Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 19 Dec, 2022

By Kelly Morgan

Global markets have been mired by inflationary pressures, geopolitical disruption, and the threat of a potential recession for much of 2022. What lies ahead for 2023? In our recent Big Picture webinar, Kelly Morgan, Research Director for Datacenter Services & Infrastructure at S&P Global Market Intelligence, discussed how the tech sector has been impacted by ESG, inflation, and other elements addressed in our Big Picture Outlook report for the TMT sector.

Editor’s Note: the commentary and outlooks in this post were shared on November 17, 2022. They do not reflect any potential change in forecast from the intervening month.

Michael Miller – Executive Director, Global Client Advisory & Thought Leadership, S&P Global Market Intelligence

Kelly, [can] you talk a little about the role that ESG is playing in the technology sector?

Kelly Morgan – Research Director, Datacenter Services & Infrastructure, S&P Global Market Intelligence

Yes, the sector has certainly been focused on ESG. [That is partly because] energy used by the tech sector, in particular, has made headlines.

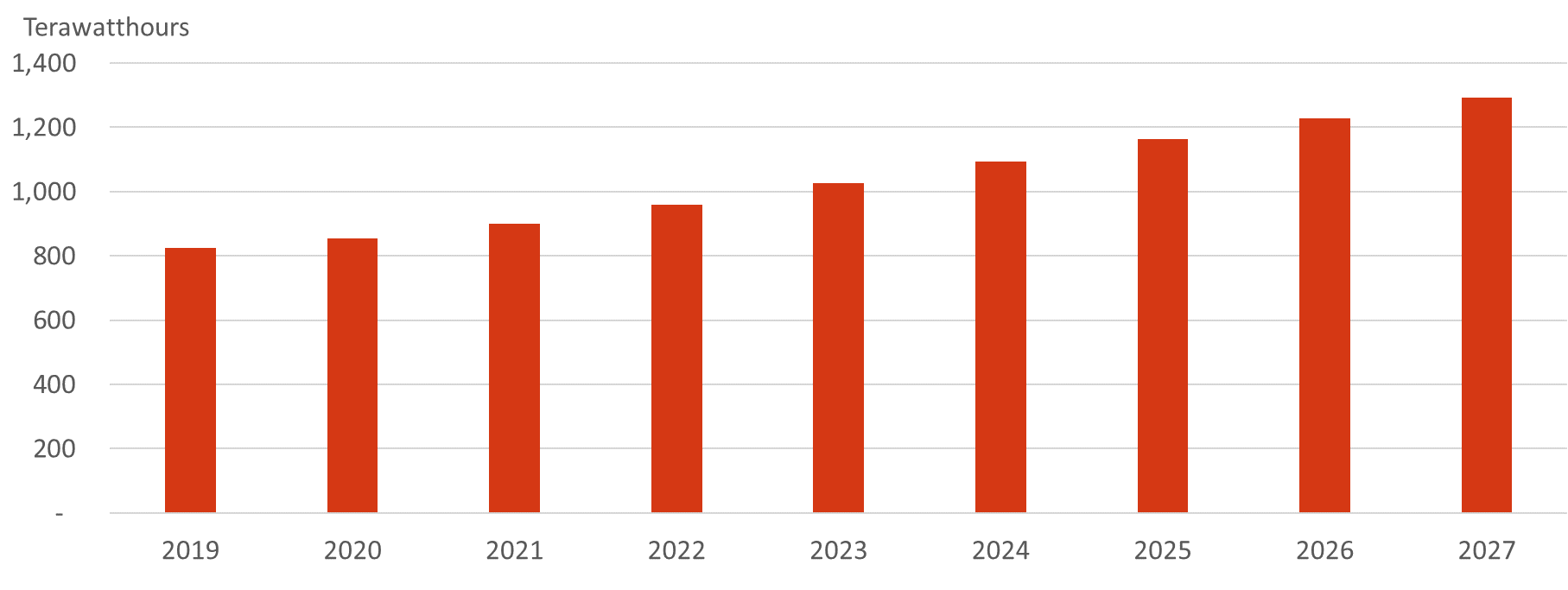

[In the chart below], we estimate that data centers, where IT equipment is kept, currently use around 900 terawatts of energy per year, or [about] twice as much as France. That's growing at about 6% per year, so it's pretty dramatic energy use. That's starting to get the attention of governments and regulators as they look to meet renewable energy goals.

Graph 1: IT/Datacenter Energy is Growing

Source: S&P Global Market Intelligence, Datacenter Market Monitor as of Nov. 2, 2022

As Lindsay [said] earlier, industries [in Europe] will be asked to cut back on some of their energy use. [To do that], we'll probably see more [data centers] run their own energy sources, which will increase their costs in some cases and certainly use more diesel fuel.

On a positive note, as enterprises shift from their old equipment and [in-house] data centers to newer facilities and [the] public cloud, they typically use less energy for the same amount of computing power. We've found that moving the workloads from these enterprise facilities to public cloud, for example, and other IT service providers can reduce the energy they're using by as much as 80% due to efficiency gains from using newer IT equipment.

There's been a lot of innovation around making this IT equipment and the data centers more efficient. We're seeing some heat reuse schemes as well, [where] heat from the IT equipment is used to heat homes and greenhouses. The largest tech firms actually have the scale to really push this innovation and adopt these new approaches.

Sustainability was already becoming really important to enterprises: We've seen around 80% of enterprises say [in our surveys that] they have programs in place to improve the sustainability of their IT equipment. Certainly, rising energy prices make this more urgent, right? The fact that using cloud and IT service providers could actually help with their sustainability efforts means we [could] see progress on this. Perhaps [that’s something] for those activist investors out there [to watch].

Richard Neale – Managing Director, Financial Institutions Group, S&P Global Market Intelligence

Thanks, Kelly. Let's stay on the technology sector for a moment. Over the course of the webinar, we've heard from Lindsay, Nathan, and Mike [on] inflation and interest rates. Can we talk a little bit about the impact on the technology sector [of] those 2 drivers?

Kelly Morgan

Yes. Some of the largest tech and media companies have been in the news with their stock prices falling, some revenue growth slowing and some large layoffs. In our analysis, we can see that the share prices for the communications sector, including Meta and Alphabet, have been down almost 40% on the year, while tech sector stocks overall are down about 25%. That compares with an S&P average [decrease] of about 17%, so they've been underperforming.

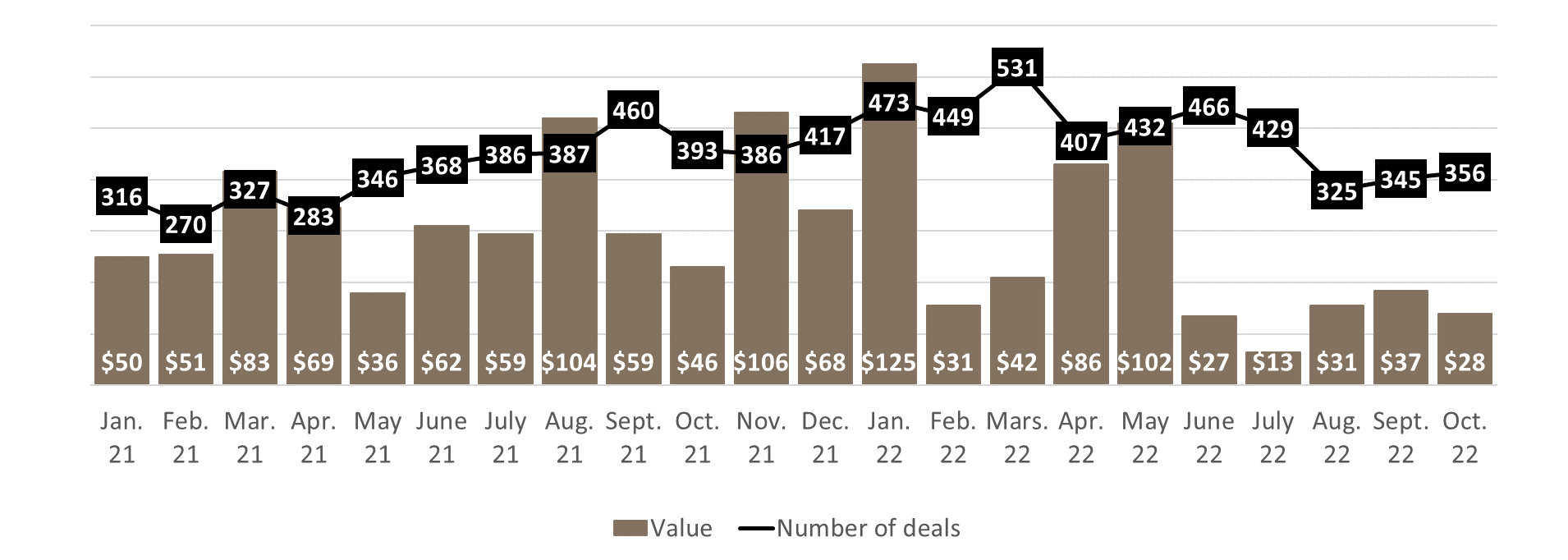

On the [chart below], you'll see that's been reflected in the large tech M&A deals as well, with some of the largest buyers going quiet. Microsoft, for example, has typically bought 12 companies per year, but they've only acquired three this year. Smaller overall amounts [have been] spent. Private equity has stepped in with some purchases, and we may continue to see that as some of the tech firms look more and more like value stocks. But it certainly made a big difference to a lot of the bankers out there and in the M&A sector overall.

Graph 2: Tech M&A Spend is Down, but Many Tech Fundamentals are Still Strong

Source: S&P Global Market Intelligence, M&A KnowledgeBase as of Nov. 1, 2022

Still, the fundamentals are strong. For many firms, digitization [and] the transformations that were begun during the pandemic will continue. In our Voice of the Enterprise surveys, more than 75% of respondents expect their enterprise IT to transform in the next three to five years. This is still happening and, in many ways, a recession or any kind of economic pressure makes this more likely [to continue].

That transformation often still includes public cloud use. In the past, we've seen [cloud use] rise during challenging economic times because firms look to reduce their spend on IT equipment and shift to a more flexible OpEx model. Given this year's supply chain challenges [and how] hard [it is] to get the equipment, that has also contributed to public cloud and hosting, private cloud, [or] any options to use other people's equipment.

Cloud providers have so far responded by keeping their prices fairly steady year-on-year overall. They haven't raised [prices] much despite inflation and the supply chain challenges. We're expecting to see continued strong demand for a lot of these services, and that should be reflected at some point in [2023] in how some of these IT and tech firms are doing.

Richard Neale

In a recessionary environment, which tech sectors and capabilities do [you] think are going to perform well? What are private equity firms targeting and looking at in the tech space today?

Kelly Morgan

That's a great question. We've talked about cloud services probably doing well and data center demand for places to put equipment. In past recessions, those sectors have done very well.

In other areas, I think security is always key, and security as a service is becoming really popular [as firms] move to that OpEx model and let someone else hire the specialized staff. We're seeing broader adoption of AI, which I think will continue as well.

Then there is always that kind of to and fro about media/[content demand] and working from home, which doesn't look like it's going away soon. There is certainly likely to be continued interest in fiber cell towers. In the U.S., we have some money floating around for more infrastructure. Perhaps gaming and some of the media sector [will] do [well].

Richard Neale

One of the things that you've been talking about is cloud and the capabilities that we're seeing many organizations embrace in these times. What's your view on cybersecurity, [its] role, and its importance in 2023?

Kelly Morgan

This gets more and more important every year, right? That brings in, to a certain degree, the fintech question. We are, generally, seeing this big shift in the financial system with payments becoming embedded in software, and fintech growing. I think security will continue to be an extremely important part of that and will likely continue to extend out to cover all these new sectors and new innovations that we're seeing throughout the tech industry.

Campaign