Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 13 Sep, 2023

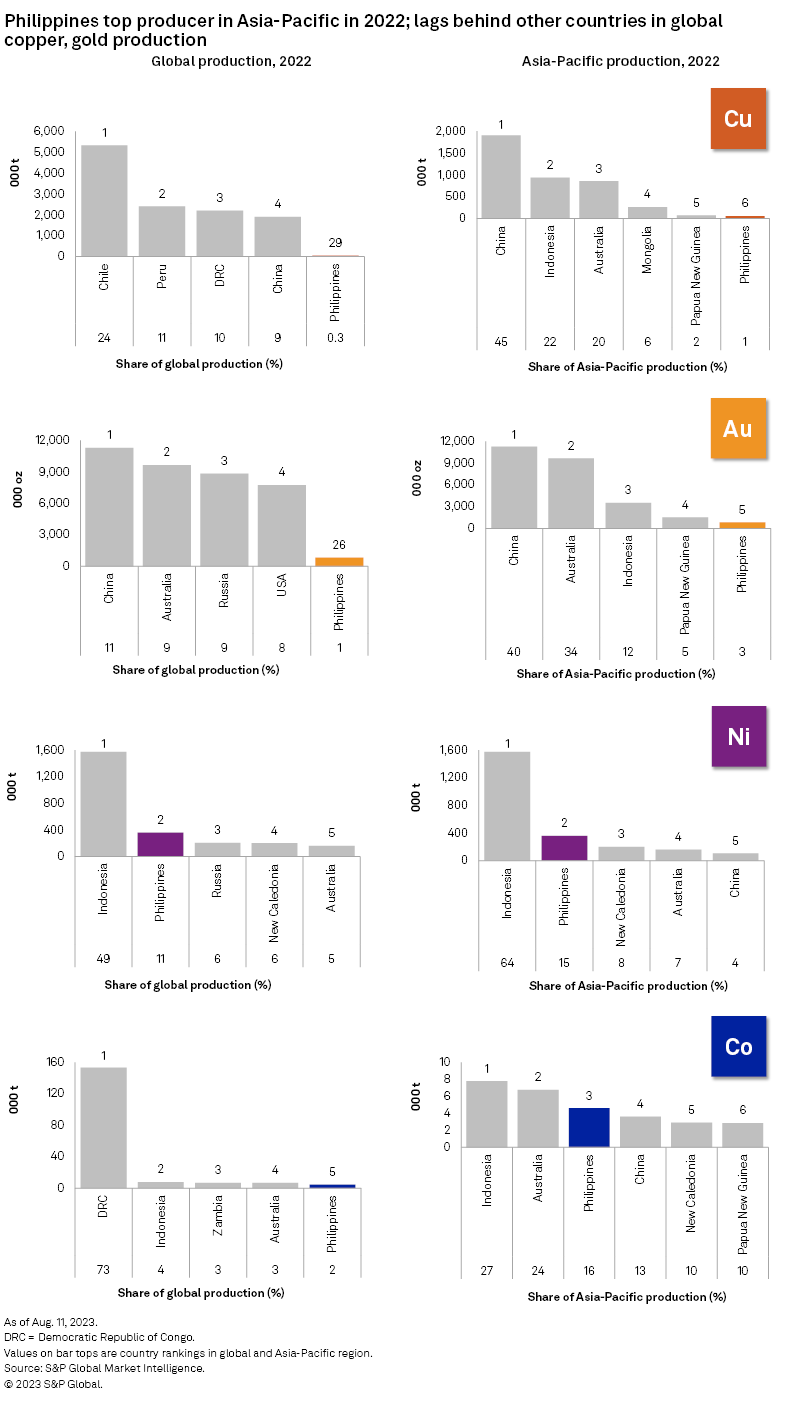

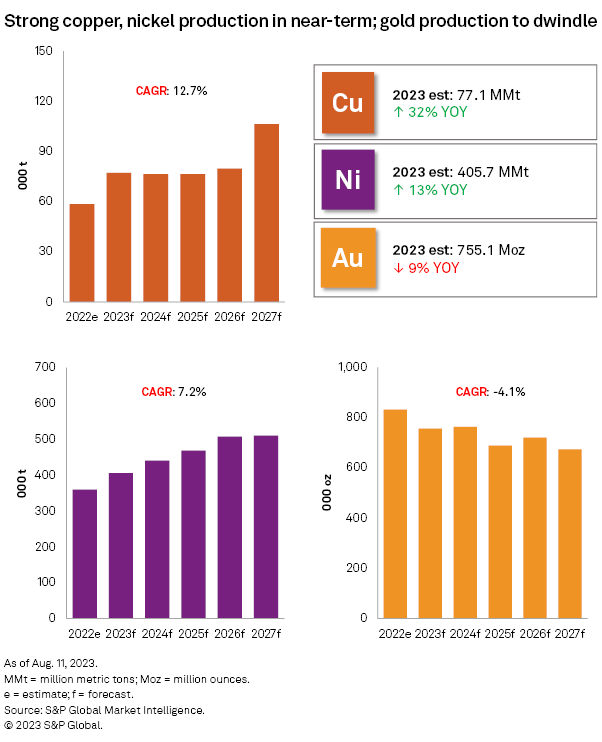

The Philippines remains a significant contributor to nickel markets, producing an estimated 360,000 metric tons of contained nickel in 2022, equivalent to 11% of the global production, placing the country in a far second spot next to Indonesia. The country's robust nickel and copper production is expected in the medium term, supported by factors such as the anticipated commencement of operations at the Tampakan project. Meanwhile, a different story is projected for gold, as production from new mines starting operations in 2025 is expected to be insufficient to cushion the impact of several gold mines going offline, resulting in a compound annual growth rate (CAGR) of 4.1% from 2022 to 2027.

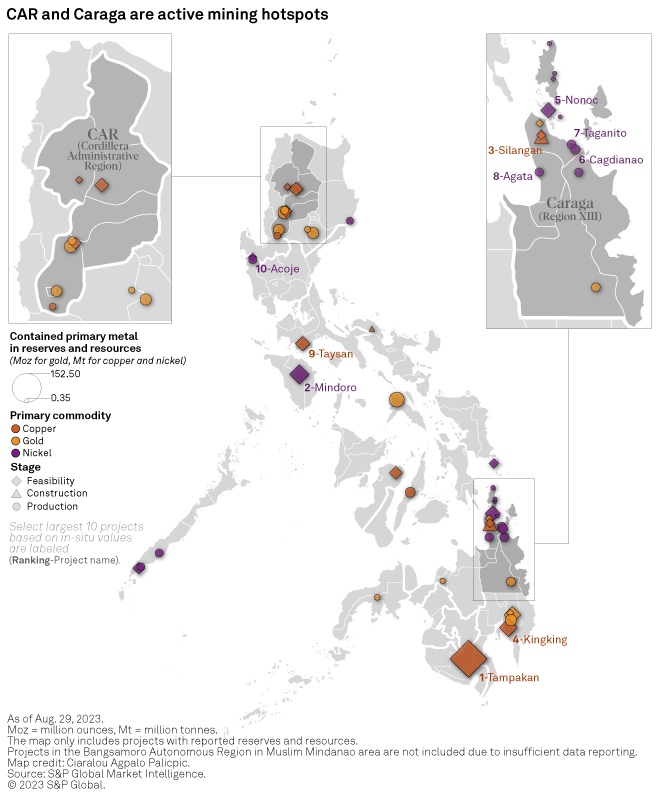

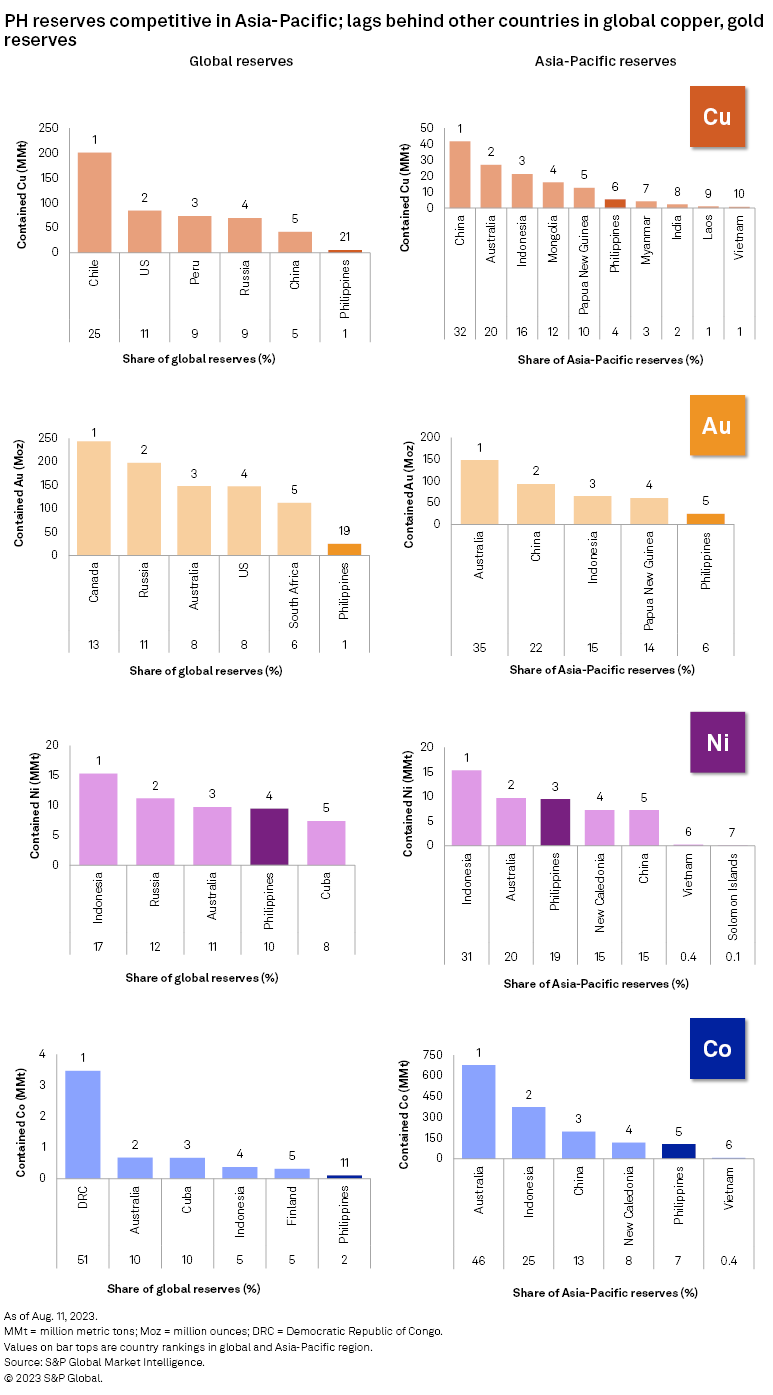

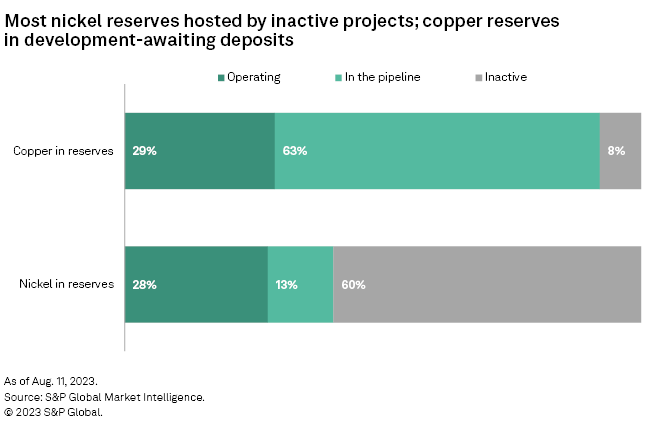

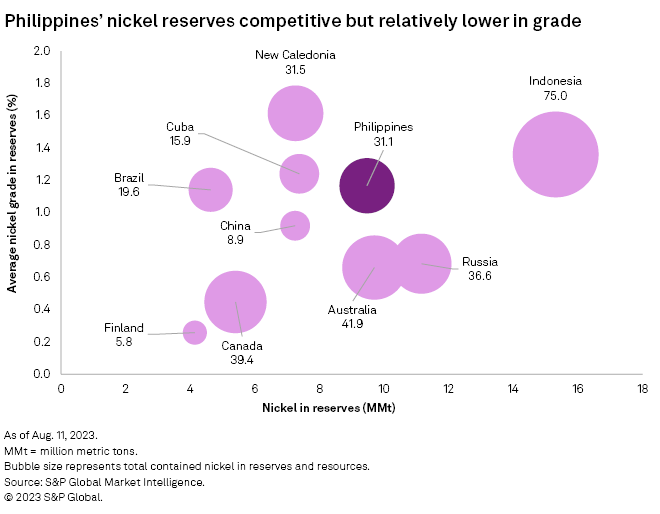

The Philippines continues to rank among the top in the Asia-Pacific region in terms of metal reserves, most notably for nickel, and ranks fourth in nickel reserves globally, accounting for 10% of the global total; however, it continues to lag in gold and copper reserves. Most of the copper and nickel in reserves are hosted in underdeveloped projects, providing an opportunity that the country can harness, especially amid the rising global demand for green metals.

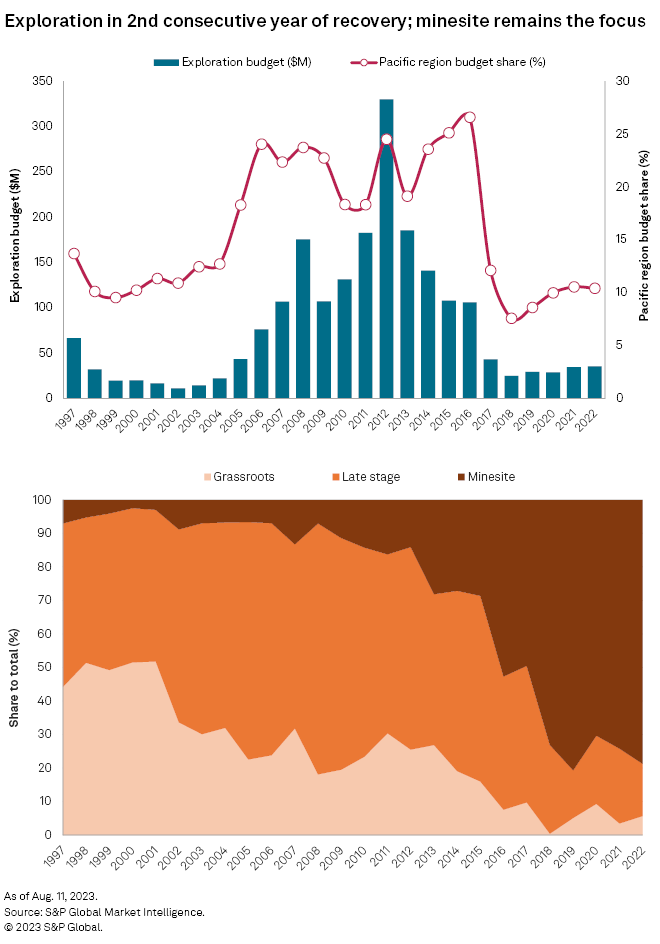

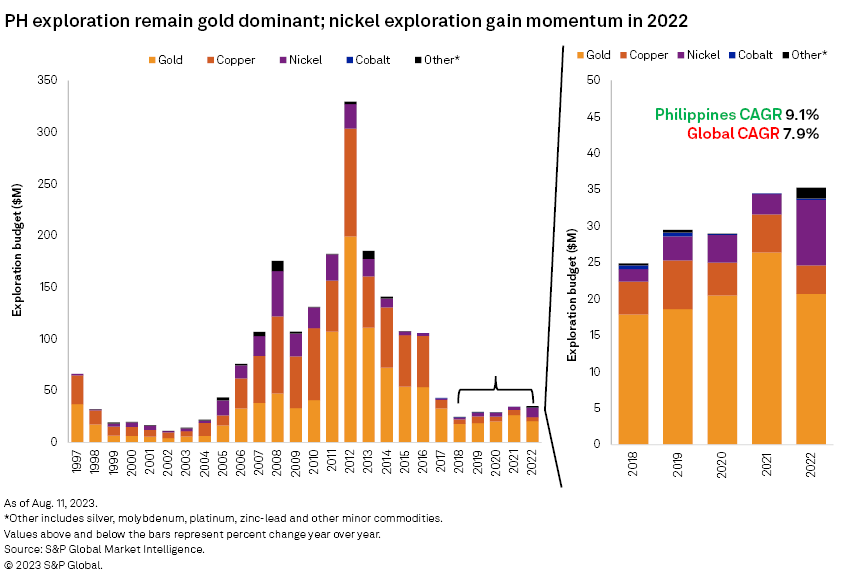

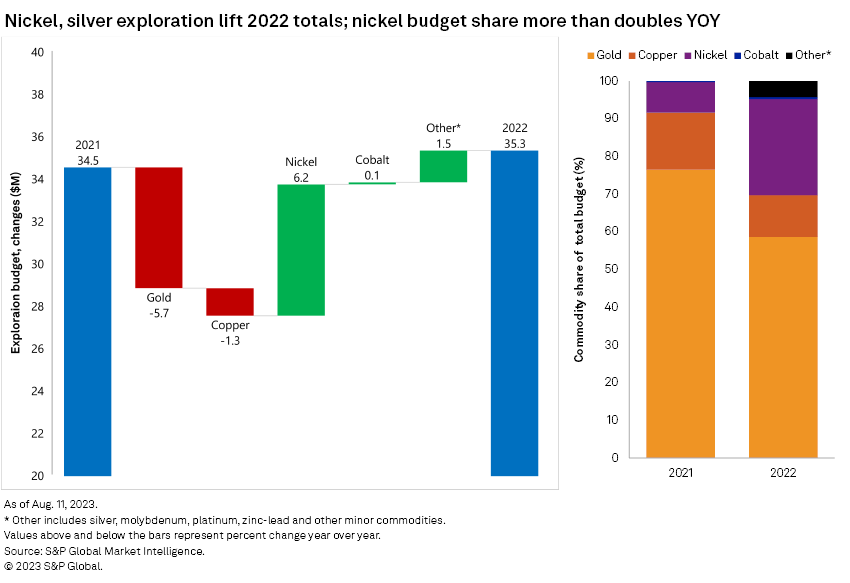

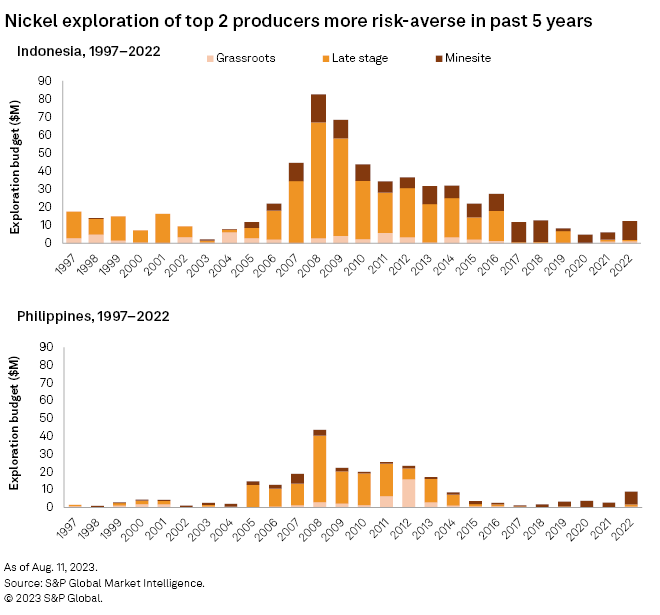

The 2022 exploration budget in the Philippines was in its second consecutive year of slow recovery, up 2% to a five-year high of $35.3 million from $34.5 million in 2021, supported by an increase in nickel exploration. Despite this year-over-year increase, substantial growth in exploration remains to be seen, with the 2022 budget only 11% of the staggering $329.8 million peak in 2012. Allocations to the exploration of nickel assets in 2022 recorded increases across all stages of development, with late-stage budgets tripling to $1.2 million and near-mine exploration almost doubling to $4.4 million. The renewed interest in nickel cushioned the declines brought by gold exploration, particularly in programs within or around operating mines. Overall, exploration in the country remains risk-averse as companies remain heavily focused on minesite projects.

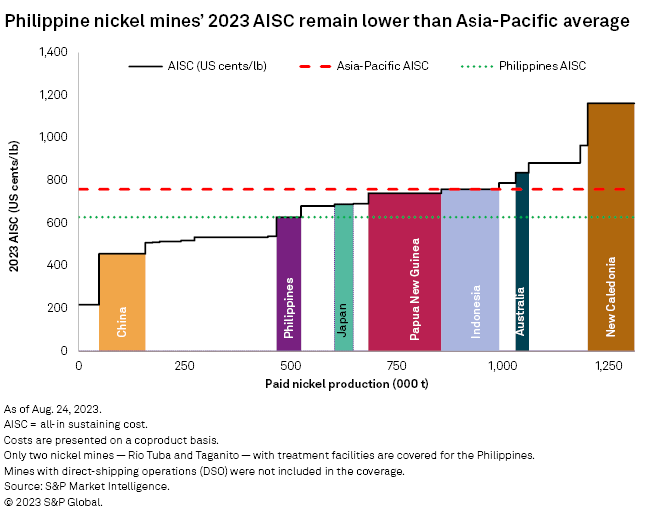

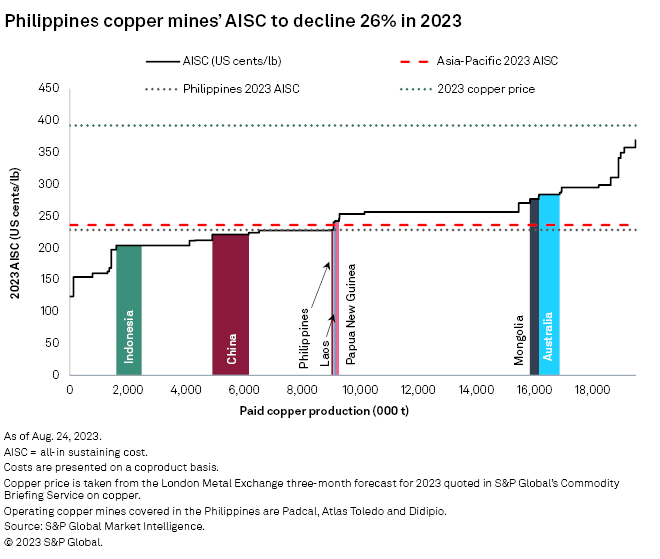

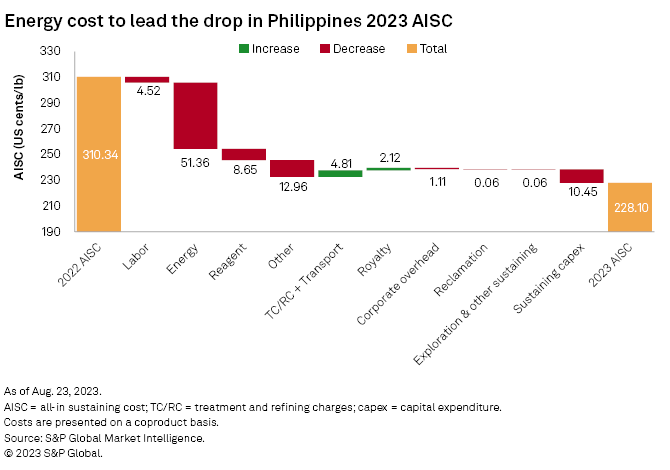

The all-in sustaining costs (AISC) for nickel and copper are forecasted to be lower than the Asia-Pacific average in 2023. Copper AISC, in particular, is projected to decline 26% year over year to $2.28/lb, significantly weighed down by a decline in energy costs.

Althea Keziah Liwanag and Ciaralou Palicpic contributed to this article.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.