Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Aug 28, 2024

By Matt Chessum

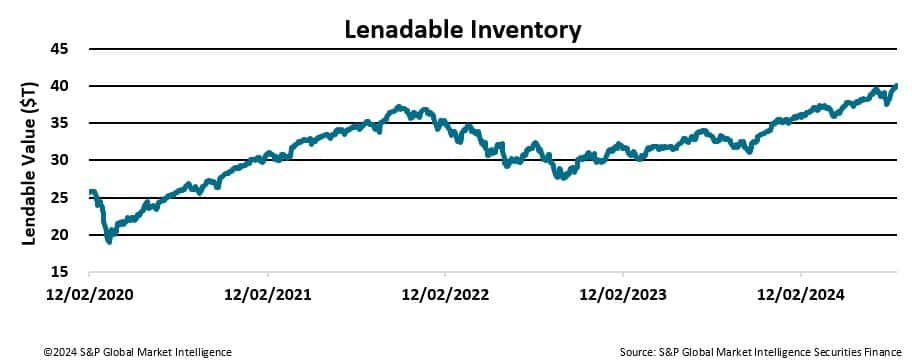

A combination of growth in asset valuations, new inventory from an expanding range of client types and a raft of innovation have propelled lendable inventories past the $40 trillion mark for the first time in history, after reaching $40.13 trillion on August 27th, 2024.

The growth in lendable supply, of which over $1.3 trillion is from new participants (over the last 24 months), underscores the vital role that securities finance continues to play in global financial markets. Securities lending not only adds liquidity, reducing bid-offer spreads, but also generates significant incremental returns for pension and investment funds lending their assets.

New and important innovative solutions such as intraday trading analytics, ETF collateral lists, repo data analytics and tools to accelerate the onboarding of new lending mandates have all contributed to the development and growth of this market. Data continues to be the lifeblood of the securities finance markets, driving efficiency, transparency, innovation, and informed decision-making. As the industry celebrates this milestone, S&P Global Market Intelligence is proud of the pivotal role it continues to play in this critically important sector of the financial markets.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.