Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 7 Sep, 2023

By Rica Dela Cruz and Zuhaib Gull

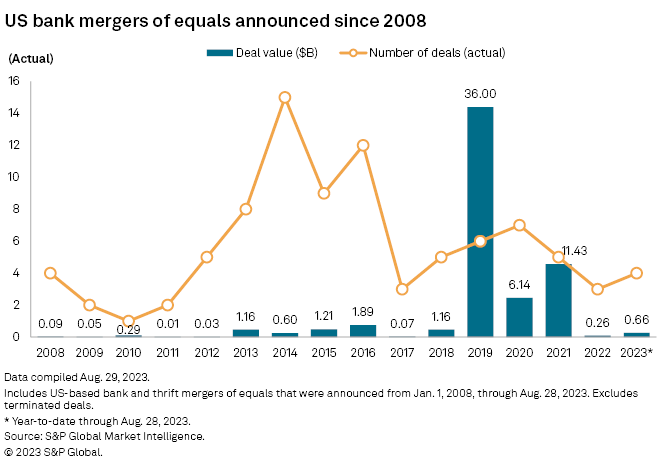

US bank merger of equals activity is bouncing back after hitting a five-year low in 2022.

The merger of equals (MOE) announcement between Burke & Herbert Financial Services Corp. and Summit Financial Group Inc. marks the largest such deal since 2021, and brings the yearly total of US bank MOE announcements to four so far this year.

MOEs make up 6% of all US bank M&A activity in 2023 through Aug. 28, higher than the last two years, according to S&P Global Market Intelligence data. Moreover, the four MOEs announced so far this year represent a combined total deal value of about $659.5 million, or 25% of total deal value through Aug. 28.

While broader M&A appetite soured this year and led to a slowdown in activity, MOE activity was unwavering as banks increasingly viewed those deals as an attractive alternative to pair up and gain scale to tackle ongoing headwinds amid a lack of buyers and low valuations. These deals are especially attractive for smaller community banks.

There will continue to be more "lower premium, merger of equal type deals," Frank Sorrentino, managing director at Stephens, said in an interview. "There's going to be a lot of those because in a lot of geographies, there's just a lack of larger acquirers who can pay bigger premiums, so not every seller is going to have a buyer. If you don't have an outright buyer, that's when a lot of times the merger of equals discussions really pick up."

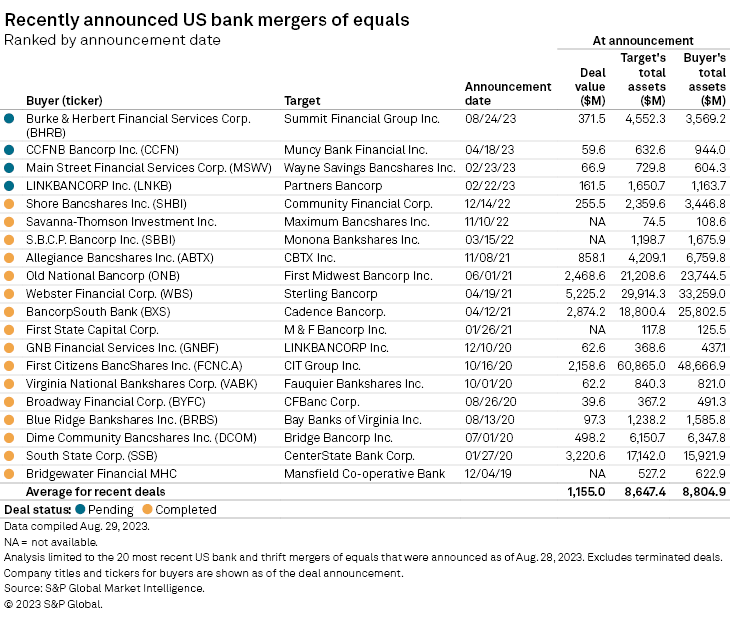

Among the four MOEs announced so far this year, all involved community banks. Similarly, community banks were involved in the majority of the 20 most recent US bank MOEs. As such, the average asset size of the buyers involved in those 20 deals was $8.80 billion, while the targets had an average asset size of $8.65 billion.

Some community banks view MOEs as an attractive pathway to boosting their value for a future sale to a larger lender.

"What is unique about a no or low premium merger ... is that the parties can use them as a stepping stone to achieve those goals in order to later get a higher premium than they could have gotten on their own without the MOE," said James Stevens, a partner at Troutman Pepper Hamilton Sanders LLP.

Also, given the current more stringent regulatory environment, hurdles associated with interest rate marks and the more challenging operating environment, community banks are viewing MOEs as even more attractive right now, according to Mark Fitzgibbon, managing director and head of financial services group research at Piper Sandler.

"These tend to be smaller transactions that should face less regulatory obstacles and where the balance sheet interest rate marks are quite manageable," Fitzgibbon said in an interview. "I think many management teams recognize the need to [add] scale, but most are still not in a position to do deals."

2023 MOEs

The $371.5 million all-stock MOE between Virginia-based Burke & Herbert Financial Services and West Virginia-based Summit Financial Group is the latest MOE announcement this year, and the largest MOE transaction announced since 2021.

|

– Access the S&P Capital IQ Pro M&A summary page for US financial institutions. – Get the latest M&A news. |

The second-largest MOE this year is the all-stock deal between Pennsylvania-based Linkbancorp Inc. and Maryland-based Partners Bancorp, which had a value of $161.5 million at announcement.

The two other MOEs are the $59.6 million transaction between Pennsylvania-based CCFNB Bancorp Inc. and Muncy Bank Financial Inc. and the $66.9 million deal between West Virginia-based Main Street Financial Services Corp. and Ohio-based Wayne Savings Bancshares Inc.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.