Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Feb 22, 2023

By Sara Johnson

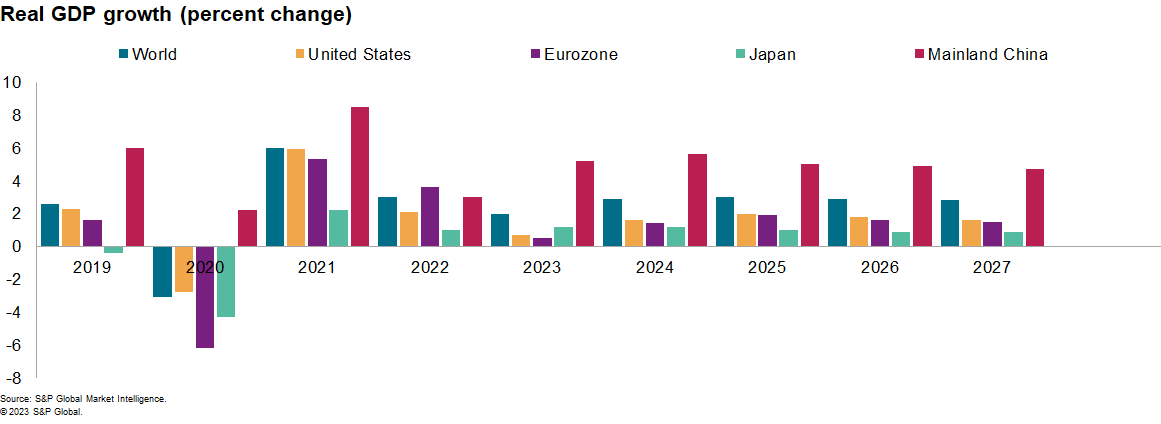

The global economy is proving resilient in early 2023. Supply conditions are steadily improving, while demand conditions are neither too hot nor too cold. For a fourth consecutive month, the S&P Global Market Intelligence forecast of 2023 global economic growth has been revised upward. After a 3.0% expansion in 2022, world real GDP is now projected to increase 2.0% in 2023, up from 1.9% in our January forecast and a low of 1.4% in the October 2022 forecast.

While Western Europe and North America will likely experience mild setbacks in early 2023, recession risks are diminishing, and annual real GDP growth will be positive in both regions. After its abrupt exit from zero-COVID policies, mainland China's rebound is coming sooner than anticipated, lending support to its trading partners. Market Intelligence analysts project world real GDP growth to pick up to 2.9% in 2024 and 3.0% in 2025, as inflation subsides and monetary policies ease.

Inflation will slow significantly in 2023 but achieving central bank targets will be a two-year process.

Global consumer price inflation eased from a peak of 8.3% year on year (y/y) in September 2022 to an estimated 7.5% in January. Led by a deceleration in goods prices, we expect global inflation to slow to 4.0% in December 2023 as declines in prices of energy and other commodities filter downstream. In mid-February, the Material Price Index by S&P Global had fallen 20% y/y. Inflation in services prices is proving more persistent in an environment of labor shortages and accelerating wage rates. The scars of the COVID-19 pandemic and retirements from aging populations have reduced labor force participation in the major economies.

Globally, we expect consumer price inflation will subside from 7.6% in 2022 to an average of 5.3% in 2023 and 3.2% in 2024. In the advanced economies, inflation will retreat from 7.2% in 2022 to 4.1% in 2023 and 2.1% in 2024. Elsewhere, progress in reducing inflation will come more slowly, reflecting rising food prices and the end of subsidies. Consumer price inflation in emerging markets will likely slow from 7.6% in 2022 to 6.3% in 2023, while inflation in developing countries retreats from 15.4% to 11.5%.

Central banks are not finished raising interest rates.

With inflation rates uncomfortably high, major central banks will continue to tighten policies in the first half of 2023. We expect policy interest rates to reach highs of 5.25% in the United States, 4.25% in the United Kingdom, and 3.50% (refinance rate) in the eurozone. The surprising strength of US employment and retail sales in January could lead to more aggressive rate hikes than assumed in the February forecast. We expect that these peak rates will remain in place throughout 2023 to dampen wage pressures and long-run inflation expectations. With forward markets now accepting this view, financial market conditions are tightening, as seen in rising 10-year bond yields. As inflation approaches target rates, the S&P Global Market Intelligence forecast shows monetary policies starting to ease in the second quarter of 2024, with policy rates falling to their long-run neutral levels by the end of 2025.

The US economy enters 2023 with a new burst of energy.

In January, payroll employment surged by 517,000 while the unemployment rate fell to 3.4%, its lowest level since May 1969. After declines in November and December, retail sales and manufacturing production posted strong rebounds in January. Our latest US GDP tracking suggests that real GDP will decrease at a modest 0.5% annual rate in the first quarter of 2023, pulled down by a sharp reduction in inventory accumulation and further declines in residential construction and business equipment investment. Consumer spending remains on a slow growth path, supported by rising employment and savings accumulated during the pandemic but restrained by rising interest rates and rising debt. After 2.1% growth in 2022, we project US real GDP to increase 0.7% in 2023 and 1.6% in 2024.

The eurozone may avert a recession, but economic conditions remain challenging.

Real GDP increased marginally in the final quarter of 2022, and we expect a slight contraction in the first quarter of 2023. Owing to mild winter weather, high natural gas storage levels, and falling energy prices, the risk of a severe recession has been averted. Consumer and business sentiment has improved, and the S&P Global Eurozone PMI™ signal an upturn in services activity in January, coupled with a slower rate of decline in manufacturing output and new orders. Despite easing, consumer price inflation remains high, at 8.5% y/y in January, eroding household incomes. Rising interest rates, tightening credit standards, and housing market corrections will impede near-term growth. After a 3.6% advance in 2022, our projection for eurozone real GDP is an increase 0.5% in 2023 and 1.4% in 2024. Elsewhere, the United Kingdom, Sweden, and Denmark will likely see annual declines in real GDP this year.

Asia Pacific will lead all regions in growth as mainland China reopens.

We project Asia Pacific's real GDP growth to pick up from 3.2% in 2022 to 4.2% in 2023, led by an acceleration in mainland China's output from 3.0% to 5.2% growth. The shift in policy focus from zero-COVID to economic stimulus has advanced growth. Tourism surged during the Lunar New Year holidays, and our PMI™ surveys indicate a strong rebound in services activity. Manufacturing activity has remained sluggish, however, reflecting weak export demand. Consumers remain cautious, saving at a high rate and refraining from large purchases that require financing. Real GDP growth should pick up to 5.6% in 2024 before resuming a long-run deceleration.

Although growth in other parts of Asia Pacific will moderate in 2023, India, Vietnam, the Philippines, and Cambodia will achieve real GDP growth rates above 5.0%. However, tightening financial conditions and downturns in segments of the electronics industry will lead to more subdued growth in South Korea, Taiwan, Malaysia, Australia, and New Zealand.

Bottom line

The global economic outlook has brightened, with the major economies showing resilience in early 2023. However, persistent core inflation will lead to further monetary tightening, restraining growth. With supply conditions improving, progress in reducing inflation will continue, allowing central banks to lower interest rates in 2024-25. Therefore, we project world real GDP growth to pick up from 2.0% in 2023 to 2.9% in 2024.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.