Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

BLOG — Dec 01, 2023

By Chris Rogers and Jose Sevilla-Macip

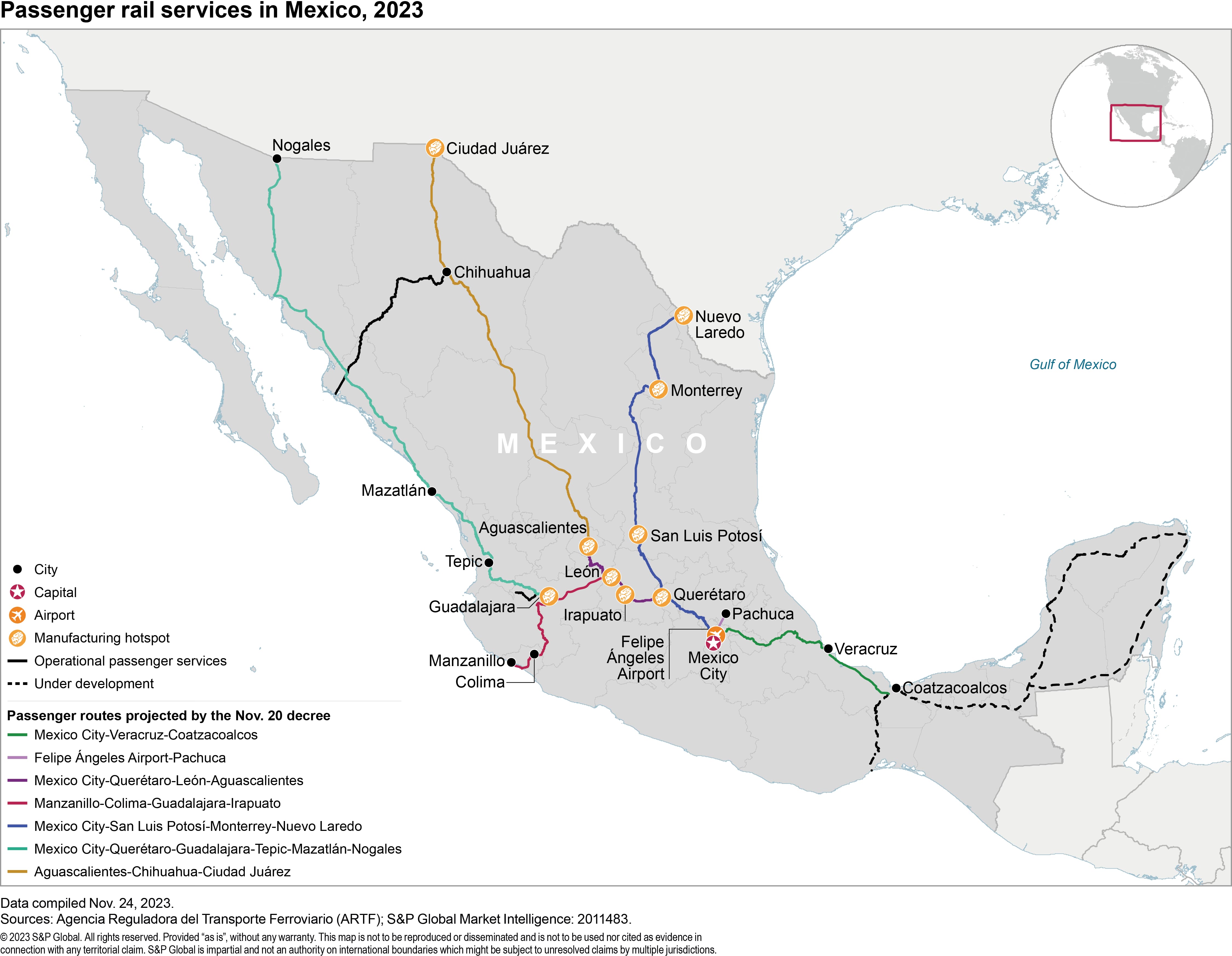

Mexico's President Andrés Manuel López Obrador (AMLO) issued a decree on Nov. 20 declaring passenger rail service a "national development priority," urging existing concession owners to develop passenger services on their lines.

Other than two existing tourist services and two state-owned passenger routes projected to begin operations in the one-year outlook, Mexico's roughly 20,000-km rail network is currently used solely for cargo purposes. Concession owners will face heightened contract risks in the one-year outlook if they do not engage with AMLO's proposal.

The most substantial business risk from passenger service rollout would relate to disruption of automotive sector supply chains. Our data shows that rail transport accounted for 11% of Mexican exports in the 12 months to Sept. 30, 2023. Automotive manufacturers made heaviest use of rail facilities. Exports of cars and goods vehicles accounted for 61% of rail freight in the past 12 months. Forty-four percent of exports of cars and light trucks and 46% of heavy goods vehicles were shipped by rail.

Learn more about our Supply Chain Console

The sector's supply chains also face exposure regarding supplies of components, with 42% of gasoline engines and 11% of all other automotive components moved by rail. Alternative logistical arrangements may not be readily available. Displacing automotive exports to road transport would require a significant increase in the number of trucks transiting towards already saturated Mexico-US border road infrastructure.

Several of the proposed routes for passenger services are currently among the busiest ones for cargo, increasing the challenges for simultaneous services. According to government data, Mexico's average rail car traffic density (car/km per km of line) stood at 136,000 for 2022, significantly lower than the United States' 338,000. Although US rail infrastructure is better developed and more efficient than in Mexico, and provided that supporting infrastructure across the network is updated, this standard measure suggests that Mexican rail lines should have scope to improve their capacity to provide room for passenger services.

Four out of the seven routes proposed by the government cross through major manufacturing centers where the supply chains heavily rely on rail transportation: Querétaro, León, Aguascalientes, San Luis Potosí, Guadalajara, Monterrey and Irapuato. Several of these routes also have the highest potential passenger demand. This appears to increase the likelihood of coordination challenges, particularly if different firms operate cargo and passenger services. Curtailment of, or delay to, cargo services would imply the risk of moderate increases in transportation costs for manufacturers.

Signposts

The Nov. 20 decree outlined seven routes to be prioritized for the development of passenger services, all of which will run along lines granted as concessions. The concession owners have been invited to present an initial passenger service implementation proposal by Jan. 15, 2024. If they do not submit proposals, the government plans to invite submissions from other interested parties. If other private interest is not forthcoming, the government plans to award concessions for passenger services either to the Defense (Secretaría de la Defensa Nacional: SEDENA) or Navy (Secretaría de Marina: SEMAR) ministries.

According to AMLO, existing concessions focused on freight will not be revoked or amended even if concession owners choose not to develop passenger services. Still, if the government does task SEDENA or SEMAR with passenger service provision, the simultaneous presence of private freight operators and the military's passenger service-development works along the same routes would increase the likelihood of eventual disputes over the infrastructure's shared use. In this scenario, contract alteration risks for concession owners would increase.

Campaign statements by candidates for the 2024 presidential election supporting passenger rail development would suggest a greater likelihood of policy continuity under the next administration.

Sign up for our Supply Chain Essentials newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.