Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 20 Sep, 2022

By Brian Bacon

Introduction

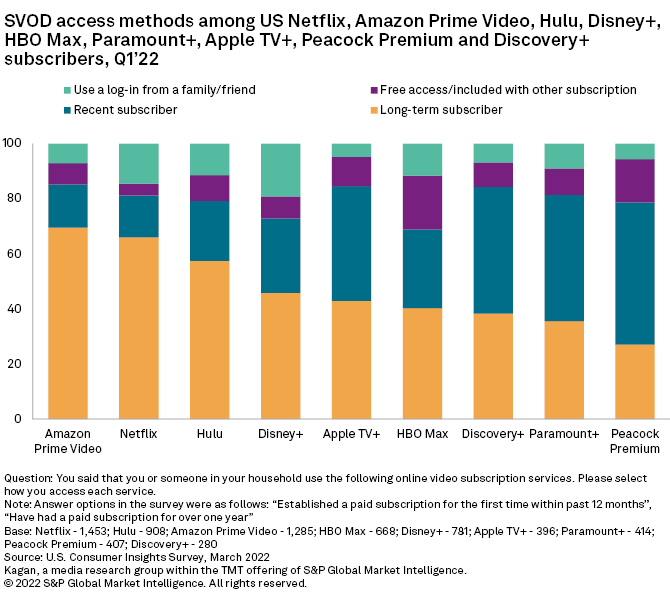

As would be expected, the subscription video-on-demand services that have been around the longest have the largest shares of long-term subscribers (over a year), according to data from Kagan's U.S. online consumer survey, conducted in March. Services like AT&T Inc.'s HBO Max and Paramount Global's Paramount+ have been around for a while, but both have a slightly smaller share of long-term subscribers, at 40% and 36%, respectively, than relative newcomer Apple Inc.'s Apple TV+ at 43%. HBO Max and Paramount+ have undergone extensive rebranding and have seen an uptick in users since the original services launched as HBO NOW and CBS All Access.

* Younger users were more likely to be recent subscribers to SVOD services, compared to older respondents polled in Kagan's recent Consumer Insights survey.

* Users of smaller services like Paramount+ and Peacock Premium tend to use more SVOD services on average, compared to users of the larger services, such as Netflix and Prime Video.

* For many of these services, recent subscribers (less than a year) were more likely to watch more broadcast than on-demand video.

Netflix Inc. and Walt Disney Co.'s Disney+ are planning to launch ad-supported subscription tiers, in part to better monetize users sharing passwords. The concern for password sharing is warranted given that among surveyed users of these services, Disney+ had the largest share of shared log-in users at 19%, followed by Netflix at 15%.

HBO Max had the largest share of users with free access/included with another subscription at 19%, followed by Peacock Premium at 16%. HBO Max is included as a perk for several different AT&T services. Comcast Corp.'s Peacock Premium is included with select Xfinity, Charter Communications Inc. and Cox Communications services. The share accessing Paramount+ as part of another subscription is expected to increase with the tie-up with Walmart Inc.'s Walmart+.

Examining the length of subscription trends among service users by generation shows that younger users tend to have larger shares of recent subscribers compared to older users. For example, 27% of Gen Z Netflix users were recent subscribers compared to 8% of boomers/seniors. Younger respondents were also more likely to indicate they used a shared log-in for these services. Again, with Netflix users as an example, 24% of Gen Z used a shared log-in compared to 13% of older generations.

Free access/included with other subscriptions among HBO Max users was more common among older respondents, with 32% of boomers/seniors accessing the service this way compared to 11% of Gen Z users. Similarly, 26% of boomer/senior users of Peacock Premium access the service this way compared to 12% of millennials. This is not the case for discovery+ where the largest share of free access users was among Gen Z users at 15%.

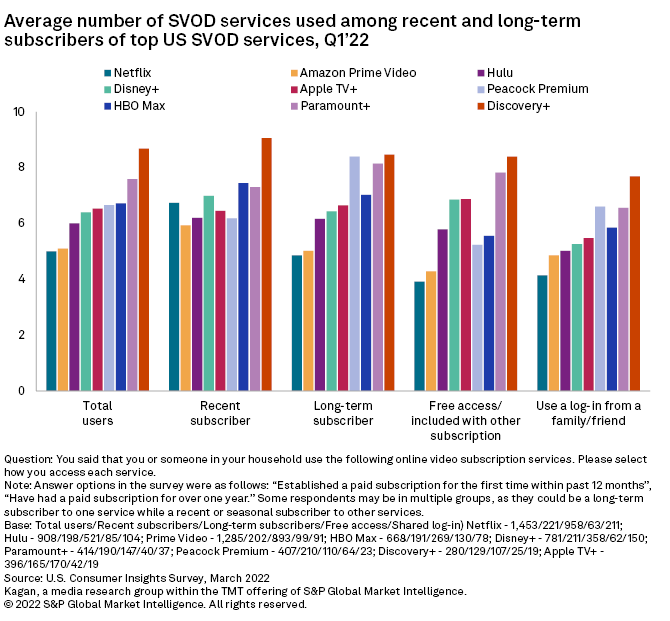

Users of popular streaming services like Netflix and Amazon.com Inc.'s Prime Video tend to use fewer SVOD services, at 5.0 and 5.1 services on average, respectively. Users of smaller services tend to use more SVOD services on average, especially among niche services. Among this group, the highest average number of services used was among discovery+ users at 8.7 services. For some services, including Netflix, recent subscribers used more services on average than long-term subscribers, at 6.7 and 4.9, respectively. However, for some services, the opposite was true, especially Peacock Premium, with 8.4 for long-term and 6.2 for recent subs.

As shown above, HBO Max had the largest share of free access users (19%) of the services surveyed, and these free access users used fewer SVOD services on average (5.6) compared to recent (7.4) and long-term (7.0) subscribers. Shared log-in users tended to use the fewest SVOD services on average, compared to other users of many of the services.

When asked about TV content viewed (broadcast versus on-demand), recent subscribers to Netflix were more likely to watch more broadcast than on-demand at 63%, compared to long-term subscribers at 44%. The same holds true for the other services, except for Peacock Premium, discovery+ and Apple TV+, where a larger share of long-term subscribers indicated they watch more broadcast than on-demand content than recent subscribers. For every service other than Peacock Premium and Apple TV+, shared log-in users had the largest share indicating they watch more on-demand than broadcast.

Data presented in this article and the associated Excel banner file was collected from Kagan's U.S. Consumer Insights survey conducted in March 2022. The surveys included 2,519 internet adults with a margin of error of +/- 1.9 percentage points at the 95% confidence level. Percentages are rounded to the nearest whole number. Gen Z are adults ages 18-24; millennials, 25-41; Gen X, 42-56; boomers/seniors 57+.

Consumer Insights is a regular feature from Kagan, a media research group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.