Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 28 Jul, 2022

By Deana Myers

Highlights

Netflix will slow content spending growth, but still try to increase its subscriber base.

Netflix's strategy for subscriber growth includes focusing on international local productions which have helped increase its base in non-U.S. markets.

The pandemic impacted original productions, but Netflix has had a huge influx of programming this year as a result.

Netflix Inc. has spent aggressively on content, growing original productions quickly over the past decade. Going forward, we anticipate Netflix programming expenditures to become more moderate and rise at a slower rate.

The company started to focus more on originals before its worldwide expansion as executives sought more control over the service's library and to rely less on acquisitions. That decision has paid off for Netflix, as many content owners now have their own streaming services and the pay-TV market has slowly declined for the past several years. The company's original amortized spend grew at an annual growth rate of 68.2% between 2014 and 2020 and is expected to slow to about 14% between 2021 and 2025.

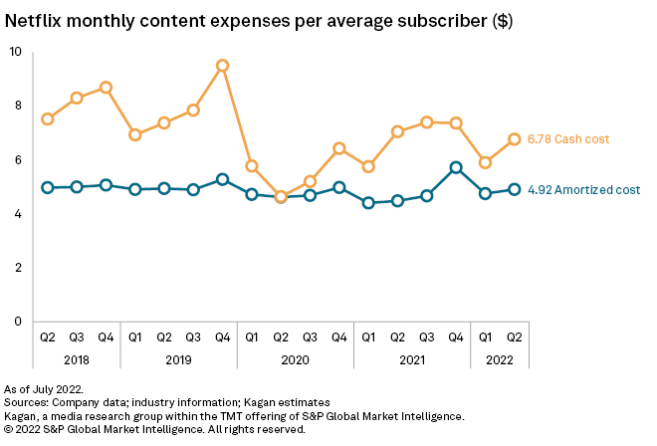

Netflix's average monthly spend per subscriber fluctuates by quarter depending on what programming is available during the quarter. Amortized spend in the second quarter was higher compared to the first due to high-priced originals launching new seasons, including the fourth seasons of both "Ozark" and "Stranger Things."

The impact of the pandemic is highlighted in the graphic above, with cash and amortized spending very close during the second quarter of 2020. This was due to many productions shutting down during that time, which led to a delay in releases.

Netflix plans to continue investing heavily in originals, maintaining a level of about $17 billion in annual cash spend for its entire worldwide programming budget. The July 19 announced deal for Netflix to acquire Australian animation studio Animal Logic Pty. Ltd. underscores its loyalty to making originals.

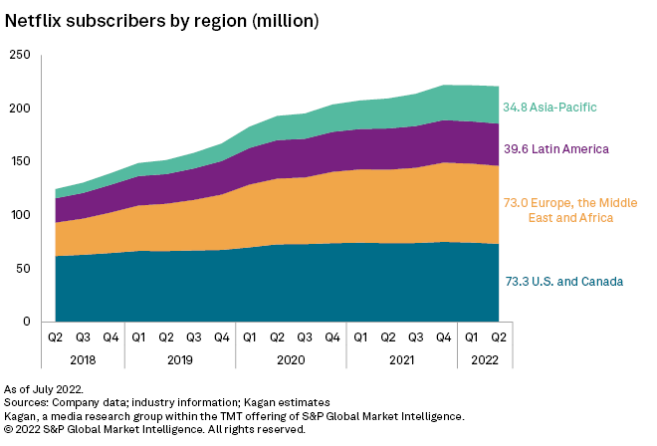

Our estimates indicate that Netflix is spending a larger portion of its budget on international content, at about 65% of spending in 2021. The company has concentrated more of its budget on international rights since 2016 and is expected to do so going forward as well. That local focus has helped with rapid subscriber growth in regions outside the U.S. and Canada over the past several years.

The service plans to launch an ad-supported option in select markets early next year, which will impact some content with rights deals that do not allow for ads to be shown. The company is confident that it has enough content with ad rights to proceed with the launch at this time.

News

News

News