Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 14 Sep, 2022

Highlights

Streaming music and radio ad revenue will grow to nearly 4% of total U.S. online ad revenue in 2032, according to our projections.

We estimate that podcasting ad revenue accounts for about 15% to 20% of total streaming music and podcasting ad revenue in 2022.

A surge in paid music subscriptions along with the popularity of podcasting and improvements in ad insertion have led to an uptick in our streaming music and podcasting ad revenue projections for 2022-2032.

We estimate streaming music and podcasting grew to $4.35 billion in 2022, up 12.0% from $3.89 billion in 2021. According to our model, streaming music and podcasting ad revenue should grow 11.0% in 2023 to $4.83 billion, maintaining a 3.1% share of total U.S. online ad revenue. We project that streaming music and radio ad revenue will grow to nearly 4% of total U.S. online ad revenue in 2032. While we do not break out podcasting revenue in our model, we estimate the format accounts for about 15% to 20% of total streaming music and podcasting ad revenue in 2022, a small portion of the overall streaming audio pie.

Our U.S. ad revenue projections for streaming music and podcasting, formerly labeled as pure-play internet music and radio, consider streaming music and radio services such as Sirius XM Holdings Inc.'s Pandora, Apple Inc.'s Apple Music, Spotify Technology SA and others listed as streaming music services in our internet streaming service database. Our analysis does not include digital and online buying through terrestrial radio stations, station websites, stations streaming (simulcasting), HD radio or station mobile ad revenue. Likewise, our projections exclude monthly subscription revenue, song download fees and event ticket sales that are potentially part of a streaming services portfolio.

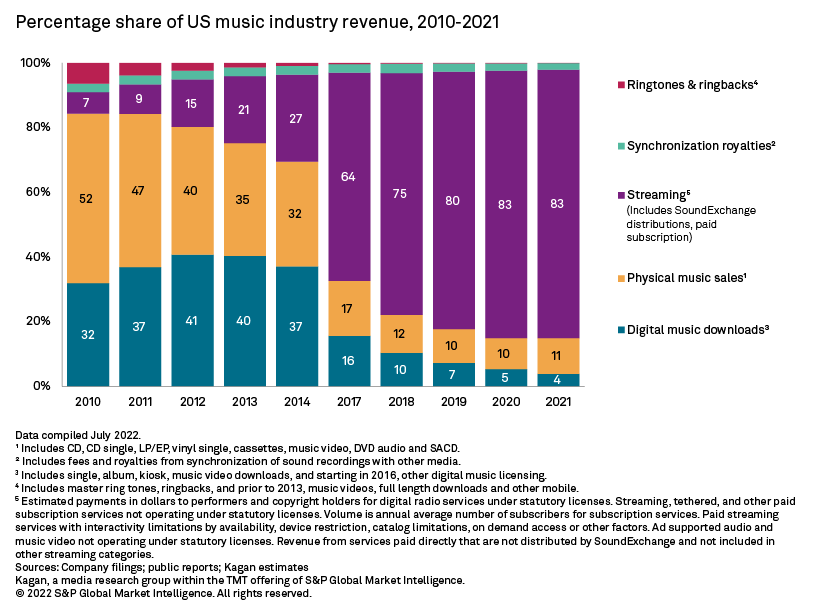

According to the Recording Industry Association of America Inc., or RIAA, total digital music sales grew 21.6% in 2021 to $13.03 billion, accounting for 83% of total music revenue — similar to its share of the industry in 2020.

The COVID-19 pandemic provided a listening boost to streaming music and podcasting as many consumers listened from home and may have contributed to a rise in subscription services. Paid subscriptions accounted for the largest share of total U.S. streaming music revenue, growing 23% to $9.5 billion in 2021, according to the "RIAA 2021 Year-End Music Industry Revenue Report."

In iHeartMedia Inc.'s second-quarter earnings release, the iHeartRadio streaming service reported that its digital audio revenue increased 27.6% to $252.6 million. Podcasting was the major driver of growth, up 60.4% year over year to $85.7 million. Digital audio revenue, excluding podcast revenue, increased 15.5% year over year.

Spotify founder, CEO and Chairman Daniel Ek on the company's second-quarter earnings call talked about the company outlook this year in the face of a possible economic downturn. As of the earnings call, the potential downturn was not causing the company to see any material impact on expectations for user or subscriber growth, according to Ek. Spotify has set its sights on a user base of 1 billion by the end of 2030.

CFO Paul Vogel said on the call that on the premium subscription side, which represents a majority of Spotify's revenue, the company expects average-revenue-per-user gains in the mid-single digits at the end of the third quarter.

Meanwhile, broadcaster Audacy Inc., formerly Entercom Communications Corp., reported that its second-quarter streaming listeners grew 18% year over year. In July, Audacy launched a revamped streaming platform — also called Audacy, formerly Radio.com — with added features and content.

Audacy said digital revenue grew 16% year over year in the first quarter, and the new, enhanced streaming platform helped increase supply and led the category to a 19% increase in the second quarter. In April, the company entered into an affiliate partnership with FOX News Audio to offer a linear and interactive stream on the Audacy platform.

Despite a softening of some ad categories in 2022 and perhaps beyond, streaming audio platforms appear positioned for growth as a main source of music and the increasingly popular podcast category. Advancements in advertising efficiency and audience measurement, along with significant content investments, should help drive the segment's continued ad revenue growth over the next 10 years.

Broadcast Investor is a regular feature from Kagan, a media research group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

Research