S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

8 Jun, 2023

By Jason Lehmann and Heike Doerr

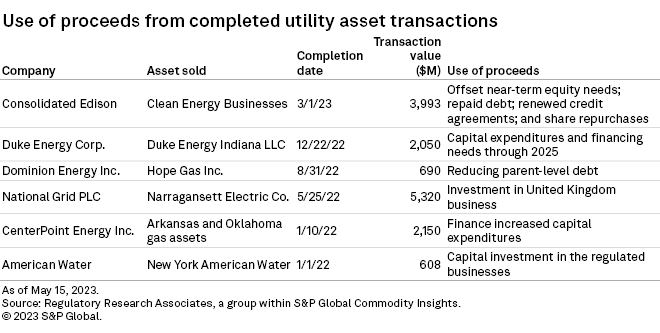

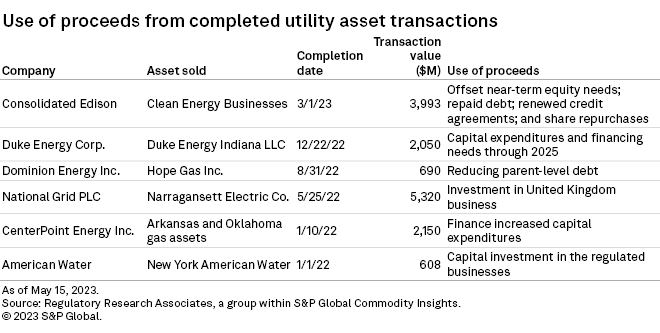

US utilities are focused on strengthening their balance sheets as they navigate economic uncertainty. Since late 2022, multiple utilities have initiated internal strategic reviews and begun the process of divesting assets or selling minority interests in projects to raise cash and to facilitate capital reallocation.

➤ US utilities have reverted to small strategic transactions, in contrast to the utility "megadeals" of decades past. These utility holding companies aim to simplify their business profile, strengthen their balance sheets and reduce strategy risk through a greater focus on regulated pursuits. Proceeds of sales are intended to finance capital expenditure programs, reduce and refinance debt obligations, and mitigate equity financing needs.

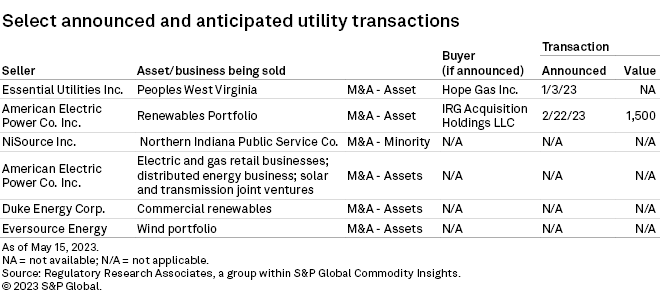

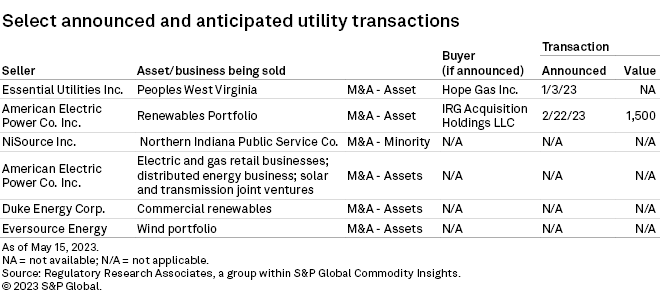

➤ While investors seem to prefer full asset sales, Duke Energy Corp. and NiSource Inc. have opted for minority interest sales in Indiana to shore up their balance sheets and fund the state's clean energy transition.

➤ In addition to Consolidated Edison Inc., which has already completed a divestiture of its clean energy assets, Duke Energy and Eversource Energy have also targeted renewable energy assets to spin off.

➤ In the case of Dominion Energy Inc. and Algonquin Power & Utilities Corp., strategic reviews are primarily being undertaken for a larger strategic analysis to enhance shareholder value and, to a lesser extent, to address current macroeconomic conditions.

Consolidated Edison's divesture already complete

Proceeds from Consolidated Edison's

About a week after the sale was completed, the company announced a $1 billion accelerated share repurchase program. Also in March, the company replaced a $2.5 billion credit agreement and repaid $600 million borrowed under a 364-day senior unsecured term loan credit agreement.

Additional renewables businesses up for sale

Eversource

Management said proceeds from the sales could result in "greater levels of regulated investment, less financing needs, or a combination of the two."

Duke Energy

Minority interest sales in Indiana

Duke Energy

In November 2022, NiSource

National Grid (US) Holdings Ltd., which distributes gas in Massachusetts and New York, is considering selling a part of the Northeast gas utility business, sources told The Wall Street Journal. The talks include selling a minority interest in the business, the WSJ reported.

Larger strategic evaluations

In some instances, strategic reviews are being primarily undertaken for a larger strategic analysis to enhance shareholder value and, to a lesser extent, to address current macroeconomic conditions. When Dominion Energy

Dominion sold its West Virginia natural gas utility, Hope Gas Inc., to Ullico Inc.'s infrastructure fund for $690 million in August 2022 with proceedings going toward reducing parent-level debt. In 2021, Dominion sold its remaining 67% controlling interest in certain nonregulated solar projects to Terra Nova Renewable Partners and its remaining 50% controlling interest in Four Brothers and Three Cedars to Clearway Energy Inc.

Most recently, Algonquin Power & Utilities

With the aim of refocusing its investments toward its core electric utility, regulated renewables and transmission businesses, American Electric Power Co. Inc.

AEP's latest efforts to reshape its business toward one focused primarily on regulated electric transmission and distribution and renewables extend back several years when management announced a strategic review and potential sale of its Kentucky generation, transmission and distribution assets with the aim to offset financing needs for planned renewable energy additions at its other utility units. AEP and sale partner Algonquin eventually terminated a $2.85 billion deal for the Kentucky assets, including debt, with AEP now considering its strategy in the state ahead of a potential electric base rate case filing.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

US utilities are focused on strengthening their balance sheets as they navigate economic uncertainty. Since late 2022, multiple utilities have initiated internal strategic reviews and begun the process of divesting assets or selling minority interests in projects to raise cash and to facilitate capital reallocation.

➤ US utilities have reverted to small strategic transactions, in contrast to the utility "megadeals" of decades past. These utility holding companies aim to simplify their business profile, strengthen their balance sheets and reduce strategy risk through a greater focus on regulated pursuits. Proceeds of sales are intended to finance capital expenditure programs, reduce and refinance debt obligations, and mitigate equity financing needs.

➤ While investors seem to prefer full asset sales, Duke Energy Corp. and NiSource Inc. have opted for minority interest sales in Indiana to shore up their balance sheets and fund the state's clean energy transition.

➤ In addition to Consolidated Edison Inc., which has already completed a divestiture of its clean energy assets, Duke Energy and Eversource Energy have also targeted renewable energy assets to spin off.

➤ In the case of Dominion Energy Inc. and Algonquin Power & Utilities Corp., strategic reviews are primarily being undertaken for a larger strategic analysis to enhance shareholder value and, to a lesser extent, to address current macroeconomic conditions.

Consolidated Edison's divesture already complete

Proceeds from Consolidated Edison's

About a week after the sale was completed, the company announced a $1 billion accelerated share repurchase program. Also in March, the company replaced a $2.5 billion credit agreement and repaid $600 million borrowed under a 364-day senior unsecured term loan credit agreement.

Additional renewables businesses up for sale

Eversource

Management said proceeds from the sales could result in "greater levels of regulated investment, less financing needs, or a combination of the two."

Duke Energy

Minority interest sales in Indiana

Duke Energy

In November 2022, NiSource

National Grid (US) Holdings Ltd., which distributes gas in Massachusetts and New York, is considering selling a part of the Northeast gas utility business, sources told The Wall Street Journal. The talks include selling a minority interest in the business, the WSJ reported.

Larger strategic evaluations

In some instances, strategic reviews are being primarily undertaken for a larger strategic analysis to enhance shareholder value and, to a lesser extent, to address current macroeconomic conditions. When Dominion Energy

Dominion sold its West Virginia natural gas utility, Hope Gas Inc., to Ullico Inc.'s infrastructure fund for $690 million in August 2022 with proceedings going toward reducing parent-level debt. In 2021, Dominion sold its remaining 67% controlling interest in certain nonregulated solar projects to Terra Nova Renewable Partners and its remaining 50% controlling interest in Four Brothers and Three Cedars to Clearway Energy Inc.

Most recently, Algonquin Power & Utilities

With the aim of refocusing its investments toward its core electric utility, regulated renewables and transmission businesses, American Electric Power Co. Inc.

AEP's latest efforts to reshape its business toward one focused primarily on regulated electric transmission and distribution and renewables extend back several years when management announced a strategic review and potential sale of its Kentucky generation, transmission and distribution assets with the aim to offset financing needs for planned renewable energy additions at its other utility units. AEP and sale partner Algonquin eventually terminated a $2.85 billion deal for the Kentucky assets, including debt, with AEP now considering its strategy in the state ahead of a potential electric base rate case filing.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

For a complete, searchable listing of RRA's in-depth research and analysis, please go to the S&P Capital IQ Pro Energy Research Library.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.