Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 13 Jan, 2022

By Adam Wilson, Monesa Carpon, Kristin Larson, PhD, and Ciaralou Palicpic

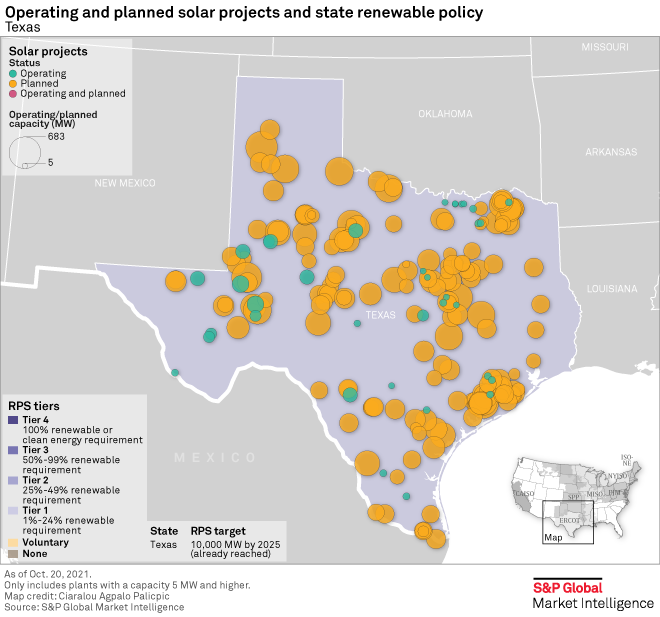

At the end of 2019, there were just over 2,800 MW of operating solar in Texas. In the last two years, that figure has nearly tripled as nearly 5,000 MW of solar have been installed in the state since 2020. This recent ramp-up in solar interest is just the beginning. Over 43,000 MW of solar capacity are in development in Texas, nearly four times more capacity than the next-highest state of California. Multiple drivers are behind this aggressive pipeline, but analysis of the financial outlook for new solar projects in Texas, while adequate, is not proportionately favorable.

Wind taking backseat to solar

Texas has been the dominant market for renewables in the U.S. for over a decade. However, this has largely been driven by the enormous build-out of wind across the state as developers have taken advantage of strong winds; cheap, abundant land; and the federal production tax credit. The tide has shifted in recent years as the development pipeline in Texas now favors solar over wind by a 2.5:1 ratio. This is not due to state legislative drivers, which remain limited. Texas does have a renewable portfolio standard, but it is a capacity target requiring state energy providers to jointly procure 10,000 MW of renewable energy by 2025. This target was surpassed in 2011, yet development has remained aggressive.

The development queue for solar has swelled in recent years and is now putting Texas on track to be the leading market in the country. Declining costs of solar combined with a phasing out of the federal investment tax credit have prompted developers to rush to take advantage of a comparatively open market. In the early 2000s as wind generation quickly grew, so did grid congestion. As a result, curtailment rates rose. This was ameliorated by the Competitive Renewable Energy Zone, a $7 billion transmission upgrade. Due to the Texas grid's isolation and FERC's lack of jurisdiction in the Electric Reliability Council of Texas Inc., such transmission projects are easier to build as many federal hurdles can be avoided.

With installed wind in excess of 34,000 MW, developers turned their sights to solar, which many view as a natural complement. The lucrative market opportunities for wind and solar have also caught the eye of the corporate renewables market as Texas is a deregulated electricity market providing corporate off-takers such as Google and Amazon an easier path to contracting cheap power purchase agreements directly with developers. As of April, an estimated 13,000 MW of renewable capacity in Texas was contracted to corporate off-takers. One of the most noteworthy of these projects is the Samson Solar Energy project along with phases Samson Solar Energy II Project (Cunningham Solar 2), Samson Solar Energy III, Samson Solar IV Project and Samson Solar V Project which will be the largest solar energy facility in the country, at 1,310 MW, when completed in 2023. The project, developed by Invenergy LLC, has nine nonutility off-takers including AT&T Inc., Honda Motor Co., Ltd. McDonald's Corp. and Google LLC.

Declining REC prices lead to tighter returns

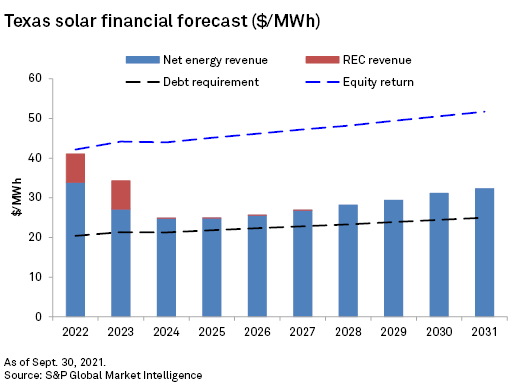

Texas has a renewable energy credit market, tracked by S&P Global Market Intelligence. Often viewed as a proxy for the volunteer REC market since energy providers in Texas no longer need to comply with an RPS mandate, Texas RECs have historically featured relatively low prices. Increasing interest from corporate off-takers, however, has driven an increase in prices over the past year, providing an additional revenue stream to drive development in the state. After 2023, merchant solar projects in Texas are forecast to meet their debt obligations but not much more. In 2022 and 2023, forecast REC prices in Texas exceed $7/MWh, making project revenues at least $13/MWh higher than the minimum debt requirement.

In 2024 and beyond, forecast REC prices plummet, tightening the margin for merchant solar farms in the state. 2024 also has the lowest energy revenue at $24.86/MWh, but this increases to $32.30/MWh by 2031, compared with the debt requirement of $25.01/MWh. The full equity return in 2022 is $42.13/MWh, increasing to $51.69/MWh by 2031. Since FERC does not have jurisdiction in ERCOT, there is no EQR data currently available for solar projects in Texas. However, current power purchase agreement indexes in ERCOT, according to analysis from LevelTen Energy Inc., have power purchase agreement prices around $27/MWh, reflecting slow increases over the past year.

While the longer-term outlook for solar in Texas is not quite as favorable as in other states, forecast revenues are sufficient for the profitability of new projects. Given the multitude of drivers in place that are making Texas such an appealing market for solar developers, sufficient revenue is enough.

Regulatory Research Associates is a group within S&P Global Market Intelligence.

Monesa Carpon, Kristin Larson and Ciaralou Palicpic contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.