Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 3 May, 2023

Mid-band spectrum dominates the list of announced spectrum auctions from regulators worldwide. The popularity of 3.5 GHz in 5G deployments is the main driver for auctioning more mid-band spectrum, especially for markets that are yet to launch commercial 5G services.

The importance of mid-band spectrum is further stressed by the International Telecommunication Union (ITU) as it will decide this year on assigning new frequency bands for mobile services.

Announcements of future mobile spectrum auctions remain concentrated on mid-band spectrum as most markets focus on building out recently introduced 5G services. Mid-band's balance between coverage and capacity plus its adjacency to existing spectrum for older mobile technologies makes it the most attractive for near-term needs. Millimeter-wave spectrum, while essential for delivering some novel 5G applications, is not a priority for many operators as the current demands for 5G do not justify further investments in high-frequency spectrum.

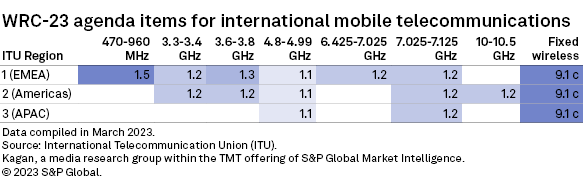

The ITU is set to convene Nov. 20–Dec. 15, 2023, in Dubai, United Arab Emirates, for its quadrennial World Radiocommunication Conference (WRC). ITU's last conference, WRC-19, opened the doors for allocating new millimeter-wave bands for 5G. WRC-23 this year is expected to deliberate the allocation of more low- and mid-band spectrum for 5G. This is in response to the need for more mid-band spectrum, especially above 6 GHz, to support the growth of 5G, as well as the potential for low-band spectrum in helping expand coverage to rural areas.

Agenda 1.2 of the WRC-23 conference is the most extensive when it comes to mobile services. It explores the allocation of several new mid-band spectrum for mobile services "on a primary service." This includes 3.3 GHz-3.4 GHz and 3.6 GHz-3.8 GHz, which are both adjacent to the popular 3.5 GHz, deployed in many 5G deployments worldwide. If approved, this would lend support to the decision of the U.S. Federal Communications Commission to open spectrum licenses in this range for 5G in its recent auctions.

The most significant provisions of Agenda 1.2 are concerned with the possibility of assigning new spectrum above 6 GHz to mobile services. This would significantly expand the available mid-band spectrum for mobile services, like what WRC-19 did for new millimeter-wave spectrum bands for mobile services.

Mid-band spectrum (between 1 GHz and 6 GHz, and possibly beyond 6 GHz)

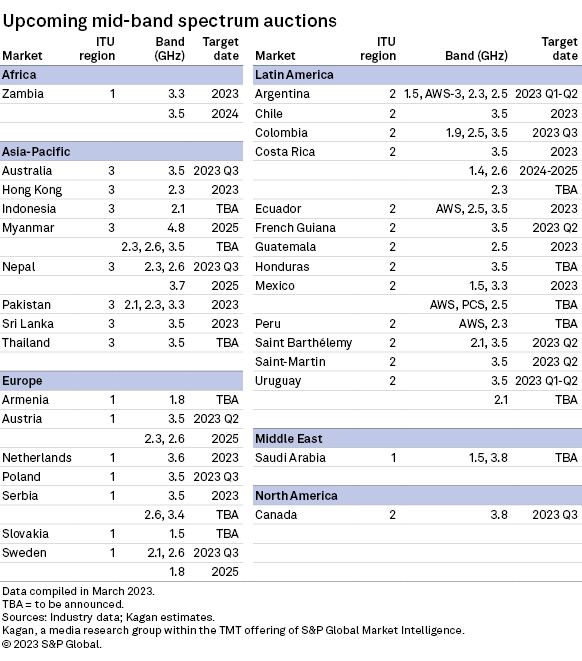

In line with WRC-23's emphasis on mid-band spectrum, regulators worldwide are keen to auction more licenses in this range. The bulk of announced spectrum auctions as of March 2023 is for mid-band spectrum, with at least 31 markets worldwide planning a tender process.

Almost all these auctions, however, are on existing mid-band spectrum below 6 GHz. There appears to be a trend of diversifying on top of 3.5 GHz, which featured prominently in past auctions. For instance, some regulators are targeting the release of spectrum in Advanced Wireless Services (AWS), 1.8 GHz, 2.1 GHz, 2.3 GHz, and 2.6 GHz bands — frequencies that were previously used for 4G but have been proven to be useful as well for 5G through Dynamic Spectrum Sharing (DSS). This trend of using DSS for 5G arose from the strategy of Latin American operators to substitute 4G spectrum for their 5G launch in 2020 when the COVID-19 pandemic shuttered planned 5G spectrum auctions. Markets that have experimented with DSS 5G have moved to the globally harmonized 3.5 GHz spectrum after auctions were finally held and concluded, but additional bandwidth from non-harmonized bands can still help to augment spectrum supply as demand for 5G grows.

Many markets in North America and Latin America (ITU Region 2) have announced plans to auction mid-band spectrum around 3.5 GHz in anticipation of approval of WRC-23 Agenda Item 1.2.

While not many regulators have announced auctions above 6 GHz, more could do so if the additional spectrum bands in WRC Agenda Item 1.2 gets approved for mobile services. This would take time as licenses from other industries currently occupy such frequency ranges. Careful planning and transition would have to be implemented to vacate these ranges for mobile services. Consultation with stakeholders would be necessary to ensure there is sufficient demand for these new spectrum ranges to warrant an auction.

Low-band spectrum (below 1 GHz)

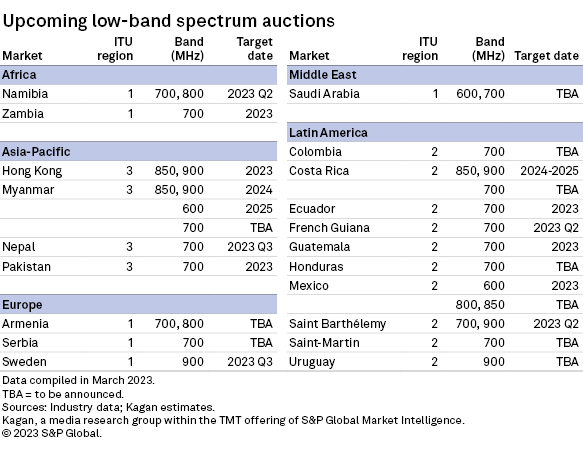

At least 20 markets worldwide have announced intentions to auction spectrum in low-frequency bands as of March 2023 — down from 32 markets in our last update.

For many operators seeking to include low-band in their 5G spectrum arsenal, these frequencies are primarily intended for coverage expansion in rural and sparsely populated areas. This is especially true for many Latin American markets that have announced auction plans for the 700 MHz band starting this year. Expansion will only happen once operators firmly establish their presence in urban areas — something that many 5G operators are yet to achieve.

Other regions have already allocated low-band spectrum in previous auctions, so some of the announced auctions are not for 5G. Instead, they are to replace expiring 3G and 4G spectrum in the 850 MHz and 900 MHz bands instead.

High-band spectrum (millimeter-wave bands above 24 GHz)

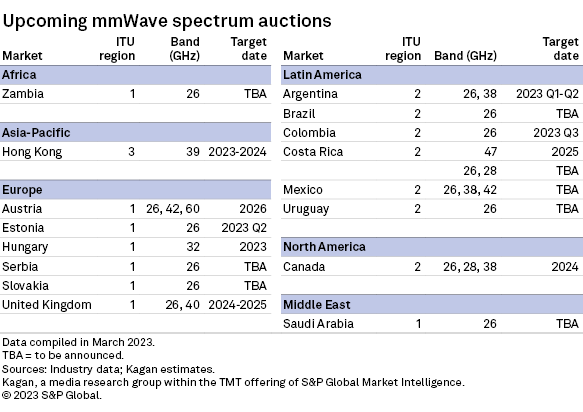

While several millimeter-wave spectrum auctions followed the announcement of new high-frequency bands for mobile services in WRC-19, most of these have been met with little to no interest from commercial operators. Some markets, such as Hong Kong, opted to give away licenses for free after local operators skipped the bidding process, citing the lack of economic value of such high-frequency bands. Consultations in other markets such as Chile, Cyprus and Poland have also yielded dismal results, causing regulators to scrap previously planned tenders for millimeter-wave spectrum.

The situation remains unchanged in 2023, with many regulators all over the world — except for North America — remaining quiet about their millimeter-wave spectrum release plans. Only 16 markets as of March 2023 have announced auctions for millimeter-wave spectrum, and this figure excludes those that opted for administrative assignment instead.

For a few markets that have earmarked millimeter-wave spectrum for auction in Latin America and Europe, their regulators have been unclear on the timeline or opted for a distant target year (such as 2026) for the auction. This reflects the paradox that while most agree that millimeter-wave spectrum would be indispensable to key 5G use cases, no one seems to want to shell out money for it right now given that such touted use cases are still far from reality.

Still, for markets such as Canada that have a positive disposition toward millimeter-wave spectrum, the existence of incumbent users from other industries such as satellite earth stations delay the release of spectrum to mobile operators. This is in part due to the recent earmarking of millimeter-wave spectrum for 5G mobile use only in 2019. The Canadian regulator stressed that the release of millimeter-wave spectrum will support local and enterprise 5G applications such as those in manufacturing and transportation.

Wireless Investor is a regular feature from Kagan, a part of S&P Global Market Intelligence.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Research

Research