Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Feb 22, 2022

By Sara Johnson

Two years into the pandemic, COVID-19 continues to take surprising turns, disrupting the global economy through multiple channels—public health, work, education, travel, consumer spending patterns, production of goods and services, and international trade flows. Just as regions were rebounding from the Delta variant, the Omicron variant emerged, sending global COVID-19 infection rates to new highs. As 2022 begins, economies are adapting to the new, highly contagious variant. While considerably milder than previous strains, Omicron is dampening supply and demand in the most-affected regions, delaying resolution of market imbalances.

Global economic growth will slow.

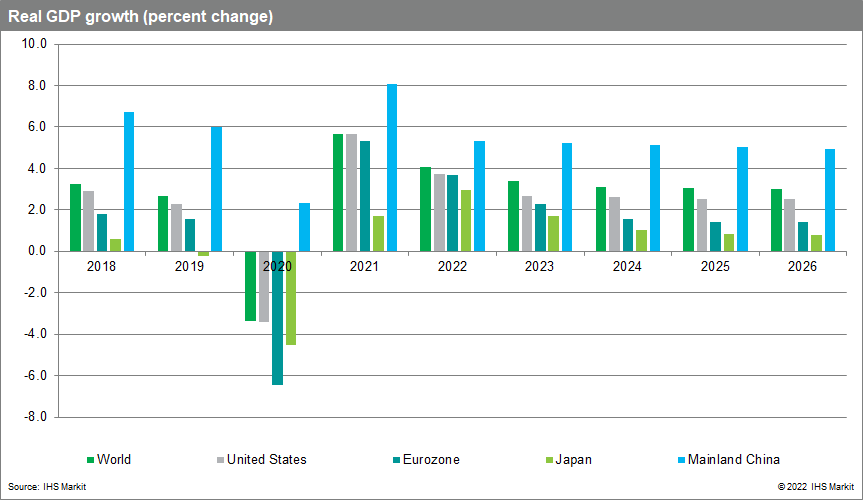

After a 3.4% contraction in 2020, world real GDP rebounded an estimated 5.6% in 2021, reaching a new high in the first quarter. Global growth is projected to slow to 4.2% in 2022, slightly below last month's forecast owing to weaker performances in Western Europe, North America, mainland China, and Japan. Just as the 2021 rebound was broadly based, most regions will experience a deceleration in 2022. A notable exception is the Middle East and North Africa, where higher oil export revenues will spark a pickup in growth. Global real GDP growth will settle to 3.4% in 2023 and 3.1% in 2024 as fiscal and monetary policies tighten and pent-up consumer demand is satisfied.

With shipping bottlenecks and some critical supply shortages persisting, global price inflation will remain high in 2022.

Global consumer price inflation reached 5.2% year on year (y/y) in November and December 2021, its highest pace since September 2008 (Venezuela and Zimbabwe are excluded from all aggregates because of distortions caused by hyperinflation). Worldwide inflation will likely remain near 5.0% in early 2022 before gradually easing in response to declines in industrial and agricultural commodity prices. On an annual basis, global consumer price inflation picked up from 2.2% in 2020 to 3.8% in 2021 and will average 4.1% in 2022 before subsiding to 2.8% in 2023. Risks to the inflation outlook are concentrated on the upside.

Global semiconductor and electrical steel shortages will also continue well into 2022, forcing automakers to limit production. While the initial chip shortage shock is under control, disruptions have moved from microcontrollers to cross-chip manufacturing operations, particularly in Malaysia, affecting several types of chips. In 2022, analog chips will be another source of concern. Electrical steel—used in battery-electric vehicles, transformers, motors, and generators—faces a structural supply deficit that will require significant investment in capacity.

Labor shortages are also contributing to the rise in inflation. In the United States, labor force participation remains below pre-pandemic levels and job vacancy rates have risen to record highs. Across Europe, COVID-19 has disrupted migrant labor flows. Mainland China's zero-COVID policy and demographic shifts are restricting labor supply. Wage pressures are most acute in service sectors where workers are most exposed to the COVID-19 virus. The business implications of labor shortages and continuing supply chain disruptions are more automation of labor-intensive processes, near-sourcing of supplies, and a reconsideration of lean inventory policies.

The US economic expansion will face headwinds from inflation and the withdrawal of fiscal and monetary policy stimulus.

Thus, real GDP growth is projected to slow from 5.7% in 2021 to 4.1% in 2022 and 2.5% in 2023. On the positive side, healthy household balance sheets, supportive financial conditions, and employment gains will support continued growth in consumer spending. There are early indications that the wave of Omicron infections is subsiding in the areas that were hit earliest. Meanwhile, inventory restocking will support near-term growth. With headline inflation (measured by the Consumer Price Index) reaching 7.0% y/y in December and core inflation at 5.5%, the Federal Reserve will likely start raising interest rates in mid-March, sooner than previously expected.

Western Europe faces another bumpy ride in 2022.

After a mid-2021 growth spurt, eurozone growth has slowed abruptly in late 2021 and early 2022 in response to record-high energy costs, ongoing supply chain disruptions, and a widespread increase in COVID-19 cases. As these headwinds ease, growth should strengthen in the second quarter. The service-oriented economies in southern Europe should benefit from a rebound in tourism and travel-related activities in the third quarter. After a 6.4% decline in 2020 and an estimated 5.2% recovery in 2021, eurozone real GDP is projected to increase 3.7% in 2022 and 2.3% in 2023.

Mainland China's real estate downturn dampens economic growth.

Real GDP growth slowed to 4.0% y/y in the fourth quarter of 2021 as the government's deleveraging campaign led to contractions in real estate and construction activity. Meanwhile, the zero-COVID policy, decarbonization drive, and regulatory crackdowns have weighed on most sectors. Economic stabilization has now become the top policy goal. The government started easing monetary policy in late 2021 and will accelerate infrastructure investment in 2022. Mainland China's real GDP growth is projected to slow from 8.1% in 2021 to 5.4% in 2022 and 5.3% in 2023.

Asia Pacific will lead global economic growth, benefiting from trade liberalization.

The Regional Comprehensive Economic Partnership (RCEP) took effect on 1 January 2022 for those countries that have ratified the agreement—mainland China, Japan, South Korea, Australia, New Zealand, Singapore, Thailand, Vietnam, Cambodia, Brunei, and Laos. An important advantage of RCEP is its favorable rules of origin, which will provide cumulative benefits along manufacturing supply chains. This will help to attract foreign direct investment in manufacturing and infrastructure projects in member nations. After a mild 1.0% decline in 2020 and 6.0% growth in 2021, Asia Pacific's real GDP is projected to expand 4.8% in 2022 and 4.5% in 2023.

Bottom line

The global economic expansion will continue at a moderating pace in 2022 and 2023 alongside a transition from COVID-19 pandemic to endemic. With supply disruptions continuing, inflation will remain elevated in the months ahead, leading to monetary policy tightening. As demand growth cools and supply chain problems are gradually resolved, inflation will subside.