Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 10 May, 2021

Tax reforms, minimum wage policies, health insurance acts, and other regulations all impact business operations. It is estimated that federal regulations alone cost U.S. companies a total of $1.9 trillion annually.[1] Litigations are also costly, averaging nearly $115 million per U.S. entity each year, and are steadily increasing.[2]

To mitigate exposure to fines and the reputational and commercial risks that accompany being non-compliant, companies should keep track of their judicial exposure. In this blog, we examine how two datasets combined with machine–readable transcripts can help banks stay on top of this exposure. The datasets include Yewno Judicial Analytics that provides document-level information from millions of court opinions to identify key legal themes, as well as FiscalNote U.S. Legislation & Regulation that uses proprietary technology to aggregate laws and regulations from Congress and federal agencies in real time.

Seeing What Earnings Calls Reveal

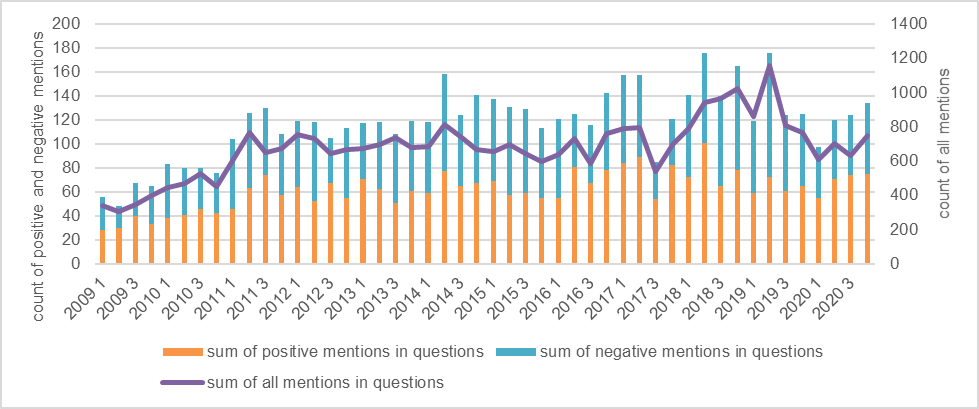

Accessing S&P Global Market Intelligence’s machine readable transcripts from earnings calls, we looked at the Q&A section for mentions of regulatory words, such as “rule”, “regulations”, and “bill”. These mentions were then divided into those that were positive versus negative, based on surrounding words in the same sentence. For example, a question such as, “How are you handling the increasing number of regulations", counts as negative, while a sentence mentioning a "decreasing number of regulations" counts as positive.

The number of mentions have been steadily increasing over time. Figure 1 below shows the split between positive and negative mentions, as well as the total number over time, grouped by quarter for all current constituents of the S&P 500 index.

Figure 1: Mentions in Questions

Source: S&P Global Market Intelligence, April 16, 2021. For illustrative purposes only.

Looking Further with Transcripts and Yewno Judicial Analytics

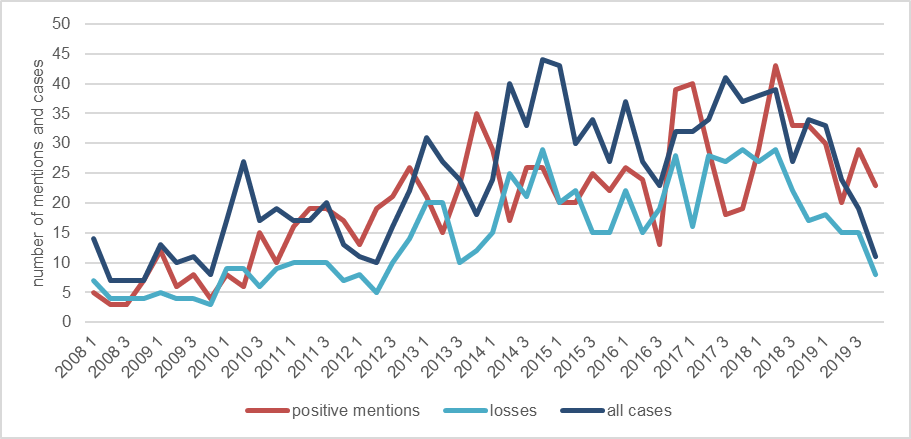

Yewno's data is tagged at the entity level, and enables users to filter by the company ID of the defendant, plaintiff, or any other entity mentioned in the text of the court opinion. Our sample includes all cases where a company operating in the banking sector was a defendant, with the outcome given from the perspective of the plaintiff. In these cases, all court opinions ending in a loss outcome means that our group of companies have been sued, but ended up winning the case in court. Figure 2 below shows all positive mentions in company earnings calls for current constituents of the S&P 500, overlaid with the number of cases that they won in court.

Figure 2: Positive Mentions and Wins

Source: S&P Global Market Intelligence, April 16, 2021. For illustrative purposes only.

Adding More with FiscalNote

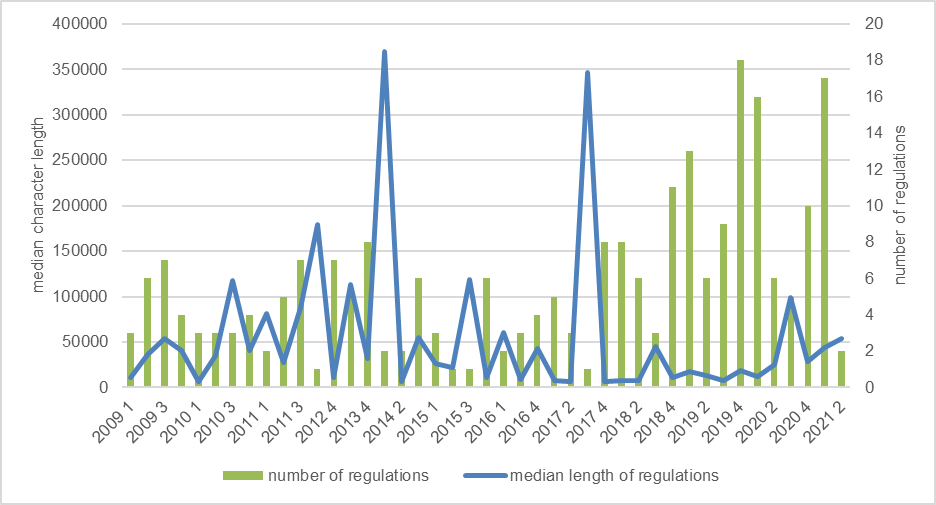

Figure 3 below tells a powerful story using FiscalNote for the number of issued regulations by agencies dedicated to the banking sector, including:

The data has been filtered to only count regulations with “final” as a keyword in the action text. Alongside the number of regulations is the median number of characters that are used in each document. The two major peaks in number of characters was due to the fact that there was a single larger regulation published during those quarter. There has been a clear increase in regulatory activity since 2018, while the characters used in each text remained fairly stable.

Figure 3: Issued Regulations

Source: S&P Global Market Intelligence, April 16, 2021. For illustrative purposes only.

Identifying Trends with Term Frequency — Inverse Document Frequency (TF-IDF)

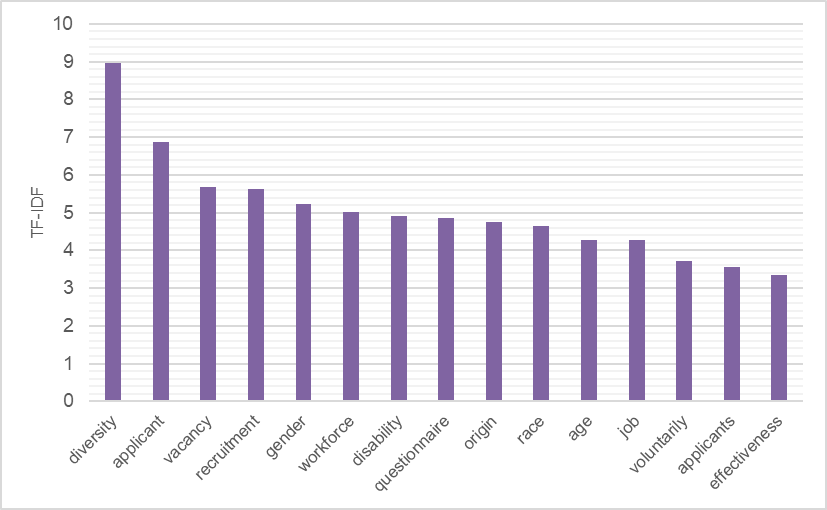

TF-IDF is a numerical statistic that is intended to reflect how important a word is to a document in a collection or corpus. We looked at regulations that are aimed at the banking sector and that share a great deal of common language. Figure 4 shows the highest-ranking words, indicating themes that are making their way into the text of federal regulations.

Figure 4: Highest Ranking Words

Source: S&P Global Market Intelligence, April 16, 2021. For illustrative purposes only.

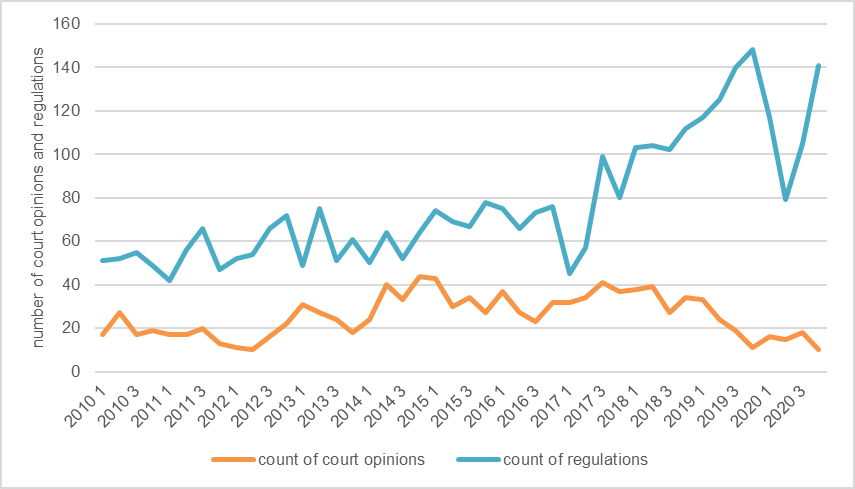

Does the increase in the number of regulations seen above, translate into a higher volume of court cases? As shown in Figure 5 below, that is not necessarily the case. To better understand this, we would need to analyze the text of these regulations and the magnitude of their impact.

Figure 5: Count of Court Opinions and Regulations

Source: S&P Global Market Intelligence, April 16, 2021. For illustrative purposes only.

[1] “Federal Regulations Cost an Estimated $1.9 Trillion per Year: Many Rules Hinder Virus Response, Economic Recovery”, cei.org, May 28, 2020, https://cei.org/citations/federal-regulations-cost-an-estimated-1-9-trillion-per-year-many-rules-hinder-virus-response-economic-recovery/.

[2] “Litigation Cost Survey of Major Companies”, Lawyers for Civil Justice, Civil Justice Reform Group, U.S. Chamber Institute for Legal Reform, May 10‐11, 2010, www.uscourts.gov/sites/default/files/litigation_cost_survey_of_major_companies_0.pdf.