Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Apr 14, 2023

By David Owen

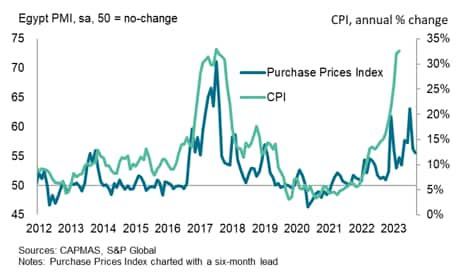

S&P Global's Egypt PMI™ continued to signal multiple headwinds on the private sector economy in March, rounding off a bleak first quarter of 2023. Demand remained crippled by a triple whammy of high inflation, a weakening currency and import controls. The rise in inflation to 32.7% in March - the highest since July 2017 - illustrates the daunting cost-of-living crisis affecting the country at present, in large part due to a marked fall in the Egyptian pound. However, the latest PMI data provide some hope that the peak of inflation could be near.

Output and new orders fall sharply in March

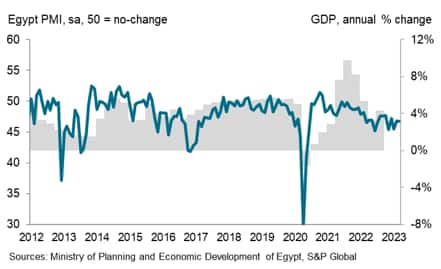

The headline S&P Global Egypt PMI™ once again posted below the 50.0 neutral mark and in contraction territory in March, dropping to 46.7 from 46.9 in February. The slowdown in non-oil economic conditions was largely driven by further sharp contractions in both output and new orders. Survey panellists that reported a downturn primarily indicated that steep inflationary pressures had led customers to rein in demand. The readings suggest that we could see a softening of growth across the Egypt economy to 3-4% at the start of 2023 (a reading below 50.0 can still be indicative of the country growing albeit at a slower rate).

The current surge in inflation to 32.7% in March continued to reflect both global and local factors resulting from the Russia-Ukraine war since its onset just over a year ago. As the world's largest importer of wheat, a commodity commonly sourced from both Russia and Ukraine, and with other notable trading ties to the region, Egypt's import supplies have been severely disrupted over the past year.

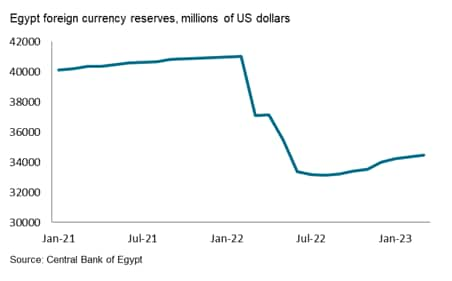

A global flight to safe assets and a sharp drop in tourism also meant that foreign currency reserves crumbled in the first half of 2022, especially of US dollars. The resulting depreciation of the Egyptian pound, both through market forces and the government's decision to float the currency in line with IMF loan requirements, contributed to a rapid rise in import prices last year.

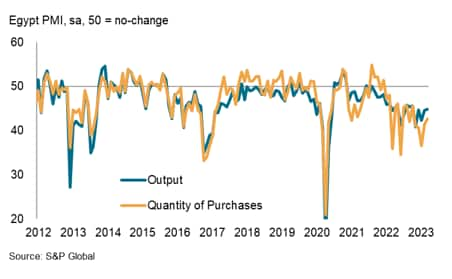

Government intervention to restrict the outflow of US dollars with controls on imported items has more recently helped to steady currency reserves, but it has added to firms' difficulties accessing key inputs. In many cases, this has led to reductions in purchases, output and orders at surveyed companies over the past year, with sectors such as manufacturing and construction affected to a greater extent than elsewhere.

Cost pressures start to recede, but remain strong

The latest survey data also illustrate the impact of currency and import shortfalls on prices. Last year saw marked increases in purchasing costs at non-oil businesses, with rates of inflation picking up in the second half of the year as supply chains tightened and energy costs spiralled. In January, the PMI's Input Purchase Prices Index reached its highest since July 2017, when inflation last hit a peak. While purchase prices continued to rise sharply in February and March, the rate of increase has softened since the beginning of the year.

Encouragingly, output (or selling) prices have not risen as sharply as seen at the beginning of the year, offering some hope that Egypt could be close to reaching the peak level of inflation. Notably, March's CPI reading undershot expectations and marked only a slight rise from February.

Outlook remains weak

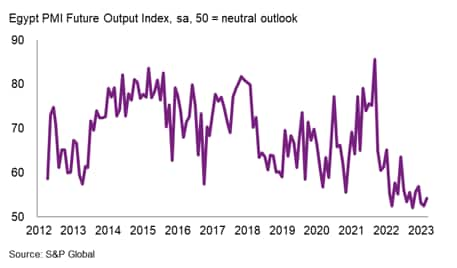

Looking ahead, the outlook for future activity among non-oil firms remained subdued in March. The PMI Future Output Index, which measures business output expectations for the coming 12 months, has fallen to record lows in recent months. Despite picking up to a three-month high in March, the index still signalled an historically low degree of confidence.

Firms often indicated that poor economic conditions and a further depreciation of the currency could continue to harm activity.

With sales also falling, the low degree of confidence led businesses to reduce their headcounts for the fourth month running on average, and thereby cut capacity, adding to evidence that firms have little optimism of a pick-up in the economy in the short term.

David Owen, Economist, S&P Global Market Intelligence

Tel: +44 2070 646 237

david.owen@spglobal.com

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location