Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 13 Feb, 2020

Highlights

We estimate 5G subscriptions comprise 6.7% and 0.2% of South Korea's and mainland China's mobile markets, respectively, as of year-end 2019.

South Korea, Hong Kong and Australia have the largest spectrum inventory in Asia-Pacific as of year-end 2019 due to recently concluded 5G spectrum auctions.

Regulators in several Asia-Pacific markets have tried to stimulate local competition by either introducing new market entrants or empowering mobile virtual network operators.

The Asia-Pacific region leaped into the 5G era with two 5G commercial deployments in 2019 — but several markets are still struggling with 4G.

South Korea's three telcos simultaneously launched 5G commercial networks in April 2019. 5G data plans launched by SK Telecom Co. Ltd., KT Corp. and LG U+ were cheaper than existing plans, with the first two telcos offering unlimited data packages. China followed in November 2019 with a simultaneous 5G launch from its three incumbent operators. China Mobile Ltd., China Unicom Ltd. and China Telecom Corp. Ltd. offered tiered data plans based on both data allocation and speed caps, attracting 10 million preliminary registrations.

We estimate 5G subscriptions comprise 6.7% and 0.2% of South Korea's and mainland China's mobile markets, respectively, as of year-end 2019.

The full version of this report is available to clients here.

Emerging markets post robust subs growth

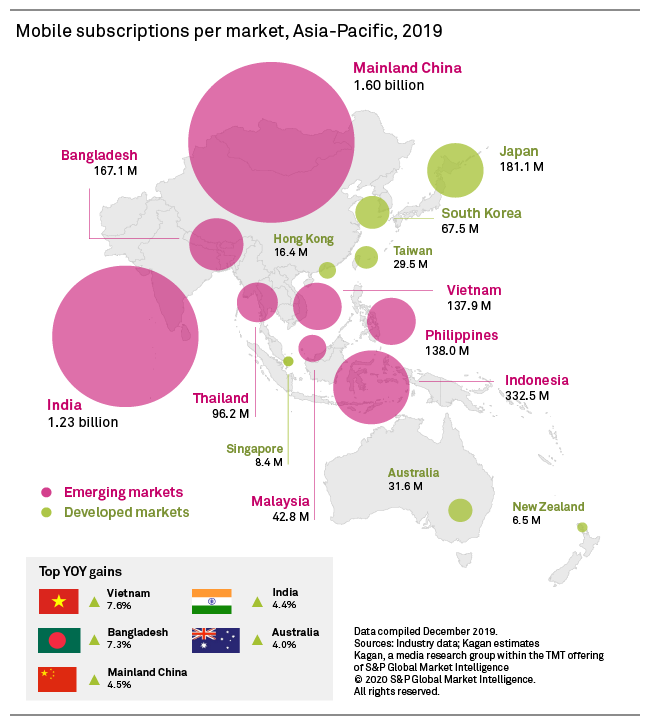

In terms of mobile subscriptions, emerging markets dwarf developed markets due to their larger populations. Mainland China tops the list, with India trailing closely at second place.

Emerging markets also top the list in terms of sub growth due to their relatively higher population growth rate and larger proportion of younger users. We expect continued uptake in mobile subscriptions from emerging markets in 2020 as local operators attempt to bridge the digital divide between their urban and rural populations.

Since emerging markets have a greater proportion of their population living in rural areas compared to developed markets, prepaid is the more dominant form of mobile usage as opposed to postpaid. 2G and 3G services also persist in emerging markets since 4G coverage remains spotty outside key urban areas.

We discussed in an earlier report how developed markets in Asia-Pacific are shutting down their 2G networks to free up more spectrum for 4G and 5G.

Spectrum auctions, towerco licenses bring breath of fresh air to congested markets

South Korea, Hong Kong and Australia have the largest spectrum inventory in Asia-Pacific as of year-end 2019 due to recently concluded 5G spectrum auctions in the 3.5 GHz, 26 GHz and 28 GHz bands.

To have a rough idea of how congested mobile networks are in Asia-Pacific, we compared each market's spectrum and tower inventory. We factored in subscriptions to arrive at subs per MHz of spectrum and subs per tower. The Philippines has the most congested tower market while India has the most crowded spectrum network. Considering both spectrum and towers, South Korea has the best network in the region.

To see a preview of our report on Asia-Pacific's towers and small cells, click here.

New MNOs, MVNOs to disrupt stagnant markets

Regulators in several Asia-Pacific markets have tried to stimulate local competition by either introducing new market entrants or empowering mobile virtual network operators.

Mainland China, Japan and Thailand have revamped their rules to accommodate more MVNOs in the market. Failed operator bidders TPG Telecom Ltd. in Australia, NOW Corp. in the Philippines and MyRepublic Ltd. in Singapore have shifted gears to the MVNO scene instead.

Rakuten Inc. in Japan, Dito Telecommunity — formerly Mindanao Islamic Telephone Co. — in the Philippines and TPG in Singapore have all received licenses to operate as new mobile operators in each of their respective markets. These disruptors prompted incumbent telcos in the three markets to offer generous discounts and offers to prevent customer churn, with some even removing lock-in periods in service contracts.

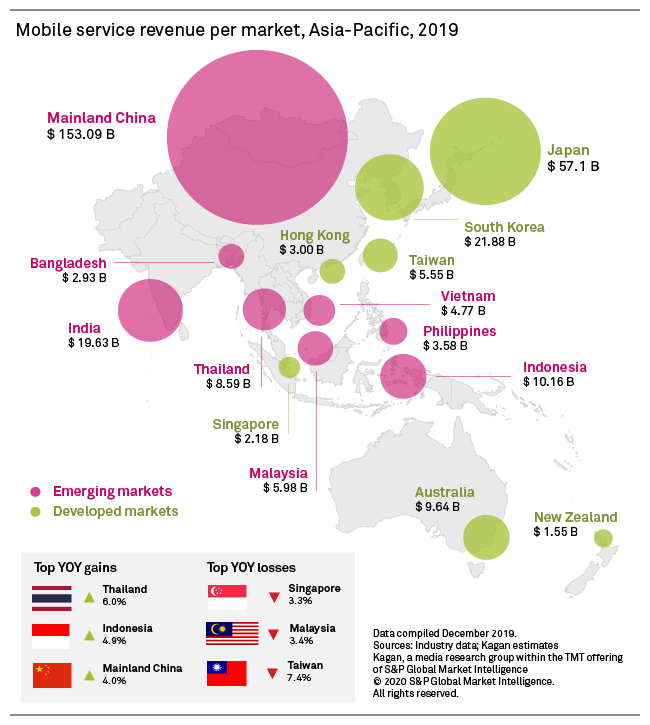

Developed markets contribute a large portion of the region's aggregate service revenue in 2019, with Japan and South Korea being the largest. Mainland China still has the highest service revenue both due to the sheer size of its subscription base and the extensive value-added services offered by local telcos.

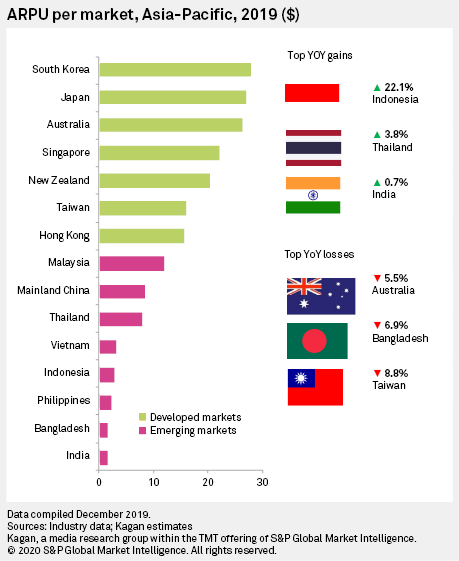

Ranking the markets by average revenue per user shows a clear divide between developed and emerging markets. South Korea is at the upper end of the list while India sits at the bottom. Indonesia and India generated some of the largest ARPU gains in 2019 due to the ongoing expansion of 4G networks in rural areas.

Wireless Investor is a regular feature from Kagan, a media market research group within S&P Global Market Intelligence's TMT offering, providing exclusive research and commentary.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Subscribe to our complimentary TMT monthly newsletter to stay up-to-date on key industry news and insights.

Blog

Blog