Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Market Intelligence — 22 Apr, 2020

Highlights

COVID-19 pandemic presents opportunities for companies to start implementing ‘back-to-work’ strategies that align with global climate goals.

Governments could look to mobilize stimulus packages that align with global climate goals, responding with renewed vigour in tackling the climate crisis.

7% reduction in freight shipments in the shipping sector and 40% reduction in business travel in the aviation sector could help align the industries with a 2°C climate scenario by 2030.

A 3-day work-from-home policy in the professional services sector would align emissions from passenger transport over the next 5 years.

As governments around the world continue to tackle the coronavirus pandemic, many of us are adjusting to a new normal characterised by social distancing and other measures to slow the rate of contagion. With Earth Day upon us, we take a moment to consider how the unfolding pandemic could affect the way we tackle other global systemic risks, such as climate change.

We have already started to see news reports on the connection between the pandemic and climate-related issues. Satellite images show a marked fall in global nitrogen dioxide levels as the slowdown in non-essential travel and industrial activity has improved the air quality in major cities and other industrial heartlands in Asia and Europe[1]. In China, carbon emissions were down an estimated 18% between early February and mid-March due to reduced coal consumption and industrial output[2]. In Europe, reduced energy demand and a slowdown in manufacturing could cause carbon emissions to fall by nearly 400 million metric tonnes this year[3]. While a recent report by the Scenario Planning Service Team at S&P Global Platts Analytics projected that behavioural change in the light-duty transportation and aviation sectors could result in a reduction of over 3 million barrels of oil per day demand from these sectors by 2040, compared to 2019 levels. At a global level, scientists predict annual carbon emissions may drop by more than 5% – in what would be the largest fall since the end of the Second World War[4].

The indirect health and societal benefits, no matter how significant, offer no cause for celebration right now. However, when the immediate health crisis and economic downturn are over, the world will be presented with a choice. Carbon emissions could come surging back if countries lean heavily on carbon intensive energy sources and historically low oil prices to rebuild their economies. Alternatively, countries could mobilize strategies that align with global climate goals and respond with renewed vigour in tackling the climate crisis. This could be an opportunity for businesses to embrace strategies that decouple growth from emissions and for the investment community to accelerate the flow of capital to more sustainable assets.

A stimulus package for sustainable growth

A shift of this nature must be underpinned by economic stimulus packages that promote sustainable growth. So what can we learn from the way governments have responded to crises in the past? Following the 2008 financial crisis, governments around the world injected large sums of capital into their economies to support growth. At the time, some countries did recognise the value of accelerating the transition to a low-carbon economy and used the opportunity to build resilience against climate change. In the US, for example, the financial incentives included in the 2009 Recover Act, played a significant role in lowering the cost of solar PV and battery production across the country[5]. In China, 5% of the government’s 4-trillion-yuan stimulus package went into projects on energy conservation, emissions reductions and environmental engineering[6]. However, despite this ambition, carbon emissions grew 6% in 2010, offsetting the 2% decrease caused by the financial crisis itself[7]. Emissions have increased almost every year in the decade that followed.

Figure 1: Global carbon emissions from 2005 to 2018

Source: Global Carbon Project, (2020). Global Carbon Atlas.

However, there may be cause for optimism this time around. The majority of governments around the world have now endorsed the Paris Agreement and an increasing number have started to set carbon-neutral goals for their countries. Against this backdrop, we may expect more governments to integrate measures that enable the low-carbon transition. The early signs are certainly promising. For example, there are calls for the EU Commission to use the European Green Deal as a framework for a comprehensive EU recovery plan that includes the green transition and digital transformation. The Green Deal would constitute a new growth strategy for the EU, which could deliver on the twin benefits of stimulating economies and creating jobs while supporting sustainable growth.

The rise of sustainable investment over the past decade is also a cause for optimism. Environmental, social and governance (ESG) and impact investing have grown 34% worldwide since 2016, reaching assets of more than US$30 trillion at the start of 2018[8]. The pace of issuance in green bonds has also exceeded expectations with US$1 trillion in annual green investment in sight in 2020[9]. As of early April, the S&P 500 ESG Index is also outperforming the S&P 500 benchmark by 2.47%[10]. This provides increasing evidence that capital is flowing more readily to sustainable assets and this could accelerate further with the right economic stimulus in place.

Decoupling growth from emissions

But what could this mean for businesses? How can companies start to embrace strategies that support the low-carbon transition? One of the tools they have used in recent years is to set carbon reduction targets that align with the central goal of the Paris Agreement to limit global warming to well below 2°C. These targets provide companies with a clearly defined pathway to future-proof growth by specifying how much and how quickly they need to reduce their carbon emissions[11]. While a growing number of businesses are measuring and reporting emissions, and many are setting reduction targets, those that are aligned with climate science (i.e. limiting global warming to well below 2°C) have been in the minority. However, there is an opportunity for companies to start implementing ‘back-to-work’ strategies that align with global climate goals. We have explored what this might look like for three areas of business: shipping freight, business air travel and commuting.

Shipping Freight

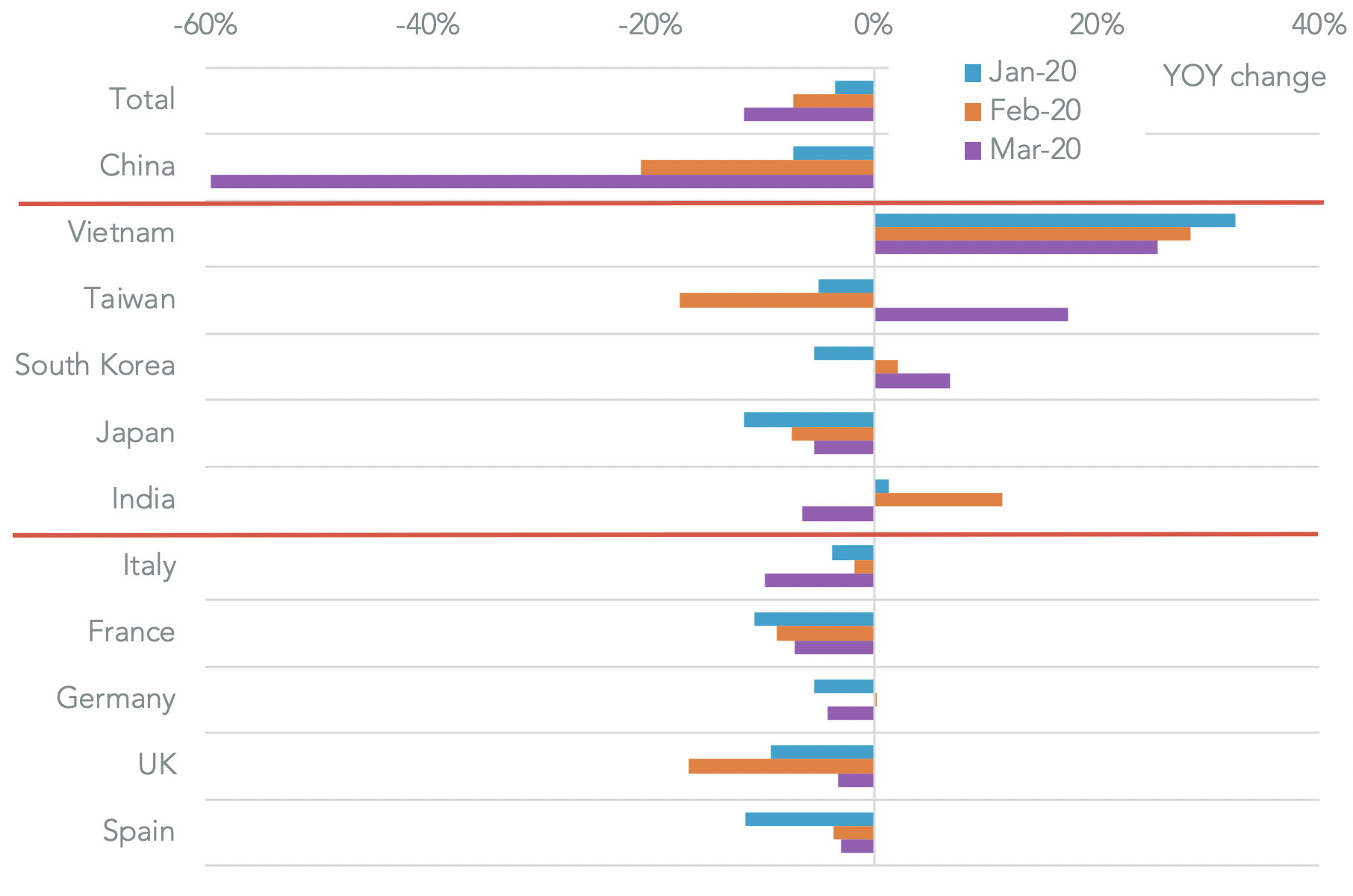

According to data from Panjiva, part of S&P Global Market Intelligence, lockdowns around the world have had a significant impact on trade. US seaborne imports from China, for example, fell 59.5% year-on-year in the first three weeks of March. In response, companies have been relocating their production bases to reduce disruption risks. This process, known as “proximity sourcing” or “re-shoring” has been more prevalent since the onset of the US-China trade dispute but has accelerated in recent weeks as the pandemic has worsened. Sectors such as consumer goods that are built on just-in-time delivery models and rely on components from different parts of the world would be hit hardest. As we emerge from the economic downturn, these sectors will be faced with a difficult challenge to ramp up production. Managing tariff costs, disruption risks and efficiency will be core to their response and further re-shoring of their supply chains will likely continue.

Figure 2: Year-on-year change in seaborne imports to the US, by country of origin, Jan-Mar 2020

Source: Panjiva, (2020). Q2 2020 Outlook.

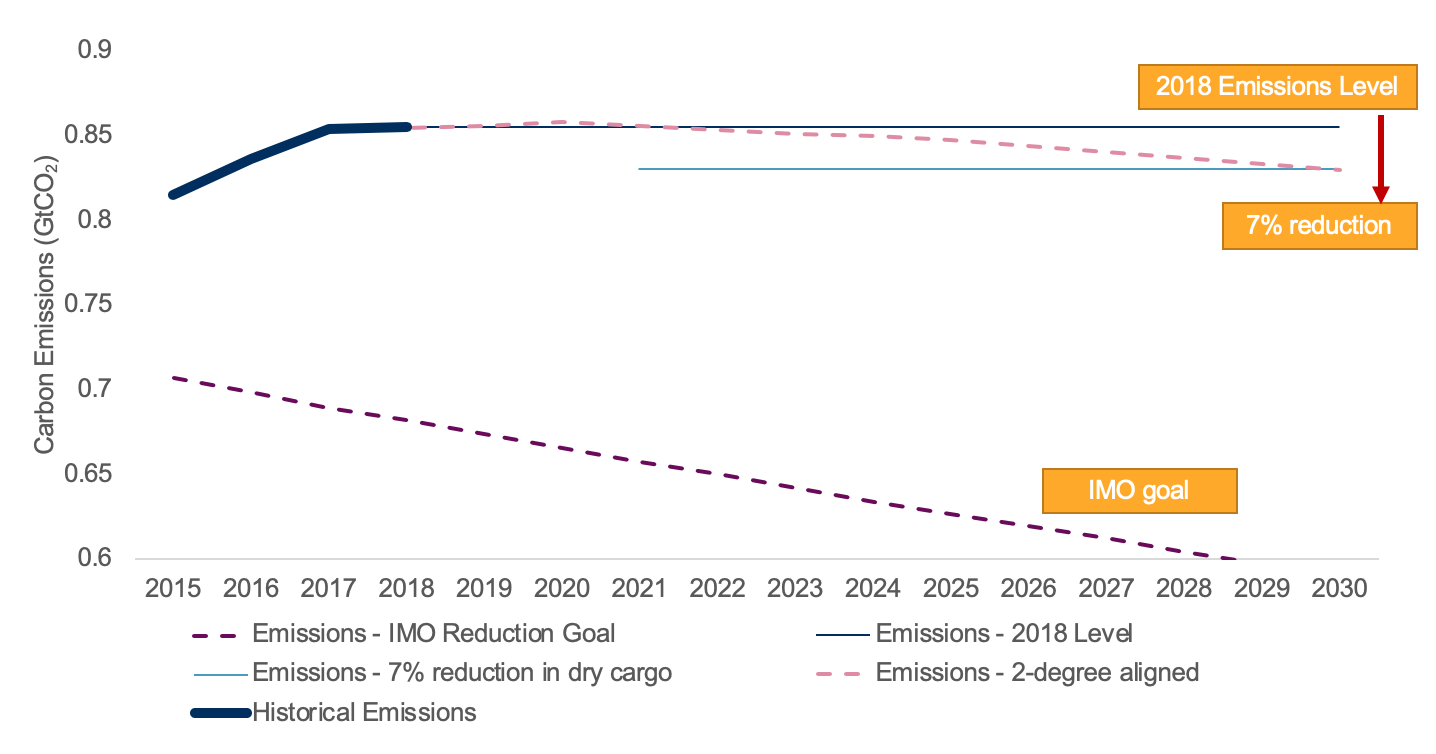

However, this may present an opportunity for companies to redesign their supply chains in accordance with global climate goals. Global shipping accounts for about 3% of global carbon emissions[12] and while not directly included in the Paris Agreement can contribute significantly to a company’s upstream and downstream carbon footprint. If companies continue to re-shore parts of their production, it would result in lower demand for international freight shipping. In fact, our projections show that just a 7% reduction in dry cargo trade would align carbon emissions from the shipping sector with a 2°C scenario by 2030 (Figure 3). This would also bring it closer in line with the IMO reduction goal to halve emissions by 2050 compared to 2008 levels.

Figure 3: Emissions trajectory of the shipping sector in selected scenarios[13]. 5% reduction excludes tanker trade.

Source: Trucost (As of April 2020)

Business Air Travel

Until very recently, aviation was projected to be one of the fastest growing industries within the transport sector with forecasts showing passenger numbers doubling by 2037[14] and the miles travelled by paying passengers increasing by 82% by 2050. Like shipping, aviation is not directly included in the Paris Agreement but carbon emissions from the sector are expected to increase by a third by 2050 based on these growth projections. However, extensions to lockdowns could result in further losses and the industry will face a number of challenges as it rebounds, compounded by the reduced demand for long-haul flights.

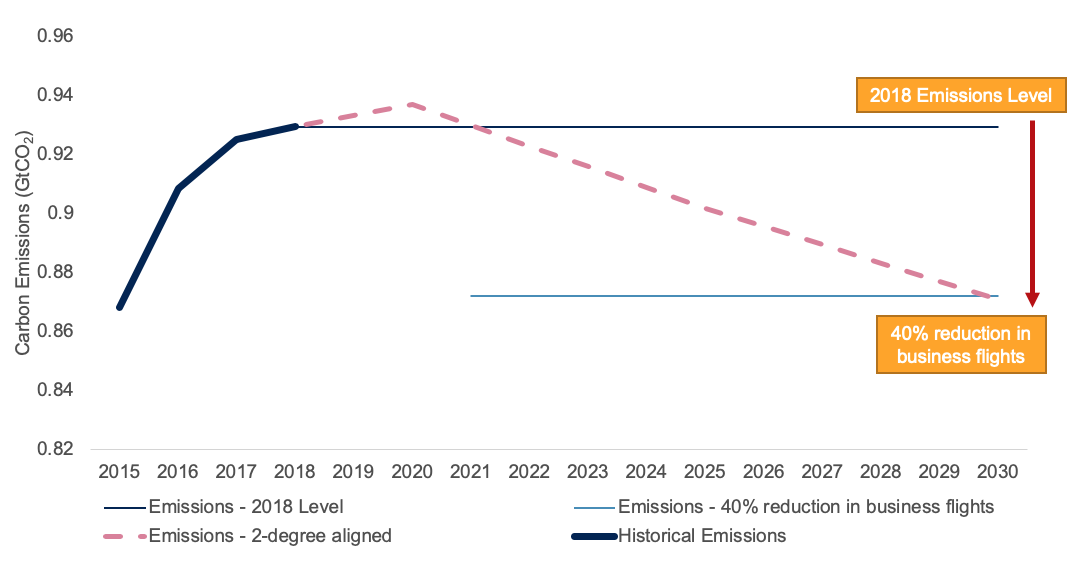

In the short-term, companies in all sectors are likely to feel the pressure to reduce overheads and business travel would be an easy target. Virtual attendance at conferences or meetings is likely to receive broader acceptance after the “biggest work-from-home experiment” triggered by the coronavirus pandemic and this could have a long-lasting impact on how businesses approach travel policies within their companies.

Emissions from aviation remains one of the biggest contributors to emissions from the professional services sector with companies like PwC, one of the Big Four accountancy firms, reporting that business travel is their single biggest source of carbon emissions[15]. However, our analysis shows that if every company currently engaged in business travel were to reduce air travel miles by 40% it would align the whole aviation sector with a 2°C climate scenario by 2030 (Figure 4).

Figure 4: Emissions trajectory of the aviation sector in selected scenarios[16].

Source: Trucost (As of April 2020)

Employee Commuting

The lockdown of cities around the world has had an immediate effect on transport associated with employee commuting. Motor vehicle journeys in the UK reduced by approximately 60% between February and April[17]. In March, petrol sales also declined by 8.2% year-on-year in Washington State, the centre of the coronavirus outbreak on the west coast of USA[18].

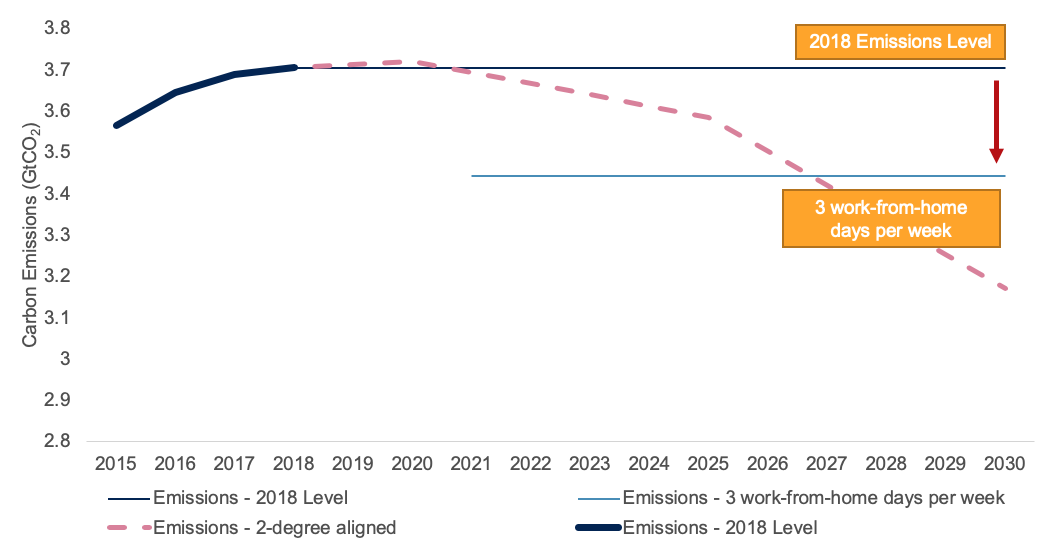

Employee commuting is likely to return to normal once the pandemic subsides and lockdowns are lifted. However, having spent months working from home, businesses and their staff have will have removed many of the technical and behavioural barriers associated with remote working. This could produce long-lasting impact on how companies and their employees view flexible working practices and change daily commuting routines. The impact on carbon emissions from passenger transport could be significant.

For example, if all businesses in the professional services sector, assuming work can be done remotely, implemented a 3-day work-from-home policy, it would align emissions from passenger transport with a 2°C climate scenario for the next 5 years. However, further efficiency gains and more sustainable transport use are needed elsewhere after 2026 to keep emissions reductions in line.

Figure 5: Emissions trajectory of the passenger transportation sector in selected scenarios[19].

Source: Trucost (As of April 2020)

The road ahead is uncertain and many sectors will be faced with different challenges as they look to respond to the unintended consequences of the pandemic. The opportunities for businesses to align ‘back to work’ strategies with global climate goals will also clearly have indirect implications for other sectors. However, with the right economic stimulus packages in place and the increasing flow of capital to greener assets, we may be able to lay the building blocks for a sustainable future.

[1] The Guardian, (March 23, 2020), Coronavirus pandemic leading to huge drop in air pollution. Available at: https://www.theguardian.com/environment/2020/mar/23/coronavirus-pandemic-leading-to-huge-drop-in-air-pollution

[2] Carbon Brief, (2020), Analysis: Coronavirus temporarily reduced China’s CO2 emissions by a quarter. Available at: https://www.carbonbrief.org/analysis-coronavirus-has-temporarily-reduced-chinas-co2-emissions-by-a-quarter?utm_content=bufferae67b&utm_medium=social&utm_source=twitter.com&utm_campaign=buffer

[3] ICIS, (2020), European power and carbon markets affected by COVID-19 – an early impact assessment. Available at: https://www.linkedin.com/pulse/european-power-carbon-markets-affected-covid-19-early-ferdinand/?published=t&trackingId=fSJPQdTmRXSKtxMRY%2BlOZw%3D%3D

[4] Newsweek, (April 3, 2020), Covid-19 pandemic could lead to fall in CO2 not seen since the end of WWII. Available at: https://www.newsweek.com/covid-19-pandemic-fall-co2-end-wwii-1495961

[5] The White House, (2016), American Recovery and Reinvestment Act (Recovery Act). Available at: https://obamawhitehouse.archives.gov/the-press-office/2016/02/25/fact-sheet-recovery-act-made-largest-single-investment-clean-energy

[6] WWF, (2010), Climate and Energy Impacts of China’s Stimulus Package. Available at: http://awsassets.panda.org/downloads/stimulus_final_en_lr_edit_fin.pdf

[7] Peters et al., (2011), Rapid growth in CO2 emissions after the 2008–2009 global financial crisis. Available at: http://www.gsi-alliance.org/wp-content/uploads/2019/03/GSIR_Review2018.3.28.pdf https://www.globalcarbonproject.org/global/pdf/pep/Peters_2011_Budget2010.pdf

[8] Global Sustainable Investment Alliance, (2019), 2018 Global Sustainable Investment Review. Available at: http://www.gsi-alliance.org/wp-content/uploads/2019/03/GSIR_Review2018.3.28.pdf

[9] Climate Bonds Initiative, (2020), Green Bonds Reach Record $255bn for CY 2019 - New Milestone $350-400bn Climate Bonds initial forecast for 2020 $1trillion in annual green investment in sight for early 2020s. Available at: https://www.climatebonds.net/files/releases/media_release-green_bonds_255bn_in_2019-new_global_record-latest_cbi_figures_-16012020.pdf

[10] As of April 6, 2020

[11] SBTI, (2019), Raising the Bar: Exploring the Science Basted Target initiative’s progress in driving ambitious climate action. Available at: https://sciencebasedtargets.org/wp-content/uploads/2019/12/SBTi-Progress-Report-2019-FINAL-v1.2.pdf

[12] CDP, (2019), A Sea Change. Available at: https://www.cdp.net/en/articles/media/shipping-heavyweights-at-risk-of-missing-climate-targets

[13] IEA, (2019), 2-degree scenario aligns with IEA’s SDS scenario. Tracking Transport. Available at: https://www.iea.org/reports/tracking-transport-2019

[14] IATA, (2018), 20-Year Air Passenger Forecast. Available at: https://www.iata.org/en/pressroom/pr/2018-10-24-02/

[15] PwC, (2019), Managing our travel emissions. Available at: https://www.pwc.co.uk/who-we-are/our-purpose/low-carbon-circular-business/travel.html

[16] IEA, (2019), 2-degree scenario aligns with IEA’s SDS scenario. Tracking Transport. Available at: https://www.iea.org/reports/tracking-transport-2019

[17] Cabinet Office Briefing Room, (2020). Slides to accompany coronavirus press conference: 7 April 2020. Available at https://www.gov.uk/government/publications/slides-and-datasets-to-accompany-coronavirus-press-conference-7-april-2020

[18] Financial Times, (March 14, 2020). Coronavirus puts the brake on America’s gas-guzzling ways. Available at: https://www.ft.com/content/45c9829a-6573-11ea-b3f3-fe4680ea68b5

[19] IEA, (2019), 2-degree scenario aligns with IEA’s SDS scenario. Tracking Transport. Available at: https://www.iea.org/reports/tracking-transport-2019

Campaign

Theme

Location