Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Dec 12, 2024

By Tony Lenoir and Adam Wilson

Solar-plus-storage systems are fast becoming the preferred solution to address the primary interrelated challenges posed by the rapidly advancing renewable energy revolution — namely, intermittency and inconsistencies between maximum generation and peak load. These flexible systems not only help smooth out energy supply and demand dynamics, thereby bolstering reliability, but they also offer photovoltaic plants additional revenue streams in the form of capacity payments and arbitrage.

Utility-scale solar capacity is closing the gap with the wind generation fleet in the US, totaling nearly 120 GW compared to approximately 155 GW for wind. However, most of that solar capacity — approximately 93 GW — is in stand-alone projects. Furthermore, eight states account for about two-thirds of the stand-alone total. Signs of market saturation are becoming increasingly evident in this sector, with high solar generation during daytime hours causing energy prices to plummet, undercutting revenues for photovoltaic generators.

Additionally, curtailment is rising as plant operators must manage the mismatch between peak solar generation, which generally occurs around noon, and peak load hour, which takes place late afternoon or early evening. As of Sept. 30, 2024, both the California ISO and the Electric Reliability Council of Texas Inc., the leading US independent system operators for grid-scale solar capacity, had already set new records for annual solar curtailment — with three months to go before year-end.

Download the interactive US solar-plus-storage investment outlook and its Excel companion.

Developers and grid managers have taken note and are now aggressively shifting their photovoltaic strategy toward colocated solar-plus-storage systems. The enthusiasm for these systems is evident in the US energy generation pipeline as well as in interconnection queues. As of this report, the operational colocated solar-plus-storage capacity is approximately 33 GW, comprising 22.8 GW of solar generation capacity and approximately 10 GW of battery energy storage. Additionally, the US has 162 GW of hybrid solar-plus-storage capacity in planning, with 42% of the total dedicated to storage.

A significant proportion of this pipeline — more than 42% — is planned to be located in areas designated as energy communities, making them eligible for the 10% tax credit adder under the Inflation Reduction Act, supplementing the base investment and production tax credit.

On the interconnection queue front, an April 2024 analysis of the power projects requesting permission to connect to the grid across all seven US ISOs and 19 major utilities outside of the ISOs shows that nearly 658 GW of hybrid solar-plus-storage capacity has been proposed for potential grid connection, accounting for approximately 30% of the total interconnection queue. In CAISO, where the saturation of stand-alone solar is more advanced than in other ISOs, more than 92% of the solar projects seeking interconnection are part of a proposed solar-plus-storage combination.

The surge of hybrid solar-plus-storage projects expected to come online over the next 10 years will help balance out intermittent generation and peak demand, lowering curtailment risks — a prerequisite to further the transition away from fossil fuels. S&P Global Market Intelligence Power Forecast anticipates that utility-scale solar will account for nearly 17% of the overall US power generation in 2035, making it the third-largest source of electricity production behind natural gas and wind.

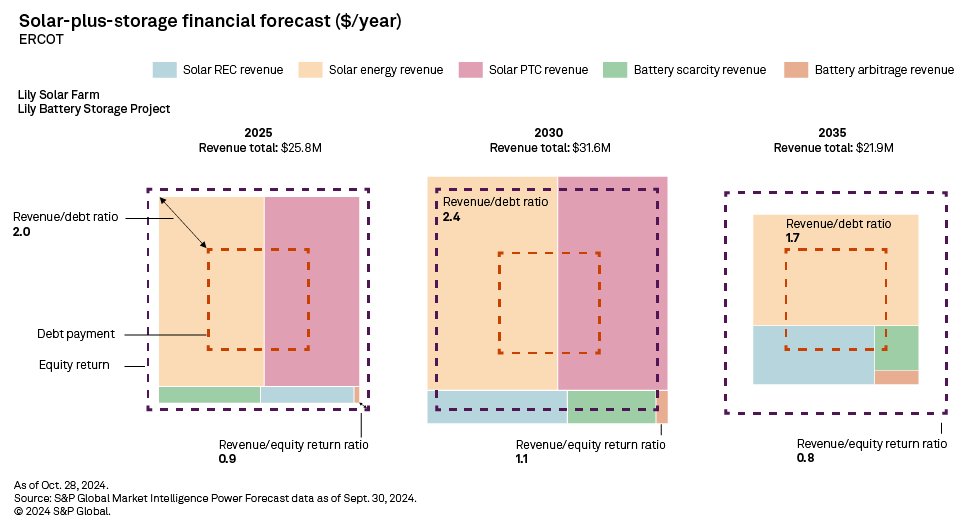

For the solar generation companies, colocated battery storage translates into incremental income sources: storage arbitrage revenue, or the difference between solar charging costs and discharging revenues; and payments pertaining to resource adequacy, or "capacity revenue." The anticipated robustness of these revenue streams unsurprisingly varies across the US, with conditions on the ground — natural resources, supply and demand dynamics, and fiscal incentives — a major determinant. Battery sizing in relation to the generator may also play a critical part, with Power Forecast expecting lower solar-to-battery capacity ratios to be more favorable as arbitrage revenues increase.

Data visualization by Rameez Ali, Shirley Gil, Joseph Reyes and Allen Villanueva.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ.

Regulatory Research Associates is a group within S&P Global Commodity Insights.

For wholesale prices and supply and demand projections, see the S&P Global Market Intelligence Power Forecast.

For wholesale prices and supply and demand projections, see the S&P Global Market Intelligence Power Forecast.

Theme

Location