Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 Oct, 2020

Highlights

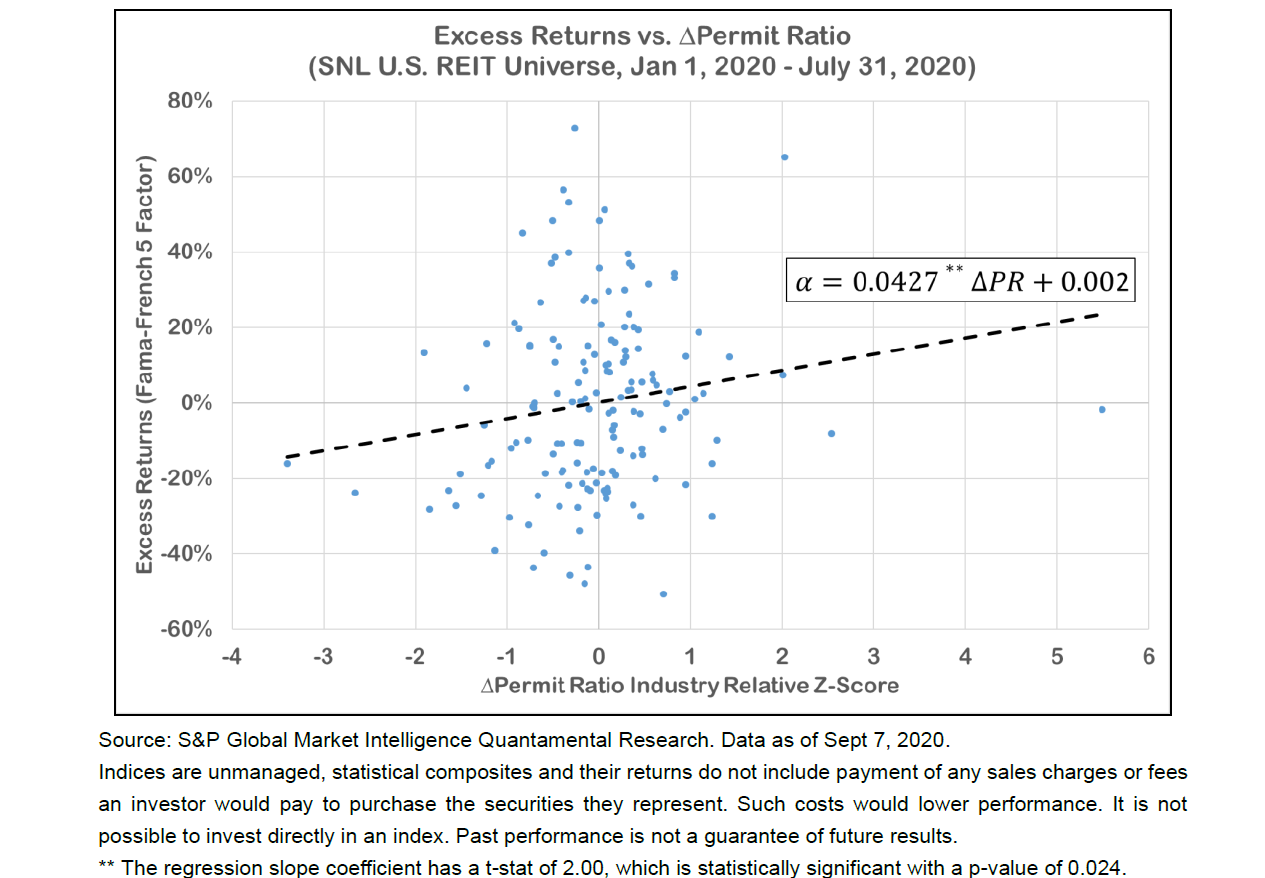

Publicly-traded REITs that have continued building permit-requiring activities during the 2020 economic lockdown have outperformed their peers.

Using the BuildFax data on the S&P Global Marketplace, a one standard deviation increase in a derived permit ratio is associated with 427 bps of excess return over the same period.

As property owners curtailed construction and renovation projects in the wake of the economic lockdown, building permit data has provided valuable transparency for investors of Real Estate Investment Trusts (REITs).

Investors have struggled to price the uncertainties facing commercial Real Estate owners as tenants’ businesses continue to be impacted by the economic lockdown following the COVID-19 global pandemic. Building permit data has provided valuable transparency for investors of Real Estate Investment Trusts (REITs) during this time. Publicly-traded REITs that have continued permit-requiring activities have outperformed their peers during and following the economic lockdown. A one standard deviation increase in a derived permit ratio, compared to the industry average, is associated with 427 bps of excess return over the same period.

Figure 1. REIT Returns vs. Year-on-Year Change in Permits. A Fama-French 5 factor framework was used to generate excess stock level returns for the universe of U.S.-based REITs within the SNL REIT dataset. These returns were plotted against the year-on-year change in the permit ratio as defined in equation 1.

During the period ranging from February 21 to March 23, the S&P United States REIT Total Return Index fell 43.9% as market participants attempted to price the impact of the COVID-19 pandemic and consequential economic shutdown on real estate owners. The ability of businesses that rely heavily on storefront foot traffic, such as hotels and restaurants, to continue paying rent to property owners was called into question after several state governments legislated a halt on so-called “non-essential” activities.

Download The Full Report

Products & Offerings

Segment