Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — 19 May, 2021

By Celeste Goh

Major banks in the Asia-Pacific region could grow to become a larger source of capital for financial technology startups as lenders seek to future-proof their business.

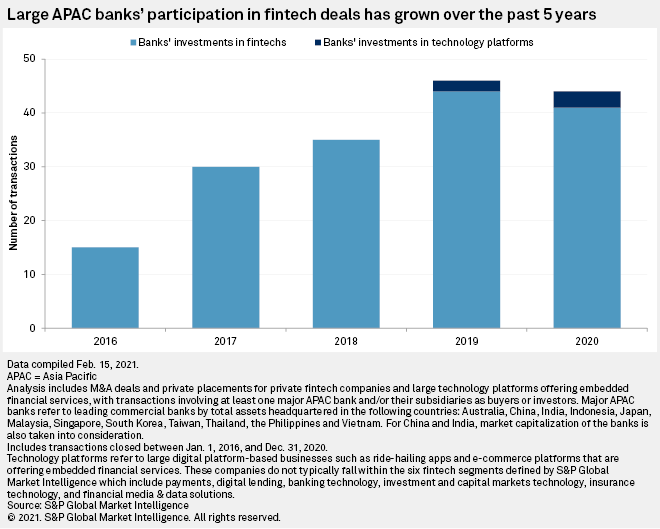

Large APAC banks have been ramping up participation in fintech deals over the past five years. Despite the pandemic taking a toll on banks' profits, lenders have maintained a consistent involvement in fintech transactions. Including technology platforms with embedded financial services, major APAC banks took part in 44 fintech equity rounds in 2020, just two fewer than the prior year. That said, fintech acquisitions have not gained much traction among APAC banks. In the last five years, M&A transactions only accounted for four deals, all of which took place between 2016 and 2018.

Platform businesses with embedded financial services do not typically fall within the fintech segments defined by S&P Global Market Intelligence as the categories are determined by the company's core business. However, we have included them in this report as these platforms have a burgeoning fintech presence in the region.

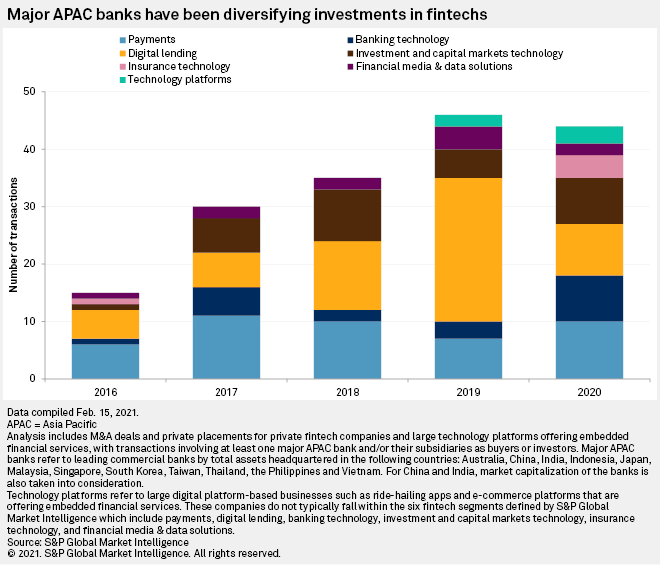

Banks want in on embedded finance play

APAC banks' investments in fintechs have grown more varied over the years as new trends emerge. Cognizant of the proliferation of embedded finance, a trend where financial services are integrated in platforms of nonfinancial companies, major lenders have been acquiring strategic stakes in Southeast Asia-based ride-hailing apps and e-commerce firms in the past two years.

Big banks in Thailand have picked up stakes in ride-hailers as these platforms expand into the country. Kasikornbank PCL and Bank of Ayudhya PCL have invested in GrabTaxi Holdings Pte. Ltd. while Siam Commercial Bank PCL has forged a strategic alliance with PT Aplikasi Karya Anak Bangsa, otherwise known as Gojek.

The banks primarily assume a supporting role in the platforms' financial offerings by jointly underwriting loans and providing the payment infrastructure and capital for lending. Distribution of financial products, on the other hand, is largely done via the ride-hailing apps with the platforms retaining control of the customer relationship.

For banks, the value of working with these platforms lies in the potential to unlock a new customer segment. Ride-hailers serve a large user base of gig workers and small-and-medium enterprises that are typically underserved by banks. Tapping on the extensive reach of these platforms presents a cost-efficient way for lenders to acquire new customers.

APAC banks also appear to be investing in technology platforms as a strategy to drive customer acquisition in their cross-border expansion plans.

Kasikornbank, which sees Vietnam as a growth market, acquired an equity interest in Sendo JSC, a large Vietnamese e-commerce firm that also offers loans to users. Mitsubishi UFJ Financial Group Inc., which holds stakes in a network of banks in Southeast Asia, has also made a strategic investment in Grab, which has a large fintech business in the region.

Large APAC banks setting up fintech-focused venture funds

The recent establishment of bank-backed corporate venture units has contributed to incumbents' growing participation in fintech deals. These bank-owned venture funds typically invest in early-stage startups, with most focusing on fintechs based in Southeast Asia. Of the 46 large APAC banks we reviewed, at least 18 have launched their own venture funds, most of which were set up in 2016 or later.

Our analysis covers the top three to five commercial banks by total assets headquartered in the following markets: Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand and Vietnam. For China and India, we also take into consideration the banks' market capitalization as leading banks by total assets tend to be state-owned and have an obligation to support their government's financial inclusion agenda. This may depress the banks' capitalization levels, leaving little room for technology investments.

APAC lenders have been actively refilling the coffers of their investment units, which likely gave them sufficient dry powder to push ahead with fintech investments last year even as COVID-19 weighed down the banks' profitability.

Since its initial A$50 million capital commitment to Reinventure Group Pty. Ltd. in 2014, Westpac Banking Corp. made two other top-ups in 2016 and 2018, tripling its original capital contribution. National Australia Bank Ltd. doubled its venture fund size with a A$50 million cash infusion in 2018. PT Bank Central Asia Tbk also added another $14 million to Central Capital Ventura in 2019, just two years after its establishment.

But subdued earnings have not deterred large Thai banks from allocating more cash to their venture funds either. Earlier this year, Kasikornbank added another $50 million to Beacon VC despite 2020 net profits declining by 23.9% on a year-over-year basis. In February, SCB 10X announced the launch of a new $50 million fund dedicated to investing in blockchain, decentralized finance and digital assets even as SCB, its fund sponsor, recorded a 32.7% drop in net profits for full-year 2020.

To be clear, venture funds are not the only means for banks to invest in technology companies. MUFG, for instance, has been picking up strategic stakes in fintechs through various subsidiaries prior to the launch of MUFG Innovation Partners Co. Ltd. However, the Japanese banking group noted in a press release that having a separate corporate venture unit will allow it to adopt a more sophisticated framework toward strategic investments that are necessary to hasten the pace of innovation.

But while some banks look externally for technology enhancement, Chinese banks seem to prefer bolstering their digital capabilities organically. According to a report by China Banking News dated July 29, 2020, five of China's largest state-owned banks — Agricultural Bank of China Ltd., China Construction Bank Corp., Bank of China Ltd., Industrial & Commercial Bank of China Ltd. and Bank of Communications Co. Ltd. — have set up dedicated fintech units to carry out their own research and development projects.

Japanese banks making fintech bets to grow revenue

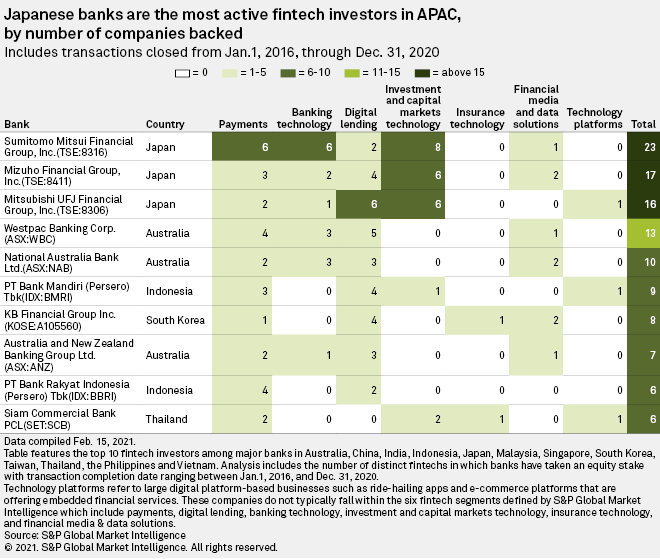

APAC banks with venture funds are generally more active fintech investors than their counterparts without one. Across the region, the three mega Japanese banking groups, MUFG, Sumitomo Mitsui Financial Group Inc. and Mizuho Financial Group Inc., backed the largest number of fintechs between 2016 and 2020. For these banks, growing noninterest income to boost profitability is likely to be at the forefront of their fintech investment decisions.

Years of aggressive monetary policy by Japan's central bank have led to razor-thin margins on loans, crimping the earnings of the nation's banks. Across developed markets in APAC, Japanese banks registered the lowest net interest margin and profitability ratios.

The Japanese megabanks seem to have identified wealth management and retail trading as key growth areas with fintech investments skewed toward the investment and capital market technology sector. The three banks have made common investments in startups that demonstrate potential in improving their bank's investment advisory capabilities and brokerage services.

One of these companies is Robot Fund Co. Ltd., which provides software that automates investment monitoring and reporting. MUFG had subsequently integrated the startup's fund analytics model in their offerings to enhance the analysis of customers' investment status to improve advisory services to clients.

Another company that saw investments from the three Japanese banks is Xenodata Lab. Co. Ltd., a data analytics company that leverages natural language processing to analyze financial and economic reports to predict corporate performance. Following the strategic investment, au Kabucom Securities Co. Ltd., the online brokerage subsidiary of MUFG, introduced the startup's technology as a premium service to clients.

Deregulation

Japanese banks could take an even more active interest in fintechs in the coming years as the government seeks to ease investment rules. A drafted proposal sought to remove the need for banks to get prior approval from the Financial Services Agency to acquire more than a 15% stake in fintechs, making it more convenient for lenders to invest in the startups.

Besides Japan, South Korea has also revamped regulations to promote fintech investments. In October 2019, the Financial Services Commission issued a set of revised guidelines that broadened the scope of fintechs that financial institutions can invest in.

Banks' case for more fintech bets

APAC banks' growing interest in fintech deals seems to suggest that the expected value of revenue growth and technology gains from backing fintechs outweighs the associated costs and risks. As such, we think lenders will likely accelerate fintech investments, particularly as they face further competition and earning headwinds.

Banks' profits will likely remain under pressure as Asian central banks are expected to keep interest rates low, depressing net interest income. Fee income may also be threatened by the growing popularity of nonbank e-wallets, which could eat into banks' card interchange fees.

The APAC region has also been seeing an influx of digital banking upstarts as central banks open the banking sector to technology players. While the newly minted virtual banks are unlikely to chip away at the incumbents' dominance, at least in the near term, it reinforces the need for banks to innovate and double down on their digital capabilities.

Although investing in fintechs would require banks to set aside additional capital, it may be a cost-efficient hedge against budding competition while also offering the potential of new revenue streams.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Theme

Products & Offerings

Segment