Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 28 Mar, 2023

S&P Global Commodity Insights reports on M&A in the metals and mining industry with a minimum deal value of $10 million and 1 million ounces of gold or 100,000 metric tons of base metal in acquired reserves and resources in 2022. This report categorizes acquisition assets by primary metal — gold, copper, nickel and zinc — and the acquisition cost for projects that contain more than one metal is not split. Terminated, nonequity deals like royalty and streaming and "earn-in" transactions are not included in the analysis, and deal status is as of the time the data was compiled.

M&A activity remained robust in 2022 amid a gloomy macroeconomic environment. With a few high-profile, high-value acquisitions, the total deal value was just 12% lower year over year. In a reversal of a four-year trend, buyers spent more on base metals than on gold, with copper driving the difference — strong evidence of increased interest in the red metal due to its central role in the green energy transition and concern over dwindling reserves and supply. Australia and Canada were the favored target locations, as in 2021, and buyers spent significantly more on companies than on projects, and on producing operations than on nonproducing assets, with majors being the biggest spenders.

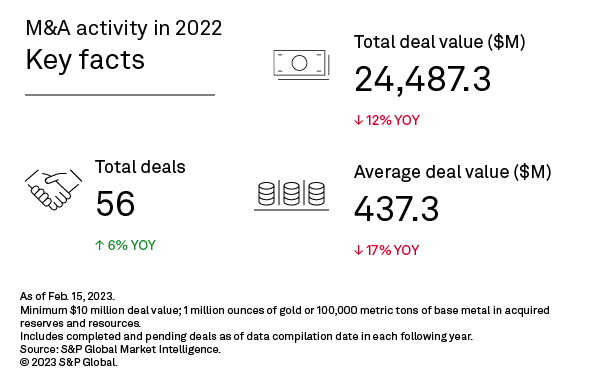

M&A activity was healthy year-round, progressing at a good clip in terms of either the monthly number of deals announced or deal value. There were 56 deals for projects and companies with primary metal in reserves and resources in 2022, with a total deal value of $24.49 billion. While the number of deals was 6% higher compared with 2021, the total deal value was 12% lower, making for an average deal value of $437.3 million, down 17% year over year.

There were 29 deals valued at more than $100 million, totaling $23.46 billion and accounting for 96% of the total 2022 deal value. The metrics for 2021 were similar at 30 deals over $100 million, totaling $26.96 billion and making up 96% of the year's total.

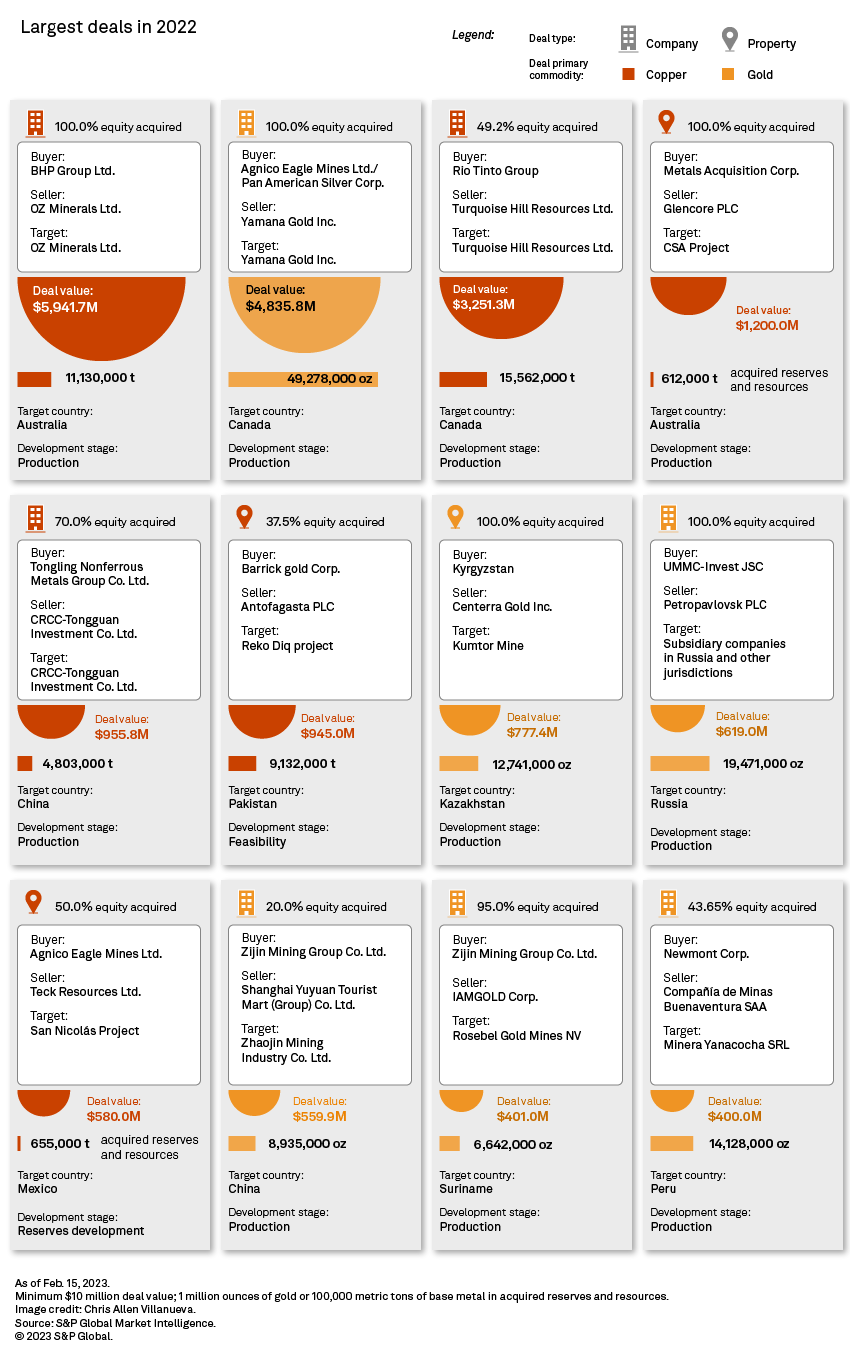

In general, companies were favored as targets over properties — slightly so in number of deals at 31 versus 25, respectively — but more significantly in overall amount — $18.70 billion compared with $5.78 billion. The year's top three deals were major-major takeovers, with two focused on copper and one on gold. The fourth largest was U.S.-based Metals Acquisition Corp.'s proposed acquisition of the producing Cobar copper mine in New South Wales, Australia, and its 612,000 metric tons of reserves and resources for $1.20 billion. The high deal value reflected the price paid for acquired copper, which was the highest for the metal in 2022 at 89 cents per pound.

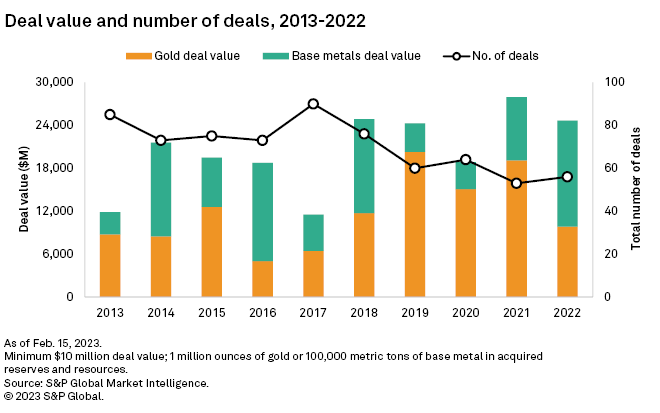

M&A activity has been robust over the past 10 years. Even considering the slump in 2013, total annual deal value rebounded to an average of $20.37 billion, weighted toward the latter half of the decade. A trend toward fewer but higher-value transactions is emerging, driven by factors including the price environment, shifts in target focus and longer-term expectations of demand evolution.

Despite the volatility and uncertainty that the COVID-19 pandemic and the Russia-Ukraine conflict have injected into the commodities market, the resulting sustained high metals prices have benefited mining operations in the last few years. With available cash flow, companies could more easily look to big purchases that promise bigger returns, especially producing assets, as has been the trend. As a further consequence of global events, governments have increasingly emphasized the need for local supply chains for raw materials and energy — and most importantly, the raw materials tied to sustainable energy technology. With the green energy transition increasingly driving decisions in the industrial commodities sector, miners have increasingly focused on key metals and minerals and on specific jurisdictions.

The list of top annual transactions by deal value in the last decade features high-profile deals focused on energy metals such as copper and, increasingly, nickel, while acquisition target location is becoming more influential as governments underscore the importance of domestic or "approved" sources through policies such as the US Inflation Reduction Act of 2022. Further, as supply of many energy-related commodities is expected to lag demand in the medium to long term, M&A will be central to developing promising assets through strategic takeovers by larger companies.

Copper overtakes gold in total deal value

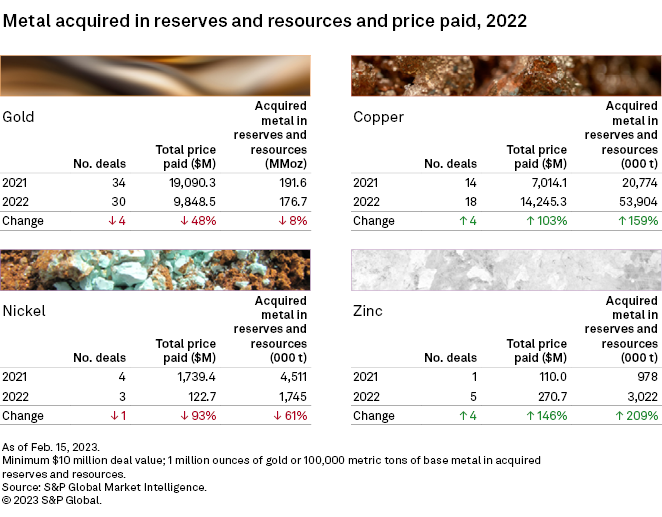

While there were four more gold transactions than deals focused on base metals in 2022, the overall deal value was lower for gold in a reversal of a four-year trend. Year over year, this translates to a 48% decrease in the gold deal total to $9.85 billion and a 65% increase in price paid in base metals acquisitions to $14.64 billion. Most, or 97%, of the base metals deal value can be attributed to copper deals, emphasizing the metal's prominence among the industrial metals.

Copper has recently been at the forefront of the industry due to its central role in the green energy transition as a key metal and its rapidly dwindling global reserves. Commodity Insights expects the refined and concentrate copper markets to be in deficit in 2027. At a nine-year high in 2022, copper exploration budgets were mostly directed toward minesite exploration and away from generative programs, led by major companies as they seek to extend the life and capacity of their producing mines. With 10 of the 18 copper-focused deals targeting assets in the reserves-development stage, many buyers' acquisitions reflect long-term strategies rather than immediate boosts to production.

With more money spent on copper assets in fewer transactions than for gold, the average deal value was markedly higher for copper at $791.4 million, compared with $328.3 million for gold. Copper and gold transactions were evenly distributed among the top 20 transactions, as were deals for companies and projects.

Nickel and zinc deals made a negligible contribution to the annual base metals transaction total value. The eight deals — three focused on nickel and five on zinc — amounted to just shy of $400 million, with the price paid for metal in acquired reserves and resources lower for both year over year. Buyers were either junior mining companies or "Other" entities headquartered in every continent, while all the targets but one were companies, with their assets evenly split between the producing and reserves-development stages.

Producing companies, projects command highest prices

In the year's largest deal, BHP Group Ltd.'s proposal to acquire copper-focused OZ Minerals Ltd. for $5.94 billion was about half of 2021's largest — the $10.62 billion merger between Agnico Eagle Mines Ltd. and Kirkland Lake Gold Ltd. The deal was first announced Aug. 8, 2022, with an initial bid rejected by OZ Minerals as undervaluing the company. BHP upgraded its offer in November 2022, and the two Australian miners signed a definitive agreement at year-end. Upon completion of the deal, BHP will acquire several operating copper mines in Australia and Brazil containing over 11 million metric tons of copper in reserves and resources.

Canadian gold miner Yamana Gold Inc. was the target of two takeover bids in 2022. The first was an all-stock offer from Gold Fields Ltd., announced May 31 and terminated Nov. 3, with Yamana agreeing to pay a $300 million termination fee. The rejection was promptly followed by a $4.84 billion joint proposal from Agnico Eagle Mines Ltd. and Pan American Silver Corp. that included a desirable cash element. Yamana accepted the offer — now the second-largest deal value of 2022 — handing over several operating gold and a few key copper projects containing 49.3 million ounces of gold and 4.7 million metric tons of copper in reserves and resources. Agnico Eagle will manage the acquired Canadian mines while Pan American will oversee the South American assets.

In the third-largest deal, focused on copper, Rio Tinto International Holdings Ltd. completed its acquisition of the remaining 49.2% interest in Turquoise Hill Resources Ltd. that it did not already own for $3.25 billion. With it came 15.7 million metric tons of copper in reserves and resources, for which the company paid just 9 cents/lb — one-tenth of the premium offered by Metals Acquisition Corp. mentioned above. Among the three copper mines included in the deal is the expansion-stage Oyu Tolgoi open pit operation in Mongolia. As of early March, Rio Tinto, which now owns 66% of the mine, said it will begin underground operations, finally getting past numerous delays in bringing the project online. The takeover of the mine is expected to simplify the governance and management of Oyu Tolgoi while bringing some financial certainty and stability to the operation and an attractive premium to Turquoise Hill shareholders. Once fully ramped up, the operation is poised to become the world's fourth-largest copper mine, with an expected output of 500,000 tonnes per year.

Canada, Australia favored target countries; majors biggest spenders

Canada, with 13 deals, and Australia, with 12, hosted 45% of the companies and projects targeted in 2022. Most of the targeted companies were in the two jurisdictions — 11 in Canada and 10 in Australia — and the buyers were mostly junior companies in both cases. Overall, the two countries accounted for 69% of the total deal value: Canada at $8.83 billion and Australia at $7.96 billion. China was a distant third with $1.73 billion spent in four transactions, and Kazakhstan was fourth with a deal value totaling $1.14 billion from the completed purchase of the producing Kumtor gold mine for $777.4 million and the pending acquisition of a copper project for $362.0 million.

Except for intermediate companies with just five transactions, the remaining deals were uniformly spread between majors, juniors and "Other" types of buyers — including users of industrial metals with 17 deals, finance and holding companies with 18 deals, and governments with 16 deals. The majors were the biggest spenders by far, however, with an average deal value of $1.08 billion. They targeted companies and projects alike but spent significantly more, 84% of their deal total, on producing assets than on nonproducing ones.

Strong start to 2023 with record-breaking Newcrest-Newmont proposed merger

M&A activity in 2023 to date has been robust, boosted by what would be the largest gold merger in history should Newcrest Mining Ltd. accept Newmont Corp.'s yet-to-be-updated proposal. In its initial bid, Newmont offered nearly $17 billion to acquire its former subsidiary, far outpacing the 2022 deal between Agnico Eagle and Kirkland Lake. It would entail 134.3 million ounces of gold in reserves and resources changing hands but would also increase Newmont's exposure to copper through the acquisition of the Cadia East asset in Australia and Wafi-Golpu in Papua New Guinea. An updated offer is expected.

Commodities Insight's Mine Economics team has published an in-depth study of the implications of the merger on the assets, production and costs of the combined entity.

Green energy tailwinds or macroeconomic headwinds: What will prevail in 2023?

The green energy transition has been a growth driver for many aspects of the metals and mining industry, with demand for key metals such as copper, nickel, lithium and cobalt expected to remain on an upward trajectory and supply to trend downward. Miners have been increasingly growing their exposure to these commodities through strategic acquisitions, even in the current environment of high metals prices. Their aim is to either diversify their current portfolios to capitalize on the sustained high prices or to consolidate their operations in an effort to ramp up supply and address the looming shortages. Further, governments and companies are looking to secure their commodities supply chains — a weak link that has recently been made obvious by geopolitical conflicts exemplified by Russia's control of its nickel supply — with M&A a possible avenue for companies to secure positions in favorable mining jurisdictions.

The current macroenvironment, however, with its inflationary pressures on wages and consumables, and its labor shortages, may influence miners' willingness to engage in M&A activity in 2023. With expected slowness in global economic growth, demand for commodities may weaken, along with prices to some extent, which could cause miners to hold off on purchases in the short term.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.