Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 27 Jul, 2021

By Sidiq Dawuda

The need to automate and digitalize large parts of the credit workflow has long since been an important requirement for credit departments across a broad range of industries. The combined benefits of reduced operational expenses and faster credit decisions while maintaining accurate credit pricing for customers and counterparties have become even more essential in an environment which has experienced a major economic downturn and fierce competition from technologically advanced competitors. Sidiq Dawuda, Director of Credit Risk Solutions at S&P Global Market Intelligence, covered some of the key considerations, challenges, and solutions when considering credit risk workflow automation on our recent webinar.

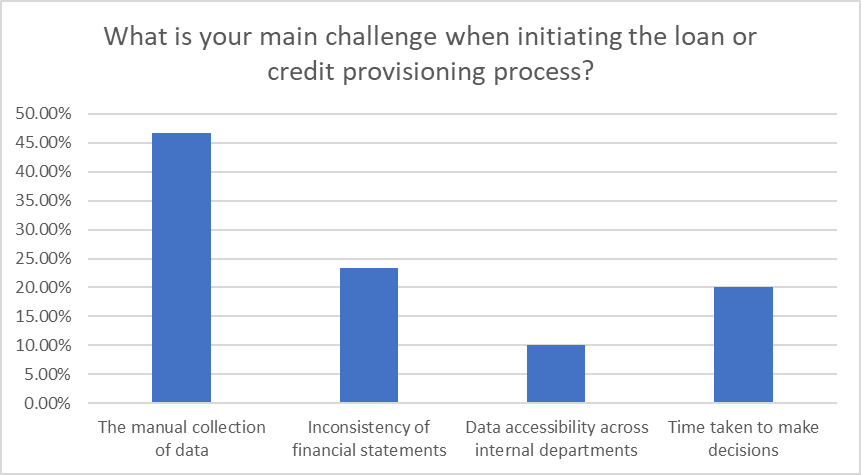

During the webinar, Sidiq asked participants consisting of individuals from the credit divisions of FinTechs, Non-Financial and Financial Corporates, “What is your main challenge when initiating the loan or credit provisioning process?” By far, most respondents pointed to the receiving and processing of business-critical information as being the most problematic aspect with 46.7% of respondents selecting the manual collection of data. A further 23.3% chose the inconsistency of financial statements received. 20% of respondents selected the time taken to make decisions. Finally, with 10% of the votes, data accessibility, was seen to present the least issues. These responses are consistent with the feedback we receive while helping our customers on their journey to credit workflow automation.

Source: Data That Delivers, Automating the Credit Risk Workflow webinar, April 29, 2021. S&P Global Market Intelligence. For illustrative purposes only. Chart shows audience responses to a live webinar polling question.

Below, we address some of the questions that were raised during the live webinar, and which we also frequently receive from customers who are interested in automating credit risk workflows.

Q. What do you recommend for extracting customer financials from various document types for credit analysis?

The first recommendation is to use financial extraction and spreading tools via software as a service (SaaS). These products should be able to automatically extract relevant financials from customer documents in a variety of formats. We suggest leveraging commonly used technology, such as Optical Character Recognition (OCR), plus the added sophistication of automatically mapping the financial items to a standard chart of accounts. Once the financials are extracted and mapped, this allows for more involved spreading of financials for credit scoring. Some tools also offer direct integration with off-the-shelf credit scoring models, which can present efficiency gains.

I refer to accessing these tools via SaaS solutions because these delivery channels aid in the automation process as the data can be integrated into a company’s internal systems. Data extraction and spreading capabilities are available through S&P Global Market Intelligence’s ProSpread™ tool and S&P Capital IQ.

Q. What should I look for with credit scoring models and factors?

I recommend prioritising credit scores and factors that can be received in an automated way, for example via data feed, API, Snowflake. The model should be able to automatically factor in parental and governmental (P&G) support. Also, the model should consider if additional financial and non-financial items add significant value in credit scoring compared to the time taken to source, spread, and compute those items. Highly correlated items do not typically add additional insight and could distort results. When building our Credit Analytics scoring models, we started with hundreds of financial and non-financial items, but have since reduced this dataset down to the most predictive and readily available data for credit scoring. Now, we produce millions of pre-calculated credit scores on a daily basis that are available via automated delivery channels.

Q. How frequently would you recommend reviewing the financial health of our customers and counterparties? How does automation affect this?

From our conversations with customers, we hear it is common to conduct risk monitoring and surveillance on a portfolio of companies on an annual basis. I would suggest this timeframe as the maximum interval for review. The more frequently one can perform these reviews, the better for the condition of that account. By automating large parts of this process, one can spend less time overall and can undertake checks more frequently.

Receiving auto-generated alerts on portfolio deterioration can help with the account management, factoring in any changes to P&G support, and other items. Incorporating market sentiment changes and S&P Global Ratings’ credit-adjusted financials can be particularly useful for receiving early warning signals of credit deterioration during gaps between reporting periods. We incorporate changes in market sentiment and how these may impact credit risk of rated and unrated entities with our S&P Global RiskGauge reports.

Another important component of the credit limit assessment process is company payment trends, which can indicate how reliable a given company is in paying its outstanding commitments. This information can include current balances, expected days of payment delay, probability of payment delays per month, payment behaviour scores such as PaySense, and more. These data points can provide timely indicators of a change to a company’s liquidity and this information can be inserted into a credit decision engine and final credit limit calculation.

Theme

Products & Offerings