Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — May 31, 2023

Understanding the impact of corporate actions is necessary when contemplating the right investment strategy. This impact is driven by timely awareness, accuracy, and attention to detail. In this blog, S&P Global Market Intelligence's Managed Corporate Actions™ team will discuss some of the most dominant corporate actions announced each month and the roles they take in the marketplace.

Corporate action announcements are meant to provide details around upcoming transactions to the market, including rate, dates, options, terms, and background around why the transaction is occurring. As markets have grown more complex and regulation has evolved, firms have started to include additional information that could impact any stage of the corporation action lifecycle, like tax code, cost basis requests, or eligibility requirements.

However, without standardized formats or information requirements, investors are often left to act without all the necessary information. This is particularly challenging with sanctions. While it may be easy to identify if a dividend is occurring on a sanctioned company, this gets tricky when you look at more complex events like the merger between AVIC Electromechanical Systems Co Ltd and China Avionics Systems Co Ltd, where the resulting company is subject to sanctions.

A (not so) standard merger

On May 26, 2022, AVIC Electromechanical Systems Co Ltd signed a letter of intent with China Avionics Systems Co. Ltd., to be absorbed via a potential merger. The two companies would finalize the details over the next year. In June 2022, it was determined that China Avionics Systems Co. Ltd. shares would be used to fund the transaction. As a result, AVIC Electromechanical Systems Co. Ltd. shareholders would receive payment in China Avionics Systems Co. Ltd. shares.

On February 8, 2023, AVIC Electromechanical Systems Co Ltd halted trading and on February 27, the company requested delisting from the Shenzhen Stock Exchange.

Shareholders who disagreed with the firm's decision to merge but didn't trade out of the security before the trading halt still had the option to tender shares back to AVIC between February 17 and February 23 at ¥10.33 per share, as announced by the company on February 9.

On March 17, the effective date for the merger was announced for the same day.

Implications of US-based sanctions

China Avionics Systems Co. Ltd. was identified by the US Office of Foreign Asset Control (OFAC) as subject to prohibitions on June 9, 2021, under Executive Order 14032 on June 3, 2021. However, these prohibitions actually dated back to Executive Order 13959 of November 12, 2020 - well before the proposed merger. The order prohibits any United States person from any transactions in a publicly traded security or derivative for a company identified by OFAC. Because of this merger, US-based AVIC shareholders faced the awkward position of not being able to receive the resulting shares of China Avionics Systems in March.

This complicated situation raises questions surrounding the initial merger valuation. The new shares couldn't be booked, even though the original security was surrendered. It's unclear how many US shareholders knew that OFAC had sanctioned China Avionics Systems before the initial merger proposal was submitted in June 2022.

Legal uncertainty is the last thing that any shareholder or custodian wants, especially when holding a particular security after a mandatory merger transaction. If all the corporate action details and the relevant sanctions were linked together for a specific market, investors could choose to sell the security to avoid potential issues.

With increasing global regulatory measures, it is crucial for financial experts to navigate the complexities of sanctions and their implications on corporate activities. By unraveling the intricacies of sanctions and their impact on corporate transactions, we empower financial professionals to make informed decisions and effectively manage risks in today's complex regulatory environment.

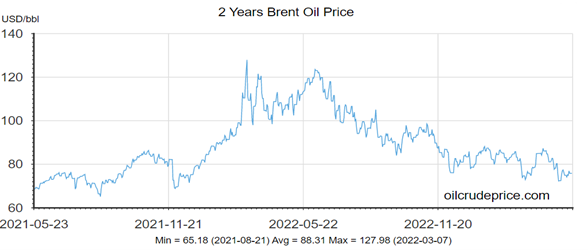

The price of petrol, diesel, and household gas has increased considerably since the onset of the pandemic. The Russian invasion of Ukraine has only added to the volatility, driven by sanctions from the West, disruptions to supply, and an embargo on Russian oil and oil-related products. At the same time, the lifting of COVID-19 lockdown restrictions led to a significant increase in energy demands as major economies emerged from hibernation.

(We talk about this on our podcast,Golden Record: Are Recession Concerns Inflated?, published August 2022)

Tracking the curve

Volatility in energy commodity pricing began in December 2021 with reports of Russia's potential invasion of Ukraine. In the first two weeks following the invasion, the prices of oil, coal, and gas went up by approximately 40%, 130%, and 180%, respectively.

The price of Brent Crude reached a high of about $120 USD per barrel in the summer of 2022, but in May 2023, had stabilized at just over $75 USD per barrel. However, with the recent announcement from several large oil exporters (OPEC+ members) that production levels will be cut, we can expect energy prices to jump again, providing little relief for global nations suffering from high inflation.

Energy suppliers' behavior and the impact on corporate actions

While energy companies and their shareholders are the likely benefactors of energy market volatility, let's not forget that these profits follow major losses suffered during the economic shutdown of the pandemic. During that time, energy markets saw a major collapse in oil prices, with some prices dropping to negative numbers due to low demand paired with high storage costs.

For perspective, let's look at how two major energy suppliers, Shell and BP, are using profits to bounce back from pandemic-era losses:

|

Shell |

BP |

|

2022 profits doubled from the previous year, at an all-time high of $39.9 billion. |

2022 profits more than doubled from the previous year to $27.7 billion. |

|

With an already generous and reliable dividend program, Shell increased its dividend by 15% in 2022. |

Increased dividends by 21% in 2022. |

|

In early 2023, Shell announced a $4 billion share buyback program lasting three months. |

In early 2023, BP announced a $2.75 billion share buyback |

|

Paid down debt and reduced gearing from 23.1% to 18.9% in 2022. |

Paid down debt from over $27 billion to $21.4 billion in 2022. |

With record levels of profitability, oil and gas companies are now facing increased scrutiny. Governments in both the Eurozone and the United Kingdom are under pressure to impose a "Windfall Tax" - a one-off tax on profits that were not expected. Various countries have therefore introduced new taxes to pay for the assistance they provided to households during the pandemic. In the United Kingdom, a levy on excess profits was introduced at the beginning of 2023, which is on top of the additional corporation tax that Oil and Gas firms pay to HMRC. All in, they pay 30% corporation tax on their profits and a supplementary 10% rate on top of that, compared to the standard rate of 25% for most companies. However, many companies are able to offset investments against this, therefore reducing the amount of tax payable.

Overall, the volatility of crude oil prices has significant effects on energy companies. Fluctuations in prices can lead to changes in production levels and profitability, and can also impact investment decisions, employment, and the overall stability of the industry.

Interested in more? Please find our:

Global Corporate Actions' October 2022 Blog Post

Global Corporate Actions' September 2022 Blog Post

Global Corporate Actions' August 2022 Blog Post

Global Corporate Actions' June 2022 Blog Post

Global Corporate Actions' April 2022 Blog Post

Global Corporate Actions' March 2022 Blog Post

Global Corporate Actions' February 2022 Blog Post

Global Corporate Actions' January 2022 Blog Post

Global Corporate Action's November 2021 Blog Post

Global Corporate Action's October 2021 Blog Post

Global Corporate Action's September 2021 Blog Post

Global Corporate Action's August 2021 Blog Post

Global Corporate Action's July 2021 Blog Post

Global Corporate Action's June 2021 Blog Post

Global Corporate Actions' September 2022 Blog Post

Global Corporate Actions' August 2022 Blog Post

Global Corporate Actions' June 2022 Blog Post

Global Corporate Actions' April 2022 Blog Post

Global Corporate Actions' March 2022 Blog Post

Global Corporate Actions' February 2022 Blog Post

Global Corporate Actions' January 2022 Blog Post

Global Corporate Action's November 2021 Blog Post

Global Corporate Action's October 2021 Blog Post

Global Corporate Action's September 2021 Blog Post

Global Corporate Action's August 2021 Blog Post

Global Corporate Action's July 2021 Blog Post

Global Corporate Action's June 2021 Blog Post

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.