Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Nov 08, 2021

Demand for semiconductors has been surging over the last two years, with demand rising across all electronic finished goods markets. In September, the IHS Markit Global Electronics Purchasing Managers' Index™ (PMI™) for new orders was at 58.0, signaling rapid expansion in new business with the index for future activity remaining highly expansionary in all three regions: Asia, Europe, and North America. Overall demand for semiconductors and electronic components demand continues to advance at a brisk pace.

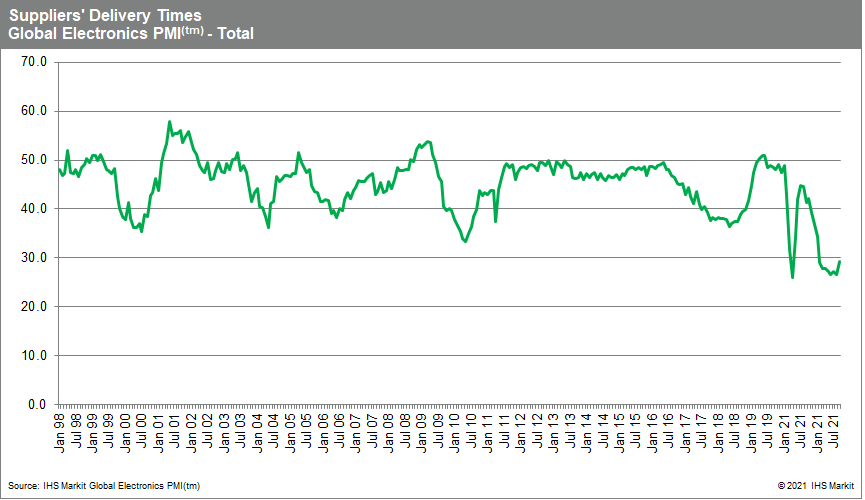

This increased demand, compounded by manufacturing backlogs and supply chain disruptions, has caused severe shortages felt across many industries that require chips, such as automakers and smartphone manufacturers as well as all electronic equipment manufacturers. The latest IHS Markit Global Electronics PMI survey shows evidence of a further lengthening in average input lead times during September, as signaled by the Suppliers' Delivery Times Index, which was at 29.3, far below the neutral 50.0 mark.

With many questions coming from clients about the availability of semiconductors, as well as deep concerns around supply chain bottlenecks, we wanted to explore what risks could further impact the supply of these integral chips.

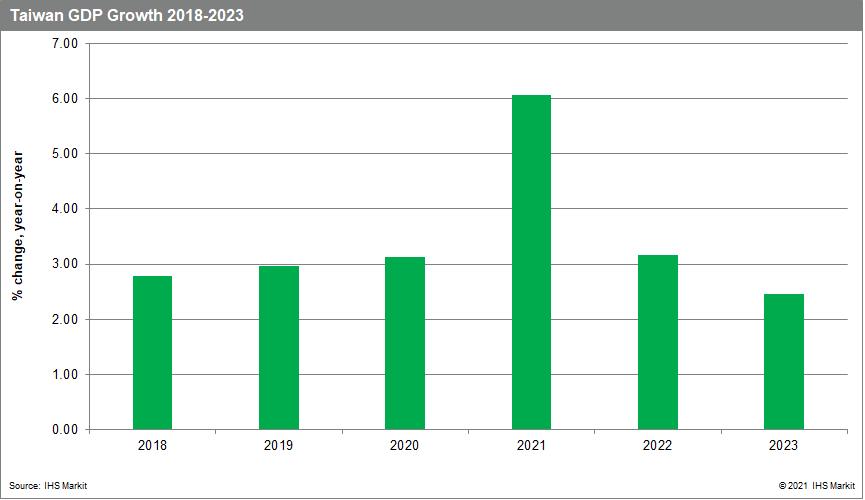

To better uncover future risks, we turned our eyes to Taiwan, a major hub for semiconductor production. Taiwan fared quite well through the pandemic and even with Covid-19 restrictions, it has felt little adverse effect on exports and the manufacturing sector. Indeed, the Taiwan economy has been very resilient, recording positive GDP growth in 2020 and showing buoyant economic expansion in 2021.

As a major provider of electronics and other technology components, Taiwan has benefited from surging sales for related products as the pandemic has boosted demand for teleconferencing and activities related to people working from home, distance schooling, and online streaming and entertainment. Exports of semiconductors account for 90% of their electronic exports or 35% of total exports. But all is not so rosy.

In addition to large manufacturing operations for semiconductors, much of the world's trade in semiconductors passes through the Taiwan Strait (in addition to many other essential products). While the manufacturing sector remains strong, and demand is high, there are considerable risks along their supply routes. Any trade disruption in the region would further exacerbate supply chain tensions globally.

![]()

When we look at the stability of the region, the situation remains volatile even though reports suggest both possible increases in tensions and a continuation of the current status quo. The combination of politically related events, such as the increase in the nationalist discourse on both sides, the hasty US withdrawal from Afghanistan or the perception in China (mainland) that it is under threat, have polarized opinions. Our political and economic risk assessments acknowledge the worsening of geopolitical fundamentals across the region. One important potential risk scenario which was quantified is for a short but intense confrontation that could elevate the challenges to an already precarious supply route.

In this crisis scenario, there would be a short-term disruption in economic, financial, and trade flows. Given the region's strategic importance, any trade disruption in the area would immediately percolate throughout the world's regions, in some cases with permanent effects including long-term changes in international trade and growth patterns. Any significant disruption to semiconductors production or transportation logistics to key markets would create significant shockwaves to various industries, such as electronics and auto manufacturing, aggravating the pressures we are already experiencing today.

The global semiconductors industry is already facing significant backlogs in its new orders pipeline that have caused disruption to global supply chains. These production shortages are expected to continue into 2022. A scenario that results in further disruption or delays to Taiwan's semiconductors production in the near-term would therefore create further shockwaves to the global manufacturing supply chain.

Contact us to learn more about our crisis scenario for the region and what it means for supply chain resiliency.

Posted 08 November 2021 by Elisabeth WaelbroeckRocha, VP & Chief International Economist, Research Advisory Specialty Solutions, S&P Global Market Intelligence and

Rajiv Biswas, Executive Director and Asia-Pacific Chief Economist, S&P Global Market Intelligence