Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Nov 30, 2021

By Daejin Lee

Market summary

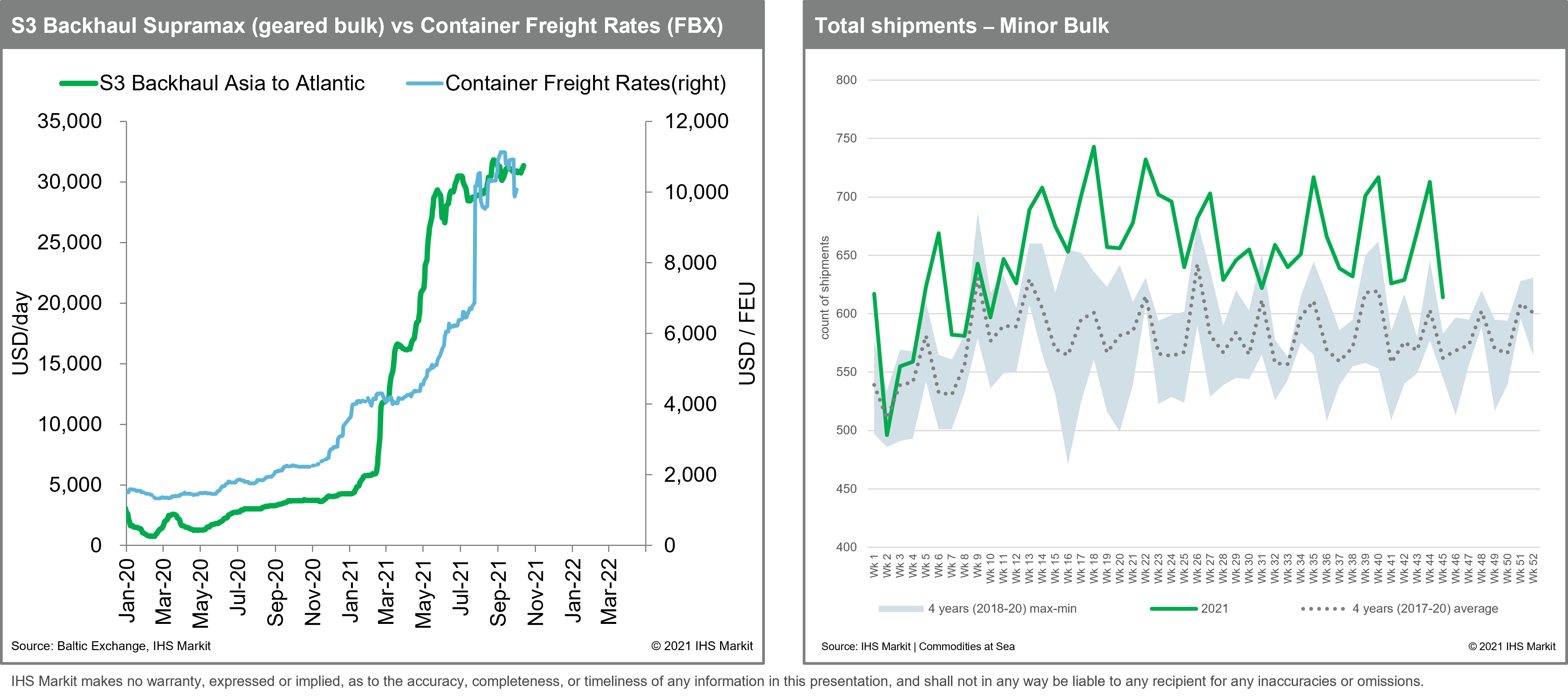

Chart 1: General cargo ships picking up containerized cargoes, an influx of minor bulk cargoes has boosted the geared bulker rates

The dry bulk and container market balance is expected to remain stable in 2022, while freight rates may face correction when vaccines reduce pandemic impacts.

We believe the strength in global containerized trade has had a profound impact on the geared dry bulk freight rates and trade pattern. General cargo (breakbulk) vessels that have shared similar terminal and cargo with geared bulkers (Supramax and Handysize) have shifted to the container-linked market because of extremely high freight rates for container ships this year; container cargo has been spilling over to general cargo ship (breakbulk/MPV/HL) and then minor bulk cargo usually carried by container or general cargo vessels have been shifted to geared bulkers. Moreover, with general cargo ships mostly picking up container-related cargoes, there has been much less competition from general cargo vessels for supra/handy minor bulk routes. These higher demand and lesser supply balance have boosted the geared bulkers' backhaul rates even higher.

Therefore, we have consistently argued that as long as container rates remain high enough to capture part of general bulkers and open hatch cargo vessels in the container sector commercially, geared bulker rates are expected to be supported, specifically backhaul routes. Then a major assumption for the dry bulker rates outlook needs to be based on the container market outlook. Based on record high backlog and limited fleet orderbook in 2022, many experts believe that container rates are likely to remain high until at least the first half of 2022 albeit lower than 2021. With continued strength in the container market in 2022, we expect many geared bulkers will stay in the container sector, which practically reduces fleet supply and enables them to outperform other size sectors.

Minor bulk vs container

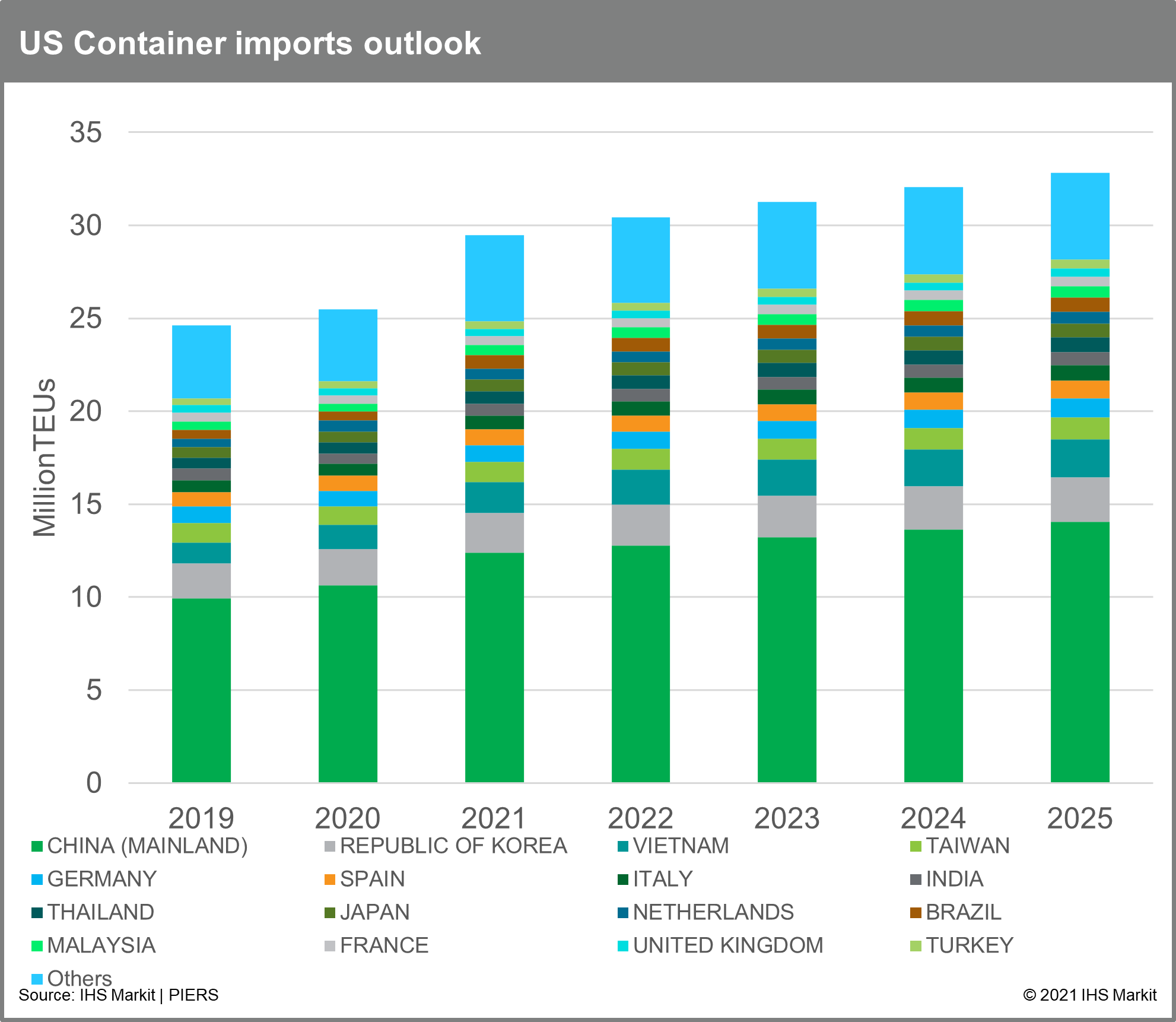

In the special edition of utilization index report Q4 2021 — Shipping Market Cycle: container and dry bulk market outlook— IHS Markit predicts that the global containerized export volume will increase by 4.8% in 2021, mainly driven by strength in U.S. container imports (15.7%) and will continue to grow by about 2-3% in 2022 based on record high backlog and gradual recovery of global economy. However, container freight rates are expected to face correction in the coming years with supply-side pressure including reduced congestion and a large number of newbuilding deliveries. We expect annual container fleet growth will increase to 4.3% in 2021, 4.5% in 2022, and 7.5% in 2023, compared with 3.0% in 2020.

Chart 2. Consumers in the U.S. are supporting the container freight rates for goods shipped across the Pacific; container trade volume to U.S. are expected to increase by 2-3% in the next two years

If we focus on 2022 market only, it is undeniably, container market demand and supply balance looks stable until at least mid-2022 and likely into full 2022. Although we believe container freight rates will still face correction and decrease by 30-40% in 2022 with reduced impact from COVID-19 including record high congestion in west U.S. ports in 2021, the container freight level will still be way above historical levels and remain high enough to employ a large number of general cargo vessels (MPV/HL) and part of geared bulkers including open hatch-box type in container sector commercially.

As we have mentioned in previous reports, we observed a significant increase in the volume of minor bulk shipments mainly driven by container-bulk convertible breakbulk cargoes comprising bagged cements, fertilizers, chemicals, minerals, metals, and steel products. Moreover, with general cargo ships and open-hatch bulker carriers mostly picking up container-related cargoes, there has been much less competition from general cargo sectors to dry bulk sectors, which leads to supply tightness in backhaul minor bulk routes. These higher demand and lesser supply balance has boosted the geared bulkers freight rates so far this year and likely support the rates in 2022 as well.

It is worth noting that with an extremely high container ship orderbook, we expect a large number of container vessels will be delivered from 2023 and will take market share back from general cargo and geared bulk sector. If we assume unofficial options of newbuilding contract to be declared from 2023, the container fleet growth may go even higher than it is expected (7%). However, since a major part of the container fleet deliveries will start only from 2023 and general cargo vessel fleet growth is expected to be flat or even minus in 2022, a large part of container trade volume will continue to spill over to the general and geared bulk market.

In this context, we expect the minor bulk trade growth is estimated to be 13% (y/y) and is set to achieve another growth in 2022 by 2-3%, in line with global economic growth. However, 2023 minor bulk trade growth is expected to slow down significantly as a decontainerized trend will be reversed and some minor bulk and breakbulk volume will likely convert back to containerized mode of transport with a large number of newly available container ships and boxes.

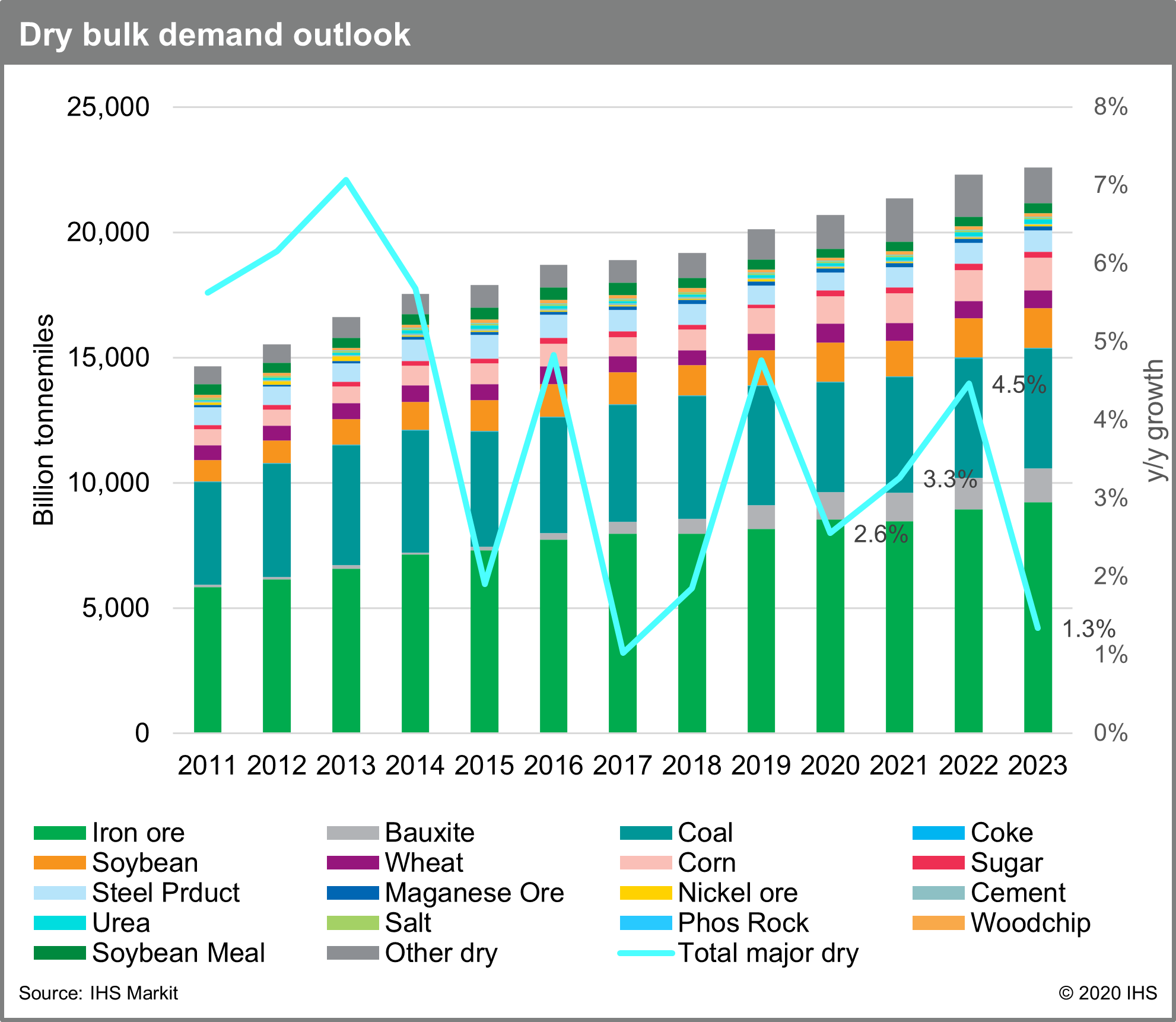

Major bulk: iron ore, coal, and grain

In the same report - utilization index Q4 2021, IHS Markit predicts that the global dry bulk tonne-mile demand will increase by 3.3% in 2021, mainly driven by coal (6.1%) and minor bulk trade (13.0%). It will continue to grow by 4.5% in 2022, largely supported by global economic recovery-related industrial materials including iron ore (5.5%), coal (3.4%), and agricultural goods (5.1%).

For iron ore trade, in line with decarbonization goal, mainland China's electric arc furnace (EAF) capacity is expected to increase from about 10% in 2020 to about 15-20% of the total steel production capacity by 2025 with its ongoing supply-side reform to limit the overall crude steel production volume. At the same time, blast furnace (BF) steel production is projected to increase very marginally or potentially decline in the coming years.

However, basic oxygen furnace (BOF) is still the primary route of steel production compared with utilizing scrap in the EAF production method. Mainland China is by far the largest producer of crude steel globally and currently only 11% of crude steel is produced using EAF with the number expected to slowly increase in the coming years. However, energy shortages and the rising cost of electricity will prove to be a downside risk for EAF processes in the short term as escalating costs of production will make BOF production more competitive and therefore improve the prospects of iron ore imports in 2022. Also, BOFs in most steel plants are modern and young. Therefore, replacing BFs with EAFs will take years owing to the high economic burden for many steel mills, while costly electricity needs will continue to delay the development of EAFs. Therefore, in our view, iron ore will remain as a main source of steel production in the coming years despite mainland China's increased consumption of steel scrap for steelmaking and annual steel production cap.

Chart 3: Dry bulk demand is expected to increase by 4.5% in 2022 driven by the recovery of iron ore and grain trade.

More importantly, even if mainland China steel production may cease to increase, the rest of the world will eventually need to increase steel production to meet the anticipated global steel consumption growth in line with global urbanization and economic growth by 2-3% annually. This would cause steel product and iron ore trade pattern to change. The mainland Chinese market share in global iron ore imports will drop to less than 70% in the coming years from 80% in 2020. Since most of BOF fleet are situated in east Asia including Japan, South Korea, and Taiwan, iron ore tonne-mile-trade distance is expected to remain similar compared with the shipments heading to mainland China. Specifically, steel capacity constraints owing to decarbonization and environmental demands will drive the usage for higher grade and benefit Brazilian high-grade ore export growth. Also, Brazilian iron ore and pellet capacity will continue to grow and is forecast to reach about 500 metric tons in 2023 with Vale hitting about 400 metric tons, although downside risk remains with reduced production of low margin product. Therefore, we expect Brazilian ore exports to grow by 8.4% in 2022 and 3.3% in 2023 as the pandemic and license-related supply constraint issues are resolved.

On the contrary, we believe that the peak coal trade had ended in 2019 with limited new investment in the coal sector. With the recovery in energy demand and high gas prices, thermal coal demand is expected to remain strong with growth of 5.4% in 2021 and 1.2% in 2022 but will remain stagnant thereafter in line with the global energy mix shift; environmental policies that favor renewables and gas over thermal coal, and favor scrap over coking coal. Metallurgical coal trade will recover from its 2020 levels and grow in 2021 (4.8% y/y) and 2022 (5.0% y/y) but annual growth will start to slow once it is near its 2019 levels.

Our assumption for the agricultural trade demand outlook remains unchanged. Agricultural shipments will continue to grow in the coming years with a structural shift in appetite of emerging countries towards meat in line with urbanization.

Soybean trade has been slow in 2021 mainly owing to limited end-stock, but the trade growth will continue during 2022-23 as mainland China will increase its meat consumption. Mainland China's soybean imports started to recover from the African Swine Fever (ASF) in 2019 and 2021/22 soybean imports are forecast to be up 10% from 2017/18. With weaker grain and soybean shipments from the United States in the fourth quarter of 2021, stronger Brazilian grain season is expected in early 2022.

Corn trade is expected to increase during 2021-23 mainly from the U.S. and mainland China routes with the trade deal, incentivizing agricultural trade. Ukrainian and U.S. corn will increase market share in the coming months until South American corn season starts in the second quarter of 2022.

Wheat trade growth has been flat in 2021 owing to the pandemic and the tax issues from Russia, but will recover during 2022-23 with high feeding demand; the strength in feed grain demand offsets the negative tonnemile impact from the recovery of Australian exports, resulting in strong Black Sea exports.

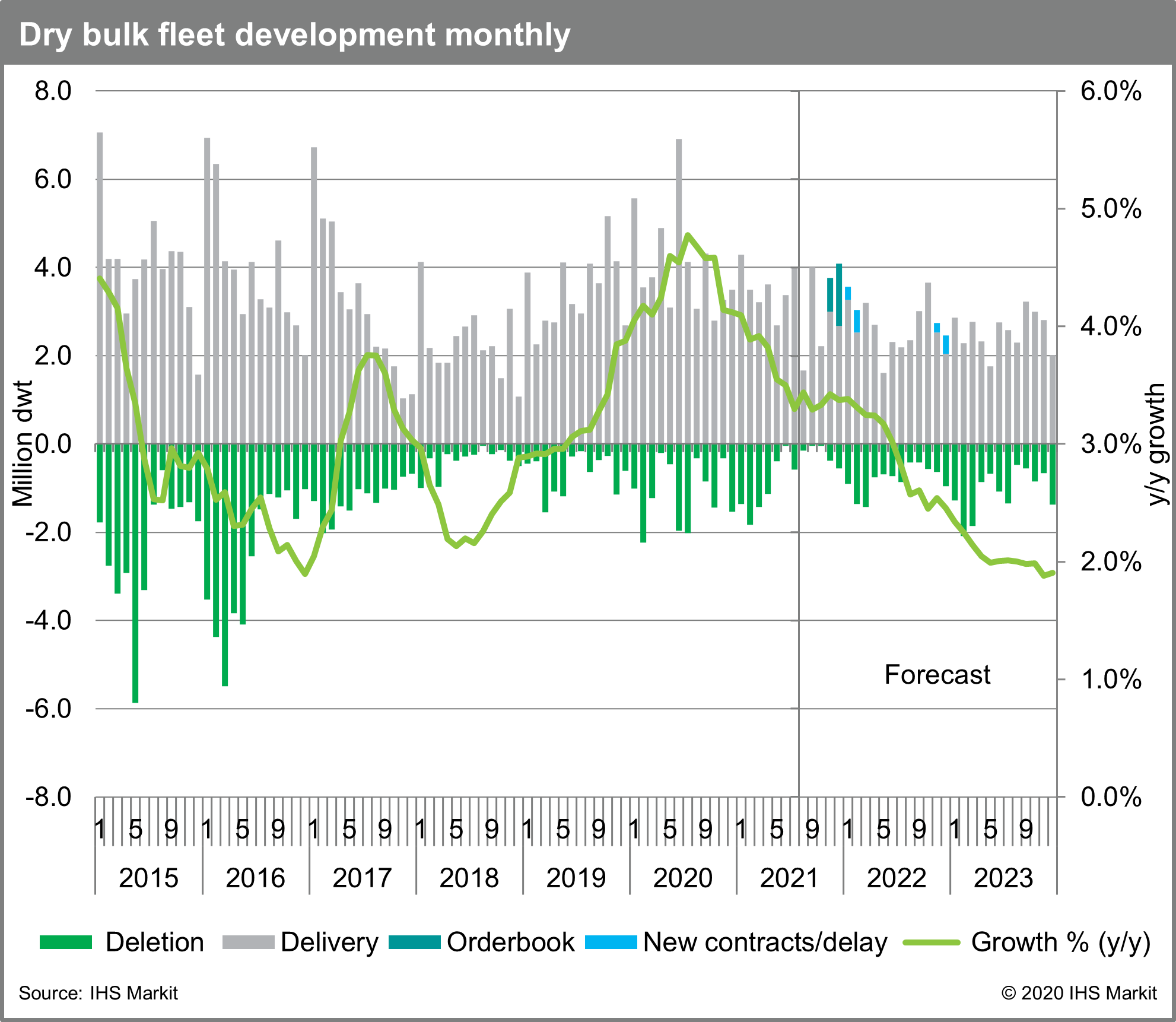

Dry bulk supply

Chart 4: annual dry bulk fleet growth will slow to 2.3% in 2022 and 1.8% in 2023

With limited newbuilding contract and orderbook, dry bulk fleet growth will slow to 3.4% in 2021, 2.3% in 2022, compared with 4.1% in 2020.

With favorable freight rates, some shipowners triggered the options of existing contracts with much lower contract prices. However, fresh newbuilding contracts were limited in the first 10 months of 2021 with concerns and uncertainty over several environmental regulations. Therefore, total orderbook ratio against existing fleet remained extremely low at about 7% of total dry bulk fleet compared with 20% in average over the past five years. Dry bulk delivery ratio in 2021-23 is expected to be about 80-90%, and newbuilding delivery will decline significantly in the second half of 2022, according to orderbook status (launched, keel laid, under construction).

With the availability of scrap candidates of 15+ years, freight conditions and regulation-related additional costs (including bunker prices) will be key for the demolition outlook. However, it is unlikely to see demolition from younger age with favorable freight environment. Also, most of the old Panamax and Handymax vessels are employed for short-haul routes in the Pacific and operated by domestic companies.

In the long term, dry bulk fleet growth will continue to slow to about 1-2% in 2023 and the growth will remain limited about 2% in 2024-30 because of concerns about trade growth potential against global decarbonization target and uncertainty over several environmental regulations.

Conclusion

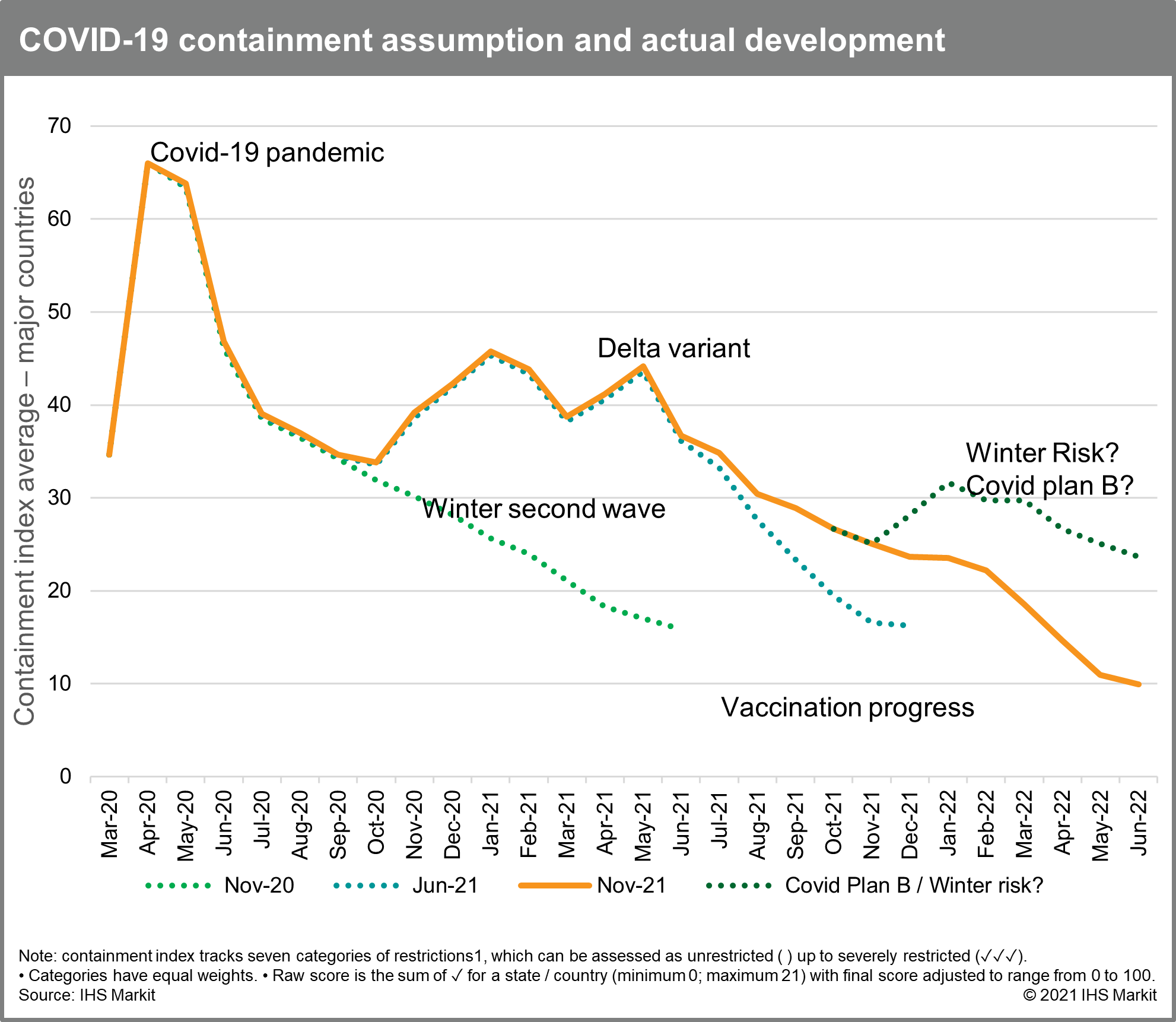

Chart 5: Vaccination should result in easing the COVID-19 restriction and consumer spending shifting from products to services, reducing shipping demand and congestion

Traditionally dry bulk freight rates have been supported from the top down, Capesize supporting Panamax and Panamax supporting Supramax/Handy sizes. However, unlike in the previous years the strong performance in the minor bulk trade has resulted in supporting the larger vessel classes from the bottom to top. Also, backhaul minor bulk rates became almost identical with container rates. Therefore, we have consistently argued that as long as container rates remain high enough to capture part of general bulkers and open hatch cargo vessels in the container sector commercially, geared bulker rates are expected to be supported, specifically backhaul routes.

That is why our major assumption for dry bulk demand and supply has been heavily linked with container market outlook. Based on record high backlog and limited fleet orderbook in 2022, many experts believe that container rates are likely to remain high until at least the first half of 2022 albeit lower than this year. Our view is slightly different from the consensus but we share the view that many geared bulkers will still stay in the container sector, which practically reduces fleet supply and makes them outperform other size sectors in 2022. However, as COVID-19 containment measures start to soften with vaccination rollouts progress and decontainerized trend will be reversed with extremely high container newbuilding deliveries, the strength in shipping freight rates, especially Asia-Atlantic container-dry bulker rates, would likely be under pressure and start to return to a fundamentally reasonable level in later part of 2022 or early 2023.

In the latest update, IHS Markit Freight Rate Forecast models predict BDI to fall 30% on the year in 2022 to average about 1,800-2,300 points in 2022 after reaching a 13-year high average above 3,000 points in 2021, but it will still be significantly higher than the 2011-2020 average of about 1,100 points and breakeven level. We assumed container freight rates will face correction and decline by 30% in 2022 but will remain high enough to employ a large number of general cargo vessels (MPV/HL) and part of geared bulkers and practically reduce active fleet and lead to continued supply tightness in dry bulk backhaul routes. A lack of stimulus from mainland China and the returning focus to environmental policies that favor renewables and scrap over coal and iron ore would be a major downside risk while continued high congestion with the ongoing pandemic and record high backlog would become a major upside risk on freight rates in 2022.

Please note this is summary of annual shipping market outlook report for IHS Markit freight analytics subscribers. To see full annual outlook report(123p), please contact Phoebus.kaloudis@ihsmarkit.com or Daejin.Lee@ihsmarkit.com

For more insight subscribe to our complimentary commodity analytics newsletter

Posted 30 November 2021 by Daejin Lee, Director, Shipping Analytics and Research, S&P Global Commodity Insights

How can our products help you?