Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

22 Apr, 2020

By David Pope and Alexandra Ronning

Highlights

Following the outbreak of the COVID-19 pandemic, investors and corporate decision-makers now suddenly find themselves needing to reach decisions with partial information.

There is a need for timely, forward-looking information that may fill the gap left by the absence of familiar tools, such as company guidance and financial reports.

This research brief initiates a series that will help decision-makers navigate this uncertain environment.

Crisis creates uncertainty. Familiar landmarks lose their value and decision-makers are left to navigate on partial information. Following the outbreak of the COVID-19 pandemic, this is the environment in which investors and corporate decision-makers now suddenly find themselves.

Investors relying on company guidance and financial reports may have to wait 45 days longer as the SEC has extended filing deadlines. Auditors and accountants will struggle to assess inventory, account receivables, and revenues. When reports are ultimately filed, they may reflect an environment from the recent past which bears little resemblance to current conditions. Corporate decision-makers often lack visibility into their own supply chains as the situation on the ground is so fluid that they lack the tools to make reliable forecasts. This brief initiates a series that will aid decision-makers in navigating this uncertain environment.

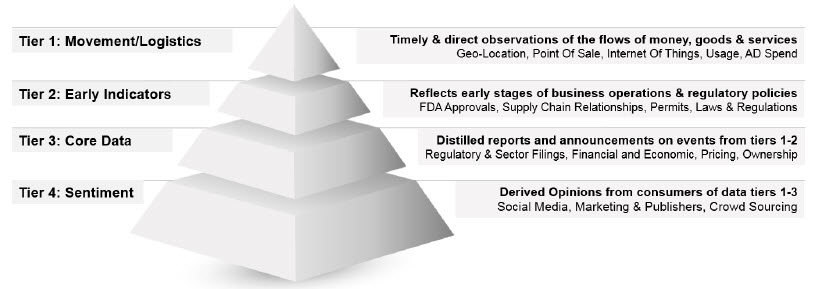

Following such a structural break, there is a need for timely, forward-looking information that may fill the gap left by the absence of familiar tools. Classes of corporate and market information can be conceptualized into four categories as depicted in Figure 1. Decision-makers are well served to focus on data contained within the top two categories, Movement/Logistics and Early Indicators, as current events will determine tomorrow’s winners and losers.

Figure 1. Data Hierarchy

Source: S&P Global Quantamental Research

The top tier is most closely tied to the situation on the ground, capturing real-time activity. In order to understand the direction companies are heading, timely and granular data is most valuable. Near real-time information sources such as Internet of Things devices, geo-location services, and supply chain intelligence can shed light on key questions:

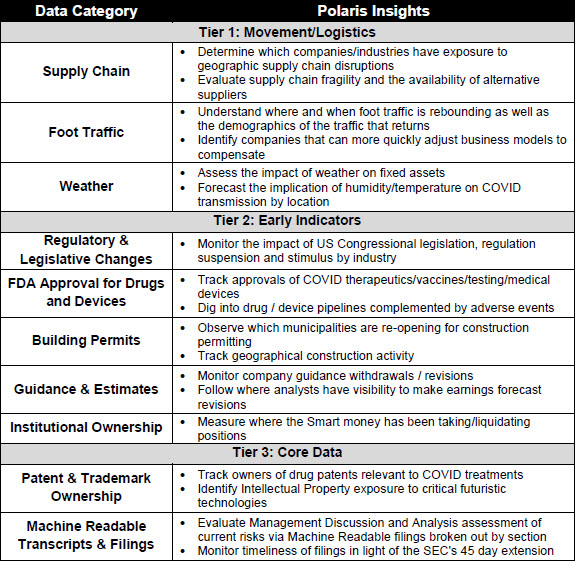

Decision-makers leveraging intelligence within non-traditional data categories detailed within Tiers 1-3 will realize visibility into the information gap created by the current crisis (Figure 2).

Figure 2. Marketplace Data and Associated Sample Insights

Decisions are made as multiple sources of information converge, empowering people to apply their own insights, experience, expertise and tools to take reasoned action. S&P Global Market Intelligence’s data philosophy is to source, structure, link, and deliver comprehensive data to our clients. S&P Global is committed to delivering timely, granular, and complementary data sets through its Data Marketplace where content is linked and available through a number of flexible delivery options. We believe the intersection of differentiated and clean data is the key to rich insights that drive your business decisions.

Please access the complete list of Quantamental Research Briefs for the latest on COVID-19’s impact.

Download The Full Report

Research

Webinar