Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 11 Oct, 2022

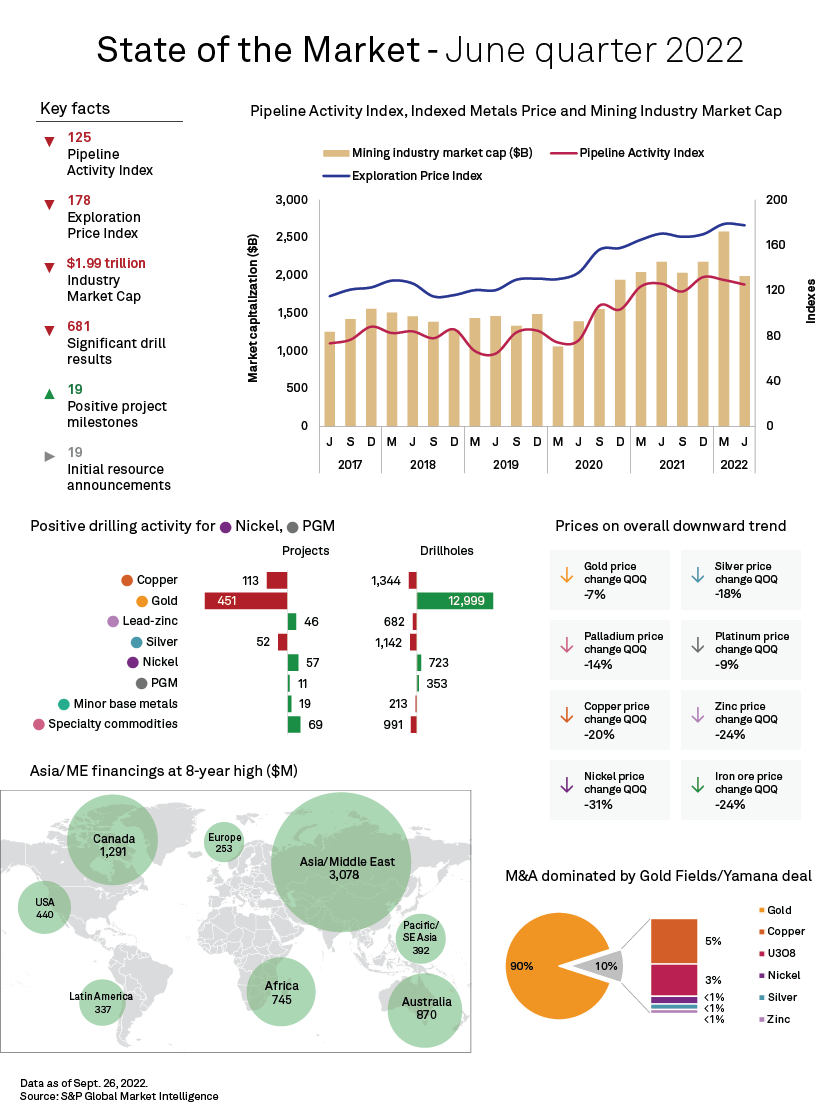

S&P Global Commodity Insight's State of the Market quarterly report highlights key trends and activity across the global metals and mining sector during the June quarter. A souring economic environment is having evident ripple effects throughout the industry.

Industry trends in the metals and mining sector reversed in the June quarter, as market sentiment weakened amid a souring economic backdrop. The ongoing Russia-Ukraine conflict had major repercussions on energy supply, fueling inflation in the Eurozone, while the aggressive actions of central banks, notably in the U.S., to counter decade-high inflation simultaneously threatened to trigger recession. Manufacturing activity also began to slow, evidenced by contractionary purchasing managers' index readings and a slowdown in industrial production that dented metals demand and prices. This was aggravated by China's economy failing to meet growth expectations as various regions were subject to COVID-19-related lockdowns.

Exploration activity remained at historically high levels, although most of our key metrics declined slightly quarter over quarter. Our Pipeline Activity Index remained robust, nevertheless, supported by increases in base metals drilling and sustained strength in initial resource announcements and positive project milestones. Platinum group metals, nickel and specialty commodity projects led increases in numbers of holes and projects drilled, indicating a shift in emphasis to minerals critical to the global energy transition.

Fundraising rebounded significantly from the March quarter, lending support to the exploration sector in the coming quarter, although weaker metals prices and rising inflation will impact operating costs and reduce margins for producers. The resurgence of market uncertainties in early 2022 nevertheless weighed on the total raised in the first half, which fell below the amount raised in the same periods in 2020 and 2021.

Our aggregate mining sector market capitalization retreated slightly from a 10-year high in the previous quarter, although the still-high valuations did not deter significant merger and acquisition activity; the total deal value was one of the highest for the June quarter, driven by one high-profile acquisition.

S&P Global Commodity Insights and S&P Global Market Intelligence are owned by S&P Global Inc.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location

Products & Offerings