Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 17 Apr, 2024

By Tanya Peevey, PhD and James Gutman

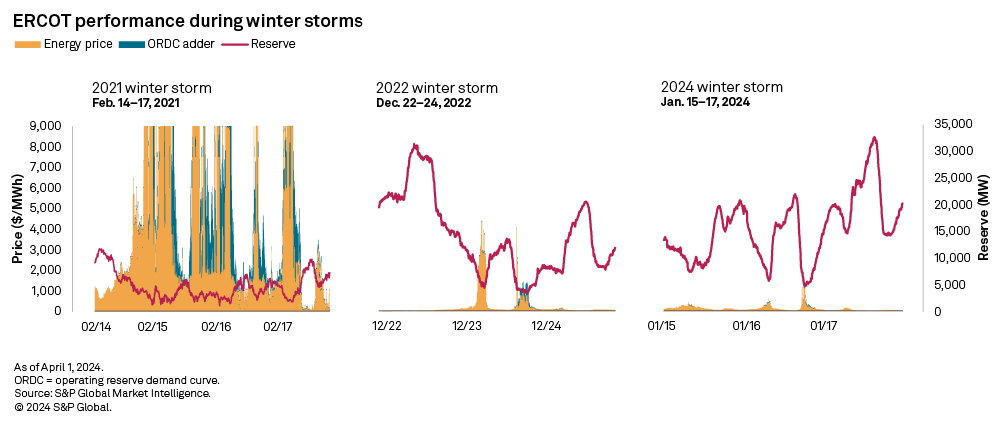

A February 2021 storm, known as Winter Storm Uri, brought into sharp focus the importance of grid reliability as generation went offline, energy prices skyrocketed and millions of Texans lost power, leaving more than 200 people dead. Following that tragic event, the Electric Reliability Council of Texas Inc. put forth a multitude of reforms to harden the grid.

The effect of these reforms is apparent in energy market data from more recent storms in January 2024 and December 2022.

In both cases, operating reserves stayed well above 3,000 MW even as temperatures fell into the teens, and weatherization efforts helped keep generation online and energy prices low, reducing the costs carried by the customers.

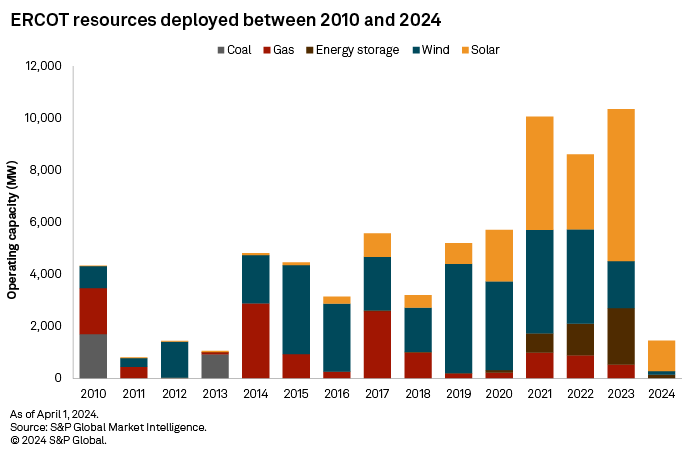

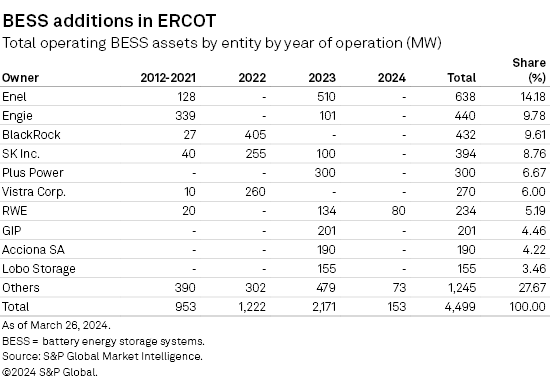

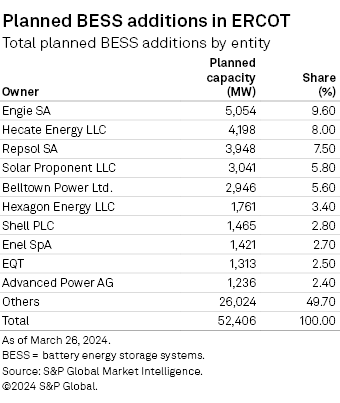

A surge of investment in battery assets, spurred by market reforms and expected growth in peak demand, has also improved reliability. Storage capacity in ERCOT jumped by 4.3 GW between 2021 and 2024. Merchant power companies have led investment, with the top 10 investors accounting for 72% of the capacity, but the value proposition has also attracted traditional gas players to the space.

➤ Heading into 2021, the expected winter peak demand in ERCOT was 57.6 GW, with a 24.9 GW projected buffer. When 33.8 GW went offline during Winter Storm Uri, reserves decreased to 1,262 MW and energy prices reached the $9,000/MWh cap.

➤ In the aftermath of Winter Storm Uri, ERCOT addressed grid reliability by modifying governance rules, implementing reliability requirements for weatherization and allowing transmission and distribution utilities to own battery storage assets.

➤ Due at least in part to these market reforms, Texans weathered the next two storms with reserves not dipping below 3,000 MW and total energy prices staying well below the new $5,000/MWh cap.

➤ ERCOT market reforms have had a positive impact on reliability and total energy prices. Ahead of Winter Storm Uri, before generation went offline, low operating reserves of 3,470 MW pushed the energy price up to $1,793/MWh — $356/MWh higher than it was during a subsequent storm on Dec. 23, 2022, when operating reserves were 3,452 MW.

➤ Market reforms and projected load growth in Texas have enticed 4.3 GW of battery capacity to connect to the ERCOT grid between 2021 and 2024, backed by merchant power companies. Planned battery capacity in ERCOT comes to 52.4 GW and includes projects from traditional gas and oil companies.

When Winter Storm Uri hit Texas, a total of 45 GW of generation went offline, 16 GW of which was generation from renewables, knocked offline mainly due to wind turbines freezing in the frigid temperatures. With an expected 2021 winter peak demand of 57.6 GW, there was a projected 24.9 GW buffer heading into February 2021. Adjusting the nameplate capacity for renewables to the actual available capacity using a capacity factor of 30%, the total offline renewable capacity was closer to 4.8 GW. The total offline capacity of 33.8 GW well exceeded the 24.9 GW built-in margin as outdoor temperatures plummeted, driving up energy demand.

As operating reserves dipped below 5,000 MW on the morning of Feb. 11, 2021, energy prices increased, and the Operating Reserve Demand Curve (ORDC) adder kicked in. Operating reserves increased again, but by the evening of Feb. 14, reserves dipped significantly, reaching 1,262 MW while the energy price hit the $9,000/MWh cap for multiple hours. Reserves remained low, not consistently exceeding 5,000 MW until mid-morning on Feb. 17, producing almost two and half days of extremely high total energy prices.

Unlike other independent system operators, ERCOT does not have a capacity market that pays generators that rarely run to be available during high peak demand hours. ERCOT takes a free-market approach that entices more generators to bid by allowing for a scarcity price adder during peak demand events. The adder is usually zero, but it ramps up during high-demand events to give dispatchable generators — which are typically fossil fuel-based and rarely run — the revenue they need to remain in business and put power on the grid.

Causing the worst blackouts in decades, Winter Storm Uri called this free-market approach into question. The storm hit Texas particularly hard, leading grid operators and regulators to plead for consumers to reduce consumption.

In the aftermath of a storm, ERCOT grappled with the balancing act of shoring up grid reliability while still delivering affordable energy prices to utility customers. The $9,000/MWh price cap, meant to incentivize generators to come online during high peak demand, is ineffective if generators are knocked offline due to extreme weather. The resulting significant supply shortfall forced ERCOT to modify its approach to reliability to ensure customer safety and affordability.

On June 8, 2021, Texas Gov. Greg Abbott signed two pieces of legislation designed to mitigate the issues brought to light by the storm. S.B. 2 focused on ERCOT governance, requiring that the presiding officer be designated by the governor and the number of members be reduced to 11 from 16. The bill also specified that all members are required to be Texas residents. S.B. 3 focused on reliability, directing the Public Utility Commission of Texas (PUCT) to ensure that ERCOT establishes reliability requirements rather than voluntary guidelines. The quantity and characteristics must be determined at least annually, requiring power generators and transmission line owners to upgrade their facilities to better withstand extreme weather, with more leniency toward natural gas fuel companies.

The legislative efforts to reform the power market continued less than two weeks later with four more bills signed into law. S.B. 415 changed the existing law to allow transmission and distribution utilities to own battery storage assets. H.B. 1520 provides a method of financing for consumer rate relief bonds. H.B. 3648 designates certain natural gas facilities and entities as critical to ensuring power supply to fuel producers. S.B. 2154 decreased the number of PUCT commissioners from five to three and requires commissioners to be US citizens and residents of Texas. This bill also specifies that at least one commissioner must be from a rural county, and at least one must have experience in representing the interests of utility customers.

In December 2021, the PUCT approved a change to the High System-Wide Offer Cap (HCAP), most notably decreasing the Value of Lost Load (VOLL) from $9,000/MWh to $5,000/MWh, effective Jan. 1, 2022. This lower cap was reached twice in July 2022, when wind output fell and thermal generator outages increased during a sweltering heatwave that set records for peak demand. To avoid rolling outages, grid operators asked consumers to reduce their electricity consumption and deployed ERCOT Emergency Reserve Services (ERS). Most of the ERS reserve was used, motivating the PUCT to increase the ERS budget by $25 million, making more funds available to pay eligible entities to either increase generation or coordinate reducing consumption.

During the next significant storm in December 2022, temperatures dipped into the teens as a strong arctic cold front moved over Texas. Grid reliability and the weatherization of power plants and oil and gas wells were tested, with wind chill below zero for much of the state through the morning of Dec. 25.

As the 2022 storm passed overhead operating reserves dipped as low as 3,452 MW the late evening of Dec. 23, pushing the total energy price up to $1,436/MWh. This was $356/MWh below the level seen ahead of Winter Storm Uri, when operating reserves fell to 3,470 MW and the energy price jumped to $1,793/MWh. The price differential highlights the impacts of ERCOT market reforms on total energy prices since the higher $1,793/MWh price occurred before generation went offline during Winter Storm Uri.

In the time between these two winter storms, 1,790 MW of storage capacity came online, greatly exceeding the 217 MW connected to the grid between 2010 and 2020. Battery resources allow owners of solar and wind generators to provide firm capacity for at least short periods, addressing ERCOT reliability concerns with the ability to respond quickly to high energy price signals. The new storage capacity helped to fill the gap left by the retirement during the same period of 1,652 MW of coal and 853 MW of gas capacity.

Ahead of that winter storm, 2,171 MW of energy storage capacity had been added to the ERCOT grid in 2023, benefiting from multiple changes to the energy market implemented earlier that year in anticipation of the expected higher summer temperatures.

A new ancillary service was added to support grid reliability in 2023 called ERCOT Contingency Reserve Service (ECRS) — the first ancillary service introduced in ERCOT in more than 20 years. ECRS is an ancillary service that is procured daily and is meant to complement the other four procured ancillary services: Regulation Up, Regulation Down, Responsive Reserve Service (RRS) and Non-Spin Reserve Service. It essentially separates RRS and Primary Frequency Response (PFR), lowering the barrier to entry for generators that want to provide RRS services since many new technologies can meet the 10-minute RRS requirement but not the PFR requirements.

Merchant power companies have led investment in battery assets in ERCOT, incentivized by changes in the ERCOT energy market and the projected load growth. Although Brookfield was the first mover into ERCOT with the 36-MW Notrees Battery Storage Project in 2012, battery energy storage system (BESS) investors only added meaningful capacity to the grid starting in 2021. Within the period of 2021 to 2024, developers added approximately 4.3 GW, or 95%, of the total 4.5 GW capacity. Out of the 33 entities invested in ERCOT BESS, the top 10 investors account for 3.3 GW, or 72%, of capacity. The list of top investors indicates a value proposition within Texas BESS that appeals to global energy players, with significant investments coming from large public and private equities and an even distribution of European (French, German and Italian), Korean and US firms as the ultimate owners.

Texas residents have now weathered two winters since Winter Storm Uri without rolling blackouts. While utility customers were still asked by grid operators to reduce their energy consumption, both the December 2022 and January 2024 storms surpassed peak demand measured during Uri without power going offline. This can be attributed to energy market improvements supporting dispatchable generation and the weatherization upgrades that keep generators online.

A significant 4.3 GW of battery storage capacity has been added in the last three years, providing dispatchable generation that can ramp up quickly to meet power needs and balance the grid. However, with a market preference for two-hour batteries in ERCOT and no mechanism to incentivize long-duration batteries, it will be a while before renewables can fully replace fossil-fuel-based generators in ERCOT.

Federal Energy Regulatory Commission (FERC) efforts to support interregional transmission and power transfer provide opportunities to further ensure grid reliability in ERCOT, but there is resistance to these efforts. Aside from the philosophical issues of "states' rights" and "independence" from federal authority, cost is a very real issue. To incentivize transmission build-out, FERC has historically approved higher returns on equity (ROEs) for transmission projects compared to the ROEs typically approved by state commissions for assets under their purview. Within its streamlined formula ratemaking construct, FERC often adds a premium for facilities deemed critical to reliability. Once set, the authorized ROE is not reviewed unless a challenge is brought, so there is less opportunity for stakeholders to argue for changes. Similarly, the formula rate framework does not allow for the same level of scrutiny for project costs as the state-level base rate case process. Another concern is that if ERCOT interconnects and FERC takes over authority, then non-Texas utilities might seek to join ERCOT, raising issues that are occurring in other regional transmission organizations where cost-causation and cost-responsibility disagreements have arisen. Finally, from a broader perspective, FERC is one step removed from ratepayers and, as such, does not focus on affordability in the same way that the states do.

This culture of independence may be outweighed by grid reliability needs, as highlighted by ERCOT cancelling its RFP plans for the 2023/2024 winter season due to receiving demand response offers for just 11 MW of the 3 GW of requested capacity.

ERCOT is not alone in its reliability struggles. Other ISOs have found it necessary to modify their capacity markets that were built around the world of dispatchable — not intermittent — generators. The same December 2022 winter storm that impacted ERCOT motivated PJM Interconnection LLC to update its capacity accreditation approach and consider moving to a seasonal capacity market.

S&P Global Commodity Insights provides content for distribution on Capital IQ Pro.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

For wholesale prices and supply and demand projections, see the S&P Global Market Intelligence Power Forecast.

Lillian Federico contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.