Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 25 Nov, 2022

Introduction

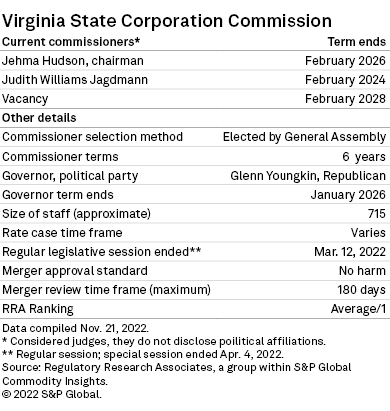

Virginia State Corporation Commission member Judith Williams Jagdmann on Nov. 16 announced her resignation from the commission effective Dec. 31, 2022. There is already one vacancy on the commission, or SCC, and Jagdmann's departure would leave the commission with one member and without the requisite quorum to conduct business. Jagdmann, however, has offered to continue to serve on a provisional basis into early 2023, but the situation is unclear if the General Assembly failed to fill one of the vacancies.

* Jagdmann's departure comes at a time when the state is mired in controversy concerning energy policy in the state, with Republican Gov. Glenn Youngkin working to reverse or at least slow the pace of the energy transition policies put in place under the previous Democrat governor. The SCC plays a pivotal role in implementing these policies.

* The SCC also has a robust energy rate case agenda, with 15 pending electric and gas cases, including both base rate proceedings and limited-issue rider updates. In addition, the commission has oversight over the water industry, financial institutions and insurance companies.

* Prior to Jagdmann's announcement, there was a vacancy on the commission since January 2022.

* Regulatory Research Associates views the regulatory climate in Virginia as somewhat more constructive than average from an investor viewpoint for energy utilities and relatively balanced for water utilities, but the prospects for an additional vacancy and/or the arrival of two new SCC members at a pivotal time for the industry creates an additional measure of uncertainty.

About the Virginia SCC

There are three full-time commissioner slots on the SCC. The General Assembly elects commissioners, who are referred to as judges, for staggered six-year terms with no term limits or party representation requirements; commissioners generally do not disclose their political affiliations. The state constitution requires that at least one member "have the qualifications prescribed for judges of courts of record." All judges of courts of record must be residents of Virginia and must have been admitted to the Virginia bar at least five years prior to their election.

If a vacancy occurs while the General Assembly is not in session or if the General Assembly fails to fill an existing vacancy prior to adjournment of a specific year's legislative session, the governor may appoint an individual to fill the vacancy for a term ending 30 days after the commencement of the General Assembly's next regular session, and the General Assembly would then elect a successor for the original unexpired term. A judge may not continue to serve beyond the end of an elected term even if no action has been taken to select a successor.

The serving commissioners elect the SCC chairman annually for a one-year term. The leadership generally rotates among the commissioners.

|

|

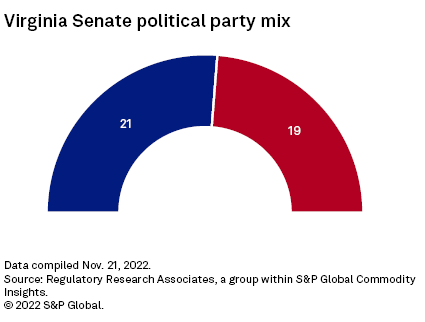

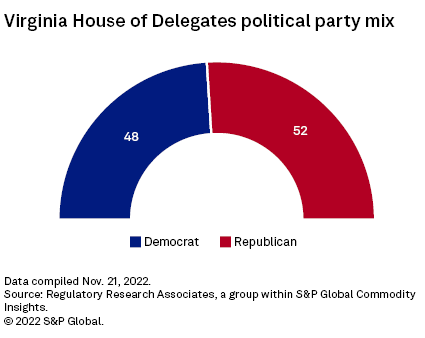

The bicameral General Assembly consists of the Senate and the House of Delegates. Delegates are elected to two-year terms, while senators serve four-year terms. The full House was up for election in 2021. As a result of the November 2021 elections and a January 2022 special election to fill a vacancy, the House of Delegates is made up of 48 Democrats and 52 Republicans. There are 21 Democrats and 19 Republicans in the Senate. No legislative seats were up for election in the November 2022 midterms. Both chambers will be up for election in 2023. The next gubernatorial election will be in 2025; in Virginia, governors may not stand for reelection to a second term.

In addition to regulating investor-owned electric, gas, telephone, water and sewer utilities, including securities issuances and affiliate transactions, the SCC also regulates electric cooperatives, state-chartered financial institutions, insurance companies, railroad safety, securities firms and retail franchising.

About the commissioners

Jehmal Hudson is the SCC chairman, serving a term that began Feb. 1, 2022, replacing Jagdmann as the chairman. Then-Gov. Ralph Northam appointed Hudson to the SCC in 2020 to fill a vacancy for a term extending to February 2026. The General Assembly voted to confirm the appointment during the 2021 session. At the time of Hudson's appointment, Hudson, an attorney, was vice president of government affairs for the National Hydropower Association. Previously, Hudson served as director of government affairs at the Federal Energy Regulatory Commission, was part of the Office of Congressional and Intergovernmental Affairs and was also chief legislative policy counsel, congressional and governmental affairs liaison and House liaison for FERC. Hudson has also held positions as deputy policy director for the Congressional House Democratic Caucus, chief counsel to Congresswoman Yvette Clarke, and law clerk to then-Sen. Hillary Rodham Clinton. Hudson holds a master of laws degree in Taxation from Georgetown University Law Center, a doctor of law degree from the Vermont Law School and a bachelor of arts degree from Adelphi University.

The General Assembly initially elected Jagdmann, an attorney, to the SCC in February 2006. Jagdmann was reelected in 2012 and again in 2018, and is serving a term that extends to February 2024. Prior to being elected to the commission, Jagdmann was the 43rd attorney general for the Commonwealth of Virginia in 2005-2006. From 1998 to 2005, Jagdmann served as deputy attorney general for the Civil Litigation Division. Prior to that, Jagdmann spent 13 years as counsel to the SCC and its staff on securities and utility matters. Jagdmann holds an undergraduate degree from the University of Virginia and a law degree from the T.C. Williams School of Law at the University of Richmond.

At the end of 2020, then-Chairman Mark Christie left the SCC to take a position at FERC. Northam named Angela Navarro to complete the remainder of Christie's term, which ran through January 2022, on an interim basis. The General Assembly confirmed the appointment in January 2021.

The House of Delegates Commerce and Energy Committee held an interview and certification hearing for Navarro in January 2022, but a resolution to reelect was not advanced to the full House at that time. Navarro's reelection apparently got caught up in political wrangling between Republicans, who now control the House of Delegates, and Democrats, who maintained control of the Senate, albeit by a slim margin.

According to news reports, Republicans in the House did not act on Navarro's reelection in response to the Senate Democrats' opposition to new Youngkin's appointment of Andrew Wheeler as secretary of natural and historic resources. Consequently, Navarro was required to step down. The General Assembly failed to take action to elect a replacement during the regular 2022 legislative session that adjourned in March, a special session convened in April or a session conducted in September specifically to address the vacancy.

Energy transition controversy

Youngkin and the legislature disagreed during the 2022 legislative session regarding the governor's attempts to roll back some of the previous administration's energy transition policy as outlined in the 2020 Virginia Clean Economy Act, or VCEA , and the 2021 Virginia Clean Energy Policy Act, or CEPA, and remove the state from the Regional Greenhouse Gas Initiative. To date, Youngkin has been unsuccessful in achieving his aims legislatively but is seeking to exit the carbon market through administrative rules.

Enacted in 2021, the CEPA espouses stretch goals rather than a mandate, with 30% of the electricity sold in Virginia to come from renewable resources by 2030, 100% of the electricity sold in the state to come from carbon-free resources by 2040 and the state to achieve net-zero carbon emissions by 2045, including the electric power, transportation, industrial, agricultural, building and infrastructure sectors.

The Virginia General Assembly's 2022 regular legislative session ended March 12. Notably absent from the legislation enacted during the session was a bill to accomplish a major goal of Youngkin's 2021 election platform — removing Virginia from the RGGI.

Senate Bill 118, introduced Jan. 12 and passed Feb. 15 by the House of Delegates, would have repealed the VCEA, effectively rescinding the authority of the State Air Pollution Control Board to adopt regulations to reduce CO2 emissions from electric generating facilities in the state and establish an auction program for energy allowances; the latter is a prerequisite for entering the RGGI. However, the bill failed to gain traction in the Senate.

While no legislation was enacted in 2022 to accomplish the governor's goal, the controversy led one major utility to withdraw an RGGI-related filing. Youngkin released his 2022 Virginia Energy Plan, or VEP, and the battle will likely resume in the 2023 session, raising uncertainty regarding the state's direction and energy transition-related initiatives the utilities have already undertaken.

The VEP calls for the VCEA and CEPA to be reevaluated based on the latest technology availability and cost assessments, and reauthorized in 2023 and every five years thereafter. In addition, the proposal would provide the SCC with greater latitude to address legacy plant retirement issues, including cost recovery; evaluate the prudence of proposed renewable resource projects; address end-of-life planning for new renewable resources; and expand opportunities for competitive renewable generation. The plan also supports deployment of traditional and advanced nuclear generation and exploration of hydrogen generation opportunities. In addition, the plan would modify the current periodic earnings review process for the state's larger electric investor-owned utilities and the rate adjustment clause, also known as limited-issue rider, a framework that is currently in place.

Active rate case agenda

Virginia has a consistently active energy rate case agenda due to the number of large investor-owned utilities operating in the state and the existence of various limited-issue rider mechanisms for recovery of electric generation and infrastructure assets and gas distribution infrastructure. Current state statutes require the state's largest utilities to file backward-looking earnings reviews every three years but do not prohibit the companies from filing for rate changes in between reviews. There is no statutory time frame for the smaller electric utilities or gas local distribution companies, or LDCs, to file base rate cases, but filings have occurred frequently in the last few years. RRA is following 15 pending energy rate-related proceedings.

The SCC is in the process of addressing a court remand of the SCC's 2020 triennial review decision for American Electric Power Co. Inc. subsidiary Appalachian Power Co., or APCO. The company is due to tender its next triennial review filing in March 2023. An earnings review for Dominion Energy Inc. subsidiary Virginia Electric and Power Co., or VEPCO, will not be conducted until 2024, but the company has eight pending rider proceedings, and the SCC is conducting reconsideration of a decision issued earlier this year in a proceeding, Case No. PUR-2022-00142, addressing the company's investment in the 2.6-GW Virginia Beach Offshore Wind Project (Coastal Virginia Offshore Wind).

Base rate cases are pending for the three largest investor-owned gas LDCs: NiSource Inc. subsidiary Columbia Gas of Virginia Inc., Case No. PUR-2022-00036; Southern Co. subsidiary Virginia Natural Gas Inc., Case No. PUR-2022-00052; and AltaGas Ltd. subsidiary Washington Gas Light Co., Case No. PUR-2022-00054.

RRA view of Virginia regulation of energy utilities

The regulatory climate for energy utility investors in Virginia is somewhat more constructive than average, and RRA ranks the state at Average/1. The periodic earnings review mechanism in place for the APCO and VEPCO includes guidelines for establishing the companies' authorized ROEs that tend to reduce volatility and authorized ROEs under the plan have been mostly in line with prevailing industry averages. The framework includes a broad symmetrical earnings-sharing paradigm that accords the companies an added measure of flexibility, and while this framework is backward-looking, relying on historical test years and average rate base valuations, the multiyear aspect tends to smooth out the impacts of year-to-year earnings volatility.

New generation investment and certain types of energy transition and reliability-related distribution investment may be reflected in rates through various limited-issue riders that allow for a cash return on construction work in progress, use a forward-looking rate year and in some instances include ROE premiums for certain types of investment.

A more traditional framework applies to smaller electric utilities in the state and gas LDCs. ROEs accorded these companies in recent years have generally been in line with prevailing industry averages when established; however, the cases rely on historical test years and average rate base valuations, which exacerbate regulatory lag. While not as extensive as the framework in place for the large electric utilities, a mechanism is in place that allows the LDCs to reflect SCC-approved incremental investment in rates through a limited-issue rider mechanism that adjusts annually.

The above-discussed debate about whether or not the state should participate in the RGGI creates uncertainty that makes it difficult for the utilities and other market participants to develop cohesive long-term strategic plans. The debate outcome will impact the generation resource planning decisions of the vertically integrated utilities, which have already put plans in place to meet the RGGI requirements.

For additional detail concerning RRA's energy rankings, refer to the latest RRA Quarterly State Regulatory Evaluations report.

RRA view of Virginia regulation of water utilities

Virginia's regulation of water utilities is relatively balanced from an investor viewpoint. ROE determinations historically have approximated industry averages when established. In its most recent decision, however, the SCC approved an ROE that was somewhat below the prevailing averages for water utilities nationwide. The SCC relies on test periods that are historical when rate decisions are issued but utilizes a year-end rate base valuation. In addition, the SCC allows certain post-test adjustments to expenses and investment, and interim rates may be implemented prior to final rate case decisions. Purchased water adjustment and infrastructure surcharge mechanisms are utilized by some water utilities. The SCC has not been receptive to revenue decoupling mechanisms or declining usage adjustments but has been supportive of consolidated rate structures proposed by the utilities. RRA accords Virginia regulation an Average/2 ranking as it pertains to water utilities.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a full listing of past and pending rate cases, rate case statistics and upcoming events, visit the S&P Capital IQ Pro Energy Research Home Page.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.