Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Feb 17, 2023

By Rajiv Biswas

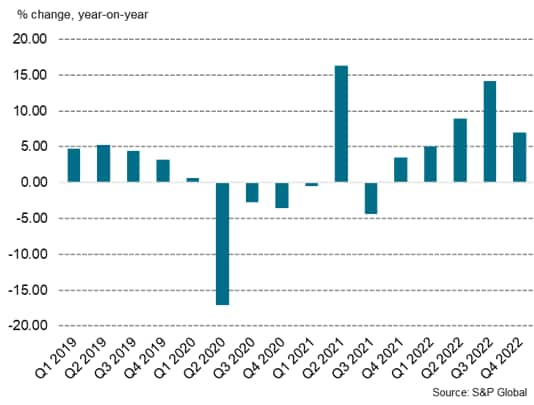

The Malaysian economy showed rapid annual economic growth in 2022, at a pace of 8.7% year-on-year (y/y). This was the fastest annual GDP growth rate since 2000. Easing of COVID-19 restrictions in early 2022 helped to drive a rebound in private consumption. Exports also posted strong growth, boosted by rising world commodity prices and buoyant growth in manufacturing exports.

However, the pace of Malaysian economic growth is expected to moderate significantly in 2023 due to a number of headwinds, including the impact of high base year effects and slowing export growth. That said, an important positive factor is expected to be the gradual recovery of international tourism visits from Asia, the Middle East and Europe.

The Malaysian economy grew at a pace of 7.0% y/y in the fourth quarter of 2022, which brought annual GDP growth for calendar 2022 to 8.7% y/y. However, GDP contracted by 2.6% on a quarter-on-quarter (q/q) basis.

Malaysia GDP growth

Helped by strong domestic demand, the Malaysian services sector grew at 8.9% y/y in the fourth quarter, still showing rapid expansion after the very strong growth rate of 16.7% y/y recorded in the third quarter. The construction sector also recorded rapid growth of 10.1% y/y in the fourth quarter. The pace of growth in the manufacturing sector moderated significantly to 3.9% y/y in the fourth quarter, compared with 13.2% y/y in the third quarter.

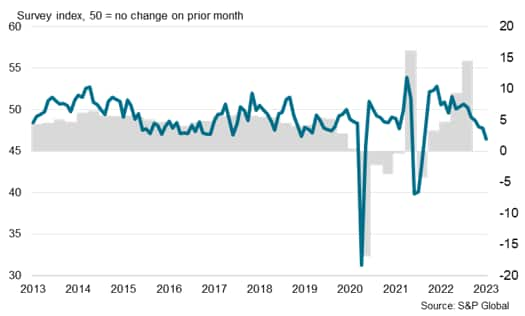

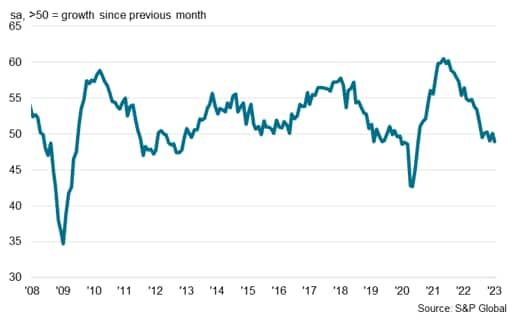

Reflecting softening momentum in the manufacturing sector, the seasonally adjusted S&P Global Malaysia Manufacturing Purchasing Managers' Index (PMI) dipped from 47.8 in December to 46.5 in January. The latest reading suggests that the gradual slowdown in manufacturing production and GDP growth at the end of 2022 continued into January 2023. This January PMI survey signals further moderation in the manufacturing sector in the near-term outlook.

S&P Global Malaysia Manufacturing PMI

During 2022, an important positive factor for the Malaysian manufacturing sector was the strength of manufacturing exports. Overall, Malaysian merchandise exports has performed strongly during 2022, with exports rising by 25% y/y. Exports of manufactured goods rose by 22% y/y during 2022, boosted by exports of electrical and electronic products, which rose by 30%.

Rising world commodity prices also boosted commodities exports, with mining exports up by 68% y/y due to strong exports of oil and gas, while agricultural exports rose by 23%.

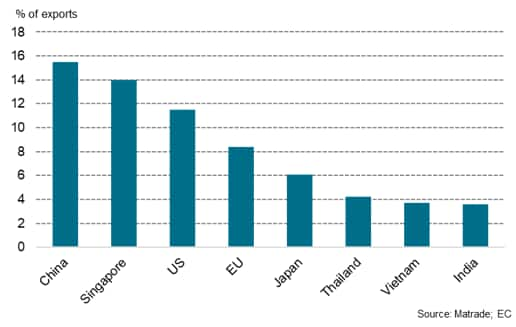

Malaysia's major export markets

In 2023, the pace of export growth is expected to moderate, reflecting base year effects as well as the economic slowdown in key markets, notably the US and EU. As mainland China is Malaysia's largest export market, accounting for 15.5% of total exports, the expected rebound in mainland China's economy during 2023 may help to mitigate the impact of softening exports to the US and EU.

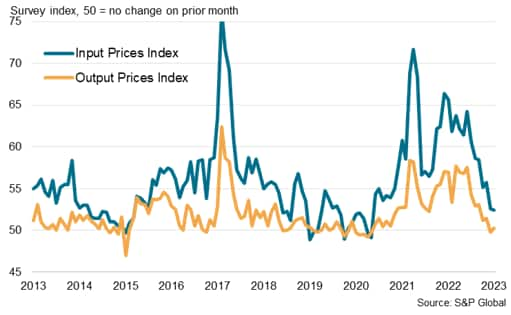

In the manufacturing sector, input costs increased for the thirty-second month running in January 2023 although the rate of inflation continued to ease and was the softest recorded in this sequence, as firms reported lower prices for a variety of inputs including oil. At the same time, manufacturers raised factory gate charges for goods, albeit only fractionally as the pass through of higher costs to clients was partially offset by the recent appreciation of the ringgit against the USD since early November 2022 as well as increased competition.

Malaysia Manufacturing PMI: Input and Output Prices

In Malaysia, CPI inflation pressures have begun to gradually moderate, easing to a pace of 3.8% in December 2022, compared with 4.5% y/y in September. During 2022, Malaysia's central bank, Bank Negara Malaysia (BNM), had reduced the degree of monetary accommodation in a series of tightening steps. The most recent monetary policy tightening was on 3rd November 2022, when the Monetary Policy Committee decided to increase the Overnight Policy Rate (OPR) by 25 basis points to 2.75 percent. In its January 2023 Monetary Policy Statement, BNM assessed that over the course of 2023, headline and core inflation are expected to moderate but remain at elevated levels amid lingering demand and cost pressures.

The electrical and electronics (E&E) sector has been an important driver of Malaysia's manufacturing exports. Exports of E&E products, which accounted for 38% of merchandise exports, rose by 30% y/y in 2022. This rapid growth was driven by robust global demand for semiconductors, reflecting technological trends such as 5G rollout, cloud computing, and the Internet of Things. Exports of integrated circuits grew by 33% y/y in 2022, while exports of parts for integrated circuits rose by 120% y/y. The combined exports of integrated circuits and parts accounted for 58% of Malaysia's total exports of E&E products in 2022.

However recent S&P Global survey data indicates that the global electronics manufacturing industry is facing headwinds from the weakening pace of global economic growth. This is expected to result in moderating growth momentum for Malaysia's E&E industry, compared with the very rapid pace of expansion in 2022.

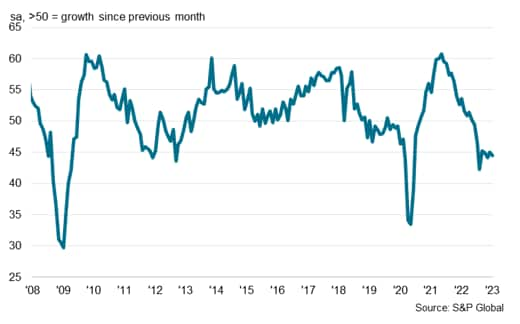

The headline S&P Global Electronics PMI posted 48.9 in January, down from 50.1 in December 2022, to signal a deterioration in operating conditions across the global electronics manufacturing sector at the start of 2023. The latest data indicated a renewed contraction in the global electronics sector, reflecting further declines in new orders and output.

S&P Global Electronics PMI

S&P Global Electronics PMI New Orders Index

The level of work outstanding at global electronics manufacturers declined for a seventh consecutive month at the start of 2023 and at the fastest rate since June 2020. Lower new orders and the easing of supply-chain constraints allowed firms to work through unfinished business, according to panellists. All four monitored sub-sectors recorded contractions in backlogs in January. Weakening economic growth momentum in the US and EU has impacted on consumer demand for electronics, with the economic slowdown in mainland China during the fourth quarter of 2022 also contributing to the downturn in new orders.

The Malaysian economy rebounded strongly during 2022, with economic growth momentum boosted by the easing of COVID-19 restrictive measures as well as buoyant exports of electrical and electronic products, palm oil products as well as oil and gas exports.

In 2022, higher world oil and gas prices as a result of the Russia-Ukraine war boosted Malaysian energy exports and contributed to higher fiscal revenues. Malaysia also benefited from higher average palm oil prices, due to disruptions to world edible oil markets, including Ukrainian exports of sunflower oil.

Looking to the year ahead in 2023, the reopening of international borders across the Asia-Pacific region, notably in mainland China, will help the continued gradual recovery of the international tourism industry, which was an important part of the Malaysian economy prior to the pandemic. This will help to mitigate the impact of slower growth for merchandise exports. Domestic demand is expected to be resilient in 2023, helped by the improvement in labour market conditions. Easing of restrictions on entry of migrant labour will also gradually help to support industry sectors that are reliant on foreign workers.

There are a number of downside risks to the near-term growth outlook, particularly due to the slowdown in world growth. Malaysia's export sector is vulnerable to weakening economic growth momentum in the US and EU, which together account for around one-fifth of total exports. However, the easing of COVID-19 restrictions in mainland China could help to boost Malaysian exports to this key market, which is Malaysia's largest export market and accounts for around 15% of total exports.

Despite the slowdown in global electronics orders in recent months, the medium-term economic prospects for Malaysia's electronics industry are favourable. The outlook for electronics demand is underpinned by major technological developments, including 5G rollout over the next five years, which will drive demand for 5G mobile phones.

Demand for industrial electronics is also expected to grow rapidly over the medium term, helped by Industry 4.0, as industrial automation and the Internet of Things boosts rapidly growth in demand for industrial electronics.

Malaysia's competitiveness as a global electronics hub has been highlighted by the decision of a number of electronics multinationals to invest in large-scale new projects. Intel is investing USD 7 billion in a new semiconductors packaging plant in Penang, which is estimated to be completed by 2024 and create thousands of new jobs in Malaysia. Infineon Technologies is constructing a new state-of-the-art wafer fab module in Kulim, with around Ringgit 8 billion of investment. The new module, which is expected to be completed in 2024, will add significant manufacturing capacity in power semiconductors.

Overall, the medium to long-term growth outlook for Malaysia remains favourable, with total nominal GDP measured in USD terms forecast to rise from USD 373 billion in 2021 to USD 720 billion by 2030. Meanwhile per capita GDP is projected to rise from USD 11,500 in 2021 to USD 20,000 by 2030, which will help to drive the growth of the domestic consumer market.

Access the full press release here.

Rajiv Biswas, Asia Pacific Chief Economist, S&P Global Market Intelligence

Rajiv.biswas@spglobal.com

© 2023, S&P Global Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.