S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — 23 Aug, 2022

By Tim Zawacki

Introduction

Efforts by U.S. property and casualty insurers to more accurately match rate to risk will drive outsized premium growth in those business lines and geographies most exposed to emerging perils.

The effects of climate change have caused some carriers to continually adjust their appetites for writing homeowners business in areas most exposed to hurricanes over the past 30 years. This process gained particular intensity after the devastating hurricane seasons of 2004 and 2005 led to a broad reevaluation of the frequency and severity of tropical cyclones.

More recently, geopolitical tensions and increased consumer and commercial reliance on connected technologies have contributed to a sharp increase in what had already been a significant amount of concern about a wide range of cybersecurity threats. With many market participants still cautious about the size and scope of the risks they insure, a limited supply of cyber insurance coverage at a time of heightened demand has led to extremely large rate increases.

In light of highly volatile loss patterns, the insurability of certain risks that are exposed to these emerging threats may emerge as an increasingly important topic, raising the specter of the need for greater governmental involvement through the establishment of backstops and/or the growth of residual market vehicles.

Cautious on the coasts

Broad reevaluations of hurricane risk appetite by large residential property insurers are not a recent development.

Following 1992's Hurricane Andrew, for example, State Farm Mutual Automobile Insurance Co., The Allstate Corp., Nationwide Mutual Insurance Co. and one of the predecessors to today's The Travelers Cos. Inc. formed Florida-only subsidiaries, also known as "pups," to concentrate the residential property coverage they were writing in the Sunshine State. Difficult hurricane seasons in 2004 and 2005, highlighted by the landfall of Katrina along the Gulf Coast, led Allstate to announce plans to limit new business written in coastal counties around the country.

Now The Progressive Corp., a much more recent entrant to the residential property market through its 2015 acquisition of a majority stake in ARX Holding Corp., has become the latest national carrier to rethink its geographical composition.

Progressive, citing "unpredictable weather and a high concentration of exposures in more volatile states," generated combined ratios of more than 110% in its property segment in the first halves of 2021 and 2022. Management maintains a 96% combined ratio target for its business lines.

To reposition the business away from states deemed to have heavy natural catastrophe risk, Progressive is raising rates, expanding underwriting eligibility restrictions, engaging in targeted nonrenewals in areas with concentrations of risk or segments that are unprofitable, implementing higher deductibles and actual cash value coverage on roofs that are nearing the end of their useful lives, and cutting back on its agency force in select markets. Meanwhile, the company is seeking to grow in 26 states that it has classified as "less volatile."

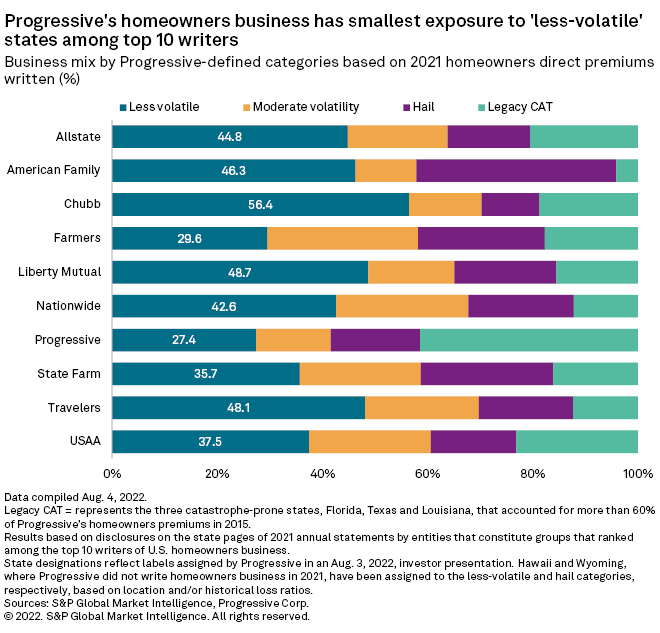

An S&P Global Market Intelligence analysis based on Progressive's Aug. 3 investor presentation finds that the company generated just 27.4% of its 2021 homeowners direct premiums written from the 26 "less-volatile" states and the District of Columbia as compared with 40.3% for the rest of the U.S. P&C industry. Our analysis adds Hawaii, where Progressive did not write homeowners business in 2021, to the "less-volatile" category based on its 5-year cumulative direct loss ratio. Among the top three homeowners insurance groups, the "less-volatile" states accounted for 35.7% of State Farm's 2021 homeowners writings, 44.8% of Allstate's and 48.7% of Liberty Mutual's.

The deviation in geographic concentration relative to peers was even wider in what Progressive labeled as its "legacy cat" states of Florida, Texas and Louisiana. Those three states, which combined for a majority of ARX's writings at the time of the company's sale, represented 41.4% of Progressive's homeowners mix in 2021 as compared with 21.7% for the rest of the industry. For State Farm, Allstate and Liberty Mutual, the respective shares in those states were 16.1%, 20.5% and 15.5%.

The combination of fewer competitors in the primary insurance market in certain coastal regions and the withdrawal of at least some property-catastrophe capacity by reinsurers has meant significantly higher costs for policyholders in excess of premium growth that would have otherwise occurred due to the impact of recent inflationary pressures on replacement costs. Reduced appetite among carriers that remain active in those regions adds to those challenges.

Rapid cyber insurance expansion

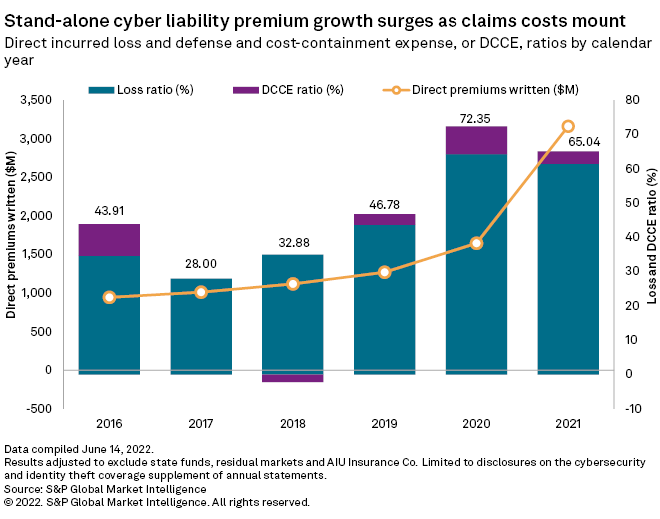

Premiums for stand-alone cybersecurity insurance policies soared in 2021, as reported on supplementary schedules in U.S. P&C insurers' annual statutory statements, and they are poised for significant expansion again in 2022.

Factors such as the increased importance of remote information technology capabilities in the pandemic era, high-profile ransomware and distributed denial-of-service attacks on large corporations and critical infrastructure, and fears about potential retaliatory attacks by state-sponsored actors have led to a surge in demand for coverage at a time many in the industry have been reluctant to materially boost capacity.

CNA Financial Corp. Chairman and CEO Dino Robusto said during an Aug. 1 call that cyber rate increases had been in the "high double digits." AXIS Capital Holdings Ltd. President and CEO Albert Benchimol, in comments made during a July 27 call, put the average cyber rate increase for the second quarter within that company's insurance book at 62%.

Beazley PLC CEO Adrian Cox provided additional clarity on the direction of cyber rate increases, saying during a July 22 call that they had been averaging "70-ish" percent after having been in the 100% range in the first quarter of 2022. Moderation, Cox noted, reflected expectations of lower losses in the near term given a slight improvement in the risk environment and cybercriminals being "distracted" by the conflict between Russia and Ukraine.

The Beazley CEO further indicated that the company is prepping for a cyber market that eventually becomes "3, 5, 6x as big as it is now."

Tough choices

Talk of federal government backstops for hurricane risk eventually stalled as 2005's devastating storm activity became an increasingly distant memory. More recently, there has been momentum toward a potential role for the U.S. government in addressing the prospective catastrophic financial losses that could result from a cyberattack on critical infrastructure.

A June report from the U.S. Government Accountability Office recommends that the Department of Homeland Security's Cybersecurity and Infrastructure Security Agency should work with the Federal Insurance Office to jointly assess the extent to which such threats warrant a federal insurance response. The Federal Insurance Office had already expanded its 2022 Terrorism Risk Insurance Program data call to include 30 lines related to the number, size, premiums and losses associated with cyber policies issued on a stand-alone basis or as part of a package.

Private reinsurance offers another possible solution. But in what Greenlight Capital Re Ltd. CEO and Chief Underwriting Officer Simon Burton described during an Aug. 3 call as a "welcome development," there has been a decline in available capacity to cover both natural and human-caused catastrophic risks. Burton, who said that the reinsurance industry has been "neglectful in pricing tail risk," noted that it is possible that certain of these risks could reemerge as areas of "compelling opportunity over the next six months" based on recent changes in coverage and pricing.

For residential property risks, the state of Florida has long been in the reinsurance business through the Florida Hurricane Catastrophe Fund, a tax-exempt trust created by the state's legislature in the aftermath of Andrew. The state is poised to at least temporarily expand its reinsurance activities through a plan intended to ensure homeowners with federally-backed mortgages would not need to immediately seek replacement coverage in the event of broad-based downgrades of the financial strength ratings for various private carriers that write residential property insurance.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.