Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — May 24, 2023

By Ana Souto and Ronel Oberholzer

A recent analysis by S&P Global Market Intelligence on the housing market in sub-Saharan Africa led to the creation of a housing cost indicator in the absence of available house price data.

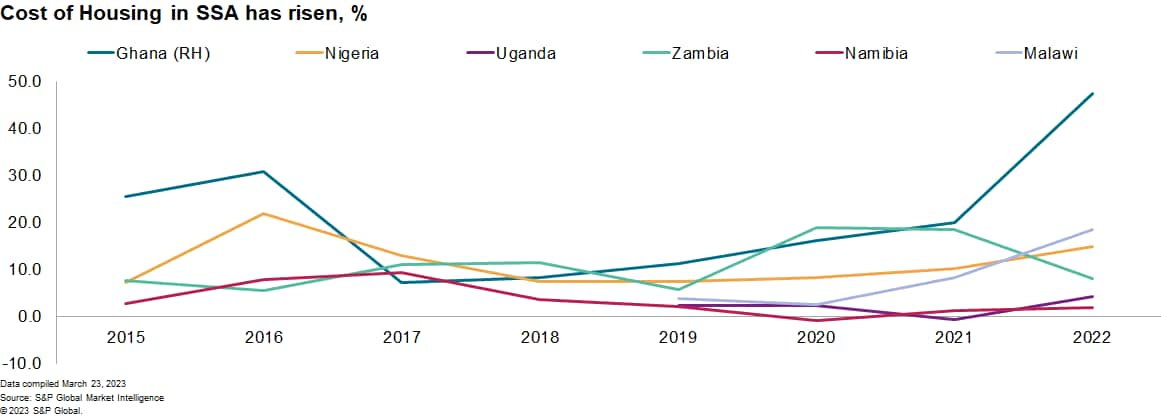

The analysis used the housing component in the Consumer Price Index (CPI) basket as a proxy for house price changes. The results showed that the cost of housing in SSA, except for Zambia, rose following the COVID-19 pandemic in 2020. The increase was mainly due to the historically inefficient housing market in the region, rather than a surge in mortgage demand driven by low-interest rates, as seen in developed economies.

The demand for property in the region has been steadily increasing due to factors such as urbanization and population growth. South Africa has also seen a rise in demand thanks to an increase in income. Still, affordability remains a significant constraint for most people.

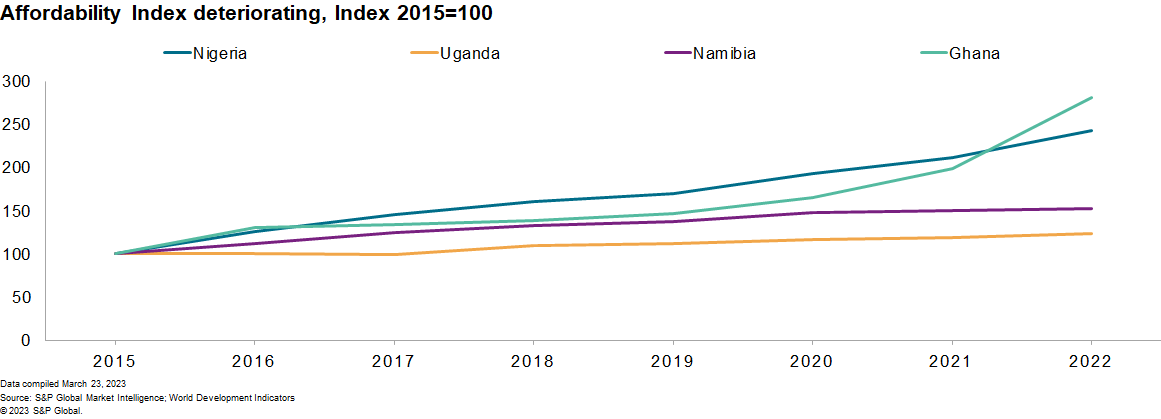

Our affordability index is unique as it considers the housing cost and gross national income per capita. Lower-income households in the region often find that their essential expenses consume around 80% of their disposable income, leaving them with 20% or less to allocate toward housing expenses. As a result, these households are often forced to accept smaller and lower-quality housing options.

The analysis revealed that the limited availability of long-term funding for banks restricts the provision of housing finance. In most banking sectors in SSA, retail deposits serve as the primary funding source. Therefore, banks must rely on short-term deposits to fund most mortgage finance, which is a major obstacle to long-term lending due to liquidity and "gap mismatch" risks for the lending banks.

Additionally, high-interest rates for mortgage loans make it difficult for people to afford them. In the region, double-digit interest rates for housing finance are common. The average bank lending rate was 14.5% in 2021, which is higher than the global average of 8.5% for emerging markets. These high interest rates make mortgage financing unaffordable for most households, limiting it to only a small portion of households and high-income individuals.

Concerning supply, the analysis accentuated that in many regions of sub-Saharan Africa, the lack of affordable housing has led to an increase in informal housing options for households. This, in turn, has limited the negative impact on formal housing prices due to supply constraints. The shortage of affordable housing can be attributed to a variety of factors, such as insufficient investment in housing construction, complex and slow registration procedures, and uncertain land ownership rules. These issues highlight the need for improved housing policies in the region.

Unlike other regions of SSA, South Africa has seen an increase in affordability and this trend is expected to continue in the long term. Although there was a slight decline in 2020, the growth of real disposable income has generally surpassed that of house prices. Furthermore, the improved financial status of households, particularly among those with higher incomes who have benefited from increased investment income from stocks and bonds, will further enhance property affordability. This will lead to sustained growth in house prices.

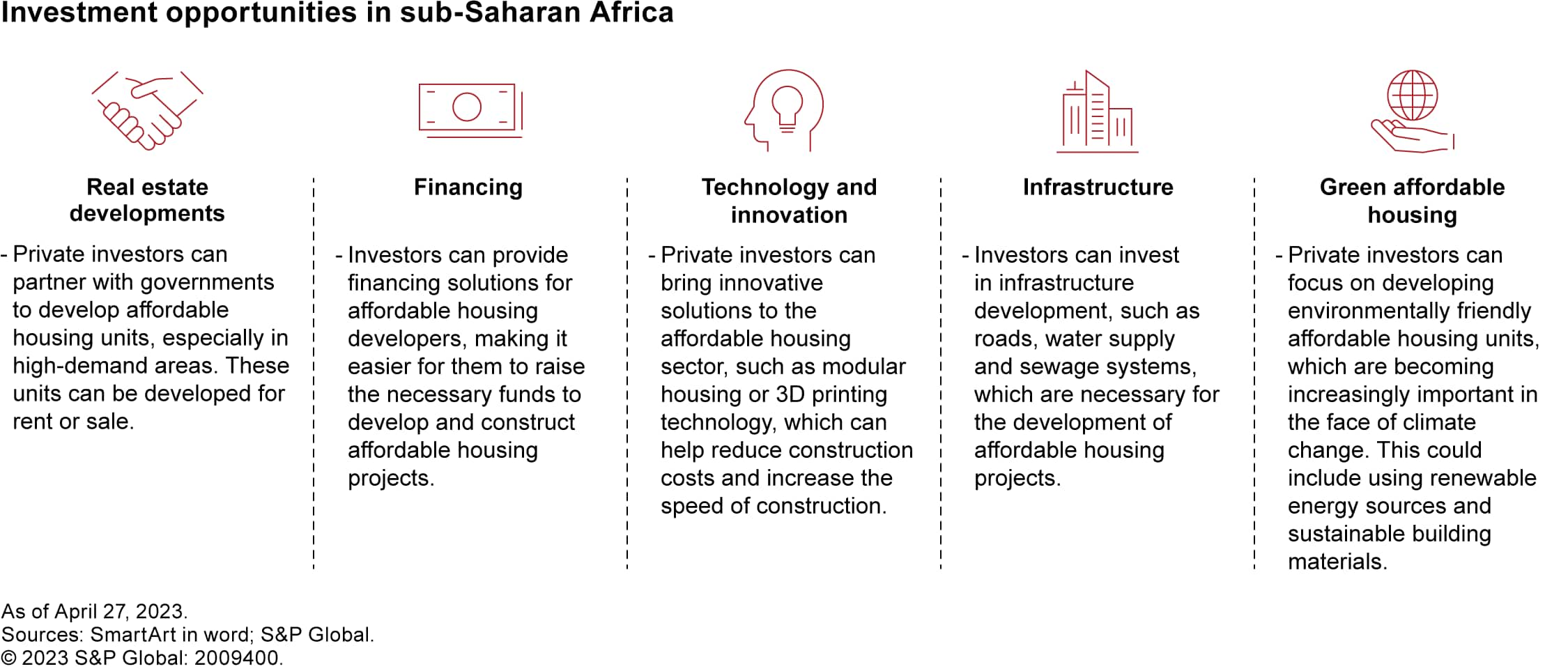

The analysis concludes by identifying investment opportunities in SSA that arise from the combination of increased real incomes in middle- to upper-income countries and a significant shortage of formal housing. These opportunities include developing environmentally sustainable affordable housing units, investing in modular housing, and improving infrastructure.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.