Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 25 Jan, 2024

By Thomas Mason

The US insurance technology space has grounds for optimism in 2024. Industry consolidation is well underway, and the companies strong enough to survive on their own have made progress on their expense reduction plans. Public market investors also seem less bearish on growth stocks, with many insurtech stocks rebounding in 2023.

We expect the insurtech space to continue recovering in 2024, as the industry keeps consolidating and companies with the best prospects for profitability survive. A return to the heady valuations of 2021, when interest rates were near zero, seems unlikely, and we would argue many companies were overvalued at the time. But a gradual decline in interest rates would help the sector, coaxing public market investors back into growth stocks and making venture funding less expensive for startups.

Regardless of the macro environment, we think artificial intelligence will be key for the space. It has the power to transform industries and, as we have seen, create more investor enthusiasm in tech stocks. Insurtech companies should fully embrace AI and promote those efforts to investors.

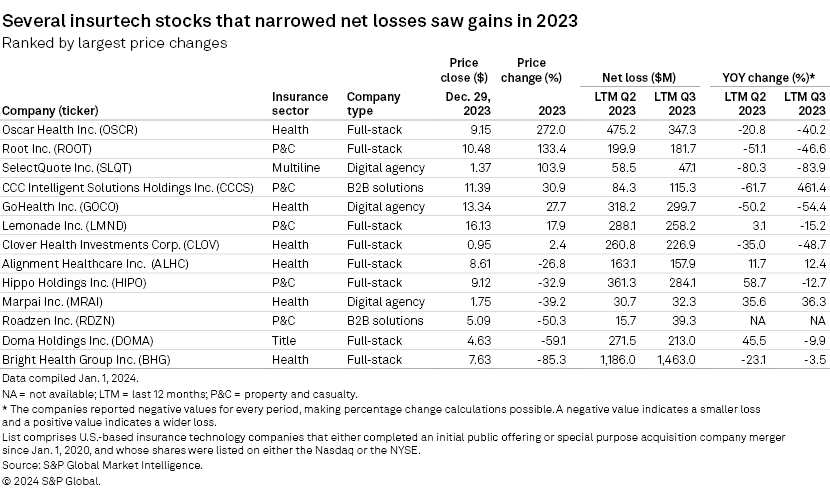

After a dismal 2022, public market investors warmed back up to the stocks of insurtech companies that have gone public on the major US exchanges in the past four years. A market-cap weighted index of these companies was up 22.2% in 2023 versus a decline of 54.0% in 2022.

The stocks are still very cheap relative to their 2021 valuations, and companies have made progress on lowering net losses.

This recovery happened sooner than we expected. We anticipated insurtech stocks bottoming out in January 2024, based on the dot-com era. Our insurtech index peaked in June 2021, and it took the Nasdaq about 2.5 years to recover after the dot-com bubble burst.

PDF: 2023 US Insurance Technology Market Report

Excel exhibits: 2023 US Insurance Technology Market Report — Data Exhibits

Part 1: Green shoots emerge

Part 2: The new class of full-stacks

Part 3: AI needs to show its work

Part 4: Direct channel stalls in personal auto

To be fair, some of the stocks benefited from special situations. Oscar Health Inc.'s stock gained on news that it named former Aetna Inc. chief Mark Bertolini as its CEO, and Root Inc.'s stock popped in June on reports of a takeover bid from Embedded Insurance. GoHealth Inc. also received a takeout offer in May from its two largest shareholders, which sent shares higher. Root and GoHealth both turned down those offers.

Short covering likely played some part in the stock gains as well. Five of the seven stocks that rallied had lower levels of short interest as of mid-December 2023 than they did at the end of December 2022. Lemonade Inc. was a notable exception, with an approximately 37% increase in short interest over that period.

Even so, event-driven catalysts and short covering could be indicators that the companies now have better prospects and are more appropriately valued.

Should this momentum continue, we expect IPO activity to pick up in 2024. Roadzen Inc. tested the waters in 2023, but it did not go well. On the first day of trading after completing its special purpose acquisition company deal, the stock dropped 40.9%. But we think companies that are either already profitable or on a clear path to profitability could have success in 2024.

Slide Insurance Holdings Inc. is reportedly evaluating a public offering sometime in the first half of 2024, among other capital-raising options, according to Insurance Insider US. The company specializes in homeowners insurance and considers the depth of its data (more than $6 trillion in total insured value) and its ability to work with that data to be key advantages.

Slide's carrier subsidiary, Slide Insurance Co., has been growing fast, going from zero direct premiums written in 2021 to $481.9 million in 2022. That growth continued in 2023, with $546.8 million in direct premiums written, across all states, in the first nine months, which was up 38.6% versus the same period of the prior year.

The majority of Slide's business is Florida homeowners insurance. Slide Insurance acquired renewal rights from Farmers Insurance Group of Cos. and two companies that went into receivership in Florida, which grew its premiums dramatically. It continued to pick up business in 2023 as well: On Oct. 17, it assumed $122.1 million in written premium from Citizens Property Insurance Corp., Florida's state-run insurer of last resort.

Slide Insurance posted a net loss in 2022, its first year of reporting, but it was a tough year for all Florida homeowners insurers due to Hurricane Ian. It had positive net income of $1.2 million as of the first three quarters of 2023, though the fourth quarter could send it back into negative territory, as it did in the fourth quarter of 2022.

We think Kin Insurance Inc. might consider an IPO too, especially if Slide goes public and its stock performs well. Kin is a fellow tech-forward homeowners insurer that targets catastrophe-prone regions, including Florida. About 77% of the direct premiums written by its main carrier subsidiary, Kin Interinsurance Network, came from Florida in 2022. Kin had previously planned to go public via a special purpose acquisition company merger announced in 2021 but terminated that transaction in January 2022.

Targeting capacity-constrained markets is not a new concept, and writing in a hard market with a fresh balance sheet can be highly lucrative. But pricing the business correctly is critical, and much depends on whether regulators will grant insurtech carriers the rates they want.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.