Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 30 Sep, 2021

By Alice Yu

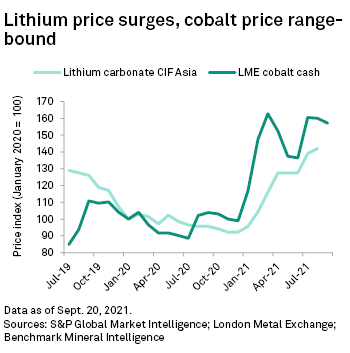

In August, the lithium carbonate CIF Asia price reached a 27-month high of $12,250 per tonne, buoyed by strong Chinese battery production and plug-in electric vehicle sales in August and weak seaborne supply.

Cobalt prices remain range-bound between $22.72 per pound and $24.04/lb ($50,093/t-$53,000/t) in the month to Sept. 20 from the interplay between supply delays and weak demand growth.

Access the Lithium and Cobalt Commodity Briefing Service September 2021 Full report and Databook.

— The global electro-mobility transition continued in August, led by China, despite a depressed overall car market undermined by the ongoing electronic chip shortage.

— China's passenger plug-in electric vehicle penetration rate rose to 19.8% in August, setting a new record and approaching the 20% penetration target set for 2025.

— We forecast the lithium carbonate CIF Asia price to remain high for the rest of the year, rising 33% in 2021 then falling 4% in 2022 from a culmination of project starts.

— We believe that current price levels are still elevated despite a 1,800-tonne cobalt market deficit this year, with prices likely to soften in the December quarter. We forecast cobalt prices to increase 50% to $21.46/lb in 2021, followed by an 11% price correction in 2022 as supply flows normalize and from mine expansions in Democratic Republic of Congo.

Theme

Products & Offerings