Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 7 Sep, 2023

By Adam Wilson

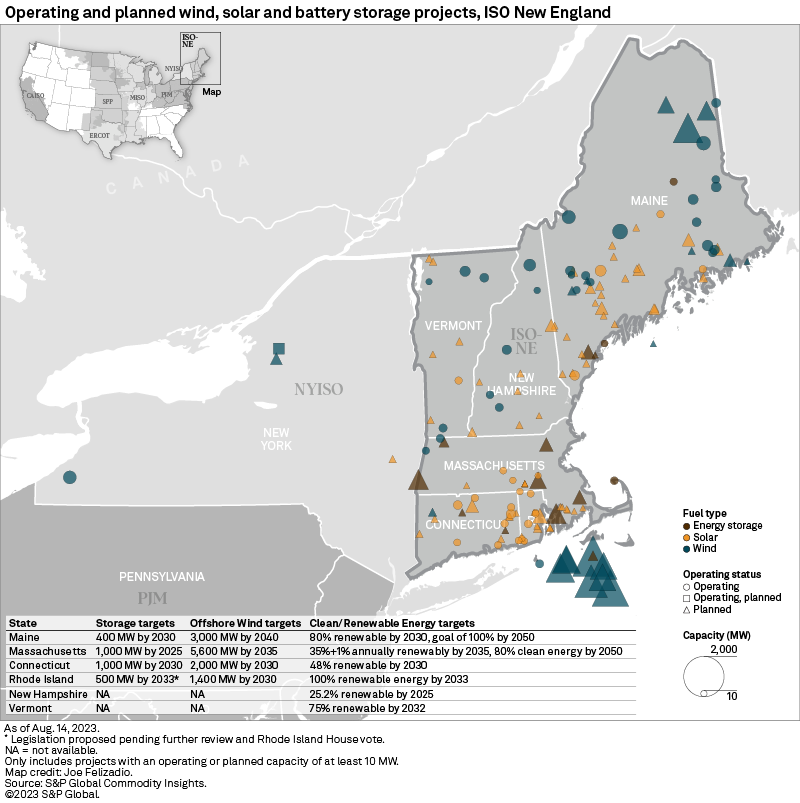

Grid-scale battery storage has yet to gain a firm foothold in ISO New England, with roughly 330 MW currently operating, mostly in the form of small projects of 5 MW or less. Prospects for battery storage are improving across the region due to state-level clean energy requirements and storage-specific targets. Robust renewable growth driven by offshore wind development is expected to add sufficient arbitrage revenue to make battery storage increasingly profitable through 2035, according to the Commodity Power Forecast for the second quarter of 2023.

Battery storage deployment in ISO New England has yet to gain traction, as only 330 MW of battery storage capacity is in operation across the entire region. Storage capacity in development is stronger but still relatively meager, with 1.7 GW in planning through state-level policy, along with the Inflation Reduction Act that could provide a jolt to the lagging development pipeline.

Driven by robust state-level targets, offshore wind is forecast to grow rapidly along the New England coastline over the next decade, with mandates totaling 12 GW. This injection of generation is forecast to lead to nonnegligible arbitrage opportunities for storage projects in the region, particularly in the winter months.

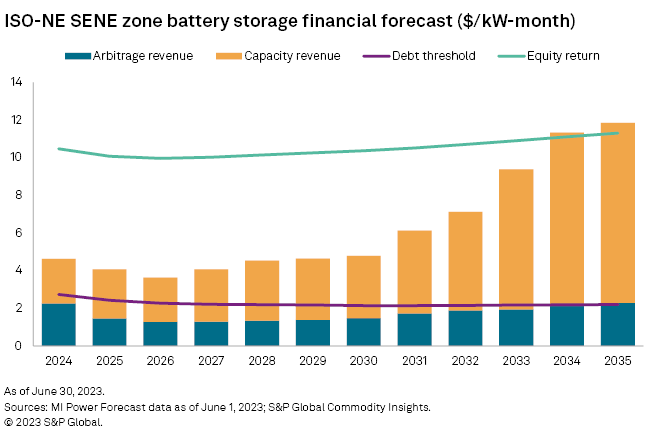

Steadily increasing capacity revenue and modest arbitrage revenue are projected to be sufficient for stand-alone storage projects to meet — and, at times, surpass — New England's minimum debt threshold throughout the forecast period, with projects expected to reach the full equity return target by 2034.

Market Overview

ISO-NE is the only independent system operator in the US in which every state has a mandated clean or renewable energy standard; however, a comparatively smaller grid load, limited land availability and generally subpar onshore wind and solar resources have hindered utility-scale development to date. Just under 4.5 GW of combined utility-scale wind and solar capacity are currently in operation in ISO-NE.

According to Commodity Insights data, the development pipeline is triple the operating total, with two-thirds of this capacity in known proposed offshore wind projects. Connecticut, Maine, Massachusetts and Rhode Island have offshore wind procurement targets totaling 12 GW. Maine recently implemented a 3-GW offshore wind goal by 2040. Massachusetts recently finalized an offshore wind solicitation totaling 3,600 MW.

Battery storage, just like wind and solar development, has been sluggish in New England thus far, with 330 MW in operation. Just three projects, however, are larger than 6 MW, the largest being the 25-MW Outer Cape Battery Storage (Eversource Energy Reliability Project). Development activity is picking up but still lagging, with 1.8 GW in development in the rest of the country. A handful of large-scale projects are in development, including two 400-MW storage projects in Massachusetts.

Massachusetts has a target to deploy 1,000 MW of energy storage by 2025. Elected in 2022, Gov. Maura Healey campaigned on the promise to quadruple the state's energy storage base by 2030, and a bill was recently proposed to double the state's storage target to 2,000 MW by 2030. Massachusetts houses well over 80% of the proposed storage capacity.

Connecticut and Maine also have storage targets of their own, and Rhode Island lawmakers recently proposed a bill to establish a statewide storage target of 500 MW by 2033. Rhode Island recently passed one of the most aggressive renewable energy targets in the country, aiming to go 100% renewable by 2033.

Offshore wind boosting arbitrage potential

Storage projects can charge during periods of low energy prices and discharge during peak demand hours when prices are higher. This process of arbitrage is a potentially lucrative revenue stream for storage projects. This is particularly true in regions with high solar penetration, such as Electric Reliability Council of Texas and the West region, where abundant solar capacity drives down daytime energy prices and provides excess generation to charge batteries.

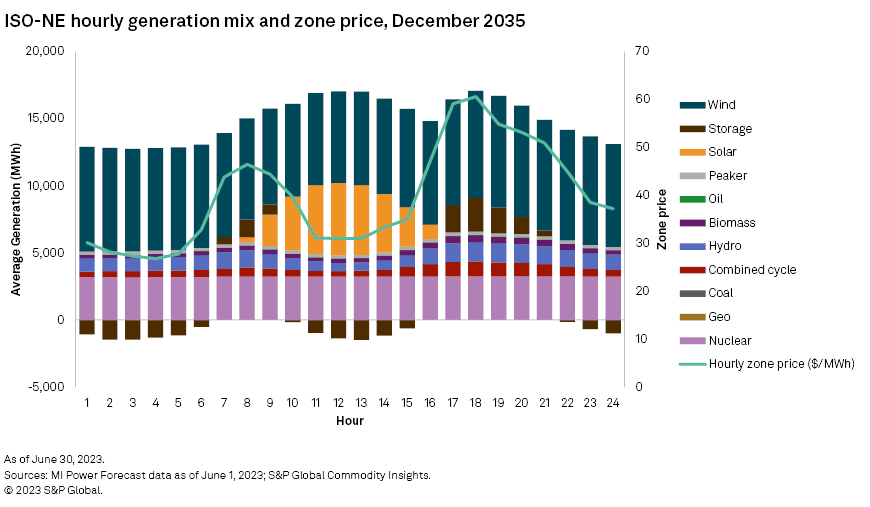

ISO-NE does not have a fraction of the solar base or pipeline of the likes of Electric Reliability Council of Texas Inc. or the West, but there are still opportunities for storage to capture modest arbitrage revenue, largely due to the expected injection of offshore wind capacity over the next decade. This is particularly true in the winter months when higher forecast gas prices drive up energy prices during peak demand hours in the mid-morning and early-evening time frames.

The winter months also coincide with stronger winds, both onshore and offshore. By 2035, the average daytime wind generation in December is projected to nearly double July's figure, which more than makes up for the reduced daily solar generation across New England. Further, winds are generally stronger overnight when energy demand is typically lower. As a result, this wind-driven excess generation is forecast to help drive down hourly energy prices in New England below $30/MWh overnight.

Higher gas prices drive peak-demand energy prices above $50/MWh. As a result, battery storage is forecast to charge overnight and during mid-day with the assistance of solar generation and discharge during peaks in the mid-morning and early evening hours. This dynamic is largely absent in summer months as wind generation lessens and the daily fluctuations of energy prices are reduced. By 2035, the average daily storage charging in December in New England will be over four times higher than in July, according to our forecast.

Storage economics increasingly favorable

Examining the forecast revenues compared to the minimum debt and full equity return thresholds in New England shows an increasingly favorable outlook for stand-alone storage in New England. Combined arbitrage and capacity revenues are projected to be sufficient to meet and surpass the minimum debt service target throughout the forecast period. In the SENE forecast zone, where a substantial portion of offshore wind is expected to interconnect, arbitrage is generally strongest, increasing from $1.27/kW/month in 2026 to $2.30/kW/month by 2035.

Forecast growth of capacity revenue in New England, however, is the clear driver of profitability in the region, with prices rising from $2.35/kW/month in 2026 to $9.57/kW/month by 2035. This allows stand-alone storage projects to make a full return on equity by 2034. Owing to this robust capacity revenue growth, storage economics across New England are generally favorable. The added boost of arbitrage revenue in some zones certainly sweetens the pot, providing higher returns throughout the forecast period.

Note: The equity return line is the return needed to pay off the entire project and deliver 12.0% returns to equity investors. The debt threshold is the fraction of the equity return value that is needed to pay off the project debt, but not any equity-holder.

Tanya Peevey contributed to this article.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.