Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

INDICES COMMENTARY — Nov 14, 2023

By Pedro Choi and Tusharika Aggarwal

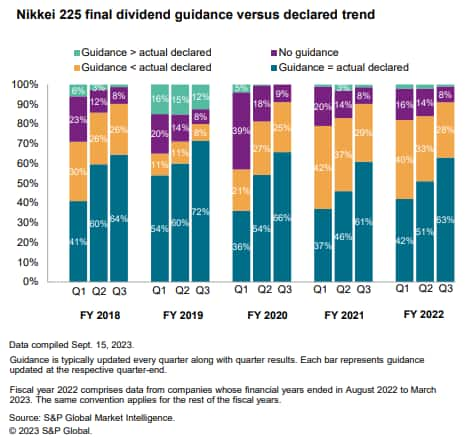

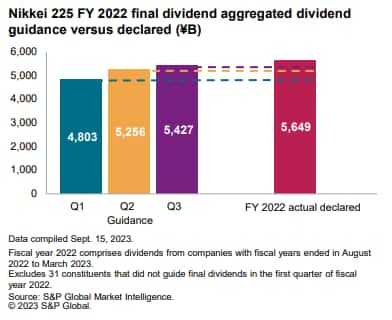

While dividend guidance provided by Japanese companies is useful, it is not to be fully relied upon. In fiscal year 2022, the aggregated guidance amounts were only 85% in the first quarter, 93% in the second quarter and 96% in the third quarter of the actual dividends declared at year-end. In this report, we quantify how dividend guidance throughout the year gradually converges to actual amounts declared and also how the guidance accuracy has evolved over the past five fiscal years.

The Tokyo Stock Exchange has published a special request in 2023, pushing companies to improve the price-tobook ratio (PBR), and the market was expectant about its impact on dividends. We have conducted a thorough assessment of how companies are responding to this and found out that about 19% of companies in the target group are altering their dividend policies, with immediate or medium-term effect.

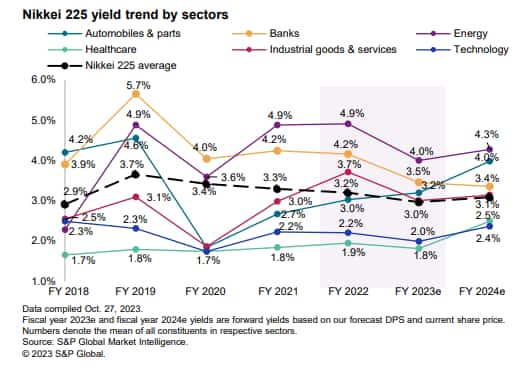

In 2023, Nikkei 225 index value has hit its 30-year high with a phenomenal growth rate, far surpassing our dividend growth rate forecast of 3.3% for the same period. As we research the resultant impact on the yield across all sectors and single stocks, we find that the index's average yield will drop from 3.2% to 3.0%.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.