Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 27 Apr, 2023

Highlights

The Stock Exchange of Hong Kong Limited (“the Exchange”) has published its consultation paper on enhancement of climate-related disclosures under the environmental, social and governance (ESG) framework.

These disclosures align with the International Sustainability Standards Board’s (ISSB) climate standard, which builds on the principles of the Task Force on Climate-related Financial Disclosures (TCFD).

Listed companies, including financial institutions, are expected to issue climate-related financial disclosures from 2024 onwards.

Climate scenario analysis is key to determining climate-related risks and opportunities and related financial effects, as well as gaps in transition financing.

The Exchange, a wholly owned subsidiary of Hong Kong Exchanges and Clearing Limited (HKEX), recently published a consultation paper seeking market feedback on proposals to enhance climate-related disclosures under the ESG framework.1

The Exchange proposes to mandate all issuers to make climate-related disclosures in their ESG reports and will introduce new climate-related disclosures aligned with the ISSB’s climate standard. The ISSB’s climate standard builds on the principles of the TCFD and sets out detailed climate disclosures. The proposals mark a significant milestone in achieving the commitment to mandate TCFD-aligned disclosures by 2025 as announced by the Hong Kong Green and Sustainable Finance Cross-Agency Steering Group. Acknowledging the readiness of the issuers and their concerns, the Exchange proposes interim provisions for certain disclosures (e.g., financial effects of climate-related risks and opportunities, Scope 3 emissions and certain cross-industry metrics) for the first two reporting years following the effective date of 1 January 2024.

As such, for a financial institution this also largely relates to assessing the impact of climate on credit and underwriting risk and reducing financed emissions to achieve its climate goals. One of the key challenges in this process is the use of forward-looking scenario analysis to assess climate-related risks and opportunities. This is difficult given the lack of robust methodologies for determining credit risks, multiple temperature pathways by climate science community, the unknown role of technological change and the opportunities it creates for financing.

At S&P Global Market Intelligence, we have developed a variety of analytics and datasets to help our clients address these issues. Our flagship offering, Climate Credit Analytics, developed in collaboration with Oliver Wyman,2 utilizes a bottom-up approach with scenarios aligned to the Network for Greening the Financial System (NGFS) that enables comprehensive and consistent sector-specific modelling, including an evaluation of key high carbon-emitting sectors. This can be done at a counterparty or a portfolio level.

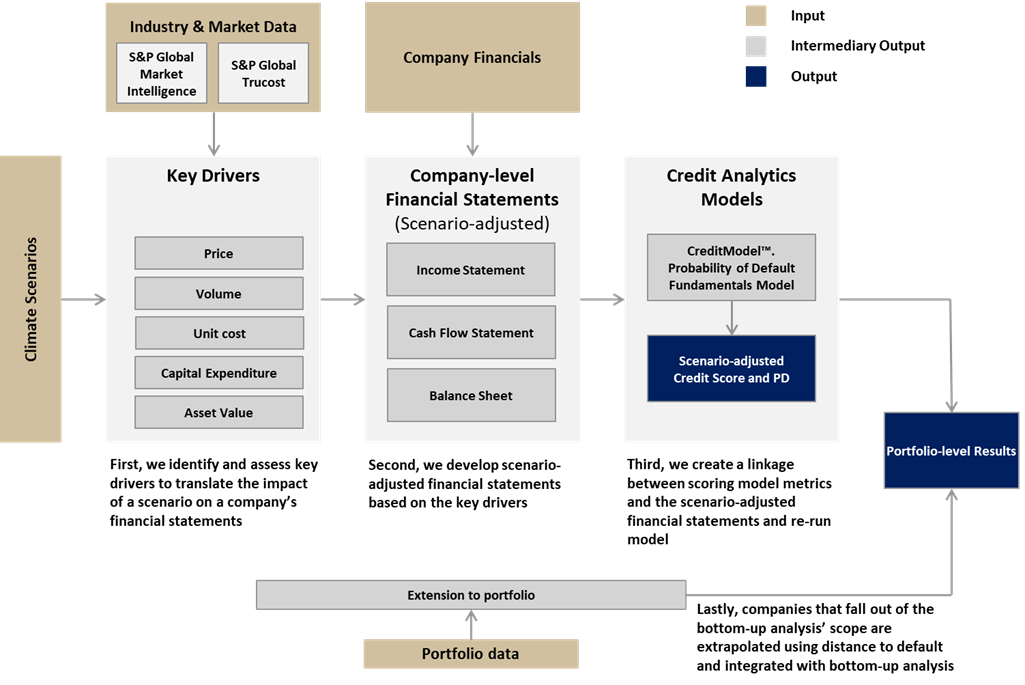

As shown in Figure 1 below, the tool leverages S&P Global Market Intelligence’s proprietary datasets and capabilities, including financial and industry-specific data, environmental and physical asset risk data, company-specific transition plans, sophisticated quantitative credit scoring methodologies and best-in-class company-level environmental data from S&P Global Trucost. The output includes projected financials of counterparties for the forecasted period and credit scores,3 as well as probabilities of default.

Figure 1: Climate Credit Analytics

Source: S&P Global Market intelligence, Oliver Wyman. For illustrative purposes only.

The tool reflects the latest climate scenarios and methodologies, enabling one to remain on track with changing market dynamics and regulations. These are designed to meet the needs of financial institutions on a complex subject matter, such as quantifying the financial impact of climate risk and providing the necessary insights to make financing decisions with conviction.

To learn more about Climate Credit Analytics, please visit https://www.spglobal.com/marketintelligence/en/solutions/climate-credit-analytics.

1 Exchange Publishes Consultation Paper on Enhancement of Climate Disclosure under its ESG Framework, the Exchange, April 14, 2023, https://www.hkex.com.hk/News/Regulatory-Announcements/2023/230414news?sc_lang=en.

2 Oliver Wyman is an independent consulting firm and is not related to S&P Global or any of its divisions.

3 S&P Global Ratings does not contribute to or participate in the creation of credit scores generated by S&P Global Market Intelligence. Lowercase nomenclature is used to differentiate S&P Global Market Intelligence credit model scores from the credit ratings issued by S&P Global Ratings.