Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 18 Sep, 2023

The US broadcast station industry is expected to reach $33.83 billion in total advertising revenue in 2023, down 7.0% from $36.39 billion in 2022. Core ad categories including automotive, retail and travel categories, have mostly rebounded from pandemic-level declines although showing signs of softness as a result of high interest rates and inflationary pressures while pharmaceuticals, telecoms and professional services are still relatively strong in terms of ad spending.

The local ad market continues to be stronger than the national side of the spot ad business for broadcast stations with major brands and ad agencies shifting budgets to streaming, mobile and social media platforms. Our 2023 projection breaks down to $21.86 billion from TV stations — including core national and local spot, political and digital/online — and $11.97 billion from radio stations, which includes national and local spot and digital, excluding network and off-air.

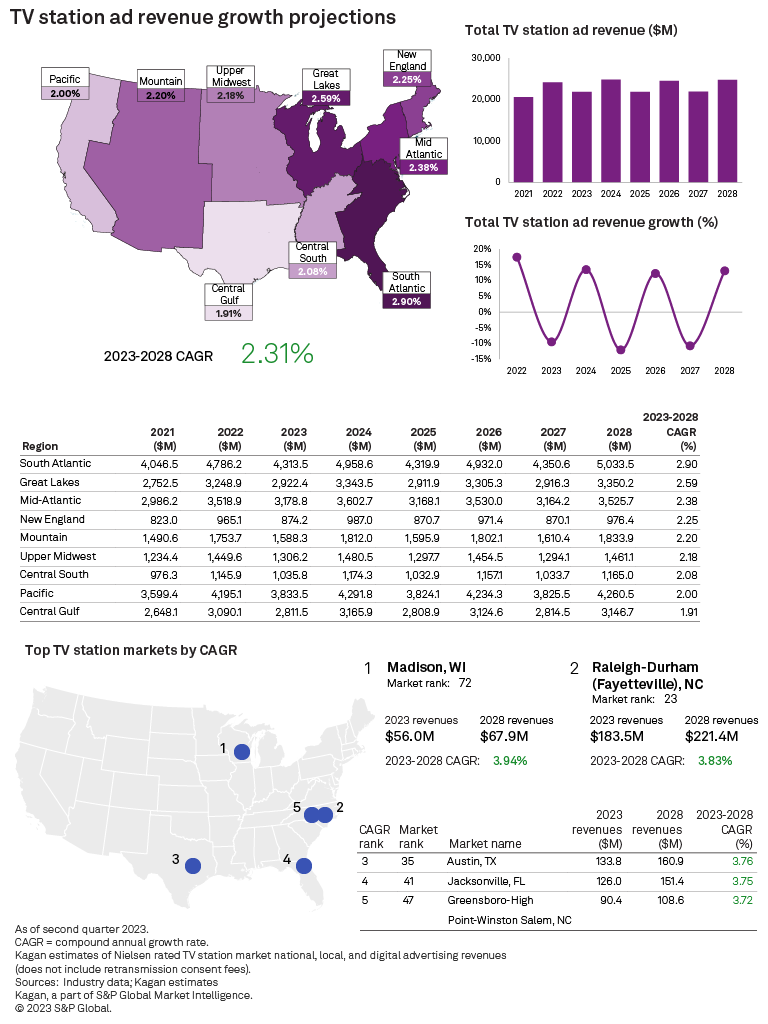

TV station core local and national ad revenues in 2023 are expected to grow slightly at 0.4% to $17.67 billion, with local spot up 2.0% and digital up 3.0% while national spot declined by 3.0%. However, including the loss of nearly $2.5 billion in political, TV station ad revenue overall is expected to drop by 9.5% to $21.86 billion in 2023. In 2024, with the influx of nearly $4 billion in political ads from a presidential election year, TV station ad revenue is expected to grow to $24.82 billion.

TV station ad revenue during the five-year period 2023-2028 is projected to grow at a 2.31% compound annual growth rate, hitting a high of $24.75 billion in 2028. This CAGR is slightly elevated given it starts in a non-election and non-Olympic year in 2023 and ends in a presidential election year in 2028. Overall, the spot ad market for TV station owners is expected to be more volatile with the ebbs and flows of political ad spending in election years while streaming and connected TV initiatives and the prospect of NextGenTV interactive and targeted ads point to the future.

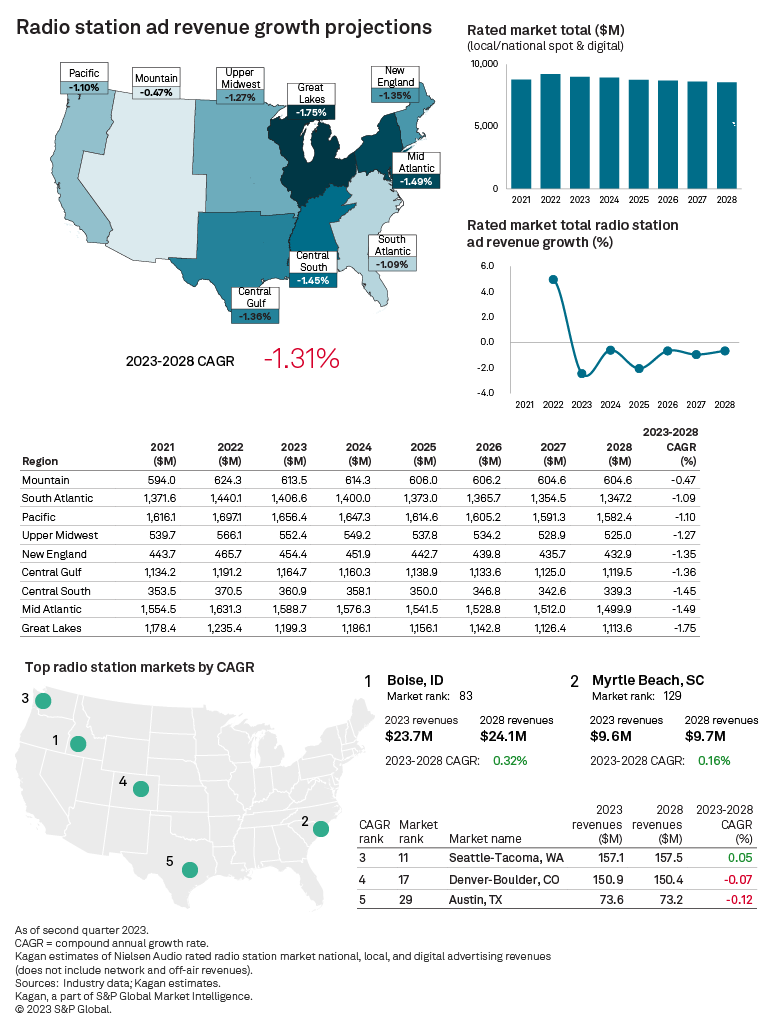

The radio station advertising business with more of a localized focus and less political ad uptick is expected to decline 2.1% in 2023 to $11.97 billion and down 0.9% in 2024 to $11.86 billion, excluding network and off-air revenue. As national and potentially more local advertising continues to shift away from radio to streaming audio and podcasting alternatives, we expect continued low single-digit declines in radio national, local spot ad revenue with digital and off-air as the only bright spots with total radio ad revenue dipping to $11.16 billion by the end of the projection period in 2028.

TV station ratings have been down so far this year compared to 2022 with more broadcast network content and viewers moving from traditional multichannel to streaming video platforms, although local news and live sports have still been relatively strong in terms of viewership. However, these TV station ratings do not include live station streams on virtual MPVDs or the station's own mobile apps or connected TV distribution strategies.

Over the five-year projection period 2023-2028, political advertising will be spent disproportionately on local stations in swing-state markets and those with higher expected population growth — such as Arizona, Colorado, Florida, Georgia, Nevada, North Carolina and Texas — which are forecast to rise more than the national average.

Spending in the 2024 presidential year elections is expected to surpass prior records with a possible Biden vs. Trump rematch at the top of the ticket along with the US Senate majority in play as Republicans look to gain control in both Houses along with the presidency. Political ad spending on TV stations is expected to reach $3.94 billion, up 10.0% from the last presidential election year in 2020.

Our five-year forecast for TV stations considers the fluctuations between even/election and odd/nonelection years and calls for $3.70 billion in the next midterm election year, 2026, and $4.06 billion in the next presidential election year 2028.

By the end of the projection period in 2028, we expect total TV station advertising revenue to reach $24.75 billion, including $17.17 billion in national and local core spot, $4.06 billion in political and $3.52 billion in digital/online revenue.

Based on our TV market-level ad projections, the top five fastest-growing US markets by 2023-2028 CAGR are Madison, Wis., at 3.94%; Raleigh-Durham (Fayetteville), NC, at 3.83%; Austin, Texas, at 3.76%; Jacksonville, Fla., at 3.75%; and Greensboro-High Point-Winston Salem, NC at 3.72%.

Radio ads are predominantly local and focused on the auto, retail, travel and entertainment categories, which were heavily impacted by the pandemic-influenced advertising pullback and now are suffering from higher interest rates and price inflation primarily from higher labor costs. Consumer spending that rebounded post-pandemic with shelter-in-place and masking orders being lifted has now come under pressure although has not dipped into recessionary levels yet.

In addition, radio owners must compete with streaming audio and on-demand options for music and talk, such as Spotify Technology SA and Pandora Media LLC, and overall radio listenership has been on the decline as more remote work and less commute time has impacted prime in-car radio time during rush hours. Another radio challenge is new cars, specifically EVs and hybrids, that deprioritize radio in the dashboard and in some cases lack an AM antenna.

Radio's core local spot ad market is projected to decline by 3.0% to $8.49 billion in 2023, down 1.0% in 2024, down 3.0% in 2025 and then slightly declining by 1% to 2% over the remaining forecast period to $7.85 billion by 2028. National radio ad revenues are forecast to decline by 4.5% to $1.97 billion in 2023 and by 6.0% to $1.85 billion in 2024, and then start to decline by 7.0% to 8.5% over the remaining years in the forecast period to $1.33 billion by 2028.

We project digital gains of 6.5% in 2023, 6.0% in 2024 and a range of 5.7% to 5.1% growth through the rest of the projection period. Radio station owners are continuing to invest in streaming, podcast and digital marketing service initiatives, with digital revenues expected to rise to $1.98 billion by the end of 2028. Off-air is forecast to grow 3.0% in 2023 and 2.3% in 2024 with live events a growing segment for the radio industry reaching $2.45 billion by the end of 2028.

Radio's lower ad cost, local audience and relatively high return on investment compared to other media will keep it relevant, although digital investments point to future growth opportunities with the spot ad market for radio expected to decline over the forecast period.

Between 2023 and 2028, we expect radio station local and national spot ad revenues, including digital, to decline at a CAGR of 0.98% in rated markets, with non-rated markets declining, at a CAGR of negative 2.68%.

Total radio revenue, including national and local spot, digital, off-air and network revenue, is expected to decline slightly at a five-year negative CAGR of 1.20% from an estimated $15.15 billion in 2023 to $14.26 billion by the end of 2028.

Based on our radio market-level ad projections, the top five fastest-growing US markets by 2023-2028 CAGR are Boise, Idaho, at 0.32%; Myrtle Beach, SC, at 0.16%, Seattle-Tacoma, Wash., at 0.05%; Denver-Boulder, Colo., at -0.07%; and Austin, Texas, at -0.12%.