% to 10.0% in 2022.

* In comparison, 10 major water utility rate cases were completed in 2021. Cost-of-capital parameters and authorized rate base values were disclosed in just half of these proceedings, however, with an average ROE of 9.46%.

* The average ROE authorized for electric distribution-only utilities was 9.11% in rate cases decided in 2022, up from the 9.04% average for full year 2021. The average ROE authorized for gas utilities was 9.53% in cases decided in 2022 versus 9.56% for full year 2021.

At the low end, the New Hampshire Public Utilities Commission authorized Eversource Energy subsidiary Aquarion Water Co. of New Hampshire Inc. a 9.1% ROE in a settled proceeding completed in July.

In a litigated proceeding, the Pennsylvania Public Utility Commission authorized Essential Utilities Inc. subsidiaries Aqua Pennsylvania Inc. and Aqua Pennsylvania Wastewater Inc. a 10.0% return on equity, which included a 25-basis-point management performance bonus. The PUC has granted management performance adjustments ranging from 5 to 25 basis points in previous rate cases.

Authorized returns may edge slightly higher in 2023 as elevated levels of inflation have prompted the U.S. Federal Reserve to aggressively raise interest rates. The effect of interest rate increases on authorized returns is unlikely to be dramatic, however, as authorized returns tend to be stickier on the upside than on the downside.

As investors familiar with the water utility sector are aware, there can be challenges discussing industry averages for such a small peer group. As shown in the table above, the common equity component of capital across rate proceedings completed in 2022 ranged from 47.97% to 54.56%.

The equity components of the capital structures approved for the water utility sector have averaged between 47.34% and 52.41% since 2010. The 10 highest authorized values, topping out between 54% and 57%, were observed in rate proceedings for California, Maine, New Hampshire and New Jersey water utilities. Interestingly, at the other end of the range, the 14 lowest equity authorizations — those at or below 44.0% — were all in rate proceedings completed in 2017 or earlier.

For additional details regarding water utility rate cases from Jan. 1, 2010, through Dec. 31, 2022, please refer to this industry document.

Comparison to electric, natural gas utilities

The average authorized ROE for electric utilities approved in cases decided during 2022 rebounded modestly from 2021. In electric distribution-only cases, the industry average ROE was 9.11% in 2022 versus 9.04% in full year 2021. There were nine such electric ROE authorizations in 2022 compared with 10 in 2021.

The average ROE authorized for gas utilities was 9.53% in cases decided in 2022, slightly lower than the 9.56% average observed in 2021. Thirty-three gas rate case decisions included an ROE determination during 2022 versus 43 in 2021.

For additional details on electric and gas utility rate decisions, refer to "Average authorized ROE for electric nudges up but drops for gas in 2022."

The attached industry document provides data for over 175 rate proceedings currently accumulated, spanning a period between January 2010 and December 2022. The simple mean is utilized for the return averages. The average equity returns indicated may not represent the returns earned by utilities industrywide as it does not include smaller proceedings and every jurisdiction overseeing water utilities.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.