Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 16 Jan, 2023

By Greg Zwakman and Liam Eagle

Introduction

Faced with the growing complexity of IT environments as they undergo modernization and transformation, enterprises are increasingly engaging with managed services providers to help design and manage a mix of applications and procedures within on-premises and cloud environments. 451 Research's recently published Cloud, Hosting & Managed Services Market Monitor provides insight into the competitive landscape, size and expected growth of the managed services market for both on-premises and cloud environments and incorporates managed services end-user adoption and forward-looking plans from our Voice of the Enterprise: Cloud, Hosting & Managed Services, Managed Services 2022 survey.

Managed services represent a service component that can be delivered on a stand-alone basis or bundled with infrastructure and application offerings. A broad range of services fall under this category, and the hurdle for inclusion is that the managed service provider is bound by a contractual agreement that specifies the scope and expectations of the relationship, with the client maintaining direct oversight of what is being managed and ensuring that services are performed remotely and not at a customer location/datacenter. Specific managed services in our market analysis include disaster recovery and backup and archiving, as well as managed security services, managed application services and operational managed services.

Details

Data marketplace initiatives are not new. The opportunity provided by data marketplaces, as a means of simplifying the process of acquiring new data or monetizing data assets, is well established. Data marketplace offerings have had a number of false dawns, but an evolving regulatory landscape, fast-maturing data roadmaps and sustained enterprise interest suggest that the monetization technology may finally be coming of age.

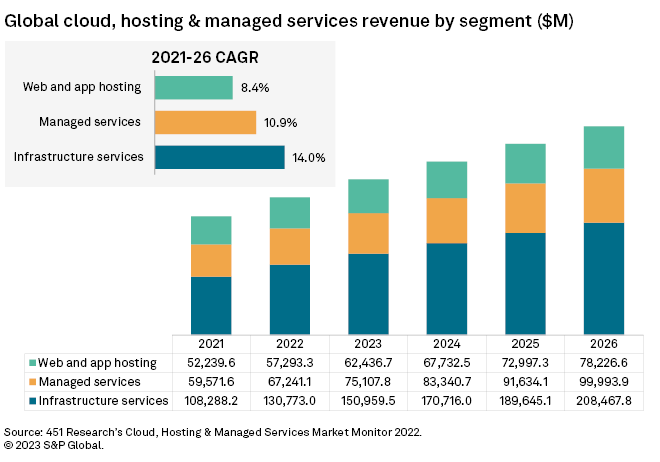

According to 451 Research's recently published Cloud, Hosting & Managed Services Market Monitor, the aggregate managed services market represented just under $60 billion in 2021 and is expected to increase to just under $100 billion by 2026, a compound annual growth rate of 10.9%. Our broader Cloud, Hosting & Managed Services analysis incorporates forecasts for over 1,750 providers, with 1,325 competing in the managed services market.

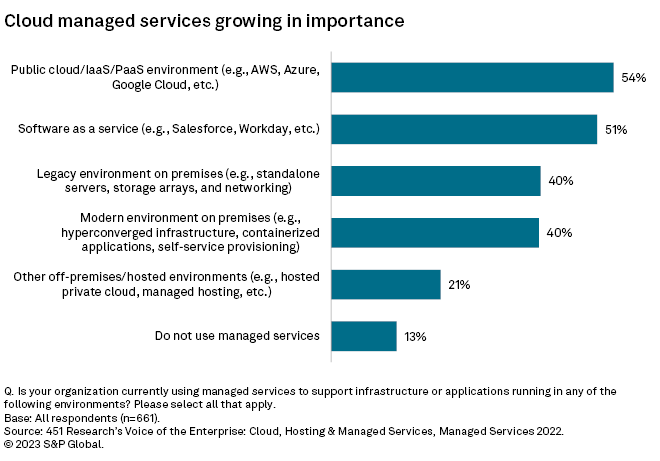

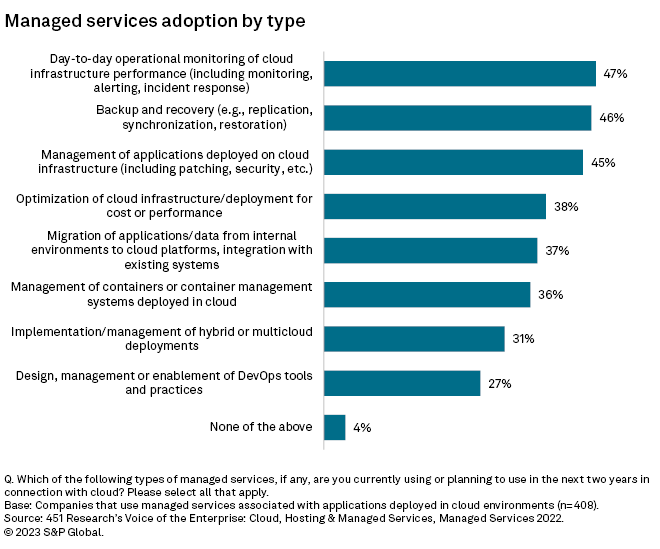

Over 50% of respondents in 451 Research's Voice of the Enterprise: Cloud, Hosting & Managed Services, Managed Services 2022 survey indicate that they currently use managed service providers to support their cloud environments. Operational managed services; disaster recovery, backup and archiving; and application services (including security) ranked as the top three managed services deployed in conjunction with public cloud deployments.

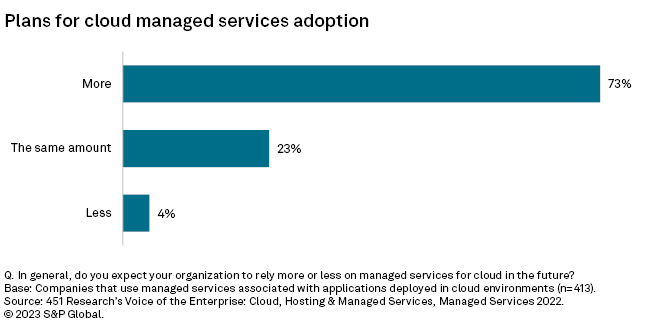

Managed services for cloud are not a stopgap, as most companies using them expect to become more engaged over time. Among those companies currently using managed services in connection with applications deployed in cloud environments, 73% expect to rely more on managed services over time. Less than one-quarter (23%) expect their reliance on managed services to stay the same, and only 4% expect to reduce their reliance. Nearly all respondents using managed services for cloud (87%) agree with the notion that managed services are becoming more important as technology skills become more difficult to acquire and maintain.

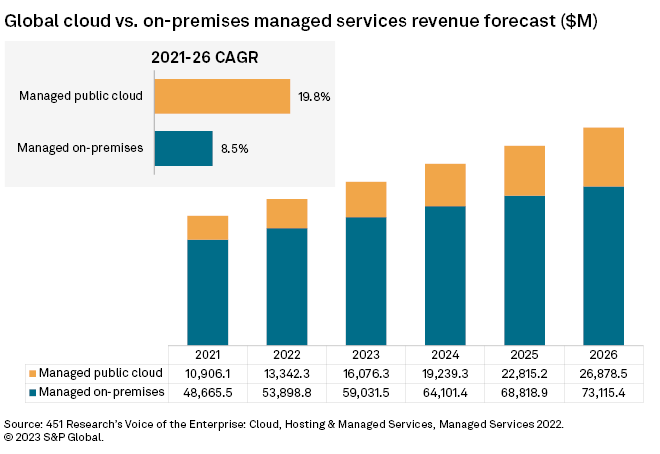

Cloud managed services revenue growth expected to more than double on-premises

While cloud managed services adoption is strong across end users, we believe the aggregate share of managed services revenue continues to be largely associated with on-premises environments (about 80%), with cloud managed services representing about 20% of the total. However, we expect cloud managed services growth to more than double that of on-premises managed services. We estimate that cloud managed services represented just under $11 billion in 2021 — expected to increase to $26 billion by 2026, a CAGR of 19.8%. On-premises managed services accounted for $48.6 billion in 2021 and is expected to increase at a CAGR of 8.5% to reach $73 billion in 2026.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

451 Research is part of S&P Global Market Intelligence. For more about 451 Research, please contact 451ClientServices@spglobal.com.