Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 16 Feb, 2023

By Tauqir Aslam

Certain credit factors have always been a part of credit risk analysis. For example, these include financial ratios to assess the financial repayment capacity of borrowers, plus measures of country and industry risk. Whilst environmental, social and governance (ESG) factors have been known to impact companies, their relative importance with respect to credit has been increasing. Stakeholders are becoming more aware of the impact of sustainability on businesses and the impact of businesses on stakeholders and the environment. The potential impact has continued to gain the attention of regulated institutions (e.g., banks, insurance companies and asset managers) due to growing government-led actions on these issues.

ESG best practices are taking hold

The formal inclusion of ESG in credit risk analysis became a recognized international best practice when the Principles for Responsible Investment (PRI) launched the ESG in Credit Risk and Ratings Initiative in 2016. The initiative’s aim was to enhance the transparent and systematic integration of ESG factors in the credit assessment process.

Today, there is little doubt that ESG factors impact credit risk. For example, S&P Global Ratings downgraded multiple oil and gas companies in early 2021 citing “significant challenges and uncertainties engendered by the energy transition, including market declines due to growth of renewables”.[1] ESG considerations are therefore on the agenda for investment and risk management professionals. One positive consequence has been the requirement from investors and regulators for mandatory ESG disclosures.

ESG in the S&P Global Market Intelligence Credit Assessment Scorecards

Credit Assessment Scorecards provide a structured framework for assessing credit risk, generating credit scores[2] that provide a complete view of risk. The Scorecards are easy-to-use tools that draw on a mixture of quantitative and qualitative questions in a check-box style to identify key risks. They are especially useful for low-default portfolios that, by definition, lack the internal default data necessary for the construction of statistical models and for those exposures that are impacted heavily by non-financial factors (e.g., project finance).

Not all ESG factors are considered important for credit risk. For example, companies producing high levels of carbon emissions to make products with no readily available substitutes (e.g., cement) would not be materially impacted from a credit perspective, even though these companies may be viewed negatively from a sustainability perspective. Thus, only a subset of ESG factors, collectively known as ESG credit risk factors, will impact credit assessments.

Scorecards with ESG Credit Metrics are enhanced Scorecards that explicitly include ESG credit risk factors. These factors are considered in detail alongside the traditional credit analysis formalized in the Scorecards, enabling users to reflect the impact of material ESG factors on credit risk while working through the regular credit assessment process.

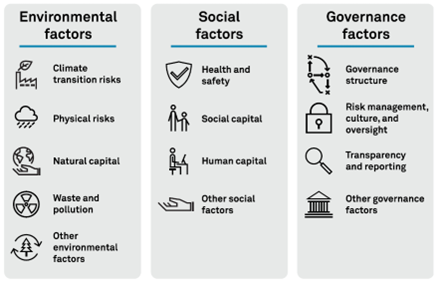

ESG credit factors generally considered include those listed below in Figure 1. However, not all will be relevant for each exposure. For example, physical risks will not be relevant for those entities operating in geo-physically stable locations.

Figure 1: Sample ESG Credit Factors

Source: ESG - Environmental, Social, And Governance Principles In Credit Ratings;, S&P Global Ratings, October 10, 2021, Copyright @2021 by Standard & Poor's Financial Services LLC. All rights reserved.

Given that Scorecards are sector-specific, the impact and importance of these factors will vary in intensity and position within the relevant Scorecard framework. For example, governance structure is less important for highly regulated entities that are subject to significant regulatory oversight. This approach enables greater transparency/visibility, granularity, and reliability when compared to the use of an ESG overlay, which adjusts the final credit assessment score with an ESG consideration.

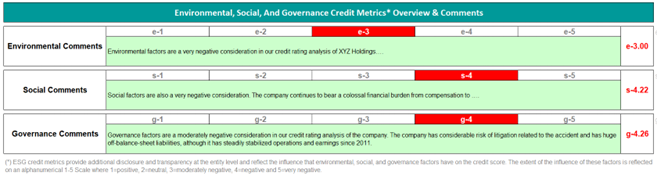

As shown in Figure 2, along with the traditional credit score, our Scorecards generate ESG credit metrics for each environmental, social and governance vertical. These metrics are alpha-numeric quantifications of the impact of E, S and G factors on the final credit score and are shown on a continuous scale from 1 to 5, with 1 being positive and 5 very negative. They are proving to be critical for addressing internal and external requirements.

Figure 2: ESG Credit Metrics

Source: Credit Assessment Scorecards, S&P Global Market Intelligence, As of: 4 February, 2023.

[1]S&P Global Ratings Takes Multiple Rating Actions On Major Oil And Gas Companies To Factor In Greater Industry Risks, January 26, 2021, https://press.spglobal.com/2021-01-26-S-P-Global-Ratings-Takes-Multiple-Rating-Actions-On-Major-Oil-And-Gas-Companies-To-Factor-In-Greater-Industry-Risks.

[2]S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence PD credit model scores from the credit ratings issued by S&P Global Ratings.

Products & Offerings