Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 12 Apr, 2024

Last week, we had the pleasure of hosting the

Private Credit: Thriving Amidst Uncertainty webinar, delving into the intricacies of this dynamic asset class. With esteemed panelists Daniel Sinclair from Ares Credit Group and Eric Capp from Pemberton Asset Management, we dived deep into the evolving landscape of private credit, dissecting its nuances and uncovering its allure in today's financial markets.

Understanding the Rise of Private Credit

The past decade has witnessed a meteoric rise in private credit, propelled by an environment of increasing market volatility. Against this backdrop, private credit has emerged as a resilient asset class, characterized by a remarkable upward trajectory in assets under management (AUM) and a growing reservoir of dry powder. This ascent signifies a new stage of maturation for private credit, underlining its growing significance in the financial landscape.

Navigating Regulatory Reforms

To comprehend the ascendancy of private credit, it's imperative to contextualize its emergence amidst regulatory reforms post the 2008 financial crisis. Stricter regulations on traditional bank lending inadvertently created a void in lending opportunities, paving the way for the rise of private credit. Unlike traditional banking institutions bound by regulatory constraints, private credit funds possess the agility and flexibility to tailor bespoke lending arrangements, catering to the unique needs and risk profiles of borrowers.

Growth Trajectory and Misconceptions

The panelists discussed how the growth rate of the private credit market has accelerated in recent years, underscoring its resilience and attractiveness as an investment avenue.

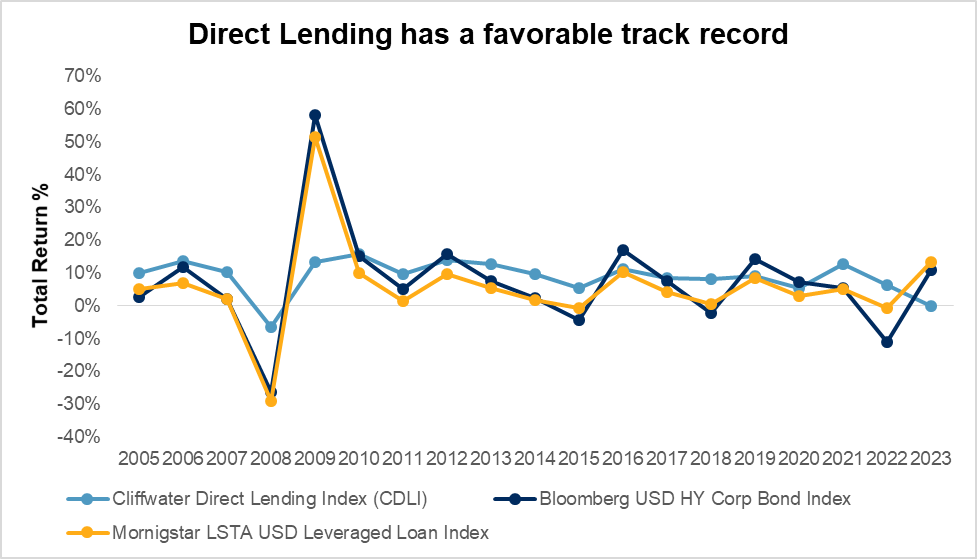

The above exhibit plots the total return performance of the CDLI against two widely tracked indices in the public credit markets: The Bloomberg USD HY Corporate Index, and the Morningstar/LSTA USD Leveraged Loan Index. Of the 18 annual periods (2005 – 2022) since the CDLI’s inception, the CDLI has outperformed these HY bond and leveraged loan indices (on a total return basis) in 13 of these years.

One key variable related to total performance (between the asset classes) is duration exposure. As a fixed rate asset class, the USD HY bond market has exposure to duration (i.e., price sensitivity to a change in interest rates). This stands in contrast to the CDLI and leveraged loan markets, which are floating rate asset classes.

However, there exists a widespread misunderstanding regarding the market's actual size. While global private credit assets under management (AUM) reached $1.6 trillion in 2023, it's essential to note that this does not necessarily imply surpassing the high yield (HY) and leveraged loan markets. Instead, private credit is reshaping the lending landscape by taking market share from other loan sources.

Regional Dominance and Diverse Strategies

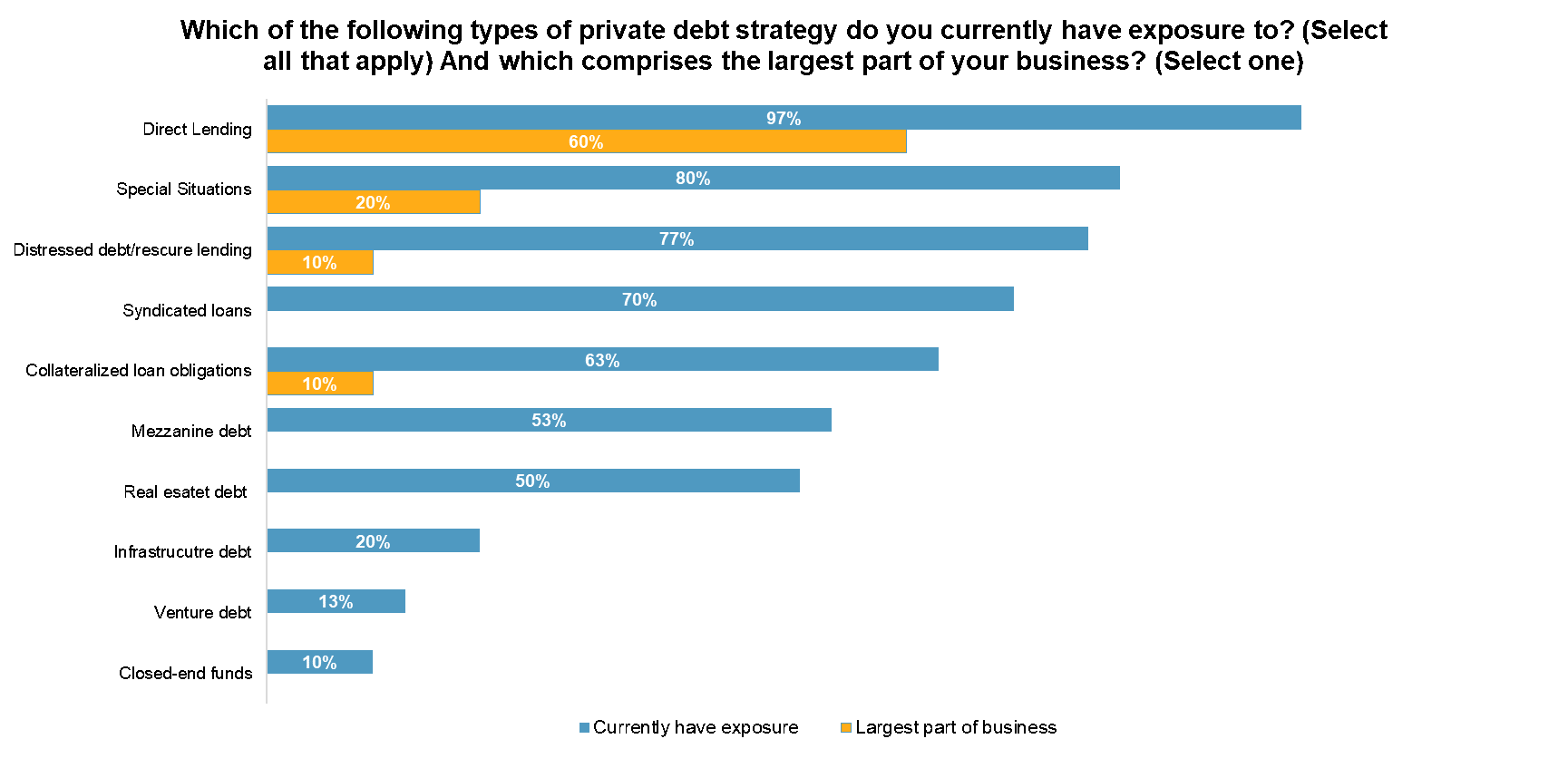

North America and Europe stand out as key regions in the private credit landscape, reflecting the scale and maturity achieved in these markets. Direct lending remains a dominant strategy, but asset managers have adopted a wide range of approaches, presenting both opportunities and risks, especially in managing increasingly complex portfolios.

Performance and Stability

Private credit offers strong and consistent performance, appealing to investors seeking stability and certainty in generating returns. Compared to private equity investments, private debt provides a more predictable income stream, with returns structured around fixed interest payments or predetermined yields.

Navigating Strategy Spectrum and Capital Structures

We discussed how Asset managers navigate a diverse spectrum of private credit strategies, ranging from direct lending to distressed debt and collateralized loan obligations (CLOs). We than further examined the distribution of private credit deals by capital structure which revealed a hierarchical pattern, with senior debt occupying the majority share, followed by mezzanine financing and unitranche structures.

In conclusion, the rise of private credit signifies not just a shift in lending dynamics, but a paradigmatic evolution in the financial industry. With its promise of stability, flexibility, and robust returns, private credit stands poised to shape the future of finance.

Webinar Replay

Theme

Location

Products & Offerings