Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

WHITEPAPER — May 17, 2023

Prior to the introduction of the G7 oil price cap in December 2022, a number of vessels moved from direct Russian ownership or nationality to new companies domiciled in India and the United Arab Emirates (UAE). These new, primarily, tanker owners have created fleets of vessels with direct and indirect links to Russian entities while retaining a general level of opaque ownership information, especially in regard to the ultimate group owner. In the meantime, these new owners have helped Russian oil continue to flow when more traditional and conventional fleet owners exited the Russian market.

The issue of vessel ownership and the potential to identify the ultimate beneficial owner has been discussed widely since the oil price cap came into effect. Recently the European Union placed Sun Ship Management on a sanction watch-list due to its relationship with Sovcomflot, the Russian fleet owner which transferred assets to Sun Ship Management, a Dubai based ship owner in 2022. In addition, two other fleet owners, Gatik Ship Management and Fractal Marine, are newly registered ship owners in India and UAE respectively, for vessels that have previously been Russian flagged or managed. Both of these registered owners are not the ultimate fleet owner and understanding who really owns those assets is not so readily available.

Recent media reports uncovering Russian related vessels registered to the Indian-based ship owner Gatik Ship Management and the UAE-based firm Fractal Marine have identified a new type of vessel owner. Gatik and Fractal have been high-profile cases with both firms acquiring multiple Russian linked vessels throughout 2022. Beyond these two firms there are numerous companies created in 2022 which have acquired previously Russian flagged or Russian owned vessels. Some of these new owners manage single ship fleets or larger entities of multiple vessels.

A total of 864 companies with a relationship to Russia have been setup in 2022, the relationship covers either a port visit for the first time after December 5, 2022, ex-Russian flagged or ex-Russian owned ship now appearing in its fleet. These companies are active within different vessel ownership structures such as group owner, registered owner, operator or technical manager.

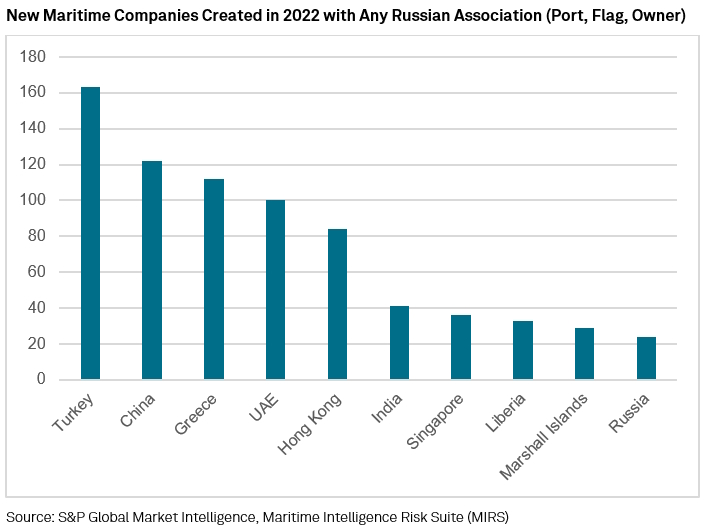

The 10 countries where the majority of these companies are located is highlighted below with Turkey, China, Greece, UAE and Hong Kong leading the way.

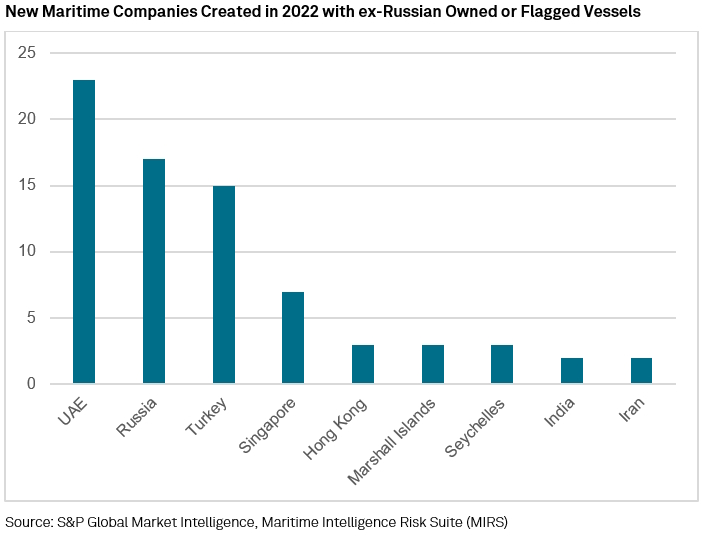

The key Russian association for the 864 vessels is a port call after the first oil price cap for crude oil was introduced in December 2022 but other firms in the 864-company list have acquired previously owned or flagged Russian vessels. There are 87 companies that have acquired ex-Russian owned or flagged ships without necessarily making Russian port visits. The leading location for registering a previously Russian owned or flagged maritime asset is the UAE.

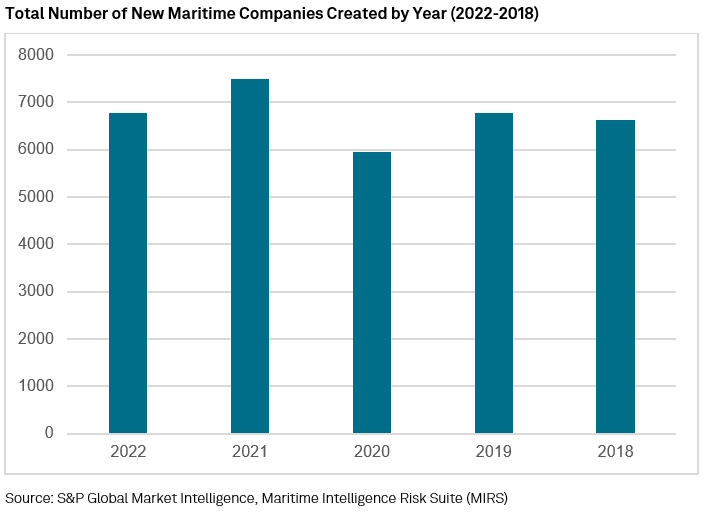

In context, the number of maritime companies setup in 2022 with a direct Russian relationship accounts for 12.8% of the overall 6,789 new firms.

The number of vessels associated with these new companies that were originally Russian flagged or Russian owned is 100.

Download and read the complete complimentary paper: Russian Shadow Shipping - Emerging New Owners. This paper seeks to identify and analyze the key organizational movements of Russian-linked vessel fleets, and their ownership and domicile status in order to understand new market entrants, what they have purchased in the wider tanker market and how this facilitates potential Russian dark shipping.

Subscribe to our complimentary Risk & Compliance quarterly newsletter, or subscribe to Maritime and Trade Talk podcast for the latest insight and opinion on trends shaping the shipping industry from trusted shipping experts.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.