Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 22 Dec, 2023

At the turn of the year, S&P Global Commodity Insights looks into the trends that will drive metals markets in 2024 and provides price and balance forecasts.

Macroeconomic headwinds to remain a backdrop against commodities markets

Amid the ongoing global battle against inflation in major economies throughout the year, geopolitical and financial events further shaped 2023, with many ripple effects that will likely carry into 2024. Two major events related to financial markets — the collapse of some banking institutions in the US and Europe and the narrowly averted US debt default — were followed by the outbreak of the Israel-Hamas war. Meanwhile, major central banks have been combating inflation, although the rising cycle of interest rates appears to be behind us, with rate cuts expected in 2024. While the US is outperforming, fears of recession still prevail in Europe, and China's stimulus-based economic recovery is stabilizing. S&P Global Ratings expect 2024 to be all about the landing for the economy — an outcome that will affect metals demand and, therefore, prices.

Fundamentals back to the fore

Over the past year, the macroeconomic backdrop has overshadowed fundamentals for many commodities, but some restorations of supply-demand dynamics have emerged. In terms of influence, supply-side factors are increasingly coming to the fore. Various issues are affecting both mine and smelter output across several commodities — supply squeezes that are challenging the market balances — with repercussions to be felt into the new year. On the other hand, tempered end-use consumption across sectors — notably construction and automotive — has subdued demand amid the still struggling economic backdrop. Further, increases in labor and operating costs have dragged some metals prices down to their respective cost curves, which could lead miners to shutter operations to remain afloat. The shifting equilibrium will determine where prices land in 2024.

Stories and trends influencing our outlook for 2024

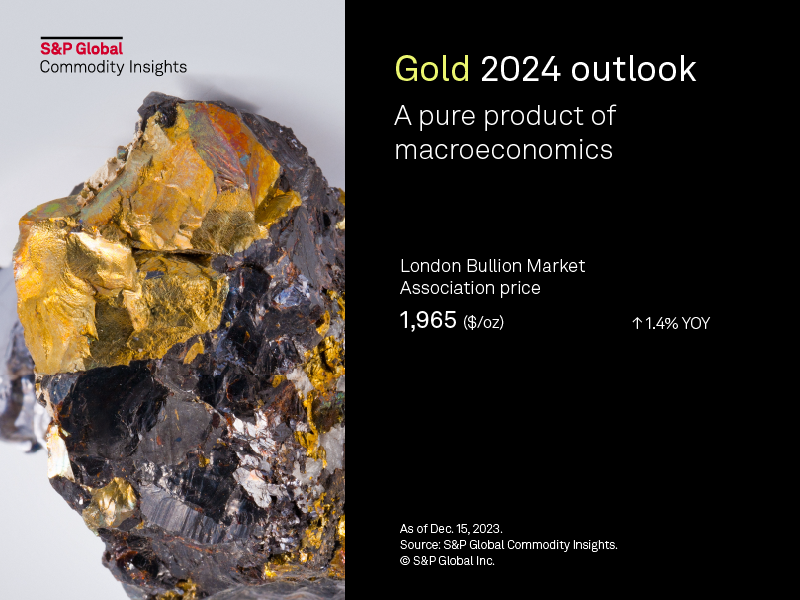

Gold prices have been climbing steadily in the last quarter of 2023, spurred by dovish Fed commentary and the outbreak of the Israel-Hamas war to breach an all-time high in December. As of writing, the Fed has maintained interest rates for three consecutive meetings and still aims for a soft landing — an environment typically not supportive of gold prices. Geopolitical tensions are expected to continue driving the upward price trend, while strong central bank purchases will offer demand-side support. We expect a volatile market in which upswings and downswings are expected to see prices trading at historically elevated levels.

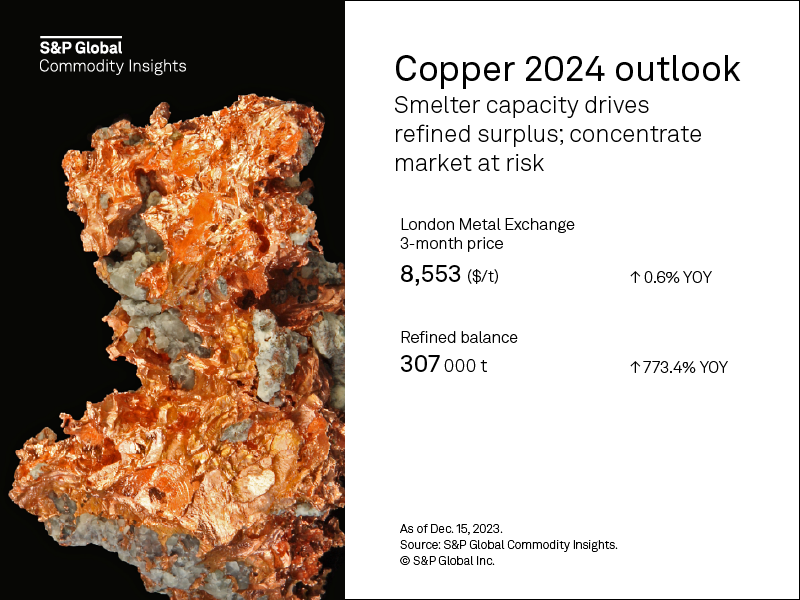

The copper market is a two-sided event. On the one hand, we see a strong ongoing demand for refined copper from China's renewable energy sector, namely solar, which drives robust smelter expansions and, in turn, feeds an oversupplied market and weighs on prices. On the other hand, this concentrate demand will likely outpace supply, resulting in a tight concentrate market and lower treatment charge in 2024 given, for instance, the expected prolonged closure of First Quantum's Cobre Panama mine. Elsewhere, the energy transition remains the main driver of copper demand, though we assess the timing for the materialization of this demand to have shifted to the medium term as the US and Europe recover from economic headwinds.

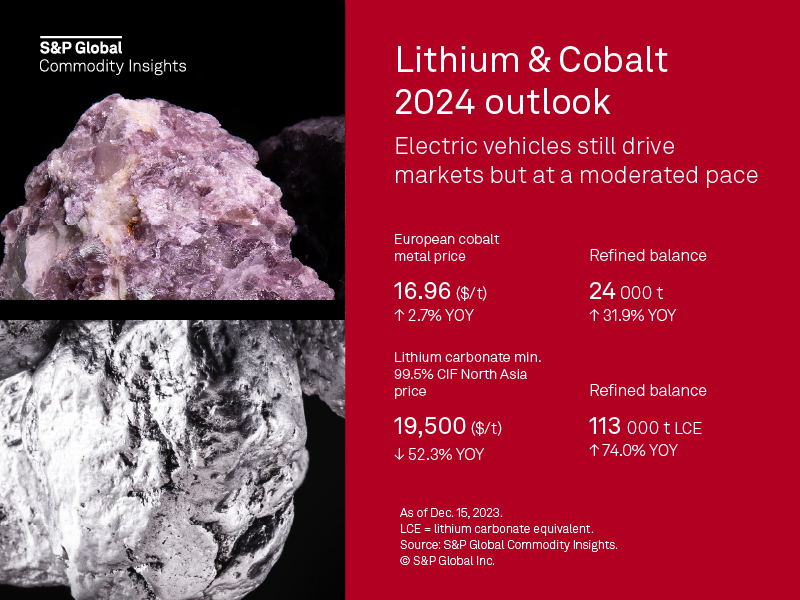

Fortunes for the lithium and cobalt battery metals markets are closely tied to the passenger plug-in electric vehicle market. While the sector was hit in 2023 by low sales due to high inflation and interest rates, PEV sales could resurge in 2024. Namely in the US, where buyers will be able to apply their federal tax credit as a discount at dealerships, which, coupled with lower starting prices, could incentivize consumers. Although we still expect some sales growth in 2024 and a rising penetration rate globally, the former is from a lower base in 2023 than in previous years.

In addition to weak demand, the widening surpluses across the lithium chemical and refined cobalt markets will pressure prices that have already touched multi-year lows in 2023. Lithium production has significantly expanded in 2023 with the start of delayed projects such that we cannot justify any price upswing for lithium in 2024. Among all non-precious metals covered, cobalt might just be the outperformer of 2024, with the only expected price increase likely to be helped by supply discipline.

Nickel markets deviated the most from fundamentals in 2023, weighed down by bearish sentiment that has yet to lift. Prices have sunk deeper into the global production cost curve, raising the possibility that mine supply curtailments could hit the market. Operations are being put on hold, with some being loss-making on an all-in sustaining cost basis. The market is well oversupplied, however, on rapid growth in Indonesia and China — a surplus that will increase in 2024. Further, nickel short positions on the London Metal Exchange are at a multiyear high. These factors are likely to weigh on prices in 2024, having recently dropped to a 2.5-year low touched in November.

Like nickel, declining zinc prices over the past few weeks are crossing below profitable levels, with miners such as Nyrstar temporarily shuttering operations. Although this could provide some upside risk to prices, global demand has been tied to manufacturing activity that hinges on economic tailwinds. We expect those to pick up in 2024 on the back of China's growing refined zinc demand, which will expand to account for about half of global demand. Nevertheless, zinc inventories have accumulated at the London Metal Exchange, and we expect the market surplus to increase, bringing prices down from 2023 levels.

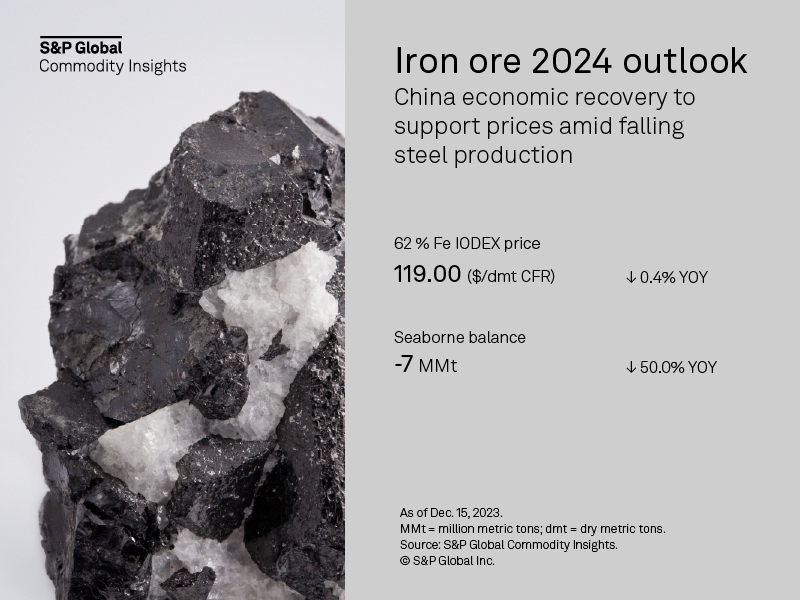

The iron ore market is in lockstep with optimism around China's economic outlook. While the recovery has been slow in 2023, many rounds of stimulus have been announced and will likely unfold fully in the coming months. Stronger-than-expected China demand has already lifted prices in the last quarter of the year. Robust domestic steel output that is consistently eating at port stocks and buoying imports, coupled with expected slow growth in seaborne supply, will support prices in 2024 at similar levels to 2023.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.