Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 10 May, 2022

Introduction

Inflation and supply chain disruptions have affected cloud computing providers worldwide over the past year. Tech companies — including "hyperscale" cloud providers Amazon Web Services Inc., Microsoft Corp. and Google LLC — have enough market power and margin to absorb some cost increases, but they are not immune to wider and longer-lasting economic trends. Those with infrastructure in Europe are especially vulnerable to the impact of the war in Ukraine and efforts to reduce dependence on Russian energy supplies.

During their most recent earnings calls, parent companies Amazon.com Inc. (AWS), Microsoft Corp. (Azure) and Alphabet Inc. (Google Cloud) proudly pointed to their cloud operations as driving record sales — including more large deals — continuing infrastructure innovation and growing their global footprints. The geopolitical picture has since changed dramatically due to the war in Ukraine, with energy and commodity prices soaring, particularly in Europe. The follow-on effects of Russia's economic isolation due to government sanctions and corporate withdrawals have only begun to play out. While AWS, Azure and Google Cloud may not experience much direct revenue impact from loss of business, their customers certainly will, and the cost of operating data centers in Europe is bound to rise. These hyperscalers are pursuing ways to absorb the economic impacts, but the expectation that unit prices for cloud infrastructure can only go down — as they have consistently for the past six years — is due for a correction.

Global energy inflation and European risk

Rising energy costs and supply chain woes threaten to push up costs for the cloud hyperscalers in building and operating their data centers; therefore, cloud infrastructure prices are poised to increase. This comes in the wake of years of price drops in cloud computing services. Several factors contributed to these declining prices, such as price competition among the big three providers. Other contributing factors include the rollout of virtual machines equipped with better price performance based on new processors such as Advanced Micro Devices Inc.'s EPYC, Ampere Computing Holdings LLC's Altra and AWS' home-grown Graviton series, as well as newer, more affordable Intel Corp. x86 chips.

Although supply chain difficulties have been easing in some regions, Russia's invasion of Ukraine — and the unified response from U.S. and Western European governments and corporations in isolating Russia economically — has driven up commodity and energy costs around the world, particularly in Europe. In March, economists at S&P Global Market Intelligence reduced real GDP forecasts for 2022 for the eurozone and EU to 2.4%, down 1.3 percentage points from the February level, and forecast 40-plus percent increases in gas prices for the rest of the year, with sustained knock-on impacts on European electricity prices. Meanwhile, governments in France, Germany and Poland have reduced taxes on natural gas, fuels and electricity to provide relief in the short term, and the European Commission has begun drafting proposals to end the EU's reliance on Russian energy imports by 2027.

The big three cloud hyperscalers blocked new sales in Russia, but none of them has facilities there, and even if they were to forfeit existing business, the impact on their bottom lines would be just over 1% in 2022-2023, according to 451 Research's Market Monitor service. As companies such as Starbucks Corp. and McDonald's Corp. suspend their business operations in Russia, any cloud services that support these operations outside of Russia may be scaled down, but the revenue impact is likely to be minimal.

AWS, Azure and Google Cloud have all implemented programs to assist humanitarian organizations working in Ukraine and to help Ukrainian customers secure their applications. This comes as the Biden administration warned U.S. businesses of evolving intelligence that Russia might be exploring options for potential cyberattacks and urged technology and software companies to implement strong security controls and processes.

The biggest effect for data centers in the region will likely come in the form of higher power costs; this goes for hyperscaler cloud data centers as well. Power costs are the top operating expense for any data center. Microsoft Azure has the greatest exposure here, with 11 locations in Europe; Google Cloud has seven regions in Europe, and AWS has six, with plans to add a seventh region in Spain this year. Both Azure and Google Cloud have locations in Poland, where many Ukrainian refugees are fleeing.

Major cloud providers have announced plans to increase their global data center presence by 20% in coming years. Again, Microsoft has the most at stake in Europe, with six additional locations on the drawing board. Besides the location in Spain set to open this year, AWS has announced plans for a region in Switzerland, while Google expects to open four new data centers in Europe. The hyperscalers typically do not announce timelines for new facilities until construction is already in progress, but the uncertain geopolitical and economic landscape in Europe may put some of these plans on hold.

A longer-term impact comes from commodities in the IT/cloud supply chain commonly sourced from Ukraine and Russia, including neon and palladium used in semiconductor manufacturing.

Like their U.S. counterparts, Chinese hyperscalers Alibaba Group Holding Ltd. and Tencent Holdings Ltd. have seen little economic impact on their cloud businesses so far. Even so, China's efforts to remain politically neutral and preserve its economic ties to Russia could prompt businesses that AWS, Microsoft and Google have shunned to shift business to Chinese-based clouds as an alternative.

Mitigating factors

Several countervailing factors could help reduce the effect of these changes on cloud providers and their customers, including energy conservation measures, accounting changes and software architecture choices.

Accelerated efforts to shift to alternative power sources in Europe are part of broader global sustainability initiatives. Google, for example, achieved carbon neutrality in 2007 and aims to fully decarbonize by 2030. In addition, Microsoft has pledged to reach carbon-negative status by 2030. AWS parent Amazon, whose business depends largely on transportation, plans to achieve net-zero carbon emissions by 2040.

The hyperscalers are more eco-conscious in building and operating their data centers. In Europe, the impact of rising oil and gas costs for Microsoft Azure will presumably be cushioned in its Sweden region, which received its Leadership in Energy and Environmental Design, or LEED, certification. Microsoft Azure opened the region in November 2021, which is powered by carbon-free energy. AWS, which has a carbon-neutral region in Frankfurt, also plans to open a region in Spain in mid-2022 that will rely on energy generated by Amazon's solar investments in the country. The solar projects are slated to produce 368 MW of renewable energy capacity. Meanwhile, three of Google Cloud's European locations — Finland, Belgium and Zurich — are designated as "low CO2," meaning the region has a carbon-free energy percentage of at least 75%. Like Amazon, Google Cloud parent Alphabet also has solar investments, with a one-third ownership stake in the Ivanpah Solar Power Facility in California, representing a capacity of 130 MW.

Hyperscale customers wishing to measure the emissions impact of their cloud workloads have tools to help them. AWS, for example, recently launched a free Customer Carbon Footprint Tool, which calculates data on current and projected carbon emissions for AWS cloud usage. Additionally, in preview now, Microsoft Cloud for Sustainability is an extensible software product designed to help businesses record and report on their operations' environmental impacts and set goals for reduction. Google Cloud's Carbon Footprint reporting tool is another example, and it is freely available and tracks and reports the gross carbon emissions associated with the electricity of customers' cloud computing usage.

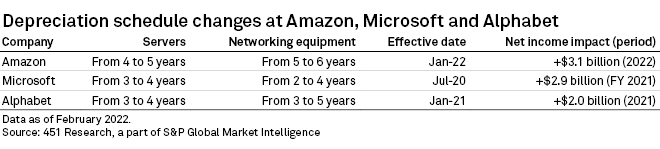

Hyperscalers have already instituted a buffer to potential supply shocks through accounting changes. In filings made by cloud parents Amazon, Microsoft and Alphabet, the companies announced adjustments in their server and networking equipment depreciation schedules, as shown in the table below. Amazon's most recent change came after it extended the useful life of servers from three to four years in January 2020.

During Amazon's February 2022 earnings call, CFO Brian Olsavsky said the company expected the accounting change to lower the company's depreciation expense by $1 billion in the first quarter of 2022, pointing to work done by AWS to run software more efficiently and reduce stress on capital equipment. At the AWS re:Invent 2021 event, AWS Senior Vice President Peter DeSantis warned against obsessing over "sticker stats" on new processors, noting that the forthcoming Graviton3 chip has a slower clock speed than comparable chips but also a wider core, enabling it to do more work per cycle with less energy.

Finally, customers wishing to offset price increases can explore their cloud-based applications for opportunities to cost-optimize with cloud-native services. Beyond the rightsizing, scheduling and autoscaling of virtual machines made possible with management tools, IT departments can reduce their cloud spending by provisioning cloud resources via events and triggers, moving to leaner serverless architectures that charge per request, rather than running processes on virtual machines that may be idle much of the time. A growing slate of third-party tools — including Spot by NetApp Inc., CAST.ai, YotaScale Inc., Akamas, StormForge, Granulate and Opsani Inc. — use machine learning to automate the optimization of applications and underlying infrastructure in keeping with customer priorities for resiliency, price and performance. And cloud hyperscalers are increasingly using similar techniques to engineer higher-margin platform services that shoulder the operational burden of running complex workloads — such as machine learning or big data analytics — which creates a "stickiness" that is beneficial to the seller but less flexible for the buyer.

Speaking of margins, it will be interesting to see how managed service providers, integrators and software vendors relying on hyperscale cloud infrastructure pass along public cloud price increases to customers or whether they will see absorbing such costs as competitive differentiation. As we saw when Google recently made updates to its portfolio, providers can introduce lower-cost services to give buyers a middle ground between accepting the price hike and undertaking the pain of moving their applications elsewhere. Regardless, price changes offer arbitrage and churn mitigation opportunities across the universe of managed public cloud service providers.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

451 Research is part of S&P Global Market Intelligence.

Location