S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

Research — April 03, 2025

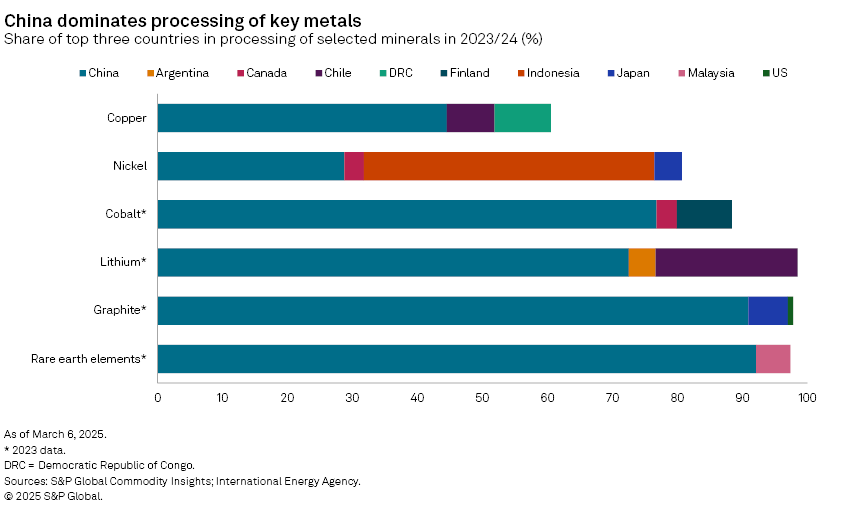

On March 20, 2025, US President Donald Trump signed an executive order directing the use of the Defense Production Act to increase domestic mineral production. "Immediate Measures to Increase American Mineral Production" is part of sweeping efforts by the US administration to reduce reliance on overseas supply of minerals, particularly from China, which dominates both the mining and refining of many critical minerals. To this end, the order defines "mineral production" to encompass the full value chain, from mining through processing and refining to the production of derivative products such as semiconductor wafers, anodes and cathodes, as well as final products such as magnets and electric vehicles. This executive order, in combination with the emergency powers of the Cold War-era Defense Production Act (DPA), looks to stimulate the development of fully integrated supply chains from raw material extraction to component manufacturing.

The executive order directs federal agencies to compile a list of projects awaiting approvals to "expedite their review and advancement," in addition to opening federal land for mining and refining over other uses and leveraging financial tools for new projects, including the International Development Finance Corporation (DFC). The National Energy Dominance Council (NEDC), chaired by the secretary of the Interior, will be responsible for coordinating the directives set out in the executive order.

The executive order does not announce new funding. Instead, it redirects several existing financial tools to support the development of domestic critical mineral supply chains.

If executed correctly, this could redirect significant capital toward US projects producing copper, lithium, nickel, cobalt, graphite, rare earth elements, uranium and other minerals. Well-positioned projects will likely be first in line for funding once these agencies start prioritizing minerals. However, without action from Congress, there will be limitations to what can be achieved within existing budgets.

Within 10 days of the announcement, the executive order directs the NEDC to identify priority projects for expedited permitting and all mineral deposits within federal land. Within 30 days, it directs relevant agencies to identify federal sites suitable for leasing for commercial mineral production. This has the potential to significantly lower capex for US refiners and processors.

The executive order adds copper, uranium, gold and potash to the Interior Department's list of 50 minerals already defined as critical. Additional minerals can be added at the NEDC's discretion. Expanding the minerals beyond that of the Interior Department's list means that mining projects focused on commodities such as copper and uranium, which are central to the growth of the electrical and nuclear sectors, could now be eligible for tax and permitting benefits.

The "Immediate Measures to Increase American Mineral Production" executive order follows a directive signed on Feb. 25, "Addressing the Threat to National Security from Imports of Copper" (EO 14220), which launched an investigation into possible national security risks arising from the dependence on imported copper. Both announcements have largely been welcomed by the US mining industry. Exclusively targeting the development of domestic minerals resources, the executive order of March 20 signals the Trump administration's focus on minerals security as part of an "America First" agenda by lowering barriers to entry and mobilizing existing funding.

.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.