Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 5 Apr, 2021

By Jason Sappor

Highlights

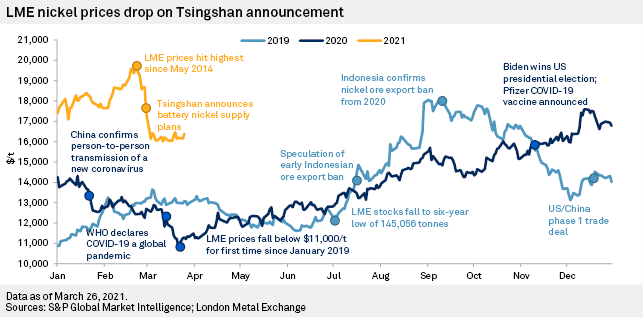

The LME three-month nickel price dropped from a seven-year high of $20,110 per tonne in trading Feb. 22 to $15,948/t on March 30 — the lowest since November 2020 — on Tsingshan's announcement.

This quarter, London Metal Exchange nickel prices are set to record their worst performance since the same period a year ago after a potential game-changing battery nickel supply announcement from China's Tsingshan Holding Group Co. Ltd. depressed bullish investor sentiment. The company plans to process nickel pig iron into high-grade nickel matte that can be converted into nickel sulfate for use in the electric vehicle battery sector. Tsingshan will supply Zhejiang Huayou Cobalt Co. Ltd. and CNGR Advanced Material Co.Ltd. with a combined 100,000 tonnes of nickel matte beginning in October.

The LME three-month nickel price dropped from a seven-year high of $20,110 per tonne in trading Feb. 22 to $15,948/t on March 30 — the lowest since November 2020 — on Tsingshan's announcement.

Access the Nickel Commodity Briefing Service March 2021 Full report and Databook.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Already a client? Read the full report

Blog

Blog

Products & Offerings