Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

By Shunyu Yao

Driven by a cobalt price rally and cost reduction, some copper-cobalt miners are actively assessing restart and expansion opportunities. An S&P Global Market Intelligence analysis suggests that even if there is a potential cobalt price downgrade, led by a narrowing market deficit, large-scale miners would still benefit from increased production.

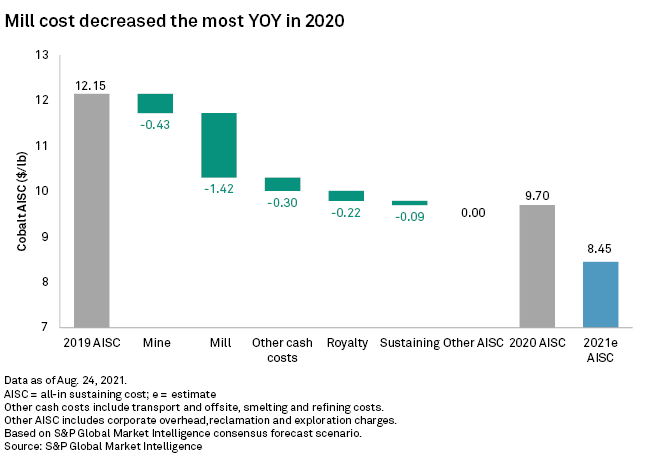

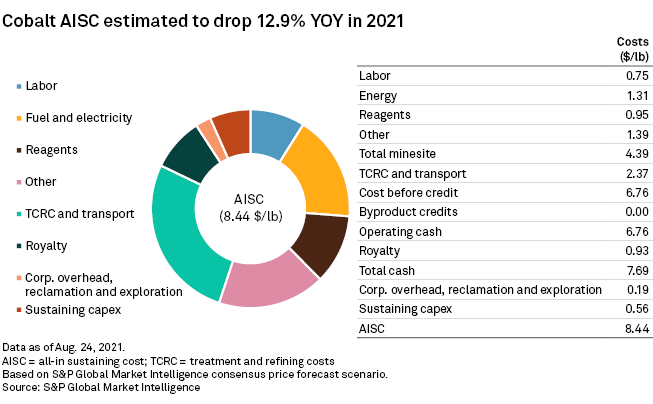

The average cobalt all-in sustaining cost, or AISC, dropped 20% year over year in 2020, from $12.14 per pound in 2019 to $9.70/lb, with mill costs decreasing the most, by $1.42/lb. Following several years of investment in plant optimizations, the major producers have gained some significant cost savings. China Molybdenum Co. Ltd.'s Tenke Fungurume operation has continuously promoted cost-reduction and efficiency-enhancement plans, which have resulted in a reported operating cash cost decrease of approximately $365 million per annum, including a $76 million decrease in mining costs in 2020. Katanga Mining Ltd.'s Kamoto SX-EW operation also carried out a series of measures to improve cost performances, including copper and cobalt recovery enhancement and reagent consumption reduction. We expect further improvements in 2021 with the AISC forecast at $8.44/lb, down 12.9% from 2020.

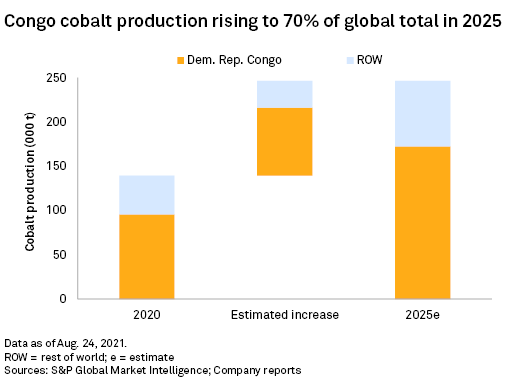

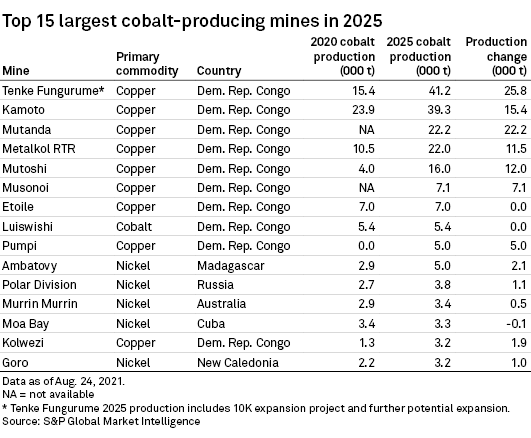

Most cobalt is produced as a byproduct of copper and nickel mining; in 2020, 60.7% of global production was from primary copper mines and 29.3% was from nickel mines. Most major cobalt-bearing deposits are in the Central African Copper Belt, with Democratic Republic of Congo contributing 68.6% of global cobalt supply. In 2020, global production totaled 139,480 tonnes, including 95,600 tonnes from Congo. Australia and the Philippines ranked second and third, accounting for 4.2% and 3.3% of production, respectively.

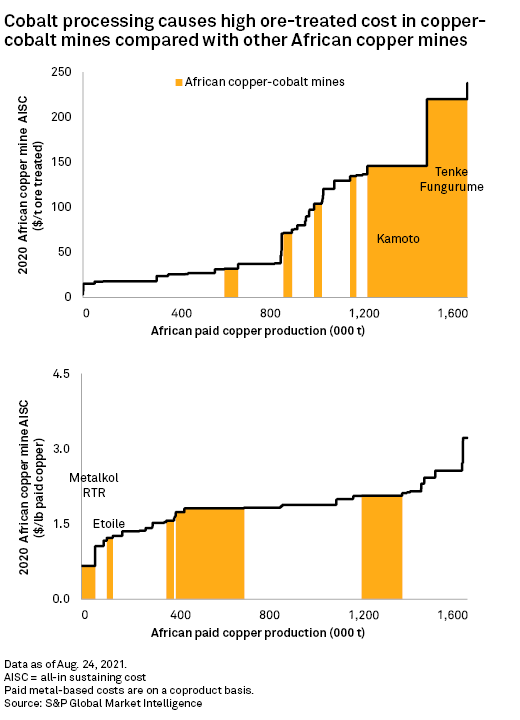

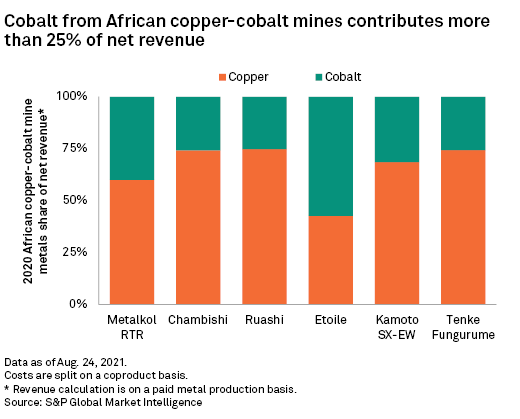

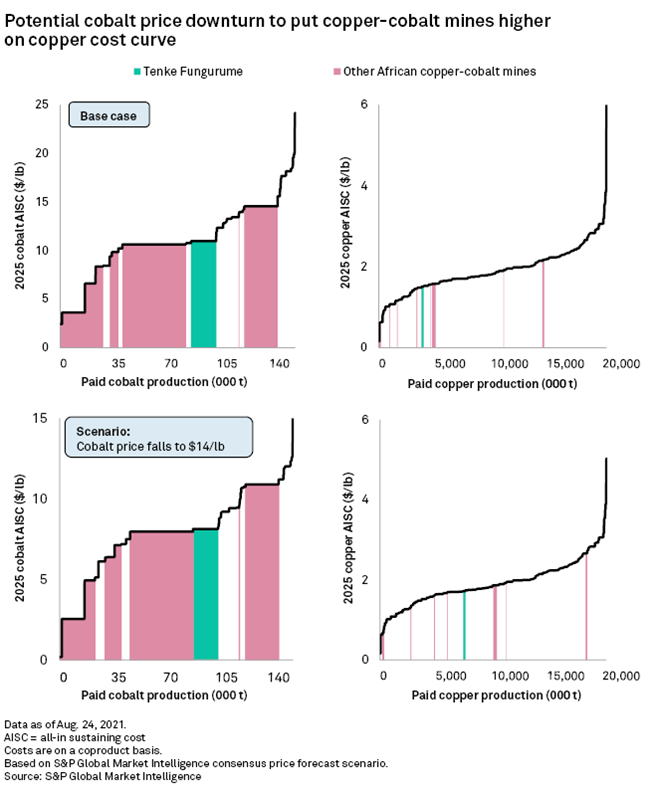

As most cobalt production is sourced from Africa, we have made a horizontal comparison between copper-cobalt mines and other copper mines within the region on the 2020 copper cost curve. The copper-cobalt mines are at cost-competitive positions on a dollars-per-pound paid copper basis due to the cobalt byproduct, although additional expenses from cobalt recovery circuits make their ore tonnage treated costs high. Cobalt revenues at all the African copper-cobalt mines exceeded 25% of the total mine revenue in 2020. Cobalt accounted for more than 40% of Metalkol RTR's and Etoile's revenue shares, placing them in the lowest 10% of the paid metal basis curve. Rising cobalt prices will push up the metal's revenue shares at copper-cobalt mines, further pushing down copper costs under coproduct costing.

The cobalt price has had strong momentum since the beginning of 2021, with the London Metal Exchange cash price increasing 52% by Aug. 31. We currently forecast a cobalt price rise to $21.96/lb by 2025, a profitable price for most cobalt miners, although there are downside risks. In our previous battery choice analysis, we concluded that cobalt may face the biggest downward risk under a nickel-intensive battery uptake scenario. From a certain point of view, however, a moderate drop in the cobalt price could slow the pace of cobalt replacement. The restart and expansion plans of existing large-scale cobalt producers could also move the market into surplus, assuming a developing cobalt-free scenario.

In May, Glencore PLC reported the restart of the Mutanda SX-EW mine, which is expected to enter production by year-end. The operation is expected to restore 20,000 tonnes per year of cobalt production and will account for 9.0% of global supply in 2025. China Molybdenum Co. Ltd. has begun a planned expansion to add 17,000 t/y by 2023 at Tenke Fungurume. With an expansion project in the pre-commissioning stage as of July, the mine will add a total of 24,000 t/y to global supply. By 2025, the major cobalt supply increases will come from Mutanda SX-EW and Tenke Fungurume.

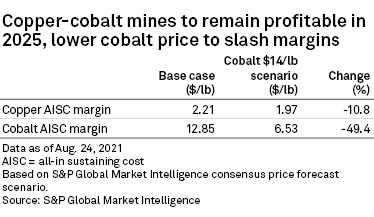

The 2025 cost curve shows that a cobalt price decline would do little to change the position of African copper-cobalt mines but could push them higher on the copper curve. We have developed a scenario based on Market Intelligence's consensus price forecasts, with the assumption that the cobalt price will fall to $14.00/lb, its lowest limit in recent years. Under the base case, most African copper-cobalt mines will be in the copper curve's first quartile. From the assumed scenario, some mines will be pushed into the second and third quartiles as lower cobalt credits will result in a copper cost rising on a coproduct basis. Using Tenke Fungurume as an example, the mine's paid copper cost will rise to $1.72/lb under the scenario, compared with $1.51/lb under the base case, pushing its position higher by 18% on the copper curve. Tenke Fungurume will, however, still hold cost advantages over most of the other copper mines. These outcomes might explain why the owner is seeking an expansion. This ramp-up will bring substantial copper revenue to the operation, and a unit cost reduction led by this investment will likely offset risks from a cobalt price decline.

The cobalt production increase may result in a price downgrade in 2025; however, this will have limited impact on large-scale copper-cobalt mines. As the $14.00/lb cobalt price scenario suggests, copper-cobalt mines will remain profitable, although margins will narrow. Copper all-in sustaining cost margins of these mines will decline by 10.8% — a range difference that could be filled by increased copper production. Current development plans are focused on taking advantage of the rising cobalt price, but the greater economies of scale mean that mines will continue to gain from producing copper alone.