Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 24 Jan, 2023

Highlights

As we enter 2023, we will expand our existing metaverse coverage with a priority on developing differentiated data and insight — including forecasts, company coverage and tracking, and use-case analysis — with the intention of clarifying where opportunities exist.

S&P Capital IQ Pro data indicates that pure-play metaverse companies accounted for announced transaction activity in debt capital markets, equity capital markets, rounds of funding, shelf offerings and M&A of more than $24 billion in 2022.

Introduction

We define metaverse as the long-term vision for the next phase of the internet, which will feature a single, shared, immersive and persistent 3D virtual space where humans interact with one another, and with data, enhancing the physical world as much as replacing it. In this report, we thumbnail our current point of view on the metaverse and our research initiatives for 2023, including our expectations for how metaverse evolution will impact several vertical industries. As we enter 2023, we will expand our existing metaverse coverage with a priority on developing differentiated data and insight — including forecasts, company coverage and tracking, and use-case analysis — with the intention of clarifying where opportunities exist. We will leverage our extensive subject-matter expertise to holistically address opportunities across the three major market segments of metaverse: industrial, enterprise and social.

The Take

The ways in which we interact with one another and with data through digital media are rapidly evolving. The metaverse, as we define it, supplies a way to encapsulate and track advances in these forms of communication and digital interaction. Human beings engage with the physical world and with one another through spatial, persistent and real-time interaction. Our ability to engage through digitally mediated approaches — our own invention — has yet to catch up with our evolution as spatial beings. Ultimately, the enabling technologies of the metaverse should close that gap, with technology adjusting to our needs (rather than vice versa) and enhancing what we can do. This report was typed on a QWERTY keyboard, which only exists because a layout was needed to stop mechanical typewriter print hammers from jamming if people typed too fast. We believe the metaverse should be considered as an environment for incremental improvement of — not a replacement for — what we already can do today across industrial, enterprise and social spheres. Discussions of belief, or otherwise, in the evolution of metaverse from the web we have today offer insight into the complexity of technical and social change. Whether we call it a metaverse or something else in the future, how we interact online and what we can do will keep evolving. As an example, AI tools that generate content such as text, images and code (thanks to recent advances) are now generating 3D objects, and metaverse locations could help populate this future, just as cameras in smartphones fill video- and photo-sharing services today.

Context

The breadth of use cases for digitally mediated communication can add to the confusion over what the metaverse is supposed to be. It ranges from the engineering precision of physical world simulation in the industrial world, such as in manufacturing, through to the ways people can work together and share ideas and tools inside enterprises, and on into how those enterprises deliver experiences and products for their customers. Emotive labeling of future technology can color attitudes and hamper adoption; regardless of its name, how we interact through digital mediation continues to evolve across the entire landscape. As an example, for the consumer, we expect 3D virtual worlds to more fully embrace advertising, social networking, live sports, video exhibitions and e-commerce functions in the years ahead, in addition to the more gaming-focused applications that are popular today.

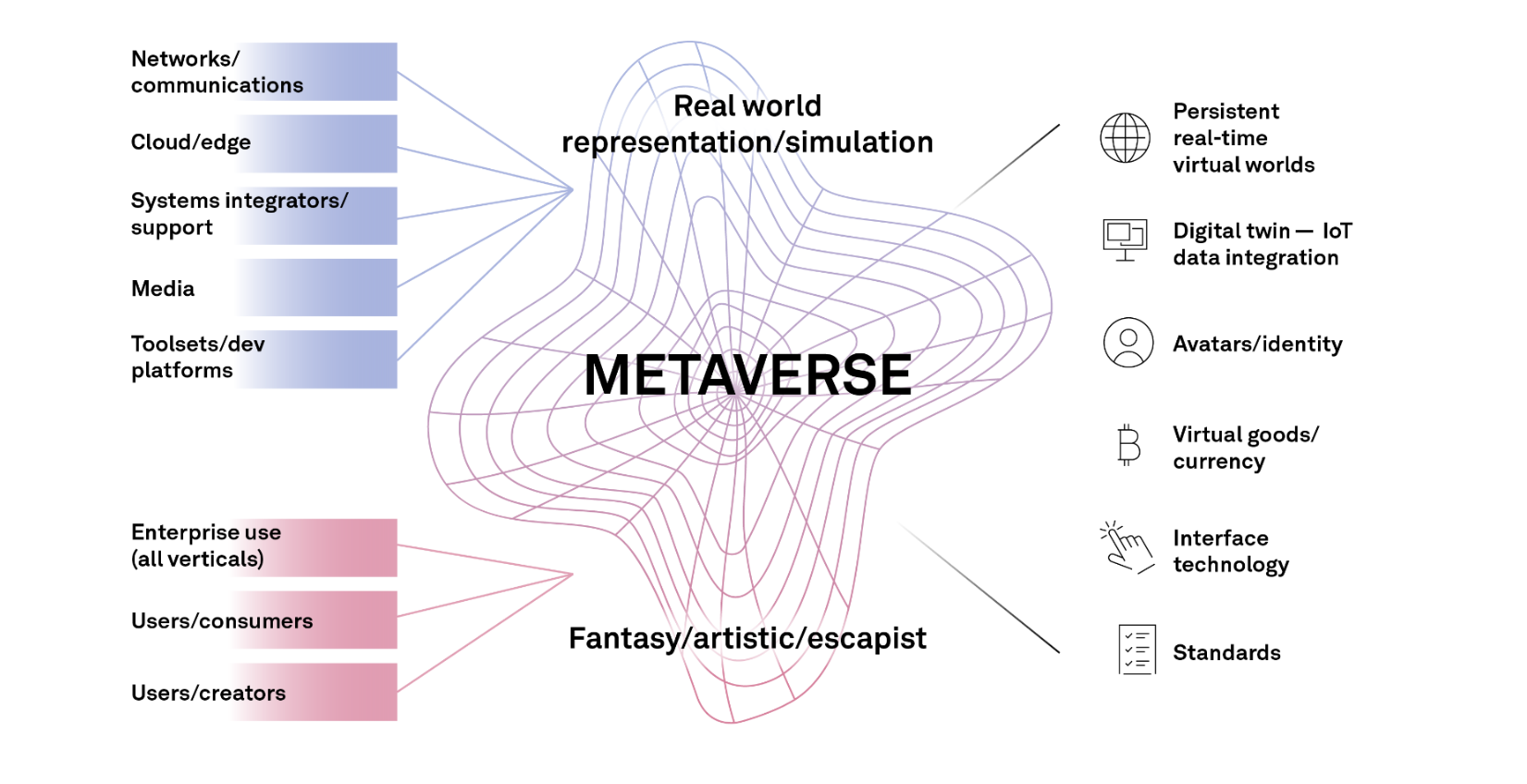

The metaverse also is a place for less commercially focused social uses, art, education, sharing of experiences and just plain fun things to do. The use case of an industrial manufacturing plant improving efficiency, safety and energy use — instrumented through IoT creating a digital twin and supported by AI predictive maintenance and shopfloor tools such as autonomous robots and augmented reality (AR) headsets — is very different from a collaborative community art project. The former is primarily about the process and the machinery; the latter is about people and expression. Between these are enterprise collaborative tools that exist in business-to-business and business-to-consumer environments. These areas straddle the commercial needs of a process with how people can express, share and buy in to ideas. This continuum spans all metaverse advancements (and is by no means new, in that it spans all our digital interactions today on the web). The central part of the figure below represents the three major categories of metaverse use cases. All metaverse approaches can be considered in terms of industrial, enterprise and social applications.

Figure 1: Breadth of the Metaverse Ecosystem

Source: S&P Global Market Intelligence

In consideration of our coverage of metaverse-related companies and services, represented on the right of the diagram above is a set of attributes and services that relate to a common view of the stack of technologies that will be needed for the metaverse. This is an area of many emerging companies with investments, M&A activity, and new opportunities to define and shape markets. There various companies engaged in this area, some with decades of experience in virtual worlds, such as Second Life, Roblox Corp., Sinespace and Virbela. More recent moves in the metaverse arena include a partnership between Meta Platforms Inc., Microsoft Corp. and Accenture PLC, and another between Nvidia Corp., Siemens AG and Deloitte. Metaverse-specific services such as the cross-platform avatars of Ready Player Me or the payment services of Tilia also sit in this area. Previously primarily game-focused development environments such as Unity and Unreal, AR-focused ones from Niantic, and industrial ones from PTC Inc. provide tools to build new types of applications. Game companies have made investments in building metaverse-focused applications, such as Epic Games' (creator of Fortnite and Unreal) $1 billion funding raise.

Metaverse taxonomy

Persistent real-time virtual worlds: These are the most common expression of the metaverse to date, and represent places in the metaverse.

Digital twin/IoT data integration: The treatment of physical world data and how it can be integrated and managed for things such as digital twins in industrial use cases is a specific service.

Avatars/identity, virtual goods and currency: These are often rolled into virtual world applications and games, but can exist separately, and may offer a path toward interoperability between different applications.

Interface technology: Not all metaverse interactions need to be through AR and VR headsets, but hardware is continually evolving to support experiences — haptics, holography and spatial audio are some of the elements in this category.

AR data mapping and integration: This is where many of the technologies listed above converge with the physical world, resulting in robust sets of metadata that can be viewed in places such as city streets through devices such as smartphones and smart glasses.

Standards: A truly unified metaverse needs common standards, just as the internet and the web have evolved through common agreement. The metaverse has many layers of complexity above and beyond the sharing of text, images, audio and video of the web today. It will be a long journey to meaningful standards, but an essential one to track.

We have identified over 120 companies with a strong operational or strategic focus in the areas listed above. S&P Capital IQ Pro data indicates that these pure-play metaverse companies accounted for announced transaction activity in debt capital markets, equity capital markets, rounds of funding, shelf offerings and M&A of more than $24 billion in 2022. The largest of these investments are flowing into Meta Platforms, Epic Games, Infinite Reality and Roblox Corp.

It is perhaps unsurprising to see Meta among the biggest battle chests for metaverse development, as it is primarily responsible for the resurgence of the term in the public consciousness. Before the company changed its name from Facebook to Meta in 2021, it led the charge into consumer VR hardware with its Oculus headsets. Meta's ambitions in this space have been at least temporarily blunted by an unfavorable economic climate and a cool reception to its Horizon metaverse experience, but we expect it will continue to play a key role in this space.

Metaverse: What it is, and what it isn't

It is worth noting that the metaverse is separate from, but can be associated with, terms such as Web3 (a drive for the decentralization and democratization of content and services). It is also separate from cryptocurrency, decentralized finance and nonfungible tokens outside of where those technologies are in service of moving assets into, out of and between virtual worlds. Similarly, we do not consider traditional stand-alone video games to be part of the metaverse. Only when games start to take on the qualities discussed above, such as persistent virtual worlds with a high degree of player agency, do we consider them part of this coverage space.

Metaverse-focused companies are not operating in isolation; this is, after all, still about the delivery of IT projects. This means that existing companies in areas such as networking and cloud will have these metaverse companies as clients. Systems integrators will be looking to engage with emerging metaverse services to build solutions for their clients. Media companies in film, TV, games and advertising all have some touchpoints to an emerging metaverse too. Video games, in particular, offer much of the underlying technology, proof points for some styles of interaction and a great deal of metaverse-related investment. Development toolset providers also need to be able to engage with the evolving ecosystem. These companies are not going to be simply providing services to others; they will themselves be involved in building metaverse applications, and have expectations from their own clients and staff as to how digitally mediated content and conversations occur.

That leaves us with everyone else. With almost every enterprise today having a public web presence, an internal set of IT services and a social media presence; advertising across multiple digital properties; performing online financial transactions; engaging with customers; designing and building products; and so on, they will want to engage with their IT service providers and systems integrators, or directly with emerging metaverse companies to further their business objectives.

Not all internet and web content today is centered on consumerism and monetization. We will also consider the societal impact that the metaverse may cause — good and bad. This is, after all, the "social" in "environmental, social and governance," and of concern to many enterprises, shareholders and governments.

2023 metaverse research agenda

During 2023 we will deliver a comprehensive set of expert-backed research, insight and data across the metaverse landscape via 451 Research and S&P Capital IQ Pro, including:

Research

Research