Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Jun 20, 2022

By Daejin Lee

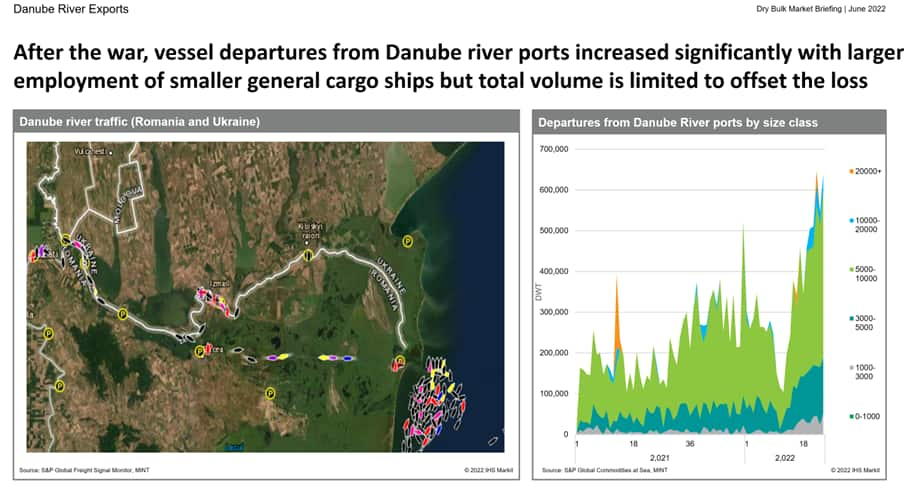

The Ukrainian supply chain issue will remain the main upside risk to food inflation in the coming months even with significant increase in shipments from Danube ports; total volume is too small to offset the loss of cargo from Ukraine.

Following the inflation and food crisis, there are several discussions on how to export or move the Ukrainian grain, and other cargo. We have already seen a significant increase in shipments from Danube River ports in Ukraine and Romania. However, most of the shipments are done by small ships less than 10,000 dwt, therefore the total volume is too small to offset the loss of the cargo, at least for now.

Recent news about silos on the borders with Ukraine to use inland transportation more efficiently is gaining more attention now. However, in our view, it will take months to procure equipment, move it into place, construct, and make it operational.

Therefore, the grain volume during the Black Sea grain season starting from the third quarter will be fairly limited and the shortage of world grain, especially wheat, is expected to continue in the near term. This supply chain issue will remain the main upside risks to food inflation in the coming months.

Following the Russia-Ukraine war, dry bulk and general cargo vessel (which can carry grain cargo) departures from Ukrainian and Romanian Danube River ports have increased by 53% from a month ago to 1.8 million deadweight tons in May 2022 with larger employment of small general cargo ships. However, total volume is limited to offset the loss of Ukrainian cargo. Combined capacity of dry bulk and general cargo ship departures from Ukraine has decreased by 92% from year-ago level (10 million deadweight) to below 1 million deadweight tons.

For more insight subscribe to our complimentary commodity analytics newsletter

Posted 20 June 2022 by Daejin Lee, Director, Shipping Analytics and Research, S&P Global Commodity Insights

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

How can our products help you?